15%

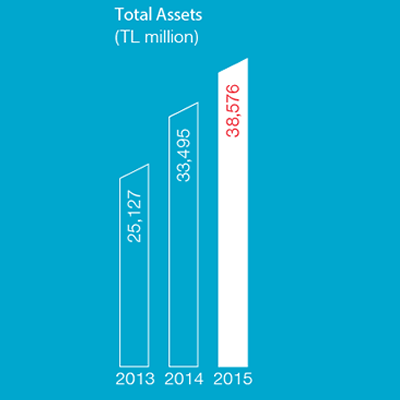

The total asset size of Türkiye Finans reached TL 38.6 billion, having posted 15% YoY growth as of the end of 2015.18%

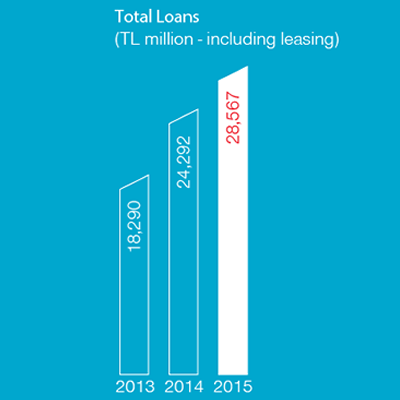

Türkiye Finans’ funds supplied, including receivables from leasing transactions, grew by 18% YoY to TL 28.6 billion as of the end of 2015.16%

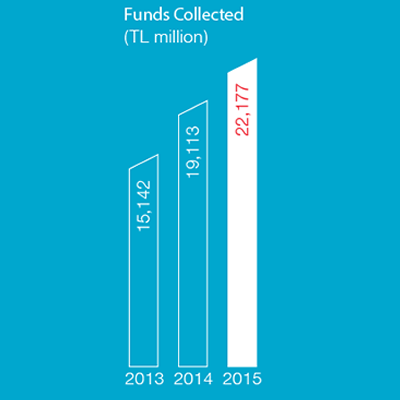

Türkiye Finans’ funds collected increased by 16% YoY to TL 22.2 billion by the end of 2015.28%

The net profit share income of Türkiye Finans grew by 28% YoY to TL 1.4 billion as of 2015.(TL thousand) |

2015 |

2014 |

Change (%) |

|---|---|---|---|

Assets |

38,576,299 |

33,494,790 |

15 |

Cash and Banks |

5,597,872 |

5,729,230 |

(2) |

Securities |

3,173,456 |

2,544,554 |

25 |

Loans |

27,014,513 |

23,056,422 |

17 |

Receivables from Leases |

1,552,415 |

1,235,541 |

26 |

Fixed Assets (Net) |

512,130 |

466,741 |

10 |

Other Assets |

725,913 |

462,302 |

57 |

|

|

|

|

Liabilities |

38,576,299 |

33,494,790 |

15 |

Funds Collected |

22,177,414 |

19,112,760 |

16 |

- Special Current Accounts |

5,432,281 |

4,297,645 |

26 |

- Participation Accounts* |

16,745,133 |

14,815,115 |

13 |

Loans Received |

8,657,646 |

8,569,415 |

1 |

Subordinated Loans |

733,023 |

- |

- |

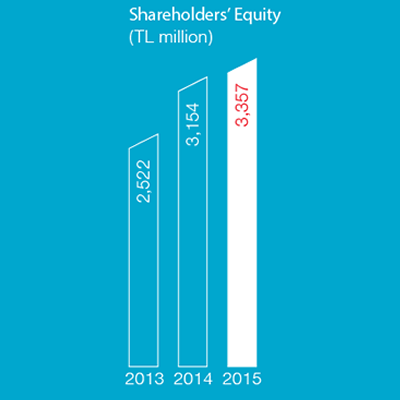

Shareholders’ Equity |

3,356,757 |

3,153,847 |

6 |

Paid-up Capital |

2,600,000 |

2,600,000 |

0 |

Other Liabilities |

3,651,459 |

2,658,768 |

37 |

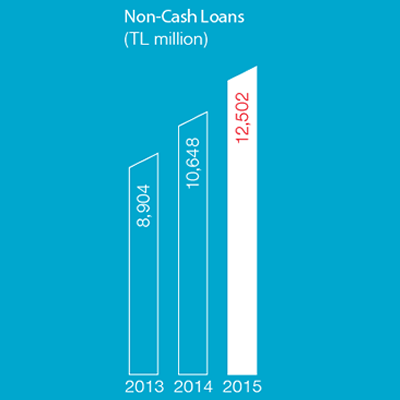

Non-Cash Loans |

12,502,404 |

10,648,417 |

17 |

|

|||

Income and Expense Accounts |

|||

Profit Share Income |

2,780,246 |

2,169,968 |

28 |

Profit Share Expenses |

(1,375,984) |

(1,072,136) |

28 |

Net Profit Share Income |

1,404,262 |

1,097,832 |

28 |

Net Fee and Commission Income |

142,469 |

148,598 |

(4) |

Other Non-Profit Income |

145,108 |

196,858 |

(26) |

Non-Profit Share Expenses |

(1,359,014) |

(1,018,003) |

33 |

Profit Before Tax |

332,825 |

425,285 |

|

Provision for Taxes |

(71,749) |

(91,057) |

|

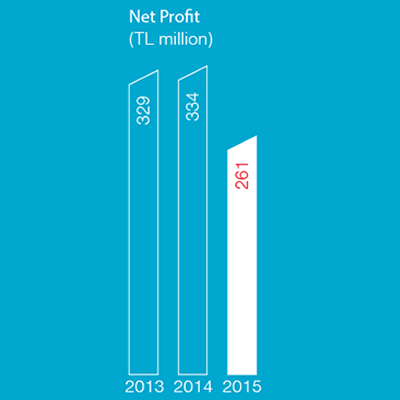

Net Period Profit |

261,076 |

334,228 |

|

|

|||

Key Ratios (%) |

|||

Capital Adequacy Ratio |

13.51 |

12.47 |

|

Return on Equity (Annual) |

8.02 |

11.78 |

|

Loans/Total Assets** |

74.05 |

72.52 |

|

Current Accounts/Funds Collected |

24.49 |

22.49 |

|

Non-Performing Loans (Gross)/Loans |

4.27 |

2.46 |

|

|

|||

Other |

|||

Total Number of Branches |

286 |

280 |

2 |

Total Number of Personnel |

4,132 |

4,478 |

(8) |

Important note: All numerical information in this report is presented in a format that is consistent with the most commonly-used European standard, which is to say that the decimal mark is (,) and the thousands separator is (.). This usage is consistent with the Bank’s reporting in previous years.

* Participation accounts include precious-metal accounts.

** Loans include financial leasing receivables.