We Generate Value for our Customers

Türkiye Finans is focused on offering all its customers the services which will allow them to feel comfortable and safe, to obtain rapid solutions in line with their needs and expectations and to experience “Tireless Banking” through unique channels.

In this context, Türkiye Finans strives to:

- support the Turkish economy in multiple directions,

- produce value for its customers in many areas through a rich array of products and services, and

- facilitate the lives of individuals and provide resources to corporations as Turkey’s Finans.

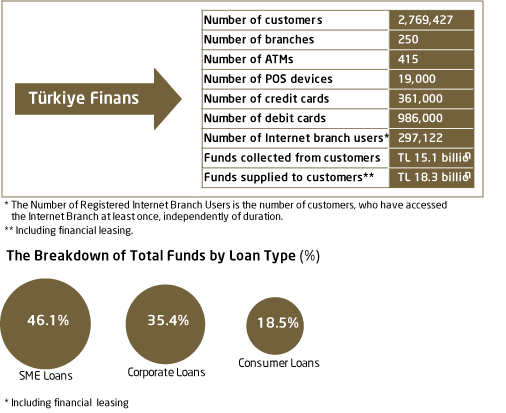

Türkiye Finans succeeded in generating increased value for its stakeholders and maintained its healthy growth in 2013. The customer-related highlights from the Bank as of December 31st, 2013 can be summarized as follows:

Thanks to its strong product and service offering organization, Türkiye Finans strives to ensure the satisfaction of its customers and offers them permanent value in every banking segment.

value creation

Türkiye Finans strives to produce value for its customers in many areas through a rich array of products and services.

Retail |

Entrepreneurial |

Commercial |

International |

Non-Branch Banking |

|---|---|---|---|---|

Financial support - rich loan portfolio |

SME loans |

Cash loans |

Products for export and import |

Online banking |

Credit cards |

Commercial cards |

Non-cash loans |

External guarantees |

Phone banking |

Accounts |

POS services |

Sector and product-based packages |

GSM loans |

Mobile banking |

Private pension |

Cash management |

Foreign trade solutions and finance |

SEP loans |

SMS branch |

Insurance products |

Sector and product-based packages |

Credit cards |

Country loans |

ATM banking |

Investment services |

Foreign trade solutions and finance |

POS services |

Advisory services |

|

|

Special products for SMEs |

Investment services |

Project finance |

|

|

Special products for tradesmen and craftsmen |

|

Treasury transactions |

|

|

Investment services |

|

FX services |

|

For detailed information about the Bank’s products and services, please visit http://www.turkiyefinans.com.tr

FOR BETTER SERVICE OFFERING - ‘CUSTOMER EXPERIENCE AND THE MULTICHANNEL STRATEGY PROJECT’

Türkiye Finans considers customer satisfaction as a prerequisite for sustainable success and therefore, carries out its activities based on the philosophy of ‘permanent development and improvement’ in all of its processes and services in order to further increase the quality of its services, and the level of customer satisfaction, accordingly.

Türkiye Finans believes in the service value creation chain;

- where it provides the right products and services, when and where the customer wants it;

- whereby value is the outcome of effective employee interactions with their customers; and

- whereby brand reputation is its most important asset and also the hardest to replace.

Türkiye Finans launched the “Customer Experience and the Multichannel Strategy Project” in 2013. The project primarily aims to provide customers with the most transparent and comparable information concerning the Bank’s products and services and to enhance the customer experience at all contact points.

Within the framework of the “Customer Experience and the Multichannel Strategy Project”, Türkiye Finans has begun to improve and transform its banking activities aimed at its customers in retail, SME, commercial and corporate banking.

The products and services offered by Türkiye Finans to its customers, as well as the channels and processes used by the Bank during such offering are the main determinants of customer experience. Within the scope of the “Customer Experience and the Multichannel Strategy Project” which targets a flawless customer experience and envisages rooted changes in the Bank’s business-making style, the strategy and elements of customer experience are created based on customer needs and the principle of efficiency.

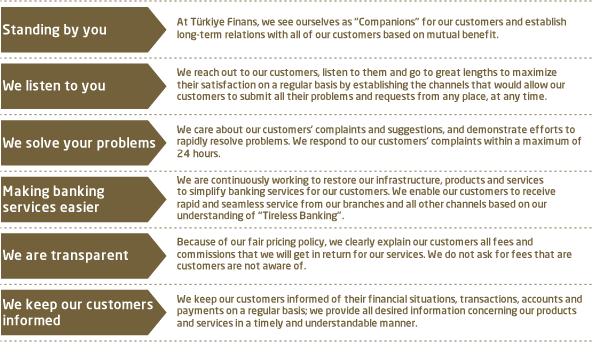

Customer Constitution: The Customer Constitution, which lays down the foundations of Türkiye Finans’ customer experience strategy, was prepared as a basis for all of the design elements of the Bank’s sales and service model, products/services, channels and projects.

The Customer Constitution is a commitment in which the Bank clearly expresses its loyalty to its customers and sensitivity regarding customer satisfaction.

Türkiye Finans has accepted this constitution as the basis of its relations with its customers. By sharing it with its customers in all of its branches as well as in its non-branch service channels, the Bank has proven its consistency and determination with respect to customer satisfaction.

Türkiye Finans’ Customer Constitution

As Türkiye Finans, our basic target is to become a leading resource provider undertaking investments and offering financial resources in line with our principles to our customers, who are our raison d’être and a source of great satisfaction for us. In line with this vision, we offer all our customers the services which will allow them to feel comfortable and safe, to obtain rapid solutions in line with their needs and expectations and to experience “Tireless Banking” through unique channels.

We are delighted to share the Türkiye Finans’ Customer Constitution with you here, in order to introduce our basic values and offer better services to all of our customers.

Multichannel Strategy: Türkiye Finans specified its growth strategy and channel priorities; and determined areas to focus on within the scope of a 5-year strategy after evaluating the current situation. As far as the Internet and ATM service channels are concerned, which have been prioritized within the scope of the multichannel strategy, the Bank designed ways to enhance the customer experience and raise the functionality of its processes.

Branch and Regional Organization: The Bank set out a new regional organization in parallel with its customer experience targets and had raised the number of regions of operation from 6 to 10 as of the end of 2013 as part of the project (“Customer Experience the Multichannel Strategy” project) which aims to optimize the regional organization structure. The Bank will maintain its efforts to broaden the application of the project within its organization structure during 2014.

Sales and Service Model: The Bank has redesigned its branch network and business model in a manner that attaches priority to customer and employee satisfaction.

Product Portfolio: The Bank evaluated its product portfolio based on customer needs and sectoral practices and determined the priority areas of improvement.

Critical Processes: The Bank has specified the customer lifecycle and the critical times for critical customer processes; and discovered new ways to improve customer experience. The Bank has also planned and implemented the necessary systemic infrastructure transformation for various elements of customer experience.

Performance Management: Türkiye Finans determined the requirements to ensure that the changes in its sales and service model are reflected to its performance system. Customer experience and customer satisfaction are directly incorporated into the Bank’s service standards performance system.

Cultural Change: Having specified and prioritized its custom-oriented service standards after determining the elements of customer experience, Türkiye Finans has begun to implement a number of practices, notably training and activities aimed at cultural change, in order to ensure that its employees easily adapt to the transformation process.

|

In 2013, the Bank

* 2013 Pozitron Insights |

Türkiye Finans prepared a Customer Constitution in order to introduce its basic values and offer better services to all of its customers.

It is envisaged that the Customer Experience and Multichannel Strategy Project will be positively reflected to the Bank’s overall performance starting from 2014. In this context, the Bank specified the Customer Experience quantification methodology.

FOR INDIVIDUAL CUSTOMERS

Türkiye Finans addresses different needs of customers from all segments by offering them a wide array of products and services in the retail banking segment.

As well as traditional products and services such as personal finance and credit cards, the Bank also offers solutions that are vital for planning the financial needs and future of its customers amid an uncertain economic environment and volatile market conditions; and implements practices that encourage individual saving in line with the principles of participation banking.

Türkiye Finans issues recommendations to customers for their portfolios based on their risk categories and also offers them private pension services as well as professional investment options that best suit their risk-reward preferences.

Finansör is an innovative product that offers consumer loans to customers with the ease of a credit card and without compromising the principles of participation banking.

Türkiye Finans unwaveringly strives to expand its product portfolio, aiming to meet the needs of individual customers

Through an array of special products addressing each and every need, particularly Consumer Finance and Vehicle Finance, Türkiye Finans continues to support individuals as and when required. The Bank receives loan applications from its customers for product purchase through SMS, and instantly concludes the loan supply process for such requests.

The Hızlı Finansman (Fast Financing) channel allows the Bank to receive applications from its customers for consumer financing, vehicle financing and housing finance through contracted dealers and to meet their financial needs in a very short space of time. The Bank aims to raise the number of its contracted dealers in this channel to 1,000 and to serve an increasing number of customers under a more focused process in 2014. Moreover, the Bank aims to receive Hızlı Finansman applications through alternative delivery channels, such as ATM, the Internet Branch and the Call Center in 2014.

Finansör: A product that stands prominently against the competition

Finansör is an innovative product that offers consumer loans to customers with the ease of a credit card and without compromising the principles of participation banking. Finansör is an effective individual banking practice that meets customer expectations with loan packages tailored to any need. The number of customers using Finansör grew strongly to reach 83,000 in 2013, while the total amount of funds supplied to customers through Finansör reached TL 88 million.

The consumer loan limit used with Finansör allows the buyer to complete payments to the seller’s account through the POS device in product purchases. Finansör also offers customers a number of advantages, particularly in terms of service fee and profit share, through a total of 13 packages addressing different sectors and customer groups as determined by the Bank.

Further enhancing the value offered to customers through special campaigns

In addition to Finansör, the Bank continued to support its customers in 2013 through 16 different consumer and vehicle loan packages. Furthermore, Türkiye Finans has further increased the value it generates for its customers by offering them an average of two campaigns in consumer and vehicle financing and three campaigns in Finansör in line with changing market conditions and customer expectations.

Türkiye Finans aims to raise the number of such campaigns in 2014. Having supported nearly 100,000 people through consumer and vehicle financing products, the Bank aims to introduce innovative products to a higher number of individuals in 2014.

Environmentally friendly practices

Türkiye Finans conducts marketing campaigns with prizes and loyalty programs to further promote the use and awareness of its non-branch banking channel, through which the Bank offers banking services on a 24/7 basis without interruption. To this end, the Bank gives prominence to paperless banking; and emphasizes the time saved in individuals’ lives through non-branch banking practices and the value the Bank produces for the environment by reducing transport and enabling low energy consumption.

The Customer Satisfaction Center - attaching the highest importance to customer suggestions and complaints

Türkiye Finans aims to respond to its customers’ complaints, suggestions and requests within 24 hours. The Bank considers customer feedback as a valuable opportunity to improve its performance and to reach a higher level of customer satisfaction.

In 2013, the Bank’s Customer Satisfaction Center evaluated a total of 20,641 pieces of customer feedback and resolved them within an average of 72 hours; the Bank aims to repeat this same success in the coming years.

Investment banking products and private pension services with a strong value proposition

By offering alternative investment products such as stock and mutual funds in addition to its participation accounts, Türkiye Finans also serves those customers seeking to invest in instruments with different risk-reward ratios.

The Bank offered the Type B Sukuk Fund to the public in 2013. Designed in accordance with the principles of participation banking, this investment product attracted wide admiration and was popular with customers. Meanwhile, the Bank offers stock trading opportunities through its Internet Branch for those customers seeking to invest in the equities of companies which operate in accordance with the principles of participation banking.

High-quality services for pensioners

Türkiye Finans also aims to serve its customers during their retirement. In 2013, the Bank designed and launched a service package for pensioners seeking to benefit from the advantageous services of Türkiye Finans. As well as allowing the Bank to pay pensioners their pensions, the service package (module) also offers a range of advantageous products and services.

An approach to appropriately manage risks…

Türkiye Finans conducted various social and economic sustainability-related activities in all of its branches in 2013. In this context, the Bank has offered various insurance products, such as PPS, House, TCIP (Turkish Catastrophe Insurance Pool), Car Insurance, Traffic, Education, Kapkaç (Purse Snatching), Emergency Health at the most affordable prices in line with customer needs and with an understanding of social risk management.

The Bank’s target is to deliver these services to a broader customer mass in 2014.

Diversifying its portfolio of products tailored to the target mass, within the scope of social sustainability.

As a part of its social sustainability efforts, Türkiye Finans continued during the reporting period to produce innovations for products that address the special needs of the target mass.

The Bank has designed innovative products, such as Happy Mother, Prefabricated Housing Financing, “Preparation for the Season” Financing and mortgages for foreigners, which all aiming to meet the needs of the target mass.

As one of the first banks in the sector to provide services in the area of prefabricated building/housing finance, Türkiye Finans has supplied Prefabricated Housing Financing loans to its customers, thus accounting for nearly 1% of the prefabricated housing sector’s growth in 2013.

The Prefabricated Housing Finance not only contributes to the development of an earthquake resistant building style in Turkey, but also encourages customers to cover their housing needs by using environmentally friendly building materials.

Türkiye Finans intensively carries out gold banking activities.

Gold banking practices which support economic development.

The Bank intensively carries out gold banking activities, which, according to the Bank, contribute to the efforts for the procurement of loans that are necessary for economic development.

Türkiye Finans organized a number of “gold days” at its branches in 2013 as part of its efforts in gold banking, aiming to bring informal deposits (mattress gold savings) into the economy. The Bank offers its customers the opportunity to place their gold savings in deposit accounts as well as physically trading gold in their accounts in line with their needs.

Türkiye Finans will also offer its customers the opportunity to save money in the long-term through the cumulative participation account, which the Bank plans to roll out in 2014. Customers will be able to save for the future of their children by opening cumulative accounts on their behalf. In the same context, customers will also be offered the chance to place their savings in alternative investment areas through mutual funds.

Handicapped friendly products and services

According to the Bulletin of Statistics for Handicapped Individuals published by the Ministry of Family and Social Policies in November 2013, there are around 1.8 million handicapped citizens in Turkey, of which 310,932 were deemed to have a disability rate of 90% or more, according to the same source.

During the design of its products and services, Türkiye Finans considers the needs of handicapped individuals and has adopted the necessary measures into its processes. To this end, the Bank designs handicapped friendly products and services, in addition to the advantageous products that it offers to its individual customers. The most recent example of this is the “Vehicle Financing for the Handicapped” product which has been offered to customers since 2012. The Bank has extended “Vehicle Financing” loans to a total of 17 handicapped customers in the last two years.

Besides offering handicapped friendly products and services, Türkiye Finans has adopted up-to-date arrangements in all of its branches and the service areas of its alternative delivery channels with the purpose of increasing the value it produces for its handicapped customers. To this end, the Bank plans to design and implement projects which offer special services to handicapped customers through alternative delivery channels, in line with its strategic priorities for the year 2014.

participation banking

Having served as a pioneer in the Turkish participation banking industry, Türkiye Finans has provided the highest contribution to the rapid growth of participation banking.

FOR SMEs AND COMMERCIAL, AND CORPORATE CUSTOMERS

In recent years, participation banks have grown at higher rates than commercial banks in every category, such as total assets, credit volume, deposits and number of branches, and have raised their share within the banking industry.

There are four participation banks in Turkey which, according to data published in September 2013, were operating with a total of 966 branches and 16,763 employees. With total assets amounting to about TL 96 billion, the participation banks in Turkey maintain their mission with a service quality that addresses all segments.

Growth dynamics also demonstrate the participation banking industry’s contribution to Turkey’s sustainable economic growth.

Funds collected in accordance with the principles of participation banking are extended to the national economy through financing products that are fully compliant with the same principles; the sector thus provides support to the business world in the broadest terms, extending from micro enterprises to SMEs and corporations.

Having served as a pioneer in the Turkish participation banking industry for many years, Türkiye Finans has provided the highest contribution to the rapid growth of participation banking.

Maintaining its efforts to ensure its success in corporate banking services is long-lasting; Türkiye Finans maintains its pioneering and innovative role in the sector with a customer-oriented service approach while steadily expanding its product portfolio in line with customer needs.

Türkiye Finans’ point of view towards the real sector and sustainable growth

Türkiye Finans believes that the development of the real sector is vitally important to Turkey’s sustainable growth and development. In this context, the Bank has always paid attention to financing the real sector and allocated almost all of its resources to the real sector. The Bank has always increased the support that it extends to regional and sectoral initiatives and directed its activities in line with its target of becoming the ‘Pioneering Participation Bank’ of Turkey, a country which is growing and producing.

Adopting a balanced approach in the SME, corporate and commercial banking segments

Another important element of Türkiye Finans’ banking approach is to ensure a balance between the SME, corporate and commercial banking segments. Despite the increasing weight of SMEs in its lending activities, Türkiye Finans believes the corporate and commercial enterprises are also highly important and play a key role, particularly in terms of sustainable development.

Although the share of individual and SME loans in banks’ balance sheets has increased, and all banks have focused on these areas over time, the share of commercial loans in the banking industry’s total loan volume still remains above 40%. To ensure sustainable growth and development in the banking sector, it is clear that banks would have to achieve success, particularly in the corporate and commercial banking segments.

Continuously supporting the real sector by supplying funds

In 2013 Türkiye Finans continued to extend collected funds to its customers in line with its mission of supporting the real sector. The total amount of cash loans (including financial leasing) provided by the Bank increased by about 40% YoY to TL 18.3 billion by the end of 2013. The supplied funds/ total assets ratio is an important indicator in the participation banking sector, which is oriented to the real sector. The Bank’s ratio of supplied funds/total assets stood at 73% at the end of 2013, indicating the intensive loan supply activities.

Working to a basic strategy of spreading the risk to the base in supplying funds

At Türkiye Finans, the risk per customer is low. Looking at the composition of risks as of the reporting period, the 10 riskiest customers accounted for a 5% share in total funds extended while the 20 riskiest customers had an 8% share. The fact that these ratios are under 10% stands as an important indicator that there is no concentration of risk. On the other hand, as of December 31st, 2013, the share of risk of the Bank’s 100 largest loan customers in the Bank’s total cash loan portfolio stood at 13.88% (December 31st, 2012: 14.04%), while that of the 200 largest customers was 20.34% (December 31st, 2012: 20.69%).

At Türkiye Finans, risk concentration is low on a sectoral basis. The Bank is determined to protect its sound portfolio structure that comprises of such sectors and companies with high growth potential and with no risk in terms of solvency. Despite the Bank’s strong growth rate which was higher than the sector average, the ratio of its non-performing loans fell from 2.8% in 2012 to 2.4% in 2013. This ratio is lower than the sector average and the average ratio of participation banks. The ratio of non-performing loans illustrates the quality of Türkiye Finans’ assets and the fact that it has grounded its growth path on robust foundations, a situation that further strengthens the Bank’s competitive edge.

In 2013, the total amount of cash loans supplied by the Bank reached TL 9 billion with 37% growth in the commercial banking segment, 26% growth in the corporate banking segment and 33% cumulative growth in the commercial/corporate segment. In the same period, the Bank achieved 198% growth in the commercial banking segment and 169% growth in the corporate banking segment in financial leasing, while the total risk of the commercial/corporate segment increased by 190% to TL 538 million.

Türkiye Finans takes steps to diversify the services that would attach prominence to its foreign trade bank identity.

Aiming to increase its contributions to sustainable economic growth by improving its foreign trade bank identity

Türkiye Finans has taken strong steps in 2013 in line with its strategic priorities, such as enabling its commercial/corporate customers to receive an increasing share in foreign trade transactions and expanding their transaction volume. Producing solutions that aim to meet the expectations of its foreign trade customers, the Bank has improved the processes related to its existing products/services and shared the developments in this area with its marketing teams by organizing various training programs.

Taking steps to diversify such services that would attach prominence to its foreign trade bank identity, Türkiye Finans offers specialized foreign trade consultancy services to its customers by effectively deploying major loan alternatives as provided by institutions that support foreign trade, such as the Saudi Export Program (SEP), the International Islamic Trade Finance Corporation (ITFC), Islamic Development Bank (IDB), GSM and Eximbank.

One of Turkey’s targets for 2023 is to increase its export volume to USD 500 billion. To this end, Türkiye Finans is determined to increasingly support its exporters in particular, and to provide a higher contribution to this national target.

Successful completion of the “Corporate Banking Field Organization” project

Positioned as part of the Bank’s “Customer Experience and the Multichannel Strategy Project”, the “Corporate Baking Field Organization” project was completed in 2013 and will be launched in 2014. Within the scope of the project, the Bank plans to open two new corporate branches (Boğaziçi and Trakya) in Istanbul and corporate representative offices in 10 cities where the corporate customer potential is high, to complement the existing Başkent and Kozyatağı Corporate Branches that are already in operation. With the completion of the project, the Bank aims to provide direct, specialized and high-quality service to nearly 95% of its 7,600 corporate customers through a field sales staff of 46 people.

All of these developments support the strategic balance that Türkiye Finans aspires to build among its customer portfolios in the SME, corporate and commercial banking segments.

Türkiye Finans offers rapid, innovative and competitive solutions to meet the financial needs and requests of tradesmen and small scale enterprises.

Always standing by SME and micro enterprises

Having concentrated on the enterprise banking segment based on such pillars as customer orientation, proactivity and mobility within the framework of its mission to produce added value for SMEs and micro enterprises, that are the driving forces of the Turkish economy, Türkiye Finans provides financial support, information and consultancy to its customers.

Within the scope of the Entrepreneur Job Family program, the Bank extended TL 4.9 billion in cash loans (an increase of 65% YoY) and TL 2.6 billion (up by 35% YoY) in non-cash loans.

According to the official SME definition, the Bank’s loan risk magnitude in the enterprise banking segment reached TL 7.7 billion. Meanwhile, the Bank has a 27% share in SME loans among participation banks, and a 2.8% share in the entire banking industry. Providing support to meet the needs of SMEs and enterprises for all types of investment tools, such as machinery and equipment, Türkiye Finans increased its financial leasing transaction volume by 129% YoY to TL 234.9 million in the enterprise banking segment.

In line with its target of expanding its customer mass and acquiring new customers by widening the base in the SME and enterprise segments, the Bank worked with a strong team of 526 people from 250 branches in 2013. With such efforts, the number of customers in these segments rose by 30% YoY to reach nearly 243,000 in 2013.

Striving to offer better solutions to SMEs

The Enterprise Banking Department was founded in January 2013 in order to expand the base in the SME portfolio and to offer rapid, innovative and competitive solutions to meet the financial needs and requests of tradesmen and small scale enterprises, which differ from commercial and corporate customers in view of their management structures and needs, as well as their scale.

Cooperation with TESK - A campaign reaching more than 2 million tradesmen and craftsmen

The Bank signed a special protocol with TESK (Confederation of Turkish Tradesmen and Craftsmen) that covers financing packages prepared for member enterprises. In accordance with the signed protocol, the Bank has prepared four different financing packages with special maturity and profit sharing for TESK members. These packages were offered to more than 2 million craftsmen and tradesmen operating in 491 business sectors and registered to a total of 3,170 chambers under 13 professional federations and 82 unions.

As an extension of this project, the Bank has entered into local protocols with the Chambers and Associations of Craftsmen and Tradesmen of Antalya, Kayseri and Denizli, and gathered craftsmen and tradesmen under a single roof, while offering them the opportunity to benefit from special advantages and discounts in product and services purchases.

Within the scope of such cooperation, TESK members were regularly informed and special campaigns such as Faal Card and POS were organized for them.

Gülen Çiftçi (Smiling Farmer) Agriculture Package

The Gülen Çiftçi Agriculture Package, which takes account of regional characteristics and also covers financial leasing projects, was revised and offered to the use of farmers. To this end, and as part of its efforts to raise its market share in agricultural loans, the Bank provided farmers with financing facilities with favorable maturities and profit shares by entering cooperation with corporations selling combine harvesters, tractors and agricultural equipment in various cities, especially Kırşehir and Kırıkkale. Through the restored Gülen Çiftçi Agriculture Package, a total of TL 73 million in loan support was provided to customers in 2013.

Support to SMEs with the Investment Incentive Certificate

Within the scope of the “Profit Share Protocol” signed by and between Türkiye Finans and the Ministry of Economy, the Bank continued to support SMEs through the Investment Incentive Certificate in 2013. To this end, the Bank extended a total of TL 55 million of financial support for product purchases related to customers’ investments in 2013.

Supporting tradesmen and enterprises with TL 191 million in cash loans and TL 61 million in non-cash loans

In 2013, Türkiye Finans extended TL 191 million in cash loans and TL 61 million in non-cash loans to about 136,000 tradesmen and enterprises in the Enterprise Banking segments.

Launched in the first half of 2013, the “Micro Scoring” project aims to implement faster and more effective credit assessment processes to deal with the loan requests of up to TL 50,000 of tradesmen and enterprises whose annual turnover is less than TL 500,000. In 2013, a total of 3,700 applications for loans of less than TL 50,000 were immediately concluded. This allowed the Bank gained to serve its customers more rapidly. The Bank now aims to provide instant service to more customers, shorten the application procedures and raise the quality of its services and loan allocation processes by including loan requests of up to TL 250,000 in the scope of the “Micro Scoring - 2” practice in 2014.

Cooperation with KGF (Credit Guarantee Fund)-KOSGEB (Small and Medium Enterprises Development Organization)

Demonstrating a solution-oriented approach to facilitate SMEs’ access to financial resources, Türkiye Finans maintained its leading position in the banking industry in 2013 on the basis of Treasury Supported Credit Guarantee Fund collaterals, as it had in 2012.

Having allocated a total of TL 260 million worth of resources through KGF Collateral in 2013, the Bank attained a total of TL 503 million in total transaction volume, providing 63% more collateralized support than the second ranking bank. By raising its market share in this category from 18% to 28%, Türkiye Finans succeeded in providing SMEs with more collateral than any other bank.

Acting on its awareness of social responsibility, the Bank entered cooperation with KOSGEB to support enterprises which had suffered financial hardship in the grievous tragedy which took place in the district of Reyhanlı in the Hatay province in 2013, and extended help for them to restart their operations.

Having adopted the mission of engaging in any type of project that would contribute to the development of our economy, Türkiye Finans offered the Cansuyu Kredisi (Lifeline Loan) for the product and service purchases of SMEs, whose projects are deemed worthy of support within the scope of Support Packages launched by KOSGEB.

About KGF Founded in 1991, KGF supports small and medium size enterprises (SMEs) by providing them with a guarantee so they can use bank loans to finance their investments and operations. By providing such guarantee to SMEs and assuming the risks, KGF consequently increases the credit usage of these enterprises in general and also allows small enterprises to benefit from long-term, cost-efficient loans. Also promoting entrepreneurs, KGF also contributes to economic growth and development by creating additional loan facilities on behalf of SMEs. One of the main priorities of KGF is to support young and woman entrepreneurs. Other priorities are to promote innovative investments, to promote high-tech SMEs, to support exports, increase the rate of employment and contribute to regional development. KGF is currently in operation with the European Association of Mutual Guarantee Societies (AECM) and the European Investment Fund (EIF). http://www.kgf.com.tr/ |

TL 191 million

Cash loans extended to tradesmen and small scale enterprises

We believe financial literacy is of key importance in terms of sustainable growth and development.

Attaching great importance to the development of SMEs and their integration with domestic and foreign markets, the Bank added momentum to its efforts with the chambers of trade and industry in 2013.

To this end, the Bank signed protocols with the Chambers of Trade and Industry of Denizli, Uşak, Mardin, Çanakkale, Rize, Nevşehir, Yozgat and Kastamonu; and held meetings entitled “Türkiye Finans Days” in a variety of cities in Turkey with the aim of providing SMEs with information and consultancy services and the chance to share their own experiences.

In addition to these efforts, the Bank has entered sponsorship agreements to raise SMEs’ awareness for branding and to contribute to the rise of new brands from Anatolia; and started “Anatolian Brands Publicity Meetings” in June. During this period, special meetings were held with the cooperation of the Chambers of Trade and Industry of Denizli, Şanlıurfa, Gaziantep and Çanakkale, where an important figure from the Turkish economy would share their inspiring brand story with participants in each city. Concurrent with the meetings, applications were received for the Anatolian Brands Contest. A number of institutions and agencies from all over Turkey participated in the Anatolian Brands Contest 2013.

Anatolian Brands Contest 2013 held by Türkiye Finans The finals of the Anatolian Brands Contest 2013 were held in Istanbul on December 13th, 2013 in cooperation between Türkiye Finans and the Capital and Economist publications. Aiming to settle brand awareness and to bring the “branding” topic forward in cities other than Istanbul, the Anatolian Brands contest aims to create role models and examples of best practices for Anatolian companies. Nearly 200 applications were submitted for the contest, which was held for the 7th time in 2013. The contest was organized under two main categories. The winners were: LARGE ENTERPRISES CATEGORY

SMALL ENTERPRISES CATEGORY As the pioneer of participation banks, Türkiye Finans always stands by those companies that take initiatives for branding. Türkiye Finans believes that companies which are successful in branding are one step ahead in the competition, more resistant against fluctuations and economic crises and more innovative and dynamic. Since its foundation, the Bank has been providing the support required by companies for branding and institutionalization, and entering cooperation with chambers of trade and industry nationwide for this purpose. |

renewable energy

Türkiye Finans mediates in the financing of environmentally friendly and renewable energy resources in Turkey, such as solar, wind, hydroelectric, geothermal and bioenergy.

TÜRKİYE FİNANS AND THE ENERGY SECTOR

Energy is the most fundamental need in the growing Turkish economy. The development of domestic energy resources is vitally important to enhance our currently insufficient energy resources and to create a sounder and more sustainable structure in energy consumption, which is currently more than 70% dependent on imports. Reducing the share of imports in the energy sector is also crucial in lowering the current account deficit, which is currently one of the most important challenges facing the Turkish economy.

The climate change and environmental problems which have been observed globally over the last 30 years have set the stage for energy generation from renewable resources as a key trend in Turkey and the world.

Turkey offers significant potential in terms of renewable, environmentally friendly energy resources, such as solar, wind, hydroelectric, geothermal, and bioenergy; and electricity production based on renewable energy resources is supported by the Turkish government. With the amendment to the energy law, all natural and legal persons who establish generation plants with a maximum installed capacity of 1 MW and micro cogeneration plants are exempt from the requirement to receive a license and set up a separate company. Moreover, the government has started to grant a 10-year guarantee for the purchase of the excessive electricity generation. |

According to the reports published by the Energy Market Regulatory Agency (EMRA), the government received a record number of applications (418 applications) for solar energy after the promulgation of the Regulation on Electricity Generation without Licenses.

Within the scope of its socially and environmentally responsible lending policies, Türkiye Finans provides financial support to all energy-related projects, particularly the renewable energy projects, based on its approach to produce added value for the community and the environment in terms of sustainability and social responsibility, and to raise social awareness on the environment.

Special importance and potential of renewable energy resources

30% of Turkey’s energy needs are met through renewable energy resources, while it is claimed that this ratio could climb to 70-80%. In line with this macro projection, Türkiye Finans mediates in the financing of high-potential, environmentally friendly and renewable energy resources in Turkey, such as solar, wind, hydroelectric, geothermal and bioenergy, in order to contribute to the national economy.

The projects to be financed under renewable energy financing are evaluated by the Bank’s specialists and customer demands are responded to as soon as possible.

Moreover, the Bank also offers KGF support under renewable energy financing to all enterprises which provide a strong contribution to the development of the Turkish economy.

Supporting clean energy: “Renewable Energy Generation without License” Package Having participated in the 5th Energy Efficiency Forum and Exhibition held in Istanbul on January 8th-11th, 2014, Türkiye Finans introduced its “Unlicensed Renewable Energy Package”, as well as its “100% Energy Package” designed for SMEs. Introduced under the motto, “Generate Your Own Electricity”, this new financing package invites electricity producers to invest in the environment for clean energy. By offering customers reasonable maturities and profit shares, Türkiye Finans finances all costs associated with the purchase of equipment for unlicensed energy generation, as well as the installment, construction and connections of the power plants and all other turnkey products and services. Under the Unlicensed Renewable Energy Package, Türkiye Finans offers its customers a variety of advantages, such as cost-efficient loans and advantageous profit shares, loans denominated in USD, EUR and TL terms and one year maturity non-refundable loans with a total maturity of up to 5 years. Through cost-efficient financing in commodity groups subject to financial leasing, the Bank offers a fixed cost advantage against economic fluctuations, as well as KGF (Credit Guarantee Fund) support in the form of collateral. |

The first participation bank to develop a product for energy efficiency: “Energy Efficiency Financing”

As Turkey’s leading participation bank, Türkiye Finans also supports efforts aimed at energy saving and energy efficiency. As the first participation bank to design the product, “Energy Efficiency Financing”, for insulation and jacketing requests of flat owners, and apartment and site managers, Türkiye Finans also provides resources for financing SMEs in the energy sector.

Cooperation with İzoder

Designed by Türkiye Finans in cooperation with İzoder (Association of Thermal Insulation, Waterproofing, Sound Insulation and Fireproofing Material Producers, Suppliers and Applicators), the “Energy Efficiency Financing” product is offered with a zero profit share to 1,700 specialized implementing companies that are İzoder members, as well as the owners of buildings and apartment/site managers. Customers who carry out insulation and jacketing in their buildings may benefit from Türkiye Finans’ preferential interest-free financing opportunity with maturities of up to 12 months and without loan application fees. The Bank also offers the opportunity to postpone installment payments for up to 3 months in all maturities. İzoder also provides technical consultancy and project control services for the projects to be financed by Türkiye Finans.

Financier of Energy

Enerjinin Finansörü offers cardholders - for their energy efficiency projects - various financing facilities with maturity of up to 24 months and without loan application and card fees. Customers who apply for Enerjinin Finansörü, a product specially designed for energy efficiency related efforts, can use their loan limits in the purchase for a variety of equipment purchases such as white goods, gas boilers or air-conditioning units, as well as for all housing and building heat and insulation expenditures. Furthermore, Enerjinin Finansörü offers a 4-installment payment option of the cash price or a maturity of up to 12 months for all expenses carried out with Türkiye Finans’ credits cards (Happy Kart, Türkiye Finans Credit Card and Haremeyn Card) in the contracted member workplaces.

100% Energy Package for SMEs

Another product offered by Türkiye Finans to support the energy sector is the 100% Energy Package specifically designed for SMEs.

The Energy Package provides resources under reasonable conditions to finance the needs of enterprises operating in the energy sector. Offering a variety of advantages and discounts for the investment and other credit needs, including foreign trade transactions and banking transactions, for enterprises in the energy sector, Türkiye Finans also extends support for the purchase of products in the energy sector through financial leasing.

The 100% Energy Package, specifically designed for SMEs, is one of the products offered by Türkiye Finans to support the energy sector.

The high potential of the energy efficiency and saving sector

According to the Population and Housing Census 2011 published by TurkStat in 2013, there are about 20 million households in Turkey. With the efforts that it has undertaken since 2012, Türkiye Finans has ensured that 0.002% of these households become more economic by extending financial support to them.

Türkiye Finans will offer more financial support for solar energy, insulation and energy-saving products during 2014 in order to ensure that these products are used by an increasing number of consumers.

Türkiye Finans allocated a total of TL 420 million in resources to the energy sector in 2013. The Bank aims to provide more support to the sector and increase the volume of its energy loans to TL 1.5 billion in the coming 5-year period.

Türkiye Finans extended TL 194 million in loans to its customers in 2013 within the scope of the 100% Energy Package. Meanwhile, the total volume of resources allocated by the Bank to various hydroelectric power plant and wind farm projects has reached TL 223.6 million. Türkiye Finans expects this trend to continue in the coming period with the total sum of loans to be allocated by the Bank to the energy sector reaching TL 1.5 billion by the end of the 5-year period.

URBAN TRANSFORMATION Turkey is located in one of the world’s most active earthquake zones, with 24,500 km of active fault lines, all of which are susceptible to earthquakes; 98% of Turkey’s population lives in regions subject to earthquake risk. Since 1903, a total of 100,000 people have lost their lives and about 2 million homes were destroyed in 130 earthquakes in Turkey. Having entered effect on May 16th, 2012, Law No. 6306 on the Restructuring of Areas under Risk of Natural Disasters aims to pave the way for the identification and destruction of buildings in areas that are under the risk of natural disasters, and buildings deemed to be at risk of collapse in other areas, as well as the creation of safe and healthy living environments. Although the exact number of buildings deemed to be at risk and the number of buildings which have been destroyed in Turkey is not yet known, it is estimated that about 6.5 million homes are at risk from natural disasters. Source: Ministry of Environment and Urbanization (Republic of Turkey) - http://www.csb.gov.tr/turkce/index.php |

Financing state-supported urban transformation projects in Turkey, which is located in the seismic belt.

Türkiye Finans was the first participation bank to sign a protocol with the Ministry of Environment and Urbanization in 2013 for the profit share support to be provided for urban transformation loans.

Providing housing financing with maturities of up to 120 months, favorable payment conditions and alternative payments plans for urban transformation projects, Türkiye Finans applies a 4% profit share deduction per year for housing loans supplied for the financing of houses that are being rebuilt; and a 3% profit share deduction per year for office loans. No RUSF (Resource Utilization Support Fund) or BITT (Banking and Insurance Transaction Tax) charges are applied for urban transformation loans, which are considered under the same statute as mortgages. Within the framework of the urban transformation financing practice launched in 2013, the Bank allocated a total of TL 190,000 in loans during the reporting period.

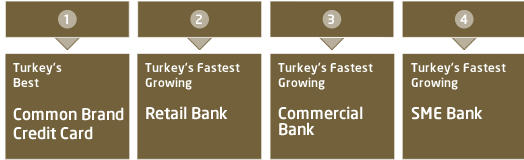

TÜRKİYE FİNANS’ EFFORTS TO MAXIMIZE THE VALUE IT OFFERS TO ITS CUSTOMERS WERE CROWNED WITH VARIOUS AWARDS AND CERTIFICATIONS IN 2013.

Turkey’s Best Call Center, EN15838:2009 and ISO 10002:2004 certifications Carrying out its activities under an approach of offering high-quality and effective services to its customers, the Türkiye Finans’ Customer Communication Center was chosen as Turkey’s Best Call Center and crowned with international certifications for its quality standards in 2013. As Turkey’s leading participation bank, Türkiye Finans received two awards at the 8th Turkish Call Center Awards in 2013, proving the high quality of its customer services. Türkiye Finans’ Customer Communication Center was announced as the winner of the “Turkey’s Best Call Center” Award, thanks to its innovative approach, use of technology and successful performance results, as well as the level of customer satisfaction that it has achieved. On the other hand, Mrs. Eda Dikici - one of the team leaders employed at the Customer Communication Center - was deemed worthy of the “Best Team Leader” Award. Technological developments and intensive competition have carried customer experience in the financial sector to a new dimension. Türkiye Finans is carrying out significant investments in the Customer Communication Center, which is critical in terms of bringing total customer experience to perfection. In 2013 Türkiye Finans completed its efforts to comply with the EN15838:2009 standard in order to ensure that the Customer Communication Center is evaluated according to international standards and to certify the quality of services rendered. Türkiye Finans is one of the 4 banks in Turkey to have received this certification. The Bank also received the ISO 10002:2004 Customer Satisfaction Quality Management System certificate in the same period. These two certifications and “Turkey’s Best Call Center” award are the result of Türkiye Finans’ solution-oriented approach, in which customer satisfaction is at the center of all of the Bank’s activities. |

Türkiye Finans' Customer Communication Center was chosen as Turkey's Best Call Center in 2013.

Four awards that crown and summarize our achievements

In 2013, Türkiye Finans was granted the following awards by Global Banking and Finance Review, one of the world’s leading economics publications:

Türkiye Finans leads the Turkish participation banking industry with its innovative products and services and continuously extends support to the real economy in contributing to the national economy.

Demonstrating a steady and sustainable growth performance, Türkiye Finans will continue to produce permanent value for its customers in the retail, SME, commercial and corporate banking segments, while progressing in line with its carefully defined strategies.