Commercial and Corporate Banking

Full support for the economy through funds supplied

Türkiye Finans serves around 15,000 companies and their partners within the framework of its commercial banking activities, which have TL 15-150 million in annual net sales. In Commercial Banking, Türkiye Finans increased its cash loans by 20% YoY to TL 10.3 billion while non-cash loans grew by 15% YoY to TL 5.3 billion as of the end of 2015. The total sum of funds supplied reached TL 15.6 billion.

Within the framework of Corporate Banking activities, Türkiye Finans serves around 3,000 companies and their partners which have annual net sales of TL 150 million or more. In Corporate Banking, Türkiye Finans increased its cash loans by 15% YoY to TL 5.2 billion while non-cash loans grew by 20% YoY TL 4.7 billion as of the end of 2015. The total sum of funds supplied reached TL 9.9 billion.

Corporate Banking branch structure which was initiated with the establishment of 2 branches in 2008 was expanded with 2 new branches and 10 corners in 2015 in order to provide better service and to improve customer satisfaction.

The Corporate Banking branch structure that was set up with the establishment of two branches in 2008 was expanded with two new branches and ten kiosks in 2015 in order to provide better service and to improve customer satisfaction. Within the scope of Corporate Banking, customers are served with four Corporate Branches, three of which are located in Istanbul and one in Ankara. In addition, corporate customer representatives in Antalya, Adana, Bursa, Denizli, Gaziantep, Izmir, Kahramanmaraş, Kayseri, Konya and Mersin also offer services to customers.

In 2015, the volume of acceptance credits and letter of credits within the scope of non-cash loans supplied to corporate customers grew by 44% to 3.8 million. Letters of credit, which increased by 22% with the support of foreign trade campaigns, was the main trigger behind the growth of non-cash loans.

We continue to offer solutions that will help our customers.

In line with our customer oriented services approach while ensuring customer satisfaction and adhering to the principles of participation banking, Türkiye Finans determines needs in its relations with customers. Customer satisfaction is ensured by offering a tailored service of appropriate products for different needs.

Within the framework of this policy, Türkiye Finans continued its activities in the corporate and commercial segment. The Bank extended funding to investment projects, primarily renewable energy projects. Türkiye Finans supported the growth of the economy.

Türkiye Finans offers solutions that will help our customers with the support of systemic infrastructure. This system simultaneously works with an accounting system and recognizes daily account activities.

The Bank continued to provide IPARD incentives that are offered through the Agriculture and Rural Development Support Agency and Ministry of Economy incentives to its customers in 2015. Thanks to special opportunities provided within this framework, the Bank played a proactive role in the increase in investment and contributed to economic activity.

Türkiye Finans’ customers are fully hedged against any risks they may face in their commercial activities through “İşyerim Güvende (My Safe Office)”, “Limit Güvence (Limit Assurance)”, “Çek Güvence (Check Assurance)”, and “Faal/Siftah Card Assurance” policies that are prepared to protect customers against risk and to establish risk awareness. The “Construction All Risk” insurance, which is required by tender specifications, was offered to customers for KİK and construction related letters of guarantee.

As a pioneer for innovations in the sector within the framework of the principles of Participation Banking, in 2015 Türkiye Finans introduced its customers with the “cheque with funds” product, which is a version of murabaha as a cheque.

A version of murabaha as a cheque: Cheque with funds

As a pioneer for innovations in the sector within the framework of the principles of Participation Banking, in 2015 Türkiye Finans introduced its customers with the “cheque with funds” product, which is a version of murabaha as a cheque. The cheque with funds is based on the funding of cheques given by customers in exchange for the purchase of goods. Maturity and rates are determined on the day of exchange. This product provides limited funding and payment ease for cash flow cycles.

Direct Collection System (DTS) in cash management

DTS provides automatic payment of purchases of goods by forming a bill through an online system or installation based on previously determined rates and maturity. This product eases the flow of goods from the main company and enables companies to collect easily. In 2015, Türkiye Finans carried out activities to spread DTS to more companies. Funding provided through DTS increased by 24% to TL 320 million, when compared to TL 260 million in 2014.

Financial leasing activities

Türkiye Finans continues to offer financial leasing service to customers in the Corporate, Commercial and SME segments within the Turkish economy, which gradually require more modern funding methods and which are growing rapidly. Türkiye Finans provides this service to help customers meet their needs for machinery, equipment and similar requirements that are subject to financial leasing. Türkiye Finans added lease-back projects to its product portfolio after recent changes in the Financial Leasing Law. The Bank provided this funding resource to its customers. The volume of financial leasing in the Commercial segment had grown by 26% YoY to 1.5 billion as of the end of 2015.

Effective solutions in foreign trade

Türkiye Finans continues to offer its customers solutions that have high value add and meet their needs, thanks to the Bank’s expert personnel and widespread correspondent network in every corner of the World. The Bank diversifies its financial products for its customers. The Bank provides funding opportunities by intermediating in funding obtained from foreign sources such as Eximbank, GSM and SEP at attractive costs in the medium and long term.

As of the end of 2015, the export volumes of the customers served increased by 280% to USD 1.1 billion from USD 301 million in the last two years. On the other hand, imports and acceptance credits grew by 17% to USD 5.3 billion from USD 4.5 billion in the last two years. The Bank’s foreign trade commission income increased by 59% to TL 11.6 million.

The Bank extended USD 75 million of cash loans within the scope of SÖİK.

Supporting the tourism sector and farmers with the Siftah Card

Türkiye Finans carried out activities to expand usage of the Siftah Card in 2015. The Bank completed its activities for “Siftah Card Tourism Professional” and “Siftah Card Farmer”, which will offer special advantages for the tourism and agriculture sectors. A closed cycle card system infrastructure, which will offer the opportunity of special rates to the agreed main dealer, was prepared for facilities such as grace periods and balloon payments. These properties will be offered to customers from 2016.

Extending long-term resources to the real sector through lease certificates

The issuance of sukuk through an asset leasing company to provide instrument diversification as well as long term resources to the real sector continued at an accelerating rate in terms of the amount and type. In addition to asset based sukuk issuance, the Bank also initiated management declaration based sukuk issuances in 2015. As a result, the number of companies increased to four, while the volume of sukuk issued rose to TL 345.5 million.

Improvements in processes for the supply of funds

Türkiye Finans took some measures for the allocation of funds in 2015 in consideration of economic and political developments in both domestic and international markets and regions we have close commercial relations with. In addition, an increase in the volume of non-performing loans was also instrumental in the Bank’s decision to take these measures.

In 2015, Türkiye Finans established a Regional Allocation Directorate in five Regions - Ankara, Istanbul (Asian side), Istanbul (European Side), Adana and Izmir). The Bank obtained positive results in meeting customers’ increasing needs in a faster and healthier manner under increasingly competitive conditions.

On the other hand, the increased contribution of technology in financial analysis and intelligence processes supported the rapid and healthy process management.

In the first half of 2015, the Bank started work to enable online real estate queries through the TAKPAS system of the General Directorate of Land Registry and Cadastrate. This contributed to the acceleration in the allocation of funds.

Expectations for 2016

Türkiye Finans will continue to maintain its customer oriented working policy with its customer experience, innovative perspective and product range, which is continuously being renewed. The Bank will continue to expand its customer base with highly credible customers from all sectors by preserving its asset quality, increasing its penetration and growing with its customers

In 2015, Türkiye Finans cooperated with “Findeks” to increase customers’ financial awareness and to contribute to risk management. As a result, customers were able to purchase their Findeks reports from branches at attractive costs. Following the pilot branch application, customers will be able to access this service from all branches in 2016.

Moreover, Türkiye Finans initiated activities for the realization of Profit/Loss Investment Partnership. The Bank expects to realize this product and expand its usage.

SME Banking

Türkiye Finans, which supports the growth and development of SMEs, is not only a financial institution for SMEs but also an advisor and business partner.

Share of Türkiye Finans among participation banks in cash loans allocated to SMEs is 46%.

Cash loan allocation increased by 23% to TL 15.8 billion while non-cash loan allocation grew by 11% to TL 6 billion when compared to the end of 2014. The total volume of funding in this segment reached TL 22 billion, with a net of 33,998 customers.

According to the official SME definition, the share of cash and non-cash loans allocated to SMEs in total loan allocation was realized at 53%.

Türkiye Finans intermediated in SME’s purchases of TL 110 million of goods through the Siftah Card, which allows SMEs to reach funding without going to a branch.

Türkiye Finans’ share in participation banks and banking sector with respect to loans supplied to SMEs are 46% and 4%, respectively. On non-cash loans side, the Bank as 37% and 5% shares in participation banking and banking sector, respectively.

Türkiye Finans ranked as number one in KGF (Credit Guarantee Fund) collateral loan allocation in the banking sector.

Demonstrating a solution-oriented approach to facilitate SMEs’ access to financial resources, Türkiye Finans maintained its leading position in the banking industry in 2015 on the basis of Treasury Supported Credit Guarantee Fund collaterals, as it had in 2014. Türkiye Finans continued to provide more collateral opportunity to SMEs than any other bank within the scope of Treasury Support, with a total amount of TL 219 million and a market share of 24%. Between 2010, when the protocol was signed, and the end of 2015, Türkiye Finans provided TL 1.3 billion of collateral funding to SMEs within the scope of Treasury Supported Credit Guarantee Fund collaterals.

Türkiye Finans introduced its customers with KGF’s renewed protocol to manufacturers, women entrepreneurs, the maritime sector and travel agencies. By doing so, Türkiye Finans provided KGF opportunities to more SMEs.

Türkiye Finans, which supports the growth and development of SMEs, is not only a financial institution for SMEs but also an advisor and business partner.

Full advisory to SMEs

Türkiye Finans, which supports the growth and development of SMEs, is not only a financial institution for SMEs but also an advisor and business partner. Türkiye Finans works with a specialist consulting firm, primarily in connection to grants provided by the Development Agencies but also incentives that support innovation in production and are extended by TÜBİTAK, R&D incentives, TTGV support, KOSGEB Project Incentives, IPARS support, rural development and stockbreeding incentives. With this cooperation, a professional service is offered to SMEs concerning these grants. The Bank played an intermediary role in purchases by SMEs eligible to grants within the scope of the KOSGEB support packages with Co-Financing Protocol according to their business plans.

Türkiye Finans continues to support SMEs that hold the Investment Incentive Certificate. Within the scope of the “Profit Share Protocol” signed between Türkiye Finans and the Ministry of Economy, the Bank continued to support companies that hold the investment incentive certificate.

From the date the protocol was signed up until the end of December 2015, financial support was provided to SMEs in their purchases of goods regarding their investments. The Bank also intermediated in TL 14 million of grants received from the Ministry of the Economy. Within this context, customers who purchased TL 50 million of goods in 2015 were awarded TL 5 million in grants.

Expectations for 2016

In 2016, Türkiye Finans will continue to enter agreements with chambers of artisans, industry and commerce, to provide collateral solutions to SMEs, to intermediate in support extended by KOSGEB.

With its identity as “the Bank of SMEs”, Türkiye Finans completed its activities for the development of www.kolaygelsin.com which is a meeting point of SMEs and contains macroeconomic news, expert opinions and information on banking, finance, grants and incentives. This portal will be offered to SMEs in 2016. Through the “Teşvikbul-Find Incentive” service available on this portal, all companies in Turkey may access grants and incentives that are suitable for their companies and investments through the online search engine.

In 2015 Türkiye Finans started work on the “e-billing” service to meet customers need for electronic billing. The Bank will take more solid steps towards making life easier for SMEs with new products and packages that will be launched in 2016.

144%

The total volume of cash and non-cash funds allocated to project finance in 2015 grew by 144% to TL 2 billion.Project Finance

We attach weight to renewable energy investments.

The Total volume of cash and non-cash funds allocated to project finance grew by 144% to TL 2 billion in 2015. Türkiye Finans served 3,426 active customers from the Corporate Banking segment in project finance, with 2,792 of these companies having net sales of TL 150 million or more, while 634 of them are business partners.

Initial agreements were established with third parties to receive advisory and technical feasibility support. This will improve the Bank’s current job quality and level of risk analysis in the field of project finance. In addition, importance was also placed on training activities, especially in legislation of the energy sector in Turkey and recent developments in the global energy sector.

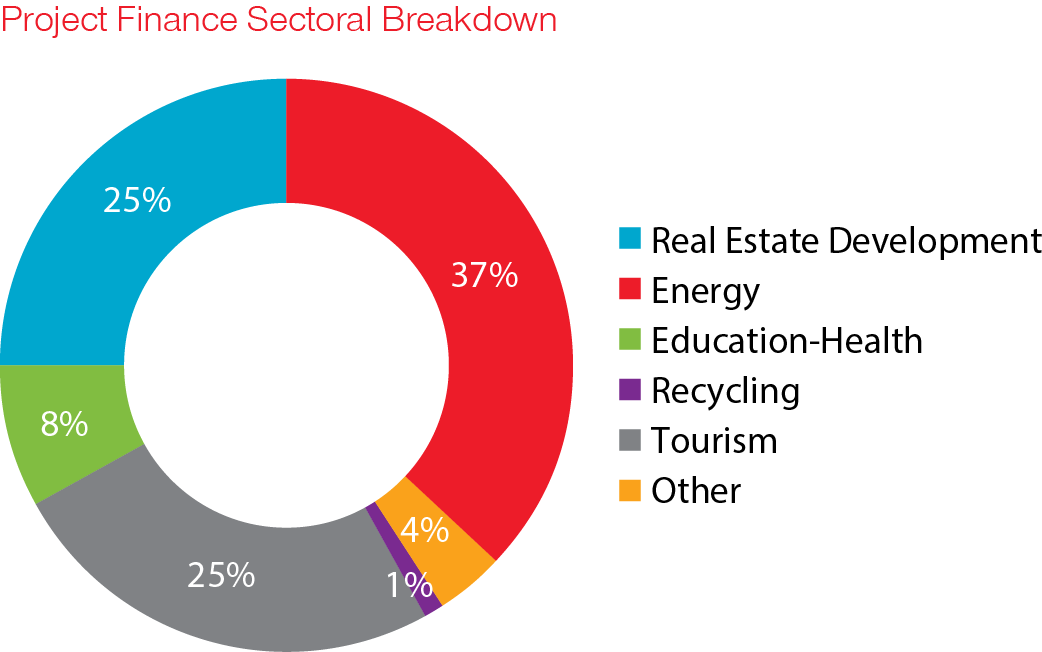

Renewable energy investments comprised 37% of the risk amount supplied within the scope of project finance in 2015.

Renewable energy investments composed 37% of risk amount which supplied within the scope of project finance in 2015. When education and health institutions and recycling plants are included, 42% of project finance risks consist of projects that will provide environmental and social contributions.

The biggest increase in project finance during 2015 was in Solar Power Plant (GES) projects.

Expectations for 2016

Türkiye Finans expects to contribute to the growth in renewable energy projects, primarily Solar Power Plant projects and biogas energy projects, which are highly efficient.

Türkiye Finans exceeded its targets and expectations for housing financing in 2015. The Bank supplied TL 1.9 billion of real estate financing in 2015.

Retail Banking

Meeting expectations in financing housing.

Türkiye Finans exceeded its targets and expectations regarding housing financing in 2015. The Bank extended TL 1.9 billion of real estate financing in 2015, with housing financing accounting for a 79% share in total real estate financing.

Türkiye Finans carried out 12 thousands housing financing transactions amounting to TL 1.5 billion in 2015. TL 570 million of this amount was related to financing provided to mass housing projects. Share of mass housing projects in total housing financing is 38%.

Türkiye Finans organized five mortgage campaigns targeting professional groups in 2015.

In addition to the financing of completed real estate, Türkiye Finans maintained its rapid increase in incomplete mass housing projects in 2015 with its financing strategies and effective and active marketing activities.

As a result of allocations, the volume of housing financing increased by 7% to TL 3.7 billion by the end of 2015 from the TL 3.5 billion at the end of 2014.

Rapid solutions in consumer financing

Türkiye Finans’ Hızlı Finansman (Fast Financing) distributors, the first of their kind to adhere to the principles of participation banking and which operate as an online financing channel, reached around 2,000 points in 2015. A total of TL 55 million in financing was extended through this channel in 2015. In order to support customers in consumer and vehicle financing, on-site supply was carried out with simultaneous responses from contracted distributors within the scope of support services outside the branches. Customers could then plan their payment according to their income through flexible payment plans.

Within the framework of participation banking principles, Türkiye Finans activated financing support for SSI payments of citizens of the Turkish Republic living in Turkey and abroad. The Bank set up special pricing models for education financing and signed agreements with several education institutions.

The Bank continued to offer the Ready Limit, which is a form of preapproved consumer and vehicle financing. The Bank’s customers were offered consumer financing opportunities after having been sent reminder messages.

Türkiye Finans continued to provide Finansör, which provides convenience to customers by meeting their consumer financing needs through the intermediation of bank cards. In this period, the number of Finansör transactions increased to 230,000 while the volume of the transactions reached TL 380 million. In order to increase service quality and improve the customer experience, customers were able to use Finansör in Türkiye Finans branches of their choice, not just the branches in which they have their account.

Expectations for 2016

In addition to realizing the Consumer Banking targets in 2015, Türkiye Finans plans to acquire new customers, organize campaigns to improve activation and cross selling ratios, enter new project agreements, provide financing support to urban transformation projects and to launch projects regarding school installment payments. The Branchless Banking Project, which was started on the Asian side of Istanbul in 2015, is expected to be expanded to all regions where the Bank is active in 2016.

Türkiye Finans is planning to update its pricing policy for consumer financing in order to provide the best service to customers. Together with improvement activities regarding products and services, the Bank aims to improve customer satisfaction as well as effectively manage costs.

Micro Banking

Always working with micro enterprises, too

In the Micro Banking segment, Türkiye Finans primarily offers services to artisans but also serves micro enterprises, small enterprises and business partners whose annual net sales are between TL 0-2 million. Within this scope, the Bank offers financial support and advisory services which customers may need. Türkiye Finans also eases the periodical and daily work loads of customers through cash management products. Within the scope of Micro Banking, Türkiye Finans provides customer oriented sectoral solutions, meets enterprises’ financial needs for trade, manufacturing and employment, and contributes to their sustainable growth.

Türkiye Finans ensured faster and more effective loan allocation through improvements in allocation processes and effective risk management. By doing so, the Bank aimed to increase its customer service quality.

As a result of the restructuring process carried out in 2015, Türkiye Finans offers service with 620 customer relations managers under the roof of “Retail Banking” in all branches. The Bank maintained its principle of growth spread to the base, with the number of active customers approaching 60,000. Türkiye Finans adopts the principle of being “the Bank of Artisans” within the scope of Micro Banking, and penetrates the fabric of the cities that the Bank operates in and offers services and products with differentiated solutions.

The trend of growth in cash loans continued. At the end of 2015, the total volume of loans supplied, including loans to enterprises and their business partners, had reached TL 1.2 billion.

Türkiye Finans Micro Banking continued to provide leasing support to artisans and small enterprises in their investment needs for machinery and equipment and other requirements. In this area, Türkiye Finans recorded a growth rate of 21% YoY with leasing volume of TL 46 million.

Türkiye Finans attaches importance to artisan banking and local cooperation in supporting artisans. Türkiye Finans Micro Banking signed special protocols with 15 chambers of artisans in Manisa, Izmir, Muğla, Aydın, Tekirdağ, Ordu, Istanbul, Sakarya and Bursa. Within this scope, the Bank offered an advantageous service by preparing special packages to artisans under the chambers in these cities.

Türkiye Finans allocated TL 160 million of funds to agricultural customers within the scope of Micro Banking in 2015. By doing so, support for agriculture and farmers continued to gain pace.

The Bank finances customers’ needs for agricultural vehicles, machinery and equipment with attractive payment conditions through the “Smiling Farmer Agriculture Package” and “Faal Card Farmer Package”. The Bank also continues its support for agricultural producers.

New packages in the Faal Card

The Faal Card is a fast and easy financing solution for corporations in their purchases of goods and services related to their commercial activities. Türkiye Finans carried out improvement activities regarding the Faal Card and prepared privileged packages which include various payment conditions for artisans. Within this scope, the Bank provided TL 60 million of financing to 5,000 artisans and small enterprises in 2015.

Türkiye Finans, Turkey’s pioneer participation bank, proved its presence in Agricultural Banking by maintaining its support for agricultural producers with its wide product and service range. The Bank finances customers’ needs for agricultural vehicle, machinery and equipment with the “Smiling Farmer Agriculture Package” and the “Faal Card Farmer Package”. The Bank extended support according to farmers’ cash cycles in the harvest period with payment plans that require payments every 12 months with a maturity of 5 years.

Expectations for 2016

Micro Banking will continue to meet the cash and non-cash needs of micro and small sized enterprises in 2016, mainly small artisans. With its products and solutions, it will continue to ease the daily work load of micro and small enterprises. Customer representatives in all branches throughout the country are the Bank’s most important source of strength in this area. Türkiye Finans’ main target will be to establish long term customer relations which are based on trust.

The Faal Card, which was offered to customers with the approach of “financing that you need is always in your pocket”, will be the main product in the Micro Banking segment in 2016 through new developments, special choices and new packages.

Türkiye Finans will continue to offer solutions and services tailored to meet customer’s needs through privileged products. The Bank will also continue to prioritize product developments. Accordingly, Türkiye Finans will expand its cooperation with chambers of artisans to a nationwide level.

In 2015, Türkiye Finans entered an agreement for the sale of the Findeks product to its customers. The Findeks product was developed by the Credit Bureau for the use of the real sector. The Bank plans to offer its products designed as consumer and commercial packages to its customers through the branches.

TL 22,2 billion

Funds collected, which represent Türkiye Finans’ most important financial resource, increased by 16% YoY to reach TL 22.2 billion by the end of 2015.Fund Collection and Investment Products Marketing

16% increase in funds collected

Funds collected, which represent the Türkiye Finans’ most important financial resource, increased by 16% YoY to reach TL 22.2 billion by the end of 2015. Within funds collected, current accounts grew by 26% to TL 5.4 billion while profit sharing accounts increased by 13% to TL 16.7 billion in 2015. In terms of the breakdown of funds, 54% of funds were TL denominated while 46% were in foreign currencies.

An expanding range of investment products

Türkiye Finans continues its marketing activities for investment products through the BMD (Bizim Securities) intermediary activity for order transmission. The monthly average transaction volume reached TL 187 million in investment products (equity market transactions and investment fund trading) which grew by 6.1% when compared to their level at the end of the previous year. Türkiye Finans had obtained TL 1.2 million of commission from investment transactions as of December 2015.

Türkiye Finans carried out the “Financing Guarantee Insurance with Profit Sharing” as a first in Turkey.

Türkiye Finans, adopting a more effective service vision, obtained following permits from the Capital Market Board in Intermediation for Order Transmission, Transaction Intermediation, Portfolio Intermediation and Limited Custody Activities. The Bank integrated infrastructure related to the Turkey Electronic Fund Distribution Platform. Türkiye Finans completed its integration activities following the Borsa İstanbul - NASDAQ OMX system transition.

The “Akıllı Bıdık Çocuk Hesap” (Account for Kids) product, which is composed of advantages and accounts for parents who to invest in their children’s future, was offered to the market in 2015. In doing so, Türkiye Finans expanded its product range.

Türkiye Finans booked commission income of TL 222 million in banking service revenue with the impact of improvements in systemic infrastructure.

In Insurance and the Private Pension System

Türkiye Finans increased its commission income from the sale of insurance products by TL 4 million YoY to TL 22.5 million in 2015. The Bank generated TL 83.8 million of premiums within the scope of Insurance intermediary activities. Insurance intermediary figures grew by 8% YoY in the generation of premiums, and 19% YoY in commission income.

The total size of funds held by Türkiye Finans in the Private Pension System (BES) reached TL 102.6 million. The Bank booked TL 2.6 million of insurance intermediary income from the Private Pension System in 2015.

Türkiye Finans carried out “Financing Guarantee Insurance with Profit Sharing” with Vakıf Emeklilik, a first in Turkey.

Türkiye Finans recorded TL 9.3 million of premiums and TL 4.4 million of commission income in the insurance campaigns organized in 2015.

Expectations for 2016

Türkiye Finans plans to carry out a range of advertising, promotions and training activities to realize a significant increase in the market share of funds collected.

The Bank will continue its activities with its main target of addressing more customers through new customer acquisitions by increasing product range in Investment and Insurance product services.

Payment Systems and Credit Cards

The Number of Türkiye Finans’ POS machines reached 36,000.

Türkiye Finans increased its number of POS machines to 36,000 in 2015. The Bank’s POS revenue grew by 50% to TL 5.3 billion.

Türkiye Finans renewed 80% of the devices in its POS portfolio. By doing so, the Bank ensured the satisfaction of member workplaces. In addition, more efficient devices contributed to an increase in revenue. The Bank increased the POS field safety inventory ratio from 10% to 20%. As a result, the Bank took action towards decreasing the time necessary for POS installation as well as the time spent dealing with faults.

The Foreign Currency POS Project, which allows member workplaces to carry out sales in seven different currencies (TL, USD, EUR, GPB, JPY, RUB and SAR), was completed in June 2015 and was launched.

Bonus on POS for the first time in Participation Banking

Türkiye Finans completed and launched the application that will support Bonus installment and campaigns on POSs in 2015. As a result, the Bonus on POS application was realized for the first time in Participation Banking. Within the scope of Bonus POS, member workplaces were able to make installment payments on 16 million credit cards of 10 banks that are members of the Bonus platform and to offer Bonus points to customers which will have a potential to increase revenue.

The Foreign Currency POS Project which enables member workplaces to carry out sales with 7 different currencies was completed in June 2015 and was launched. Member workplaces can carry out sales in the TL, USD, EUR, GPB, JPY, RUB and SAR currencies with customers who use Visa or MasterCard branded credit cards. Also, member workplaces may follow or use the sale amounts of the same currencies mentioned above.

The Bank’s POS revenue grew by 50% to TL 5.3 billion in 2015.

Continuing to support growth in different credit cards segments

Türkiye Finans continued its growth in 2015 thanks to its range of credit card products which are tailored for various segments and the development of marketing campaign models which will enable customer acquisition regarding growth. As a result of these activities, the Bank achieved 16% growth in consumer credit card revenues. Accordingly, consumer credit card revenue had reached TL 2 billion by the end of 2015.

Türkiye Finans stepped up work on various campaigns (such as discounts and additional installments.) through the Bank Bonus platform that it is a member of, in a bid to target customers’ needs and expectations that are shaped in changing retail world. These campaigns also aimed customer acquisition.

Türkiye Finans continued to provide its credit card customers with Happy Advance which is free of charge, commission and interest free. The Bank carried out campaigns on sector basis with “To Install” application. As a result, customers are provided with payment easiness and installment advantages in their in cash credit card transactions.

The number of consumer credit cards grew by 14% YoY to 1.4 million.

Türkiye Finans started the transformation project for the infrastructure of bank cards. Within this scope, customers were offered the opportunity to use their bank card in e-commerce transactions, to earn points and to define ATM cash withdrawal limits specific to customers.

Türkiye Finans reached 44,000 active HGS cards in the Fast Pass System (HGS).

“Yedek Hesap (Reserve Account)” - a current account product with Benevolent-Loan

Türkiye Finans launched the Yedek Hesap (Reserve Account), a current account product with Benevolent-Loan. This product allows customers to pay their bills immediately even if they do not have enough funds in their accounts and to obtain financing support through ATMs when they are in financial trouble. The Bank aimed to offer financing support with Benevolent-Loan and allow quick payment of bills through the Yedek Hesap (Reserve Account) when customers are in trouble. The application and allocation processes are designed to provide these facilities rapidly to ensure high levels of customer satisfaction. Customers will be able to able to choose their current account according to the services required. The Reserve Account has been offered to customers since July 2015. Türkiye Finans received 42,000 applications for this product in a short space of time.

In 2015, number of collection points increased by 26% YoY to 911 with “Hızlı NOKTA (Fast Point)” which is Türkiye Finans’ registered branded collection platform, which is touch screened, user friendly and upgradable.

Making life easier with “Hızlı NOKTA (Fast Point)”

Hızlı NOKTA (Fast Point) is Türkiye Finans’ registered brand of collection platform which operates with touch screens, is user friendly and is upgradable. This platform has served users since July 2014. The number of collection points increased by 26% YoY to 911 with “Hızlı NOKTA (Fast Point)” in 2015. A total of TL 1.3 billion in collection revenues were recorded through transactions carried out through the collection platform.

Fund supply at distributors with Hızlı Finansman (Fast Financing)

Hızlı Finansman (Fast Financing), an important application channel for consumer financing, allows on-site applications from consumer and vehicle distributor and real estate offices. Developments in Hızlı Finansman (Fast Financing) continued unwaveringly during the year. Türkiye Finans enabled on-site fund allocations from vehicle distributors, thus enabling customers to obtain vehicle financing from distributors without needing to go to the branches. Türkiye Finans recorded TL 39 million of fund supply from Hızlı Finansman (Fast Financing) distributors. This figure indicates a 100% YoY increase.

Convenience with the School Instalment System (OTS)

The School Instalment System (OTS) Project, which will allow easy payment and receipt of school fees for both educational institutions and parents was launched in April 2015. The OTS allows collection of education fees by schools through a regular payment order via a bank account, Finansör or the Bank’s credit cards through equal or variable installments of up to 18 months with one of the following choices: “payment through finansör if the balance is not sufficient”, “payment through credit card if the balance is not sufficient”, or “payment from the account only”. Türkiye Finans had entered agreements with 16 educational institutions as of the end of 2015. The Bank involved 1,150 parents into the system and defined installments amounting to TL 9.2 million. Türkiye Finans had collected TL 1.5 million as of the end of the year.

Online structure set up for Western Union transactions

Türkiye Finans set up an online structure for Western Union transactions within the scope of domestic and international money transfer services. This paved the way for a 20% increase in the number of transactions. Türkiye Finans ended the year with 73,000 transactions, bringing in commission income of TL 1.4 million within the scope of Western Union transactions.

Increasing volume of fund allocation with campaigns

Türkiye Finans conducted consumer vehicle campaigns to meet customer expectations and pricing in the sector. The Bank received intensive customer applications for all maturities with fixed and convenient profit share. One of the campaigns offering cheap pricing and that was offered to customers was the Vehicle Financing Meeting Campaign. The Bank achieved 30% of vehicle financing figures through campaigns.

Expectations for 2016

Türkiye Finans will work to achieve growth in credit card products in a more stable manner, minimize losses and maintain a soundly performing portfolio. The Bank will review working policy rules and approval sets for credit card process.

Mass housing projects play an invaluable role in the Bank’s fund allocation regarding housing purchases. In 2016, Türkiye Finans will continue to visit corporations/cooperatives in order to evaluate demand for mass housing projects more effectively.

Türkiye Finans plans to set up a “Hotline” to provide more effective services to branches and related units as well as to manage phone traffic appropriately.

Customer Experience and Service Management

Our principle is to unwaveringly build on our high standards of customer experience.

Türkiye Finans carries operates in line with the ISO 10002: 2004 Customer Satisfaction Management Standard. ISO 10002:2004 is a management system which enables enterprises to meet customers’ expectations and which sets out the required conditions for the creation of a system for customer satisfaction by evaluating customer complaints under a defined approach. The bank registered the continuity of the document after an interim audit by the documentation institution. Türkiye Finans aims to further improve its high customer experience and satisfaction.

Continuing to innovate and improve in order to enhance customer experience and service quality

Türkiye Finans took measures in response to development points raised in the customer satisfaction survey. The Bank also carried out a new survey study within the year aimed at tracing standards of service quality.

Türkiye Finans revised the complaint management procedure and reporting steps within the scope of the Level of Customer Orientation (MOD) principles. By doing so, the Bank contributed to the development of a customer oriented structure. In addition to current channels, the Bank activated fax/e-mail channels to allow customers to forward their complaints, objections or expressions of satisfaction. The Bank started work on an infrastructure that will allow customers to query their notifications.

In 2015 Türkiye Finans was ranked as number 1 in the Customer Experience Index report prepared by the website şikayetvar, on the basis of contact speed, complaint process, satisfaction with the outcome, rate of thanks and change in brand perception scores.

As part of efforts to increase the quality of service given to the customer and boost operational efficiency; centralization, process improvement projects, reorganizations in branch locations and improvement projects regarding transaction time were put into practice.

Türkiye Finans started work on the “yalın şube projesi (simple branch project)” with the aim of simplifying services provided in branches, especially regarding operational processes. The Bank also completed needs analysis. Output from the analysis was realized within 2015 to provide a faster and more qualified service to customers and enable employees to work flawlessly with high performance. Ongoing projects are scheduled for 2016.

Expectations for 2016

Türkiye Finans will implement projects that will increase customer experience and service quality.

The Bank aims to effectively manage all complaints, deal with objections, increase satisfaction and meet demands by evaluating them under a single structure.

The Bank will carry out centralization, process improvement and process simplification projects and transfer designated projects to the business flow system.

Digital Banking

Türkiye Finans continuously digitalizes its services with a fast, continuous and high quality customer experience through its integrated channel strategy. The Bank maintained its investments in technology and offered transaction and service diversity to its customers in distribution channels in 2015.

E-banking

75% of customers’ financial transactions were carried out through digital channels in 2015. The Bank realized around 500,000 product sales and activations through these channels.

The number of financial transactions conducted through mobile banking in 2015 grew by 158% compared to the previous year.

Mobile Banking

The mobile branch is the fastest growing non-branch banking channel in terms of number of customers and the volume of transactions. Investments in the mobile branch continued in 2015 with new function developments that are in line with customers’ needs. The mobile banking application developed for iPad was offered to customers.

The number of financial transactions conducted through mobile banking in 2015 grew by 158% compared to the previous year while the number of active mobile banking customers increased by 53% compared to 2014. The number of downloads of applications that were developed for mobile devices with iPhone, Android, iPad and Windows Phone operating systems exceeded 270,000.

Internet Banking

Türkiye Finans carried out campaigns to provide several rewards and discount opportunities to attract customers and increase transaction volume in the Internet Branch in 2015. The number of Türkiye Finans’ internet banking customers had increased to more than 500,000 as of the end of 2015. The number of products sold through the internet totaled 178,000.

In the 2015 Turkey Call Center Awards, the Türkiye Finans Customer Contact Center commanded the number one position in “The Best Call Center Performance Improvement” category.

Customer Contact Center

The Türkiye Finans Customer Contact Center holds the EN 15838:2009 certificate (Customer Contact Centers Service Standard). EN 15838 is a management system standard which sets out special conditions for call centers, has international validity, and defines management system requirements and technical conditions for providing call center service. The Türkiye Finans Customer Contact Center maintained its value added services with the aim of increasing customer satisfaction and loyalty in 2015.

The Customer Contact Center contacted customers through a total of 5.8 million calls in 2015. With its speed, quality and customer satisfaction oriented approach, it recorded the sales and activation of 305,000 units by introducing customers to products tailored for their needs. With these figures, the Customer Contact Center was again one of the important sales channels in 2015.

In the 2015 Turkey Call Center Awards, the Türkiye Finans Customer Contact Center commanded the number one position in “The Best Call Center Performance Improvement” category.

ATM Banking

With the aim of expanding its ATM network, Türkiye Finans increased the total number of ATMS to 573 while number of non-branch ATMs grew by 25% to 192 with the investments undertaken in 2015. The number of financial transactions undertaken through ATMs increased by 18% when compared to the previous year.

New applications and functions which will increase the efficiency and utilization of these channels were offered to customers. Türkiye Finans reached the final phase of the recyclable ATM project which will enable the use of money that has been deposited by customers for other customers’ transactions. The Bank plans to put the project into practice within 2016.

Campaigns and their results

Türkiye Finans carried out around 200 communication activities in 2015. The Bank conducted various campaigns and promotion activities which offer special service advantages, awards and discounts for customers. As a result of these activities, product sales through digital channels increased by 38% when compared to 2014.

Work on innovative applications was stepped up for the effective use of non-branch banking channels

Türkiye Finans stepped up the rollout of innovative applications that will increase the effective use of these channels and render alternative channels preferable to the branches.

Türkiye Finans offered various new functions and features for iPhone and Android mobile banking applications. These new functions and features include Anında Şifre (instant password), SSI payments, automatic payment order for bills, bill payment history, use of credit card in payments, Finansör/Faal card transactions, virtual card transactions and credit card shopping settings.

In 2015, Türkiye Finans fully revamped the ATM system infrastructure and offered various new features such as rapid money withdrawal, the use of reserve accounts, EFT to defined receivers, a transactions menu in foreign language (English), menu customization, a display menu, a choice of city in bill payment transactions, precious metals trading and so on.

Expectations for 2016

Türkiye Finans plans to continue its transformation into digital banking during 2016. Accordingly, investments in digital platforms will continue with increasing momentum. In 2016, the Bank plans to launch new features and services in the Mobile Banking channel, which is the most affected by digital transformation.

A new internet branch has been set up which is fast, user friendly and exceeds customers’ expectations, offering new transactions set and services without interruption. The Bank will continue to step up its investment in expanding the non-branch ATM network in a bid to meet customers’ cash needs.

Türkiye Finans continues to attract customer satisfaction with “TFX TARGET” which is an innovative product providing 24 hours foreign exchange transactions in secure platforms without any need to branch or treasury staff.

Treasury

Effective and efficient foreign exchange management

Türkiye Finans carried out a range of activities to offer faster and better services to its customers during the period of high volatility in the Turkish Lira during 2015. The Bank enhanced the loyalty of customers by increasing the frequency of customer visits. As a result of a 100% increase in the volume of spot foreign exchange transactions in 2015, the profitability of foreign exchange transaction grew by 60%.

Participation funds continued to be main funding item in 2015. The Bank carried out lease certificate issuances in Malaysian Ringgit and Turkish Lira as well as lease certificate collateralized financing transactions to diversify funding resources.

The Treasury department aims to increase the Bank’s profitability to high levels with effective and efficient foreign exchange management. The Treasury department carries out the follow-up of liquidity ratios and the CBT’s required reserve ratios within the scope of asset liability management. Fund transfer prices are determined on a product and segment basis within the framework of methodology and strategy set by Asset Liability Committee. The Treasury will continue to play an effective role in the implementation of strategies set within the framework of fluctuating market conditions and balance sheet developments.

12,000 customers within 2 years with TFX TARGET product

Türkiye Finans created an innovative approach for foreign exchange transactions with TFX TARGET product. The product won acclaim from a large mass of primarily corporate customers. The number of customers using TFX TARGET exceeded 12,000 within 2 years.

By being directed to foreign exchange transaction platforms through TFX TARGET, customers may easily conduct foreign exchange transactions around the clock without the need for branch or Treasury staff. This created a competitive advantage for Türkiye Finans.

Expectations for 2016

Growth in the public lease certificate portfolio, which is actively used in liquidity management, continues to gain pace. Türkiye Finans plans to increase the weight of the private sector lease certificates in total assets.

Türkiye Finans aims to build the volume of lease certificate transactions with other banks and customers in 2016, thereby increasing the liquidity and product range of the lease certificate market.

In line with the common targets of the Bank’s units, the Treasury aims to maintain an active role and generate special solutions for customer based needs in order to increase the profit share income and volume of funds allocation in 2016.

Türkiye Finans plans to carry out development activities during 2016 aimed at enhancing the TFX TARGET product.

Türkiye Finans carried out the biggest one-time lease certificate issuance in Turkey, with lease certificate issuance amounting to TL 250 million in 2015.

International Banking

Strong correspondence relations in new markets

There was an increase in diversity in Turkey’s foreign trade partners and a remarkable increase in customers’ transactions in these new markets, in line with the political, economic and geopolitical developments in the world. The African continent has become a particularly important trading base, which is attracting investors with its fast growing economy and young population.

Türkiye Finans stepped up its activities regarding correspondent relations in 2015. The Bank formed new strategies within the scope of international banking by considering customers’ transaction volume and demand as well as countries with which Turkey has foreign trade relations. Türkiye Finans added local banks to its correspondent network within the scope of its strategies. These local banks have an impact in new countries on both a global and local scale. The number of correspondent banks with which Türkiye Finans has mutual limit relations reached 213. Türkiye Finans became capable of carrying out transactions in every country of the world through the branches of its correspondent banks. The recognition and credibility Türkiye Finans commands in the presence of correspondent banks improves with each passing year, supported by a strong shareholder structure and in line with increased foreign trade volume. The Bank carried out foreign trade transactions with correspondent banks and global institutions. Within the limits of agreements signed for foreign trade financing, Türkiye Finans continued to provide long term resources as part of the GSM-102, SEP, ECA and the ITFC to customers conducting imports.

Important progress achieved in sukuk issuances.

Türkiye Finans undertook two sukuk issuances in Malaysian Ringit denomination in 2015 within the scope of a MYR 3 billion sukuk issuance program extending for 20 years, which had been formed previously. The first of these issuances amounted to MYR 150 million, and was carried out in February. The second issuance, amounting to MYR 210 million was carried out in May.

Türkiye Finans carried out a lease certificate issuance of TL 250 million in what was the biggest issuance in Turkey undertaken by a participation bank in 2015.

Türkiye Finans carried out 10 different lease certificate issuances in the domestic market in 2015. These issuances generally have a maturity of 6 months, with some variation. The issuances totaled TL 1.1 billion.

Türkiye Finans expects to continue lease certificate issuances in 2016 contingent on market conditions and the Bank’s funding and liquidity needs.

International murabaha transactions

In addition to sukuk/lease certificate transactions, Türkiye Finans carried out various borrowing activities amounting to USD 2,608 million in 2015. The borrowings, excluding sukuk transactions, had totaled USD 1,995 million as of the end of 2015. A total of USD 1,410 million of funds had been obtained through domestic and international sukuk issuances in 2015. As of the end of 2015, the total amount of borrowing stood at USD 3,405 million.

Human Resources

A good career, continuous development

Türkiye Finans acts with the mission of sharing the value generated in line with the principles of participation banking. The Bank continues to develop its human resources practices and contributes to its employees.

In line with this mission, Türkiye Finans carried out following activities in the field of human resources in 2015:

- Increasing employees’ performance,

- Improving employees’ satisfaction and loyalty,

- Providing personal and occupational development

Türkiye Finans effectively maintained core human resources activities such as recruiting qualified human resources, career planning, performance evaluation, employee motivation, benefit management, formulating remuneration policies and planning personal and occupational training by determining training requirements.

427 employees were involved in the “KARİYER-LAB” in 2015. KARİYER-LAB is a measurement and evaluation application under an approach based on the effective and efficient management of human resources and with the philosophy of realizing employees’ career development in line with the most objective measurement and evaluation principles possible.

The “STEP” Career Management model includes all information necessary for employees in their career path, starting from Assistant level to Management level. This model was realized in 2015. This model allowed employees to transparently see career paths based on a certain system, opening the path to choices, giving training support when needed and defining competency and performance criteria that are necessary for each stop.

Türkiye Finans pressed ahead with its “Katılıyorum Sana (I’m joining you)” activities in 2015. Katılıyorum Sana (I’m joining you) is a sustainable youth communication project aimed at bringing the professionals of the future and the students who attend our country’s top universities to Türkiye Finans. The “www.katiliyorumsana.com” website was launched within this scope. By doing so, Türkiye Finans gained popularity and became a preferred employer. In 2015, the Bank came together with thousands of students from our country’s top 7 universities through the “Katılıyorum Sana (I am joining you)” youth communication platform. Accordingly, the Bank received 4,166 applications.

During academic periods, 352 interns were recruited to the head office and branches in order to train the participation bank employees of the future as well as to ensure their adaptation to business life.

Within the scope of back-up activities, Türkiye Finans deepened its Management trainee pool, with 181 employees involved in the Management trainee pool. Türkiye Finans conducted structured periodic Human Resources Communication Meetings in a bid to be closer to the Units, Regional offices and the Branches and to better understand their needs. The Human Resources teams also effectively coordinated all region and branch performance evaluation meetings during the year.

Türkiye Finans’ employees benefited from a number of special benefits in 2015, including foreign language allowances, financial support for situations such as marriage, birth and death; subsistence for traveling, accommodation and meal expenses during business trips in Turkey and abroad; personnel shuttle buses for transportation to the head office; private health insurance for all employees and their families; lunch for all employees; and support for dentist and optician appointments within specified limits. The Bank’s remuneration policy is as follows; 12 gross monthly salary payments each year, an annual bonus in line with the performance evaluation, and a campaign award system which is determined by the Bank.

Employees were paid motivational bonuses in 2015. Motivational bonuses are calculated by taking into account employees’ duties and responsibilities, and both individual and departmental performance as well as the Bank’s performance.

Türkiye Finans served with 4,132 employees in 286 branches and 10 Regional Headquarters as of 2015.

Türkiye Finans served with 4,132 employees in 286 branches and 10 Regional Headquarters as of 2015. 34% of the Bank’s employees work in the head office with 2% working in the Regional Headquarters and 64% in the Branches.

Of all the personnel at Türkiye Finans, 88% hold a university degree, 31% are female and the average age of the employees is 33.

98% of the staff needs of the Senior Management and Management levels were met through internal appointments in 2015.

“BİR olmak (To unite)”

In line with the “Bir olmak (To unite)” philosophy, activities for the “Bir olmak” employer brand, which addresses all Türkiye Finans employees, were completed. Türkiye Finans carried out several events and projects which will ensure a balance between professional life and social life. The Bank received the “Best Team Spirit” award for the 2nd time in the world’s 3rd biggest inter-company Dragon Fest.

Türkiye Finans provided an average of 51 hours of training per employee in 2015 to contribute to the competencies, skills and personal development of the employees.

Training activities gain momentum

The main focus areas of training in 2015 was to support the main activities of business units under a business partnership approach, to increase credit risk perception and to improve the administrative capabilities of managers in line with the results of employee satisfaction survey.

Mandatory training programs, a component of the “STEP” Career Management model, were initiated.

- The sales activities of all employees in the commercial/entrepreneurial segment were supported by “Effective Sale and Portfolio Management” training which was given by internal trainers this year for the first time.

- Business results were supported by “Sales at Cash Desk” training which has been given for desk employees for 3 years as well as “Intra-branch Sales Management” training sessions which have been provided to operational managers. The “Sales at Cash Desk” project received the Jury’s Special Award in the “learning Program with the best impact on business results” category in the Learning and Development Awards, organized by the Turkey Learning and Development Association.

- 115 employees who possess sales competency for sales and who works in Branch Customer Transactions Service successfully graduated from the “Sales School” program. These employees were transferred to the sales segment and they took a new step in their careers.

- The Branch Manager Development Program continued with new management candidates. Four groups graduated in 2015. Branch Managers were given the support of an experienced Branch Manager (Mentor) in their new roles.

- The Bank organizes conferences under the name of “Paylaşarak BİRleşiyoruz” in which specialist speakers attended. The Bank continued to contribute to the personal awareness of employees in working in the head office.

- Under the motto of “Composing the Future”, formed “Catalogue Training Programs” which enable employees working in the head office to choose training programs which are in line with their needs and business programs.

- Türkiye Finans organized regional elective training for the first time. A pilot application was carried out in the Ankara region.

- Türkiye Finans provided training support to target audiences with distance and in-class methods for mandatory topics such as the CMB, BES (Private Pension System), SEGEM (Insurance Training Center), ISG (Occupational Health and Safety), First Aid and the Prevention of Money Laundering and the Prevention of Financing Terrorism. By providing these courses, the Bank enabled its employees to hold the related documents and certificates.

- The Bank ensured attendance of training programs of the Banks Association of Turkey and Participation Banks Association of Turkey, as well as public seminars.

- The Bank provided Master support to 60 employees seeking to enrich their careers with an academic approach.

Türkiye Finans provided an average of 51 hours of training per employee in 2015 to contribute to the competencies, skills and personal development of the employees.

71% of training was conducted through in-class sessions while 29% was provided through distance learning. E-training hours per employee increased by 20% YoY with social learning, podcast trainings, weekly e-training promotions on the basis of topics as a result of the joint project with academicians from Boğaziçi University to provide more employees with technology based training.

Türkiye Finans provided training opportunities to all employees, with 95% of employees attending at least one in-class training session in 2015.

Expectations for 2016

In 2016, following points will be at the forefront to support the Bank’s targets and strategies: to increase credit risk perception, to empower the knowledge of interest-free banking, to establish internal customer service understanding, and to differentiate the use of training technologies.

Measurable and realistic criteria in performance management

2015 was a year in which Türkiye Finans made its performance systems compatible with the developments in the sector and needs aroused from the reflections of these developments on the Bank. The fact that all employees’ performances are evaluated by measuring them with performance indicators defined within the scope of scorecard is an important step toward the Bank’s sustainable success.

“Employee Satisfaction Analysis” study which is carried out with an expert research company measures and compares the satisfaction and loyalty levels of employees. This study detects the actions to be taken regarding this topic and enlightens the activities for establishing a happier work place.

Corporate Communication

Türkiye Finans effectively maintained its Corporate Communication campaigns.

Türkiye Finans maintained its communication activities in 2015 within the framework of the 360 degree continuous communication strategy.

Türkiye Finans employed Arda Turan, a star player of the Turkish national team and Barcelona, to star in its advertisements. This attracted a great deal of interest from customers and potential customers. These campaigns significantly contributed to the improvement in the Bank’s popularity.

In 2015 Türkiye Finans diversified the media channels in which communication activities appear. Advertising campaigns appeared on national and local TV channels, radio stations, the internet, newspapers, magazines, outdoor billboards, stadiums and other channels throughout the year. Advertisements were placed on the football pitches of teams in the Super League with the agreements entered into for the 2014-2015 football season.

Corporate Brand Perception and Advertisement Impact surveys were carried out. The results of the surveys found that the Bank’s popularity and appreciation level increased in line with the rate of advertising when compared to previous years. It was observed that using celebrities in advertising campaigns increased interest in the Bank’s products and services, and positively supported the Bank’s popularity.

The Bank’s 2014 Annual Report was rewarded in 4 categories in the most prestigious competition of this field, which is organized by League of American Communications Professional.

The Bank participated in several fairs and seminars and carried out a number of field events throughout the year. In these events, the Bank demonstrated efforts to raise the popularity, recognition and reputation of the Bank and its products to its customers.

Enhancing the Bank’s leading position in the sector continued to be focus point while the Bank’s communication activities were planned in 2015. Communication activities that Türkiye Finans carried out were effective in the transmission of targeted messages for Participation Banking as well as on positioning as a leader.

The Bank’s 2014 Annual Report was rewarded in 4 categories in the most prestigious competition of this field, which is organized by League of American Communications Professional.

Active communication in digital and social media

Türkiye Finans carried out digital campaign planning in 2015 within the Bank’s digital and social media strategy. The Bank strived to reach its target audience and increase the brand’s popularity.

The corporate website, www.turkiyefinans.com.tr, was renewed with a modern and user friendly design in May 2015. With its new design, customers were able to find whatever they were looking for from all devices in a quick and easy manner.

The Knowledge contest named “Correct Answer Brings Goal” received the Public’s Favorite award in the 13rd Golden Web- Web Awards’ Advergame Category in 2015, following a popular vote.

The Bank worked to increase its number of followers on these accounts and started to carry out customer management through the Bank’s accounts on Facebook, Twitter, Youtube, Linkedin, Google+, Daily Motion and İzlesene.

Türkiye Finans climbed to 30th and 15th places on Facebook and Twitter rankings, respectively, in the Social Bakers’ finance sector report.

Our sustainability approach and its applications

Türkiye Finans formed its sustainability strategy on the axes of “Good banking” and “Good corporate citizenship”. The Bank’s goal is to enhance its contribution to society by being a good citizen while practicing the best banking applications.

According to the WIBC Leaderboard 2015 (World Islamic Banking Conference) Financial Transparency Index, Türkiye Finans was ranked first and obtained the title of the leading bank in the Eastern Mediterranean Region.

To earn the permanent trust of investors, employees, customers and all stakeholders has always been the Bank’s highest target. Therefore, Türkiye Finans’ most important commitment to its stakeholders is to uphold its approach to responsible and transparent banking. The array of awards that the Bank has received both at home and internationally in 2015 can be considered as the indicator of this commitment. According to the WIBC Leaderboard 2015 (World Islamic Banking Conference) Financial Transparency Index, Türkiye Finans was ranked first with 58 points. The Bank obtained the title of leading bank in the Eastern Mediterranean Region.

Türkiye Finans’ sustainability approach considers not only economical but also environmental and social performances. Moreover, the Bank adopts a Corporate Social Responsibility strategy which contributes economic growth and social development in line with society’s expectations.

Türkiye Finans offers high quality and diversified products with the awareness that permanent success is only achievable with society’s development as a whole. On the other hand, the Bank aims to contribute Turkey’s sustainable development through non-profit social investments.

Other activities

With an awareness of social citizenship, Türkiye Finans extended its sponsorship of the Dialogue in the Dark exhibition until June 2015.

Türkiye Finans continues its social responsibility activities in the field of education. The Bank contributed 35 bicycles to the Dr. Mümtaz Ataman Primary School to encourage school pupils to take up sporting activity.

Türkiye Finans will continue to take steps that contribute to the values and culture of the society in which it springs to life.

Operation Services

Efficiency has been continuously improving with activities to optimize operations.

Türkiye Finans evaluates operational improvement activities in terms of their cost, quality, time and flexibility. Within the scope of “Low Cost Operation”; the Bank carries out centralization, efficiency per employee and saving activities. Although the total number of operation center transactions increased by 38% within last two years, efficiency was increased through automation activities and process improvements. By doing so, the number of transactions per employee increased by 49%.

Türkiye Finans carried out several new applications for branches within the scope of operation services:

The support line was established in order to contribute to branches in their operational transactions and issues that they need.

Interactive Field Support was set up to provide short term information, continuous communication and to be used as a training platform for branch personnel through the Lync connection via the system, and to provide live business support.

The Centralization Project has been carried out to simplify operational transactions that take the most time, and to conduct these operations through the head office units.

Türkiye Finans passed to a rapid and effective structure regarding the optimization of processes between branches and the Operations Center. The ŞubemATİK came to the forefront among activities carried out within this scope. Within the scope of ŞubemATİK activities, 23 projects were completed to improve processes in commercial fund allocation in the branches.

The following activities were carried out in 2015 within the scope of projects and applications that will increase operational effectiveness-efficiency:

- Current Foreign Transactions process and Western Union process were renewed to offer faster and safer foreign transaction services.

- Türkiye Finans ensured effectiveness in 2015 by simplifying and merging banking screens regarding banking services.

- In payment systems, the Bank took new initiatives to be in line with credit card technology in the world (new generation chip, contactless card, 3D secure application between the Bank-BKM (Interbank Card Center etc.).

- A 35% efficiency increase was achieved in loan operation and commercial loan processes through module integrations in credit control processes, systemic control and optimizations, despite 20% increase in number of transactions.

Expectations for 2016

Various operational activities will be centralized in 2016 to improve the Bank’s operational activities and to decrease operational workload of branches. System and infrastructure activities will be prioritized to contribute the Bank’s efficiency. The Bank will continue its activities regarding service quality, process pace, risk quality, employee satisfaction, and internal customer satisfaction.

Within the scope of Operational Risk Optimization Project, Türkiye Finans aims to ensure process transformation and improvement of competencies and to improve customer experience and satisfaction with high quality service with the target of minimizing operational risk and managing them effectively in 2016.

Organization

Operating organization structure

Within the framework of Türkiye Finans’ reorganization to increase the Bank’s effectiveness and efficiency, some business departments and/or units were merged and their names were changed. Some units were divided into different units on function basis while some units were tied to other business departments.

Since Türkiye Finans directed funds to the SME and small scaled commercial segment, as required by its strategy, five Region Allocation Directorates which report to Credits Department were established in addition to the current regional headquarters with the aim of enhancing regional allocation structure that offers service to these segments and of managing the Bank’s risk in a more effective and controlled manner.

A “Region Non-Branch Banking Service” and team were established to carry out sale of certain products directly to customers within Regional Headquarters with the aim of enhancing Consumer sales teams.

The Board of Auditors was restructured in accordance with the best practices in the sector to increase the effectiveness of audit.

Information Systems

The first bank to hold the International Business Continuity Certificate

Türkiye Finans was the first bank to hold the Business Continuity Certificate in the Turkish banking sector. The Bank maintained a 100% success rate which was achieved in the previous year in business continuity activity tests. As a result of inspections carried out by the British Standards Institute (BSI), compliance of Türkiye Finans’ Business Continuity Management System covering the Bank’s all units and branches with the international ISO 22301 standard was confirmed again.

As a result of inspections carried out by British Standards Institute (BSI) in 2015, Türkiye Finans’ Business Continuity Management System with found to fully comply with international standards.

Türkiye Finans also holds the “Tier III Facility” certificate which is given after applying a physical test of critical control points of infrastructure (energy, cooling, fire etc.) and checking whether the facility was built in line with the certificate’s requirements.

Agile Transformation - the most comprehensive Information System (IS) in Turkey, the Middle East and Eastern Europe at Türkiye Finans

Türkiye Finans continued the agile transformation, which was started in April 2014, with an average of 50 Scrum teams. There are continuous product service teams with domain basis and Scrum teams with master project basis. A team coach assigned by Agile Studio ensured that the Scrum teams operated within the framework of Scrum. Türkiye Finans changed software processes for the first time in the banking sector and matched Cobit processes with Agile processes.

Several large scale companies visited Türkiye Finans to learn from the Bank’s success in achieving the most comprehensive Agile Transformation in Turkey, Middle East and Eastern Europe. The Bank has also been invited to attend both domestic and international events as a speaker. As a result of these invitations, Türkiye Finans attended all big events in Turkey in 2015 while the Bank participated international events in Poland, Dubai and India as a speaker.

The Türkiye Finans Data Center, ensuring efficiency in energy usage, has paved the way for USD 163,000 in annual energy savings.

Türkiye Finans’s environmentally friendly Data Center

The Türkiye Finans’ Data Center, which offers a high level of security and instant watch and control function of conditions such as electricity load, heat and moisture provides high effectiveness in energy usage. The Energy measurement ratio/PUE (Power Usage Effectiveness) stands at 1.5, well below the Turkey average (2.2).

As a result of activities carried out in 2015, the Data Center’s capacity grew by 55%. The Data Center’s utilization rate had reached 40% by the end of the year. With these features, the Türkiye Finans Data Center enables USD 163,000 in annual energy savings. The performance of the Data Center has won acclaim from domestic and international companies, who paid visits to the Center.

Enhancing our performance with Information Systems infrastructure modernization

Access to Bank data and securing the data were ensured with Microsoft’s data security solutions. Within the scope of server modernization project, 400 servers in the Data Center were analyzed, with 34 servers removed and 29 servers in the Disaster Center renewed. In addition, three physical servers were virtualized. The Data Center Day-2 capacity increase project brought about a 55% increase in infrastructure capacity.

Data warehouse infrastructure was renewed to ensure increased performance with the new data base server working with an updated data base operating system. This renewal expedited the preparation of reports and improved employee satisfaction. Data was compressed by using the new version feature (SQL) of the data base system, the Bank recorded cost savings. The data back-up period was shortened and operating expenses brought down as a result of the more stable infrastructure.

By upgrading the data base, the Bank ensured an improved performance with the transition to the SQL Server 2012/2014 version, while operational risks were reduced. With the transition to the 2012 version of the Windows operating system, the Bank provided a more stable operating system. Moreover, the maintenance needs for the server were minimized and risk of service interruption was decreased.