Overview of the World Economy

The expectation of change in the USA’s policy on the economy following the result of the Presidential election was the main factor driving the markets in 2017. The USD strengthened on the back expectations in anticipation of new economic policies, as well as prospectively higher spending, a rise in inflation and therefore more monetary tightening from the Fed. These expectations also led to a spike in long term bond yields at the end of 2016 and early 2017. Later in the year, short term bond yields increased while long term bond yields remained largely unchanged, as inflation fell short of the targeted levels, although the Fed continued to hike its policy rate in 2017. While the Fed aimed for a policy interest rate of 0.50%-0.75% by the end of 2016, the FED raised these rates to 1.25%-1.50% in 2017. The FED projects three interest rate hikes in 2018, as in 2017.

In Europe, political uncertainty stemming from elections in the first half of the year proved short lived, while the growth momentum in the economy was maintained, with the region enjoying its strongest growth in recent times. As a result of the growth, which had a broad base throughout the region, the European Central Bank (ECB) stated inflation would not remain low for long, warning of a potential rise in inflation to come. This led to a bout of short term volatility at the beginning of the third quarter, sending bond yields higher. With no major changes in inflation that would require a change of policy, and statements from ECB officers indicating that they would be cautious and gradually tighten monetary policy, the pressure diminished. The decision was taken in October’s ECB meeting that monthly asset purchases would be cut from ğ 60 billion to ğ 30 billion between January 2018 and September 2018. A consensus was reached about maintaining the expansionary monetary policy while decreasing asset purchases, given that the expected increase in inflation was restrained despite the strong growth momentum in the economy. Even though the ECB will terminate its asset purchases, it is not expected to increase interest rates until 2019.

In the UK, which took the decision to the leave the EU in the referendum in 2016, the Bank of England increased its policy rates for the first time in 10 years. The rise in the rate of CPI inflation, to more than 3% in November, was a determinant in this decision. The impacts of Brexit on the economy will continue to be in the forefront in the near term.

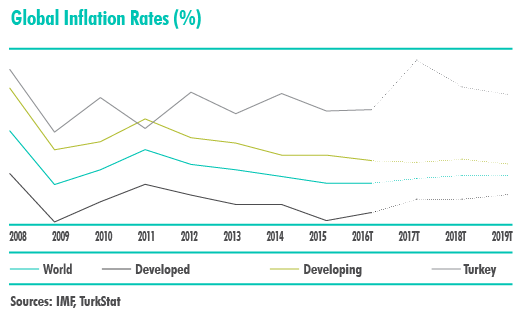

While inflation did not reach the targeted levels in developed countries, it rapidly declined in developing countries. In parallel with this, countries such as Brazil and Russia, which were stuck in a cycle of high inflation and low growth in recent years, gradually decreased their interest rates on the back of the recovery in macroeconomic indicators.

While many economies are expected to maintain their trend of moderate growth, central banks and markets will be keeping a close eye on inflation trends. Inflation will prove pivotal in the direction of capital movements

Overview of the Turkish economy

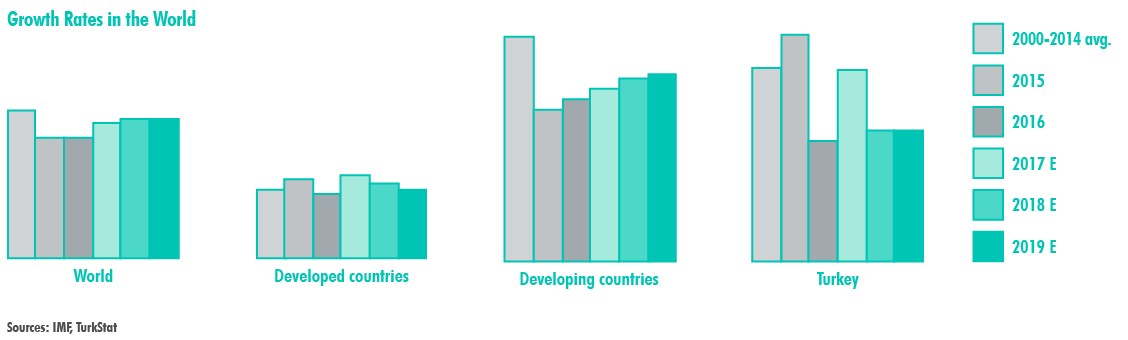

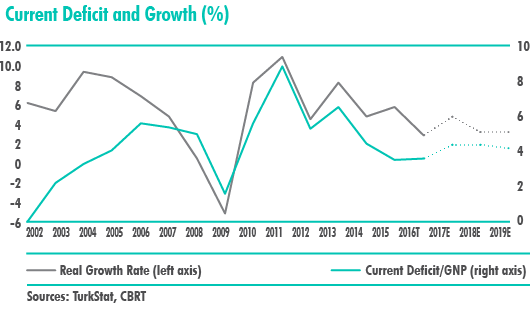

After the application of a tight monetary policy by the Central Bank of the Republic of Turkey (CBRT) to prevent a devaluation of the TL in 2017, the guarantee amount that will be offered to credits within the scope of Credit Guarantee Fund was increased ten-fold (to TL 250 billion) in March. This set the stage for rapid loan growth in the second quarter, at the highest rate seen in recent years. The positive impacts of this on growth continued for the remainder of the year. The Turkish economy matched the growth performance seen in prior years with the help of a recovery in the global economy. The growth rate is expected to come in at 6.2% for 2017, while the Medium Term Program maintains a target of 5.5% for the 2018-2020 period.

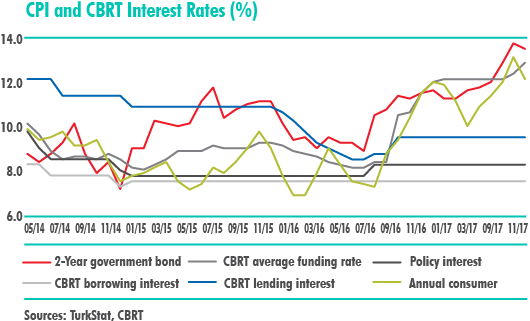

As a result of rapid devaluation of the TL at the beginning of the year, the CBRT rapidly tightened its monetary policy by utilizing the Late Liquidity Window (GLP). The CBRT increased GLP rates in response to a fall in the value of the TL in the last quarter of the year. The CBRT’s cost of market funding increased to 12.75% by the end of the year.

Inflation remained in double digits throughout the year, and the rate of CPI inflation reached 12.98% in November - the year’s highest level. The rate of CPI inflation came off its peak in December to close the year at 11.92%. Core inflation indicators also remained high levels and the rate of core inflation (Indicator c) was realized at 12.30% as of the end of December. In response to the high inflation readings, the CBRT signalled that the tight monetary stance would remain in place until the targeted inflation levels were reached.

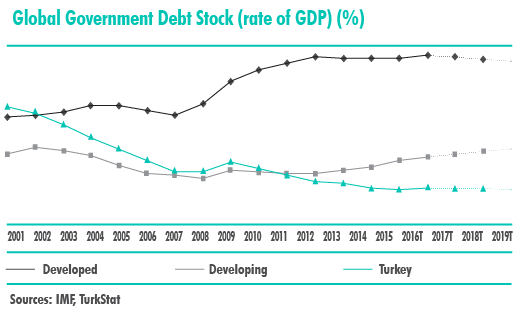

The budget performance, on the other hand, was relatively weak when compared to previous years. Periodic tax discounts were offered for certain sectors in a bid to support the economy. Together with the partial weakening of the budget, the domestic debt rollover ratio of the Undersecreteriat of the Treasury rose above 100% for the first time since 2009, to be realised at 129% in 2017. A domestic debt rollover ratio of 110% is planned in the Undersecreteriat of Treasury’s 2018 Program.

Fund flows to developing countries may lose some of their pace as the recovery in the global economy continues and developed central banks normalize their monetary policies.

A total of TL 220 billion in loans was extended in 2017 within the scope of Credit Guarantee Fund. Supported by increased appetite for credit, the banking sector chalked up a good performance both in terms of profitability and growth.

The Turkish Banking Sector and Participation Banking

A total of 52 banks were operating in the Turkish banking sector at the end of 2017, of which 34 were deposit banks, 13 were development and investment banks and five were participation banks.

The total assets of the banking sector increased by 19% YoY in 2017 to TL 3,258 billion, while the total assets of participation banking reached TL 160 billion, an increase of 21% YoY. A total of TL 220 billion in loans was extended in 2017 within the scope of Credit Guarantee Fund. Supported by increased appetite for credit, the banking sector chalked up a good performance both in terms of profitability and growth. The sector’s total loans* grew by 21% YoY to TL 2,159 billion, while participation banks posted a stronger performance with a 25% increase. While the banking sector’s deposit** growth fell short of the rate of loan growth, participation banks recorded a higher rate of growth in deposits than in loans. The sector’s deposits increased by 17% to TL 1,805 billion, while the volume of funds collected by participation banks grew by 27% YoY to TL 107 billion. The sector’s loan deposit ratio stood at 120%, compared to 100% for participation banks.

Consumer loans increased by 16% in the sector as a whole and by 11% for participation banks, while the volume of SME loans grew by 22% in the sector and by 19% for participation banks, and the volume of commercial loans increased by 23% in the banking sector as a whole and by 40% for participation banks. The fastest growing segment in the sector’s consumer loans was general purpose consumer loans, which recorded 19% YoY growth, followed by real estate loans, with 17% growth. As far as participation banks side are concerned, the fastest growth was seen in consumer credit cards, with 17% growth, followed by real estate and vehicle loans, which posted 13% growth. The fastest growing segment in the sector’s SME loans was in medium sized enterprises, with 25% growth, while the fastest growing segment for participation banks was in micro enterprises, with 34% YoY growth. While participation banks posted a higher rate of growth than the sector in micro credits, the broader sector recorded higher growth rates in small and medium sized loans than participation banks.

Backed by the positive impact of the increased Credit Guarantee Fund on growth, asset quality also improved in 2017. The sector’s non-performing loan ratio decreased from 3.2% at the end of 2016 to 2.9% at the end of 2017; for participation banks, this ratio declined from 3.7% to 3.1%. Specific provisions set aside for non-performing loans increased, with ratios of 79.4% and 70.7% for the sector and participation banks, respectively.

The sector’s shareholders’ equity grew by 20% in 2017, with participation banks recording a 19% increase in their shareholders’ equity. The sector and participation banks both recorded a capital adequacy ratio of 17% at the end of 2017.

Participation banks outperformed the sector in terms of profitability with net interest (profit share) income increasing by 24% in the sector as a whole, but by 26% for participation banks. The sector’s profit increased by 31% to TL 49.1 billion while participation banks’ profit grew by 43% to TL 1.6 billion.

Amendments were made to the tax laws in 2017. The following articles in these amendments will affect the banking sector:

- The corporation tax rate was increased from 20% to 22%, which will be applied to corporate earnings in 2018, 2019 and 2020.

- The corporation tax exemption of 75% applied to gains on the sale of real estate was decreased to 50%.

- The corporation tax exemption of 75% applied to gains on the sale of real estate that were taken over due to debts to banks was decreased to 50%.

- All transactions related to derivatives and options contracts as well as gains resulting from these transactions will be exempted from the BSMV.