Beset by internal and external difficulties, in 2015 developing countries suffered their poorest performance since 2009.

The global macroeconomic outlook

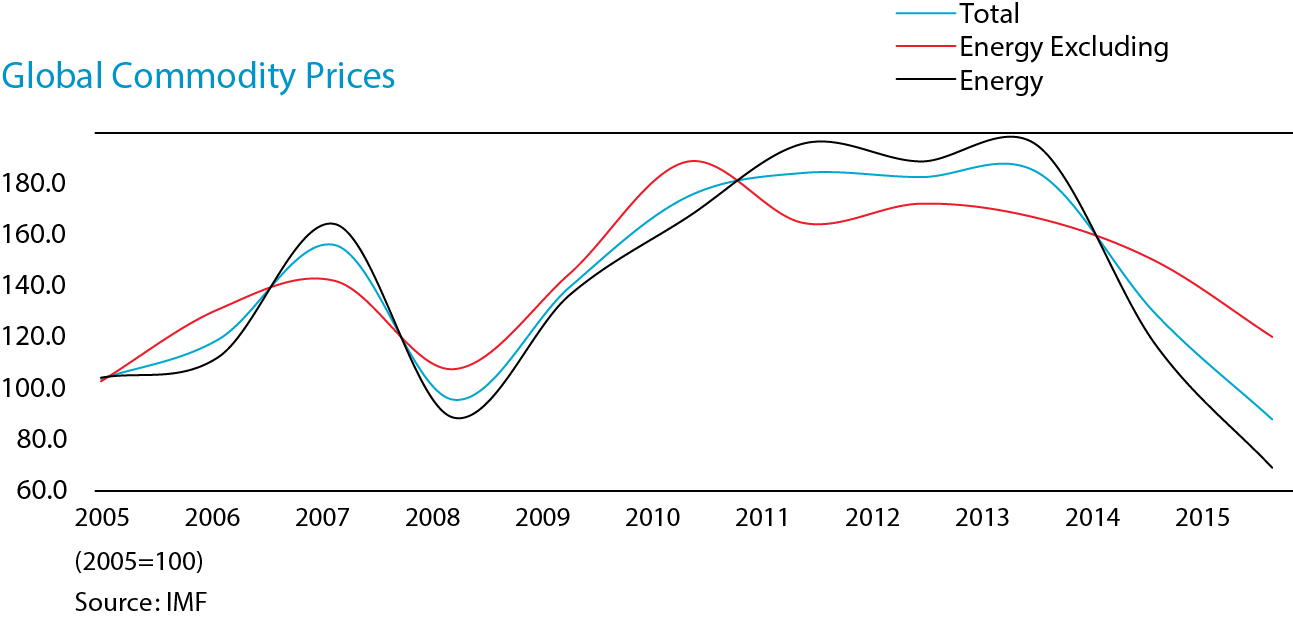

Global markets were focused on the deceleration in global economic growth, monetary policy measures taken by central banks, increased geopolitical risks, the rise in the dollar and the decline in commodity prices, mainly oil prices, during 2015.

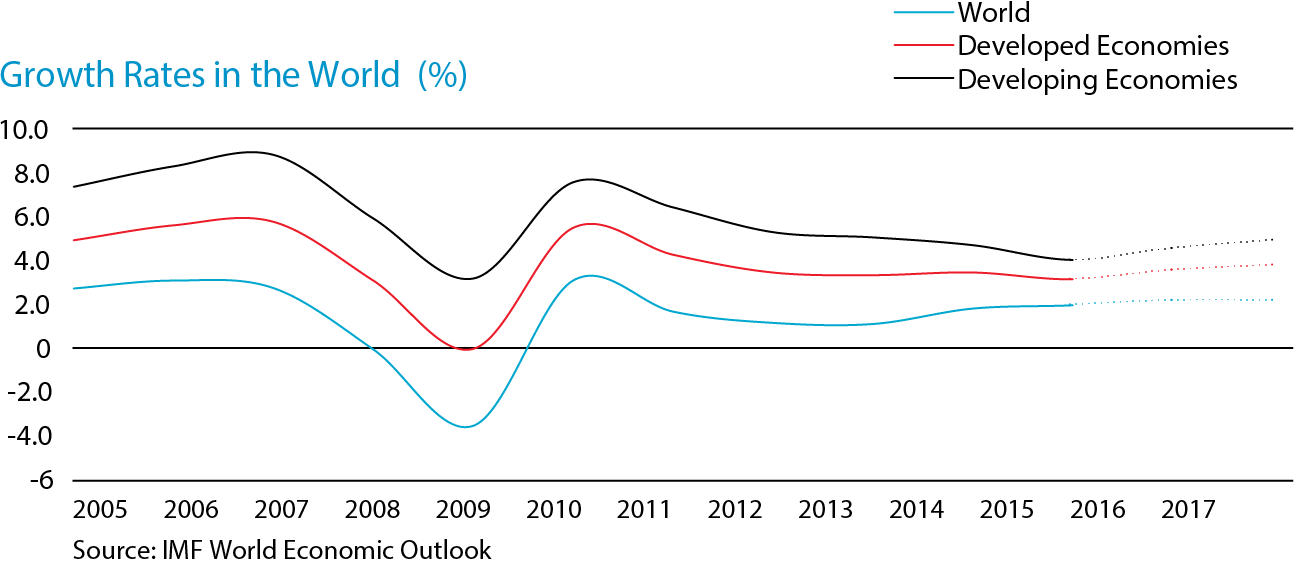

According to data in the report published by the World Bank in January 2016, after posting 3.4% growth in 2014 the global economy is estimated to have grown by 3.1% in 2015. The disappointing performance was blamed on lower commodity prices, weaker global trade volume and decreased capital flows. In addition, the slow-down in economic activity in developing countries was cited as one of the reasons for the softness of global economic growth.

The US economy posted 2.4% growth in 2014, and maintained this rate of growth in 2015. Solid labor market conditions created more than 200,000 new jobs 2015. With unemployment down to 5% in the last quarter of 2015, a consumption-led recovery in the labor market continued. Headline inflation hovered at around 0 in the second half of 2015, subdued by the slump in oil prices and a stronger dollar. However, for the first time in 9 years, the Federal Reserve raised interest rates on December 16 as economic activity continued to improve. This interest rate decision had been anticipated, with concern, in the market. However, the Fed’s statements that followed offered reassurance that there would be no sharp decrease in global capital flows, while supporting expectations that US monetary policy would continue to support the economy and that rate hikes would be gradual in the upcoming period.

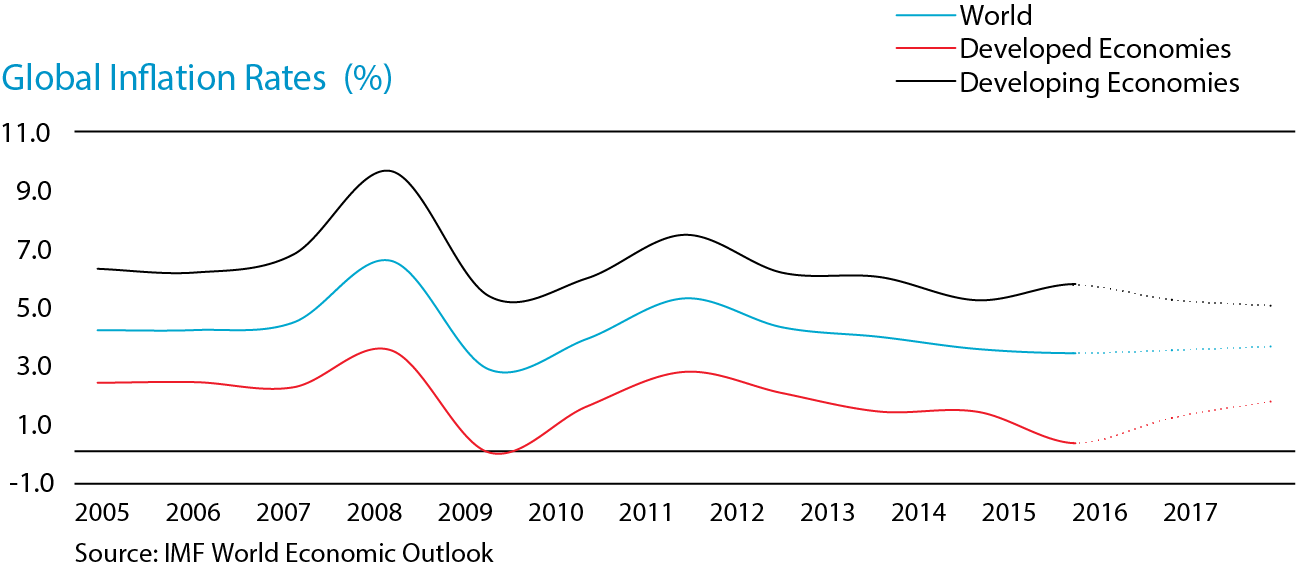

Despite recent data releases showing that economic activity in the Eurozone had slowed in the last months of the year, the continent’s economy posted a positive performance in 2015 when compared to 2014. Growth recovered through an increase in domestic demand and acceleration in exports, partially due to the lagged impact of the Euro weakness in 2015. After 0.9% growth in 2014, the Eurozone economy is estimated to have posted 1.5% growth in 2015. According to IMF data, a moderate 1.7% rate of growth is expected in 2016.

The rate of CPI inflation in the Eurozone was 0.2%. In parallel with the low levels of inflation, the European Central Bank (ECB) maintained its incentive measures in 2015. In the last phases of the year, ECB extended the deadline for the termination of asset purchase program from September 2016 to March 2017. The ECB stated that the deadline could be extended further if needed, while announcing that Euro denominated regional and local administration bonds would also be included in asset purchase program.

The slow-down in China’s economy, caused to lower commodity and energy prices, declining exports and weak demand was a source of concern. Having posted 7.3% growth in 2014, the Chinese economy grew by 6.9% in 2015. The Central Bank of China took measures aimed at cooling down economic activity and decreased interest rates and cut the required reserve ratios. The growth of Chinese economy, the World’s second biggest economy, is based on exports. In order to prevent deterioration in exports, China devalued its currency on several consecutive occasions in the second half of the year with the aim of boosting competitiveness again. The Chinese government is expected to step up monetary and fiscal measures in 2016, as well as extending support for the economy through financial reforms.

Beset by internal and external difficulties, in 2015 developing countries suffered their poorest performance since 2009. Problems specific to each developing country caused a further deterioration in the perception of their risk. Political concerns and geopolitical risks piled on extra pressure on the local currencies of developing countries in 2015.

A better growth performance is expected in 2016 when compared to 2015, as commodity prices start balancing and with the impact of the measures taken in developed economies. According to IMF forecasts, 3.4% growth is expected in 2016.

Recovery in developing countries in 2016 would depend on a continuity of the economic vigor in developed economies, a balancing in commodity prices, expansionary monetary policies being taken in big economies and stability in China’s balancing process.

When compared to 2015, a better growth performance is expected in 2016 as commodity prices start to balance out and with the impact of the measures taken in developed economies.

Outlook for the Turkish economy

After posting 2.9% growth in 2014, the Turkish economy is now estimated to have exceeded expectations with 3.5% growth in 2015. The Turkish economy grew by 2.5% in the 1st quarter of 2015 and 3.8% in the second quarter, rising to 4% in the third quarter - the fastest growth rate since the first quarter of 2014. Accordingly, in the first nine months of the year, the Turkish economy grew by 3.4% YoY. In the third quarter, consumption contributed positively by 3 percentage points to growth while investment took 0.1 points off growth; changes in inventories contributed 1 percentage point to growth. While 2.9 points of the 3.4% growth was derived from private consumption expenditures in the first three quarters of the year, the contribution from private sector investment was limited at +0.8 points. Growth was prominently supported by the agricultural sector, which posted 8.9% annual growth in the first three quarters, and services, which posted 4.4% growth in the first three quarters.

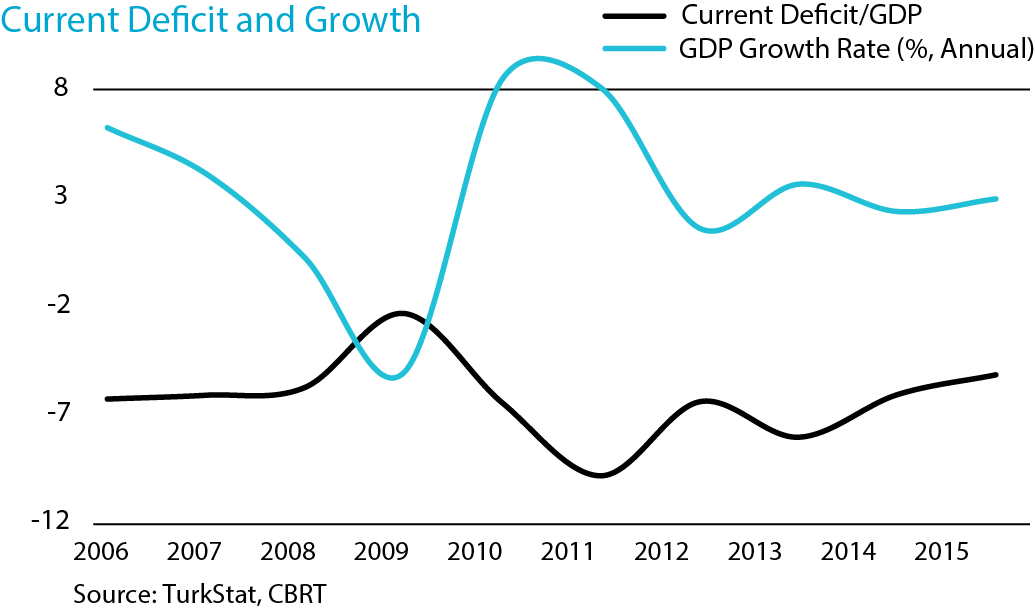

The current account deficit followed a declining trend throughout 2015. The decrease in imports, caused to a large extent by declining energy prices, played an important role in the improvement of current account balance. The current account deficit came in at USD 32.2 billion in 2015, its lowest level since 2006. The ratio of the current account deficit in GDP is estimated to have declined from 5.8% in 2014 to below 5% in 2015.

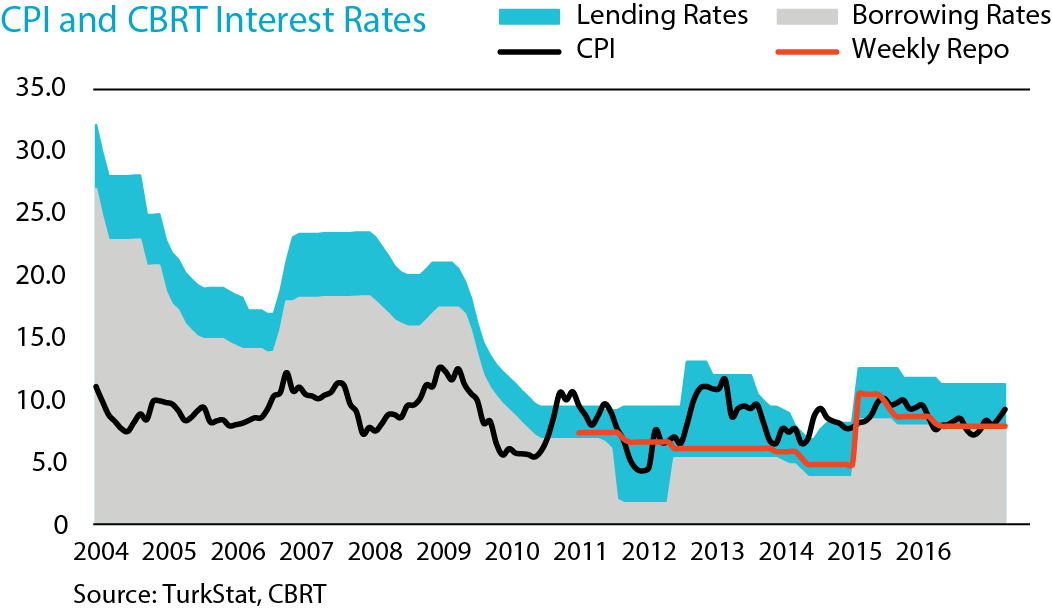

As far as inflation is concerned, a divergence between producer and consumer price inflation began to emerge by the end of 2015. The annual increase in the CPI in December came in at 8.81% - the highest inflation rate in the last four years. On the other hand, the rate of PPI inflation decreased on a monthly basis from October, to end the year at 5.71% - its lowest level in the last 3 years. The increase in food prices and rapid weakening in the Lira were the main reasons for the high levels of CPI inflation, despite the decline in commodity prices. The commodity price slump, and the fall in oil prices in particular, was instrumental in the decline in PPI inflation, even if higher food prices moderated the decline.

Foreign exchange markets are expected to be less volatile in 2016 than in 2015, which was quite a volatile year. The TL, which was affected by the global appreciation of the Dollar and Euro, suffered a loss of value within the year with the effect of geopolitical uncertainty. The Central Bank of Turkey, which explicitly tightened monetary policy in 2014, cut interest rates in January and February, but there were no further moves from the CBT following these small steps. The Central Bank kept its overnight borrowing rate at 7.25%, overnight lending rate at 10.75% and weekly repo rate at 7.5%. The CBT reacted to the volatility in the market and deprecation of TL by adjusting the marginal funding rate, which is not such a clear instrument. Moreover, the CBT stated that it would simplify the interest rate corridor an effort to lower volatility in the market once the normalization process is established.

In November, expectations of an acceleration in structural reforms gained momentum as the election process wound down and political uncertainty was resolved, paving the way for increased expectations that structural reforms would gain pace. The recovery in economic activity is expected to continue, helped by low energy prices. As a result, the rate of growth in 2016 is expected to match the growth performance seen 2015. Measures to boost income levels, especially the increase in the national minimum wage and higher pensions, are expected to stimulate demand and contribute to growth.

The Turkish banking sector and participation banking

Thanks to the experience built up in previous years and a sound financial structure, the sector left behind a year of success, as did the economy. The asset volume of the banking sector grew by 18% YoY to TL 2,357 billion in 2015, while deposits* grew by 18% to TL 1,325 billion. Loans** grew by 20% to TL 1,526 billion while equity expanded by 13% YoY to TL 262 billion. In the same period, the participation banking sector’s asset volume grew by 15% YoY to TL 120 billion, while funds collected increased by 13% to TL 76 billion. Loans grew by 15% YoY to TL 81 billion while equity rose by 10% TL 11 billion. The banking sector’s loans to deposit ratio stood at 108-110% in the first half of 2014, rising to 113-115% between the end of 2014 and the end of 2015.

The volume of securities issued by the banking sector to domestic and foreign markets rose by 10% YoY to TL 97.8 billion. Profitability in the banking sector grew by only 6% YoY to TL 26.1 billion at the end of 2015. The profit generated by the participation banking sector jumped by 184% in the same period to reach TL 409 million.

The sector’s capital adequacy ratio decreased from 16.28% at the end of 2014 to 15.57% by the end of 2015. While the sector’s capital adequacy ratio declined, the participation banking sector’s ratio increased from 14.55% to 14.96%. The banking sector is expected to be affected by the introduction of BASEL III in 2016. The fact that BRSA has decreased the risk weights applied to various loan types will improve bank’s capital adequacy ratios. In addition to the Treasury’s sukuk issuances, participation banks also carried out sukuk issuances in 2015. Despite the volatility in financial markets, the Treasury’s and participation banks’ sukuk issuances attracted strong demand.

The banking sector is expected to operate in a more positive atmosphere in 2016 and exceed the profitability and growth rates that were posted in 2015.

According to the latest World Economic Outlook Report prepared by the IMF, global growth projections have been revised downward. The slowdown in the Chinese economy and decrease in commodity prices will continue to put pressure on growth. This will also affect Turkey’s growth rate. However, positive sentiment started to take hold in Turkey with the establishment of a single party government, signaling that pressure on the Turkish banking sector’s profitability and growth will ease and a more positive period awaits. The banking sector is expected to operate in a more positive atmosphere in 2016, and exceed the profitability and growth rates that were posted in 2015.

* The text includes bank deposits and rediscounts for deposit interests, unless otherwise stated

** The text includes non-performing loans and rediscounts for loan interest and income accrual unless otherwise stated.