Commercial and Corporate Banking

We are always with our commercial and corporate customers.

Türkiye Finans works to the principle of supporting the real sector with its products such as corporate finance support, enterprise financing support, project finance, vehicle finance and leasing. The Bank continued to offer special financial solutions for customers in the Commercial and Corporate segments in 2017, as it did in previous years.

Within the scope of “New Sales Service Model”, which was launched in 2017 to offer a more efficient service to customers, seven Commercial Regional Sales Directorates and 46 Commercial Branch Directorates were formed.

The segmentation structure was renewed to improve the Bank’s service quality. The Bank started to offer services under the Corporate, Commercial, SME, Entrepreneur and Consumer segments.

Türkiye Finans offers services to legal entities and partners that have revenues of TL 150 million or more in the Corporate Banking segment, and between TL 40-150 million of revenues in the Commercial Banking segment

Financial Leasing portfolio reaches TL 1.2 billion in 2017

Türkiye Finans offers financial leasing services for all types of machinery and equipment suitable for financial leasing and which is procured both in Turkey and abroad by customers in the Corporate, Commercial and SME segments.

In addition to the VAT advantage that it provides in many new machinery investments, financial leasing offers several advantages such as 100% financing, flexible repayments which are appropriate with cash flow levels, long term financing with minimum guarantees and operational ease.

Türkiye Finans completes all financial leasing within its entity by using its advantage of being a participation bank. The Bank offers its customers operational convenience and rapid solutions.

Türkiye Finans’ portfolio volume in financial leasing transactions had reached TL 1.2 billion by the end of 2017.

Professional support in foreign trade

Türkiye Finans offers high added value solutions that are tailored to meet the needs of the customers with a professional team which is highly knowledgeable in the field of foreign trade and a global correspondent network that is ever expanding every year.

Türkiye Finans intermediates in internationally sourced, medium and long term financing with affordable loans through institutions such as Eximbank, GSM and SEP and diversifies the opportunities of the placement that it offers its customers. Through foreign exchange financing, the Bank supports exporters and its customers whose activities involve earning in foreign currency.

Türkiye Finans adopts a customer satisfaction oriented approach as its foreign trade policy. In line with this approach, the Bank diversified the fund opportunities that it offers to customers. Türkiye Finans contributes to the technical consultancy service that it continuously offers to generate the most suitable solutions to meet customers’ needs, with quality based operational solutions.

Extending our operations in cash management.

The product catalogue for effective sales of cash management products and services was established in 2017. Promotion activities on social and printed media were carried out to increase awareness of these products and to increase their utilization.

Collections Guaranteed with Türkiye Finans’ Direct Collection System (DTS)

The “Direct Collection System” (DTS) at Türkiye Finans provides customers with rapid and guaranteed collection for their payments. With the DTS, the Bank offers a practical solution to the advance or term collections of the companies that work with a large number of customers or have dealership systems.

Türkiye Finans carried its DTS service a step further in 2017 and initiated an online service through the webservice.

The DTS product provides exclusive services in the following:

- The purchases of goods by dealers,

- Automatic payment of bills that are uploaded to the system by the parent company,

- Installments at the agreed rate and maturity,

- Facilitating the flow of goods of the main company,

- Easy collection by the main companies.

A pioneer in the QR code Cheque based application (Karekodlu Çek)

In February 2016, Türkiye Finans implemented the “Karekodlu Çek” (the Cheque with QR code) system, which became an obligation in the sector in 2017. With its finger on the pulse of technological developments and working to rapidly implement innovations, Türkiye Finans offered the Karekodlu Çek (the Cheque with QR code) product to its individual and corporate customers who use cheque books. The Bank gained the acclaim of its customers in a manner that is worthy of its title of being the pioneer bank with the project. The Karekodlu Çek (the cheque with QR code) application allows the holder to swipe the QR code on the cheque, thus enabling payments by cheque to be collected more securely by allowing the payer’s past cheque payment status to be seen without the need to go through an approval process. It also provides an opportunity to see if the cheque has been forged or not.

Electronic Cheque Integration (ECE) service launched as part of the digitalization strategy

Digital integration between customers and the Bank was provided with Electronic Cheque Integration (ECE) which enables the Bank’s system to automaticly process cheque information sent by companies to Türkiye Finans for collection/guarantee purposes. The result information on the cheques that is automatically sent to customers also contributed to the optimization of operational expenses.

Türkiye Finans was ranked 3rd in the sector and 1st among participation banks in the campaign that was organized in the fist quarter of 2017 for the sale of Findeks packages. The Bank helped customers manage risks and customers’ cash flow.

Trade becomes more secure with Findeks

The Findeks package enables Credit Registration Bureau (KKB) scores and cheque payment performances of individuals and companies to be viewed. Türkiye Finans was ranked 3rd in the sector and 1st among participation banks in the campaign that was organized in the fist quarter of 2017 for the sale of Findeks packages. The Bank helped customers manage risks and customers’ cash flow.

Securely transferring our customers’ money and negotiable instruments

The transfer of legal entities’ money and negotiable instruments to branches of the Bank with security measures, by applying international standards and procedures with armoured vehicles and security staff, was initiated in 2017.

We offer an online MT940 service

The MT940, an international electronic statement of account, allows all customers to receive all of their account activities as SFTP or webservice in a format they desire. The MT940 service provides an automatic accounting register on the company side, minimization of the margin of error and reducing operating expenses for both the Bank and the company.

Payments to vendors made to accounts in our Bank

The Automatic drawee was defined to all vendors to increase new subscriber acquisition and the balances of participation accounts. A number of campaigns and communication activities sought to raise awareness. As a result, payments made to vendors for goods, products or services remained within the Bank accounts.

Clearing up cash flows with the automatic sweep service

The Automatic Sweep product enables customers to gather money in various sub accounts held at different branches, or money held in various sub accounts in the same branches in a single account at the end of the day or at the beginning of the day. This product is especially helpful for companies working with a distributor structure, or corporations which centrally manage the cash flow of their group companies.

The Automatic Sweep order enables customers;

- to manage all cashes over a unique account,

- to carry out transactions faster and more easily.

Expectations for 2018

Türkiye Finans will continue to quickly and effectively meet the financial needs of its customers under a customer-focused approach in 2018, backed its newly launched New Sales Service Model and redesigned segmentation structure. The Bank will also focuse on activities to expand its customer base.

In 2018, the Bank plans to add early instalment collections, partial collections and guarantees to its Cheque with Fund product. Meanwhile, it plans to lanch the discounted DTS feature on its DTS product, which will enable companies to arrange their cash flow by collecting their receivables before they mature.

Türkiye Finans has been a pioneer of project finance in various areas since its foundation. The Bank, able supported by its project finance team, will continue to provide financing to projects in sectors which offer high added value for the Turkish economy.

By offering products such as KGF, the investment incentivized loan and the Eximbank loan, Türkiye Finans plans to maintain its pioneering role in this area.

Türkiye finans will focus on Commercial Banking foreign trade products and place emphasis on foreign trade consulting activities in 2018, thanks to its increased foreign trade volume and widespread correspondent bank network. The forward and TFTARGET products, in particular, will be given special attention in a bid to protect importers from exchange rate volatility.

ME Banking

Sales channels were differentiated with Türkiye Finans’ New Field Sales and Service Model, which was created based on banking services that are differentiated and customized according to customers’ needs. As required by Türkiye Finans’ renewed segmentation structure, customers with between TL 8-40 million are offered services under ME Banking. The volume of cash loans under the ME Banking segment reached TL 4.3 billion at the end of 2017. ME Banking offers services to more than 13,000 legal entities and 9,000 legal entity partners.

Türkiye Finans is acutely aware of the importance of SMEs within the economy and places tremendous importance on the growth and development of SMEs. The Bank continued its support SMEs in 2017. Based on the official SME definition, Türkiye Finans’ commanded a 2.1% share in SME cash loans in the sector and 32.7% among participation banks as of the end of 2017. While share of SME loans among total cash loans, including financial leasing receivables, stood at 24.4% in the banking sector and 32.9% for participation banks, Türkiye Finans’s share in SME loans stood at 44.5%. Based on the official SME definition, a total of TL11.6 billion in cash credits and TL 4.3 billion in non cash credits had been extended to SMEs as of the end of 2017.

Türkiye Finans ME Banking continued to offer financial support, information and consulting services to add value to SMEs, which collectively serve as the motor of the Turkish economy. The Bank contributed to economic development by offering project finance to various investment projects, primarily renewable energy projects, in addition to SMEs products and services purchases.

Türkiye Finans maintained its suport for the economy by being a guarantor for SMEs in 2017 in commitments provided to public institution for the sale of services, construction work, commitments for the purchase of goods, dealership contracts and advance contracts.

Türkiye Finans offers qualified solutions to help those MEs experiencing difficulties in generating guarantees to access finance. In 2017, the Bank continued to offer KGF guarantee opportunities which are in the scope of Treasury support. Türkiye Finans provided one of the highest levels of guarantee support within the scope of the Treasury Support.

Leading participation banks in 2017 with the allocation of TL 3.5 billion in Credit Guarantee Fund support

Türkiye Finans offers solutions to help meet SMEs’ need for resources. The Bank transferred TL 3.5 billion to its customers, who serve as the motor of the economy, with the KGF guaranteed funding opportunity thanks to its cooperation with the Credit Guarantee Fund in 2017. With this performance in KGF supported transactions, Türkiye Finans was ranked 1st among participation banks and 13rd in the banking sector as a whole. The volume of Credit Guarantee Fund guarantees that have been offered to Türkiye Finans customers since 2010 reached TL 4.7 billion in 2017.

Türkiye Finans - the business partner for MEs

In addition to being a financial institution that provides financing, Türkiye Finans is also an advisor and business partner for MEs, helping them develop their current markets and achieve growth. Türkiye Finans offers SMEs professional services regarding grants, by working in cooperation with a consultant firm specialised in a wide array of areas including grants awarded by development agencies, TÜBİTAK incentives, R&D incentives, support from the TTGV support, KOSGEB project incentives and support from the IPARD, rural development and husbandry incentives, all supporting innovation in production.

Companies that hold the investment incentive certificate within the scope of “Profit Share Support Protocol” that was signed between Türkiye Finans and the Ministry for the Economy continued to receive support in 2017. A total of TL 124 million in financial support for the purchase of goods in investments was provided from the date the protocol was signed until the end of 2017. The Bank thereby intermediated its customers in obtaining TL 10 million of grants from the Ministry of Economy.

Expectations for 2018

Türkiye Finans attaches importance to following a broad-based growth model that creates value for its customers and supports the lives of its customers in their work. The Bank offers its customers the highest service standards while aiming to be a part of daily life for MEs.

In 2018, Türkiye Finans aims to meet the various financial service and advisory needs of its customers, and to continue to support their long term investment projects, primarily in renewable energy, tourism projects and production plants.

In addition, providing affordable funding by decreasing the cost of funding is one of the key strategies for 2018.

Project Finance

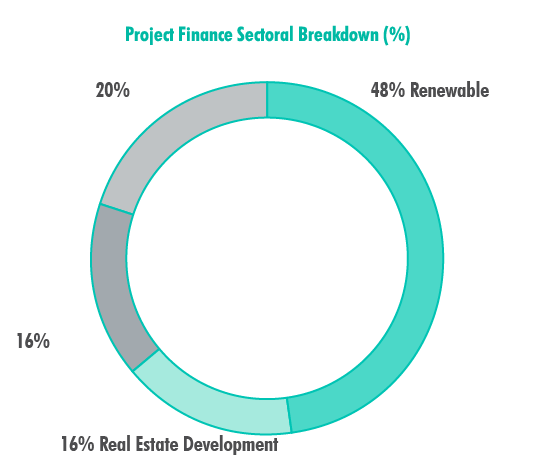

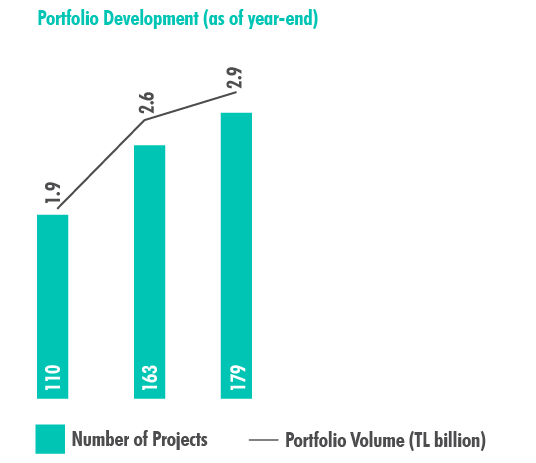

Türkiye Finans increased the volume of funds allocated within the scope of Project Finance by 13% YoY to TL 2.9 billion.

Türkiye Finans adopts project finance that will add value to its customers and society as a whole. Türkiye Finans has an important position in the participation banking sector with the Bank’s project finance volume in the 179 projects it contributed to.

Full support for renewable energy.

In line with our country’s strategy and priorities in the field of energy, Türkiye Finans places priority on supporting projects which use renewable sources of energy, which have a much lower impact on the environment when compared to conventional sources of energy.

As of the end of 2017, the Bank had provided financing support to 126 renewable energy projects with a combined installed capacity reaching 340 MW.

The rise in investment in solar energy and the investor interest shown in this field has elevated this market to a higher position when compared to previous years. In this respect, Türkiye Finans has also increased its share in the financing of solar energy investments during 2017 and strengthened its position in the market.

As of the end of 2017 Türkiye Finans contributed financing of 107 solar energy projects with a combined installed capacity of 182 MW.

Maintaining its strong and steady position in financing of projects that will support our country’s rapid development

Türkiye Finans extended financing to the Alanya cable car project after having provided financing to the Bursa Uludağ cable car project, which is the longest cable car line with a continuous line length of 9km, and in which the Bank was the only financer. The Alanya project, which was launched towards the end of 2017, is expected to provide important contributions to tourism in Alanya. These two cable car projects (Bursa and Alanya) will have a total transportation capacity of 1.5 million passengers per year.

Türkiye Finans stepped up its optimization activities for project finance allocation processes. The Bank focused on improvement of credit quality, minimization of allocation time and designing more user friendly modules.

Small Business Banking

Türkiye Finans started serving Retail Banking Business Group customers, with annual revenues of between TL 2-8 million, in newly established small business segment from July 2017. The Small Business Banking Marketing Department was formed to understand the needs of customers in the small business segment and to achieve healthy growth by generating special solutions. The department operates with 235 branches and 265 employees within the Retail Business Group.

Within this scope Türkiye Finans offers financial support and advisory services that customers need and providing financial ease to the lives of its customers with cash management products. Within the scope of Small Business Banking, Türkiye Finans offers customer oriented sector specific solutions based on a proactive approach, meets enterprises’ financial needs regarding trade, production and employment and contributes to their sustainable growth.

The Siftah Card enables companies in the Small Business segment to access their basic credit needs through a single card rapidly and with a high level of mobility. Thanks to the Siftah Card, advance purchases from suppliers can be paid to the Bank in instalments. Customers are able to carry out transactions through the Corporate Internet Branch and Call Center.

Rapid, accessible and solution based financing support that is specific for customer needs

The main strategy of the Small Business Banking Department at Türkiye Finans is to provide rapid, accessible and solution based financing support with customized applications and products that are designed to meet individual needs

After a number changes in the credit allocation policy and processes, credit valuation can be carried out more rapidly and effectively with effective risk management. In 2017, Türkiye Finans contributed to the growth of the real economy by allocating TL 3.5 billion of credit backed by the Credit Guarantee Fund (KGF), of which TL 520 million was in the Small Business Banking segment.

The Siftah Card enables companies in the Small Business segment to access their basic credit needs through a single card rapidly and with a high level of mobility. Thanks to the Siftah Card, advance purchases from suppliers can be paid to the Bank in instalments. Customers are able to carry out transactions through the Corporate Internet Branch and Call Center.

Expectations for 2018

The Small Business Banking Department expects to increase funds allocated in 2018 by improving its range of products and financing to meet the interest free financial needs of the real economy and its customers. The Small Business Banking will continue to generate healthy and sustainable profitability by focusing on cross sale method with cash management products.

Advanced developments were brought to the rating model in the last quarter of the year to meet the needs of developing sectors and changing market conditions. This raised the effectiveness in fund allocation and services to customers. The launch of the new rating model was aimed at boosting active and new customer acquisition and therefore increasing market share in sector.

It is expected that financial support will continue to be extended to enterprises within the scope of KGF in 2018.

Sector based package development activities will continue in the Siftah Card for various customer groups of the Small Business Banking in line with developing market needs. The period needed for accessing financing is expected to be shortened and the service quality is expected to be improved with applications over alternative distribution channels and automatic limit projects.

Türkiye Finans launched its “Big Ladle” Account product in 2017. The product is the first in the participation banking product range and combines participation accounts and lease certificates.

Fund Collection and Investment Products Marketing

Funds collected, which represent the most important source of funds for Türkiye Finans, stood at TL 22 billion at the end of 2017. The Bank’s current deposits increased by 20% YoY to approximately TL 6.9 million during 2017. In terms of the distribution of funds collected during 2017, 51% was made up of TL accounts and 49% was made up of foreign exchange accounts.

The “Big Ladle” Account - a first in participation banking

Türkiye Finans launched its “Big Ladle” Account product in 2017. The product is the first in the participation banking product range and combines participation accounts and lease certificates. The account enables customers to increase their expected returns. With the innovation that it brings to the sector as a hybrid product, it indicated Türkiye Finance’s pioneer positioning once again.

Complete and tailor-made solutions to meet all of insurance needs of Türkiye Finans customers

Türkiye Finans works in cooperation with leading insurance companies both in Turkey and the world in securing everything which customers attach value to.

Türkiye Finans’ affordable and high-collateral insurance solutions minimize the risks associated with the customers’ assets, health and retirement.

Türkiye Finans also supports the lives of its customers by standing with them in times of need. In this context, the Bank continued to produce special and privileged solutions during 2017 by offering consultancy services in line with customer preferences as well as offering damage, assistance and guidance services.

Türkiye Finans and the Interest-Free Private Pension

Türkiye Finans Private Pension System (BES) is composed of individual pension funds consisting entirely of interest-free investment instruments. BES is established as a complementary system to the existing public social security systems and provides supplementary pension income in addition to the pension that customers will receive from social security institutions. The Bank also helps those customers who are required to enter the automatic participation system, which was introduced in 2017, become integrated into the system by offering rapid solutions.

Expectations for 2018

Türkiye Finans aims to expand its customer base in the collected funds and significantly increase its market share. In order to reach the targets set out, the Bank plans to expand its product range in the investment and insurance product services.

Consumer Finance

An intensive year for consumer loans

Türkiye Finans carried out consumer finance campaigns in 2017 by considering customer expectations and pricing in the sector. The Bank offered attractive profit shares and expanded its customer portfolio.

Additional rate discounts were given in vehicle financing campaigns with the condition of providing motor insurance product as well. Customers whose application for vehicle financing was approved were instantly offered Finansör and Reserve Account limit. Finansör is a consumer finance limit that offers instant shopping opportunities from member businesses through a bank card. The Reserve Account product is a Benevolent Loan product. Even if there is not a sufficient balance in the account, financing support can be obtained through ATMs and bill payments can be carried out through this product.

The Finansör product, which allocates a consumer financing limit, offers financing for hajj and umrah visits, healthcare, technology, marriage and education expenditures in line with customers’ needs. Moreover, campaigns are carried out for retail consumers with the product, which is the first of its kind in the sector.

Within the scope of the Preferential Mortgage campaign in housing financing, customers who are offered finansör, credit card, automatic bill order and personal assurance insurance services were provided with competitive prices.

Maintaining a leading position with respect to the number of POS and POS revenues among participation banks.

In 2017, Türkiye Finans increased its number of POS machines by 3.7% and the revenues obtained from POS machines by 9%. The number of POS exceeded 46,000 units.

Within the scope of the Bonus POS application, which is the first of its kind in the participation banking sector, contracted member businesses were able to set up instalment payments on approximately 16 million credit cards of 10 other member banks of the Bonus platform. Campaigns were aimed at enabling customers to earn Bonus points, thereby increasing turnover volume continued in 2017.

As a first in the participation banking sector, Ready-Made POS Packages tailored to the individual needs of artisans were rolled out in the Bank. Within the scope of the packages, member businesses were given the opportunity to conduct transactions without a commission charge and without blockage for a monthly fixed package fee, with the options of prepaid and installable packages which do not require a POS turnover commitment.

All of Türkiye Finans’ POS devices were made compatible with Troy card transactions. With the Bonus version, cash register devices can be utilized by instalments and campaigns for Bonus cards through the POS devices.

School Payments System was integrated with Fast Financing platform.

The SPS is a cash platform provided by Türkiye Finans for the payment of school fees. Türkiye Finans receives payment orders over the account and bank credit card through SPS. The Bank receives applications for the School Reserve Account to make payments for customers who do not have a sufficient balance in their accounts at the dates of payment. Integration is provided between SPS and Fast Financing, which is the Bank’s financing application platform. Officials in educational institutions were able to carry out SPS order and request transactions over the Fast Financing platform.

The Bank was working with 71 institutions within the scope of SPS as of 2017. New agreements will continue in 2018.

Applications for Finansör, a consumer finance product, start being accepted through Alternative Distribution Channels in 2017

The Türkiye Finans Finansör product started to enable applications to be accepted through the internet branch and corporate web site, with activation of limits through the internet branch while providing the ability to carry out transactions without having to visit the branch.

Developing our expertise in financing mass-housing projects.

In addition to completed real estate financing, Türkiye Finans continued its rapid rise in ongoing mass-housing projects in 2017 thanks to its financing strategies and its effective and active marketing activities.

The Bank has so far been involved in 2,100 niche mass housing projects that were constructed by Turkey’s leading construction companies.

Growing channel network and service diversity in payments

In 2017, Türkiye Finans defined the collection of SGK and Tax debts, which were structured under Law No. 7020, on the channels of the Bank and began to accept such transactions.

The online Apsiyon platform, which enables the administration of collective structures such as housing complexes, apartment blocks, residences and plazas to monitor collections and payments electronically, reached 41 housing complexes.

The number of institutions in the donation collection system was increased to 27.

The Bank’s integration to HGS transitions of Kuzey Marmara (North Marmara) and the National Parks was completed.

Esnaffinans set up to support artisans

Türkiye Finans offers private banking for enterprises which generate annual revenue of up to TL 2 million. The Bank started to offer its preferential products and campaigns under the roof of Esnaffinans.

In 2017, Türkiye Finans increased its number of POS machines by 3.7% and the revenues obtained from POS machines by 9%. The number of POS exceeded 46,000 units.

Türkiye Finans offers financing opportunities to help meet the needs of artisans through the Faal Card and corporate finance support. The Bank continues to expand its solutions which are specific for enterprises. The Faal Card is a commercial finance limit which provides instant shopping at member businesses and the advantage of payments through long term instalments. It sets itself apart as a financing support that stands continuously with enterprises, with its long limit validity period of 6 months.

A Credit Card with an advantage

In 2017 Türkiye Finans continued to develop the advantages and services it offers in credit cards. The Bank continued to enjoy a stable growth performance. The mobile branch started to accept applications for the “Happy Card”, while applications became more customer focused and practical. The number of application channels increased to five, to include Mobile Banking, SMS, internet banking, interactive voice responses and the corporate web site.

Türkiye Finans is the first participation bank to offer various options in credit card application requests over the corporate web site. Credit card applications and customer satisfaction were increased thanks to the corporate internet site application process, which was improved with a customer oriented approach.

In addition to the general campaigns offered by the Bank and the Bonus Platform, which the Bank is member of, campaigns that provide advantages depending on customers’ usage habits were also offered in 2017.

The Troy project, which was formed by the Interbank Card Center as a national card in 2017, received support and the issuance of Troy branded bank cards was carried out.

Expectations for 2018

Türkiye Finans will focus on increasing the number of dealers and business volumes in the Fast Financing portal in 2018. The Fast Financing portal allows financing requests to be received through dealers and provides the opportunity for on-site use. Customers who carry out transactions with agreed consumer and vehicle dealers will be able to complete their financing needs at the dealer without having to visit the branch.

Türkiye Finans will continue to offer cross-selling focused products and services to improve customer loyalty and achieve efficient growth. In line with the aim of being the main bank for its customers, Türkiye Finans will provide support to finance customers with complementary products in line with their needs. Türkiye Finans will maintain its characteristic of being the Bank which meets all needs of customers thanks to its wide product portfolio. In retail banking, the Bank aims to increase its consumer finance volume and reach more customers. In accordance with this, Türkiye Finans plans to increase retail product diversity and enhance the customer experience and satisfaction for current products.

Türkiye Finance continues to implement projects which offer a rapid and instant service to its customers, by expanding its special products and services to non-branch channels. The transaction capabilities offered in alternative distribution channels will be increased in 2018.

In the field of collections, the Bank aims to attain higher volumes and expand its customer base by intermediating in the bill collection of corporations who generate bills and who are not currently agreed.

Türkiye Finans has implemented several projects to develop and extend public payments. The Bank will continue to closely monitor the potential and developing market conditions in this area.

With its new business plan in 2018, Türkiye Finans aims to achieve a much higher growth rate in credit cards when compared to previous years. Rapid technological development is affecting credit card usage habits. Türkiye Finans has formed its working model to keep pace with this change.

Customer Experience and Service Management

The key to our success is permanent customer satisfaction

Aiming to achieve long lasting satisfaction in its relations with customers, Türkiye Finans attaches importance to standing with its customers at all times, everywhere and in all situations, while listening to them, creating solutions for their financial needs and facilitating their transactions.

The Bank has been implementing systematic projects to generate permanent solutions for customer complaints through a service approach which is transparent and oriented towards providing information throughout the process.

Carefully implementing improvements in its responses to feedback by handling feedback from customers meticulously and with the greatest sensitivity, Türkiye Finans protects the interests of its customers at all times and responds to all received requests thoroughly.

Türkiye Finans effectively records all complaints, appeals, suggestions, gratuities and requests received from customers.

The Bank continuously carries out improvements in its infrastructure to ensure a healthy flow through the existing system. Meanwhile, a number of process improvement projects were implemented and branch locations were adjusted within the context of improving the service quality offered to the customers and increasing operational efficiency.

Expectations for 2018

In 2018, Türkiye Finans will continue its work in the field of customer satisfaction and service management, which is accepted as a fundamental element of customer loyalty.

In line with the findings of the survey, customer feedback, the recommendations and the findings shared by the Türkiye Finans teams, projects have been developed and implemented to enhance the service experience and total service quality of its customers, who make up the Bank’s most important stakeholder group.

Türkiye Finans continued to undertake investments in technology in 2017 in line with its main strategies, “with the focus on Digital Banking and Customer Experience”. The Bank offered a wide transaction and product range in its digital channels, in line with the changing trends of customer profiles. Türkiye Finans customers carried out 79% of their financial transactions over digital channels in 2017.

Digital Banking

Türkiye Finans continued to undertake investments in technology in 2017 in line with its main strategies, “with the focus on Digital Banking and Customer Experience”. The Bank offered a wide transaction and product range in its digital channels, in line with the changing trends of customer profiles.

Türkiye Finans customers carried out 79% of their financial transactions over digital channels in 2017. Türkiye Finans carried out the sale and activation of approximately 390,000 products through these channels. Together with the efforts taken in 2017, the Bank launched innovative applications that will improve the desirability and effective use of digital channels.

Mobile Banking

Following a new function development studies by taking into account customer needs, the Bank maintained its investments in the mobile branch, which is the fastest growing non-branch banking channel in terms of the number of customers and transaction volumes.

The design of the Mobile Branch application was changed. New functions that bring ease to the lives of its users, such as credit card application and tracking of applications, were offered to users. A number of value added transactions and features were added in 2017, including rapid entry with device recognition technology, approving entry to the Internet Branch over a mobile device, tax payments, applications for Finansör, customized campaign offers and the offering of services to customers with impaired hearing, as well as those over the age of 70 with “Live Support”.

The number of active customers in the mobile branch grew by 27% YoY in 2017 while the number of financial transactions grew by 32% YoY. The number of downloads of mobile banking applications developed by Türkiye Finans for the iPhone, Android, and iPad platforms exceeded 230,000 in 2017.

Internet Banking

Within the scope of providing Internet Branch customer channel migration and increasing transaction volume, campaigns were launched to offer awards and a wide array of discount advantages to customers in 2017.

Activities were completed to offer following services on the Internet Branch: customized campaign offers, applications for credit card and Finansör, tracking of these applications, offering services to customers with impaired hearing and to customers who are older than 70 years old with “Live Support”

The number of the Bank’s internet banking customers exceeded 700,000 by the end of 2017, with 190,000 products sold through the Internet Branch.

Customer Contact Center

The Türkiye Finans Customer Contact Center holds the Customer Contact Centers Service Standard (EN 15838: 2009). This standard defines the technical requirements necessary for call centers to provide their call center services and their management system needs and includes specific requirements at international standards for call centers. The Türkiye Finans Customer Contact Center successfully passed the audit in 2017 and renewed its certification

The Customer Contact Center, which is one of the Bank’s important sales channels, contacted customers through 3.9 million calls in 2017. The Contact Center, which stands out with an approach focused on speed, quality and customer satisfaction, realized sales of 190,000 products and their activation by offering products that meet the needs of its customers. The Contact Center also continued to implement value added services to increase customer satisfaction and loyalty throughout the year.

The Bank completed its efforts to provide customers with impaired hearing and customers over 70 years of age with online support from the Customer Contact Center, through its “Live Support” (chat) application.

Infrastructure was developed for the system that will provide banking services to customers with impaired hearing and who visit branches by using “sign language” with “Video Call” application.

ATM Banking

As a result of new investments undertaken in 2017 within the scope of the ATM expansion strategy, Türkiye Finans increased its total number of ATMs to 587 and the number of non-branch ATMs to 196, while old generation ATMs located in the branches were replaced with new ones. The Bank also continued to extend Recycled ATMs, which instantly enable the use of funds placed into ATMs, for other customers’ transactions.

Developmental work continued during 2017 with the aim of providing a faster and uninterrupted service to customers through the ATMs. Voice ATM transaction menus were launched for visually impaired customers. Infrastructure efforts continued with the aim of allowing orthopedically handicapped customers access ATMs.

Campaigns carried out

In 2017, under the new Internet Branch launch, various campaigns were offered to customers including special benefits, rewards and discounts. This achieved transaction and customer channel migration.

Expectations for 2018

Türkiye Finans plans to offer customers new services on digital platforms by rapidly continuing its digitalization investments in 2018.

Türkiye Finans plans to launch new projects that will provide added value for customers and the Bank, such as new transactions, features and services for Mobile Banking; adding new product applications on digital channels; adding various foreign language options on ATMs and the website.

Türkiye Finans will continue its investments to expand its ATM network to meet its customers’ needs for cash.

The Bank expects to improve the digital competency of the Customer Contact Center by launching the innovative technological application in 2018. The Customer Contact Center is expected to serve as a continuous support point for customers when switching to the digital channel.

Under the digitalization process in 2018, Türkiye Finans plans to enable customers to access services easily and from a mobile platform, to simplify the processes and to decrease the sales focused operational workload.

With the TFXTARGET mobile application, which was launched in the last quarter of 2017, the process of new customer acquisitions gained momentum and significant growth was achieved thanks to the spreading of the customer mass to the base.

Treasury

Sustainable profitability with effective treasury management

In 2017, Türkiye Finans aimed to achieve sustainable profitability with strong foreign exchange position management. In this context, it succeeded in achieving an optimal level of liquidity by taking into account the legal and intra-bank liquidity ratios and bank strategies.

Qualified solutions with management of foreign exchange risks and forward foreign exchange transactions

In 2017, Türkiye Finans continued to increase the quality in after-sale services which is one of the most powerful aspects of the Bank. Within this scope, the Bank aims to increase customer visits by decreasing operational intensity thanks to system infrastructure developments

Türkiye Finans continues to provide expert support in the area of foreign exchange risk management to commercial and corporate customers wishing to hedge their foreign exchange risks on balance sheets.

A constantly evolving pioneer in foreign exchange transactions

With the TFXTARGET mobile application, which was launched in the last quarter of 2017, the process of new customer acquisitions gained momentum and significant growth was achieved thanks to the spreading of the customer mass to the base.

A new function was added to TFXTARGET with the launching of derivative transactions to customers over the desktop application. This product, which enables foreign exchange transactions, maintained the Bank’s pioneering position in the banking sector.

Expectations for 2018

In 2018, effective strategic balance sheet management will continue to gain prominence. In this context, work aimed at implementing the strategies determined by changing market conditions and balance sheet developments will be also carried out in the forthcoming periods.

In 2018, a risk map was set out to protect customers using Türkiye Finans’ foreign exchange loan from possible exchange rate movements. In this framework, customers deemed to be exposed to high risk will receive informative visits, where they will be advised of hedging.

TFXTARGET will start to offer services on a tablet platform in the first quarter of 2018. In addition, customers using the app will gain new functions with the addition of a foreign currency derivative order structure to the system.

Türkiye Finans aims to increase its market share by increasing the use of electronic transaction platforms. The Bank also aims to expand its customer base with the image of being a strong Bank. Training sessions will be provided for the marketing and use of electronic transaction platforms by creating pilot regions, branches and portfolios.

International Banking

Despite the economic and geopolitical developments in the world and Turkey during 2017, with its expanding correspondent bank network, Türkiye Finans continued to intermediate foreign trade transactions of its customers with the privileged services and products that it offers within the scope of international banking.

In 2017, Türkiye Finans further expanded its correspondent network, which consists of more than 1,100 banks in 132 different countries, as a result of Türkiye Finans’ activities that were carried out with its advanced service understanding and its innovative and proactive approach.

Attaching importance to the diversity of Turkey’s foreign trade partners and the continuity of customer transactions in new markets, Türkiye Finans has been serving customers with its extensive correspondent network, especially in Africa and Middle East transactions. Within the scope of the determined strategies, the Bank succeeded in establishing correspondent banking relationships with banks that have both a global and local scale in the new countries.

In 2017, the number of correspondent banks with which Türkiye Finans has a mutual credit limit relationship reached 242 and the opportunity to easily trade with every country of the world was made possible through the branches of correspondent banks. The level of awareness and credibility that the correspondent banks brought the Bank has been increasing year after year in line with the volume of foreign trade. In this context, Türkiye Finans developed contacts to develop and increase cooperation opportunities with correspondent banks by sharing information about products and services in addition to carrying out corporate introduction.

Türkiye Finans places tremendous importance on having multi-dimensional and long term relations with its customers within the framework of its international banking strategy. Under this approach, the Bank effectively assists its customers in increasing their competitive power in domestic and international markets while helping them to take advantage of growth opportunities. Under the agreements signed with the correspondent banks and international institutions for the financing of foreign trade, long-term funds were extended to customers who import within the scope of the Saudi Export Program (SEP), Export Credit Agency (ECA) loans.

We offer reliable investment alternatives with our lease certificate issuances.

Since its establishment, as a participation bank that provides direction to the sector, Türkiye Finans has offered its customers investment and financing solutions through innovative products. The Bank became the first participation bank to implement the issuance of lease certificates in the financing of the real sector in Turkey. Türkiye Finans offered the lease certificate issuance service to bank customers with the second asset lease company, which the Bank established in 2014.

Türkiye Finans contributed to raising the awareness of the product by issuing first lease certificates based on ownership and management contracts. Türkiye Finans unwaveringly maintained its lease certificate issuance operations in 2017.

Through domestic and international issuances where the bank is a fund user, Türkiye Finans offered its customers highly profitable and reliable investment alternatives. Furthermore, with the resources obtained from these issuances, the Bank provided companies with affordable funding at attractive terms.

Türkiye Finans issued TL 1.3 billion of lease certificates in the domestic market in 2017 based on management contracts by using the public offering method with an average maturity of 6 months. Türkiye Finans is the only participation bank to have issued lease certificates by public offering in 2017.

In 2018, Türkiye Finans expects to continue to issue lease certificates within the scope of the TL 2 billion ceiling, whose application was approved, in line with the market conditions and the Bank’s funding and liquidity needs.

International murabaha transactions

In 2017, Türkiye Finans continued to obtain long term resources at affordable costs from international financial markets through various debt instruments thanks to its high credibility. The Bank completed a successful year in foreign resource procurement.

Türkiye Finans has a long history and extensive experience in syndication and bilateral borrowing transactions that are obtained from foreign markets. The Bank successfully renewed its murabaha credit due in December, despite the challenging market conditions. By doing so, Türkiye Finans obtained financing of USD 250 million, which was two times oversubscribed from banks participating in the murabaha, while the renewal of the transaction at 2016 prices stands once again as confirmation of the confidence that Türkiye Finans commands. Türkiye Finans aims to support companies, primarily SMEs, that are in need of financing and which bring vitality and momentum to the Turkish economy.

Türkiye Finans obtained funds from Gulf banks at a very low cost through bilateral borrowing transactions carried out throughout the year. The Bank supported foreign trade financing of real sector companies with these resources. Contribution to development of Turkish economy has maintained.

As of the end of 2017, the sum of the borrowings realized by Türkiye Finans, excluding the sukuk/lease certificate transactions, stood at USD 1,536 million.

Expectations for 2018

Within the framework of its corporate strategy, Türkiye Finans will continue to diversify its portfolio of correspondent banks and investors in 2018. In this context, it will continue to utilize resources to maximise the opportunities presented in foreign markets with appropriate timing and affordable costs.

The Türkiye Finans Data Center holds Turkey’s first Tier III Operation Certificate. The Data Center performed better than the Turkey average in terms of energy efficiency with its Green IT approach and energy-sensitive applications. Activities for the Virtualization of the Data Center continued, and the virtualization ratio increased to 93.2%.

Operational Services and Information Systems

Increased efficiency with activities aimed at improving operations

Within the scope of payment system operation activities, the business processes automation application, which was built on a new business flow infrastructure, was launched. The automation application was expanded to all branches. By doing so, Central Operation banking transactions undertaken in branches are fully integrated with the document management system through process automation infrastructure. These transactions can be completed rapidly within the framework of service level agreements. As such, efficiency in the branches was enhanced, the total number of employees in operations was reduced by 20% and these staff in sales teams could be evaluated.

Orders from the branches to the center in paper forms such as the POS Request and Revision Form and Checklist were transferred to a paperless environment through process automation. By doing so, the business flow period was shortened and became traceable on an application service level agreements base.

Creating terminals in PS data entries was automated and the business flow period was shortened. Process automation was thus achieved.

The data entry operations of single guarantee cheques of the branches was centralized and branch-related mis-entries for cheque entries were removed.

Money counters were integrated into the main banking system of the BYS. This allowed detailed clippings to be automatically written on bank receipts and complete end-of-day cash reconciliations in a rapid and straightforward manner.

Import letters of credit were developed on a new business flow infrastructure and included in the process automation. Work was carried out so these transactions could be carried out with full process automation.

The following was carried out within the scope of the “New Sales Service Model”:

- “Commercial Branch Network Management and Sales Directorate” and “Retail Branch Network Management and Sales Directorate” structures were formed,

- The “Region Sales Department” was restructured as the “Commercial Region Sales Department”,

- Branches operating as a “Mixed Branch” were restructured as “Retail Branches” and “Commercial Branches”,

- Process and procedures were updated within the scope of the new model,

- The physical document transfer and reconciliation of 627,000 customers was carried out, and flawlessly transferred to the new branches

With the InACT® Corporate Fraud Managemet Project, debit cards, credit cards and digital channel transactions can be followed instantly. This application received an award in the category of Security and Fraud Management in the IDC Turkey’s Finance Technology Award Ceremony, which took place in Istanbul in November 2017.

With its special features, the TFXTARGET Mobile Project is sector’s only instrument which enables foreign exchange transactions. This application received an awarded in the category of Digital Channel in the IDC Turkey’s Finance Technology Award Ceremony, which took place in Istanbul on 20 November, 2017.

The Operational Risk Optimization Project continued effectively. Branch-related operational risks were significantly reduced thanks to activities carried out to manage branch operational risks, the training and coaching provided to the branches and tight tracking.

Branches received interactive training through distance learning on the fund allocation products, processes and systems throughout the year, and the level of know-how was enhanced. By doing so, the rate of returns of offers coming from the branches was cut by 30%.

Card delivery ratios increased by 33% as a result of the measures taken and improvements in the process of delivering cards to customers.

Within the scope of compliance with the Law on Consumer Protection, a barcode infrastructure for New Internal Legislation Management and related documentation was established, guaranteeing that all documents would be protected in a centralized manner, of controlled changes with process automation, and always using the most updated document.

The “Confirmation with call back” application was launched within the framework of customer criteria to minimize the Bank’s risk in transfer transactions to foreign countries.

Lease certificates started to be protected in the Central Securities Depository of Turkey (MKK) instead of intermediary institutions. This ensured the clearance of traded lease certificates.

Lease certificate trading operations and lease certificate transfer activities were initiated for the “Big Ladle” product that the Bank offers its customers.

Process and cost optimization activities in cash management transactions were maintained continuously. This paved the way for efficiency improvements in branch balance management and improved efficiency in cash transfer operations.

The Bonus program was developed on the Bank’s POS devices so these devices could benefit from instalments and campaigns for Bonus cards. The customer experience was therefore improved.

Work on the new head office building was completed on the targeted date, and the move was carried out as planned. All personnel located in the Kağıthane head office, the additional Tophane office and the Training Center in Küçükbakkalköy moved to new head office building.

The building is comprised of two blocks, one being the base and the other being the tower block. The building has a total of 33 floors and hods the Leed Gold certificate in the category of green buildings. The building has the capacity to employ 3,250 people and accommodate up to 4,000 people. The building has followings attributes:

- A dining hall for 438 people,

- Two large prayer rooms which have the capacity to accommodate up to 340 men and 90 women,

- A conference hall with a capacity of 173 people, offering simultaneous translation in two different languages,

- A multipurpose room with a capacity to accommodate 503 people,

- A Cinema Hall,

- 10 training rooms and a social area,

- Parking spaces for 365 vehicles

While 17 branches were moved to new locations, 12 branches were renovated throughout the year. In the same period, 27 ATMs were installed and six ATMs were moved.

Information Systems and Corporate Project Management

Türkiye Finans was the first corporation in Turkey to move all of its application development processes to agile methods in a short space of time of just 5 months, and all of whose development teams applies scrum. The Bank has Turkey’s biggest and most matured agile teams. A total of 51 strategic projects which are at the scale of Master Plan were completed with 65 scrum teams by Information Systems. Moreover, 2,399 tactical and small developments were carried out.

All IT processes and procedures were updated in line with agile methods and COBIT criteria within the scope of Key Performance Indicators and quality criteria. The Information Systems performance management application and process infrastructure was enhanced with reporting, metric management, business intelligence and resource system integrations. A handbook was prepared for software development processes and large scale awareness training sessions were offered for critical processes. The Information Systems Recommendation Development Channel was launched and innovation and process efficiency recommendations started to be received from teams and be evaluated and implemented.

Türkiye Finans is the first bank in the Turkish banking sector to have received the ISO 22301 Business Continuity Certificate in the area of Business continuity. The Bank attained a 100% success rate in business continuity activity tests in 2017, as it had in previous years.

An independent audit once again confirmed the compliance of the Business Continuity System, which encompasses all of Türkiye Finans’ units and branches, to the international ISO 22301 standard, and certification was renewed.

New generation network investments were undertaken in Information Systems infrastructure. The network infrastructure was modernized.

The technical infrastructure of the Türkiye Finans Ümraniye Head Office building was supported with fibre-optic lines, providing full back-up between locations.

Investments in All Flash Storage systems which provide the most developed and highest performance that will carry all banking systems were completed. Modules were gradually migrated to these systems, ensuring performance improvement.

The Türkiye Finans Data Center holds Turkey’s first Tier III Operation Certificate. The Data Center performed better than the Turkey average in terms of energy efficiency with its Green IT approach and energy-sensitive applications. Activities for the Virtualization of the Data Center continued, and the virtualization ratio increased to 93.2%.

Expectations for 2018

Türkiye Finans aims to achieve the following in 2018:

- Making the banking and service process simpler and more effective by rolling out new technologies,

- Increasing centralization in operations and optimization of processes,

- Decreasing service time,

- Standing out from the competition by improving the quality of the service offered to customers

With this purpose, activities have been planned under the following headings: digitalization, transformation of credits, simple product application and agile branch operations.

74 million people

A total of 34 press bulletins about the Bank were issued in 2017, while 2,216 news items, including special reports and interviews, reached more than 74 million people in total with reporting in printed media, the internet and visual media.

Corporate Communication

Within the scope of corporate communication activities, a multi-channel strategy was successfully carried out at Türkiye Finans in 2017 and activities were announced to large audiences. Communication at Türkiye Finans, which develops innovative products and services that are fully compatible with principles of participation banking, continued through various channels. In addition emphasizing the importance of new product development and innovation in participation banking in communications made throughout the year, activities for increasing brand awareness in various channels such as TV, radio, internet, newspapers and magazines were carried out. A total of 34 press bulletins about the Bank were issued in 2017, while 2,216 news items, including special reports and interviews, reached more than 74 million people in total with reporting in printed media, the internet and visual media.

TFX Target Mobile application introduced

The TFXTARGET mobile application, which was developed by Türkiye Finans and which represents a significant innovation for the banking sector, was introduced in a press conference held in the Çırağan Palace with the participation of 29 members of the press on 12th October, 2017. The press conference attracted a great deal of interest, with 17 reports in printed media, 10 reports on digital media and 110 reports on online news sites. The conference was broadcast live on a national TV channel and on social media. A total of 5 million people were reached through printed news after the press conference, which was included in various TV broadcasts. Its visibility was ensured with 1,185 column centimetres in printed media.

Communication enhanced through campaigns

Communication of campaigns that provide periodical and special opportunities in the Bank was carried out throughout the year. Such efforts focused on the “Ramadan Campaign”, which offers 90/10 per cent profit sharing in participation accounts for customers who will open an account in the Bank for the first time, the “New Year Vehicle Finance Campaign” where customers can purchase vehicles at affordable profit rates and the “Preferential Mortgage Campaign” which offers financing support with maturities of up to 120 months at affordable profit rates.

Participation ensured in significant events in the sector

Türkiye Finans was among the attending sponsors of the Global Participation Finance Summit (GPAS) – Humanitarian Finance Summit, which was held in the Haliç Congress Center on 16th and 17th November. Visitors were hosted in the Türkiye Finance booth, while importance of new product development and innovation was emphasized in sessions held during the event.