Türkiye Finans and Sustainability

Why?

Sustainability is one of the most important topics on the agenda concerning our planet and mankind.

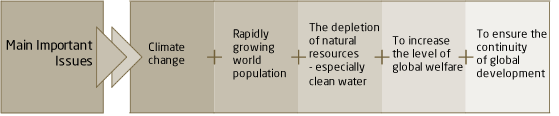

Climate change, a rapidly growing population and the depletion of natural resources - especially clean water - are among the basic problems that must be resolved by humanity in the medium and long term. Other key priorities are increasing the level of global welfare and ensuring the continuity of global development.

A number of international and supranational initiatives, mainly undertaken by the United Nations (UN) and local networks, continue their efforts with the active participation of representatives from the business world to resolve these problems.

As announced by the UN General Secretary in September 2013, the global architecture in 2015 and beyond further increases the responsibilities of the business world, a situation that calls for interactive cooperation.

As a responsible corporate citizen, Türkiye Finans keeps abreast of sustainability-related initiatives in Turkey and in the world, shares its opinions and implements the necessary measures in its service cycle, particularly for its stakeholders. The aim of the Bank is that every decision and every action it takes serves the purpose of creating a sustainable future.

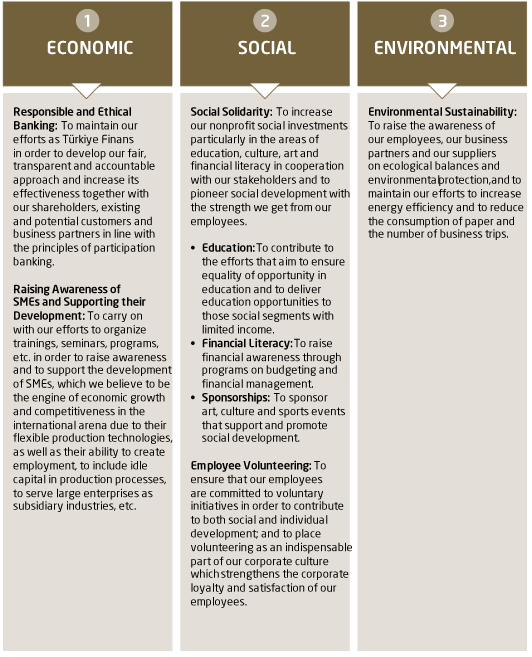

Sustainability is a concept which is not only observed in the economic sphere at Türkiye Finans, but also in the social and environmental area as well, as supported by the Bank’s Board of Directors. This general approach has been adopted as a part of the Bank’s corporate culture; all of the Bank’s core business units maintain their efforts to ensure that sustainability is thoroughly adopted by all employees, while producing value in this direction.

As a dynamic and young member of the Turkish banking industry and participation banking, Türkiye Finans is focused on making a difference by conducting activities which will have an impression on the sector in areas where it believes it will affect its corporate presence and its sustainability. By this means alone, Türkiye Finans may place its corporate future under guarantee and continue to contribute to the sustainability of humanity as a responsible economic actor.

September 2013

As announced by the UN General Secretary, the global architecture in 2015 and beyond further increases the responsibilities of the business world, a situation that calls for interactive cooperation.

How?

THE SUSTAINABILITY STRATEGY OF TÜRKİYE FİNANS

The global financial crisis of 2007-2008 and its aftermath have been the source of important object lessons for economic actors all over the world. Throughout this process, Türkiye Finans continued to stand by its customers and to support them with financial products and services of every kind while maintaining its own financial strength through attentive and prudent lending and risk-management policies.

Türkiye Finans remains resolutely on course thanks both to the strong confidence of its customers and to the correctness of its corporate strategies. For the foreseeable future, our goal will be to make an ever-increasing contribution to Turkey’s development and to the financial stability of its markets.

At the same time however, a variety of environmental, social, and economic trends continue to have in impact on our bank and its stakeholders. We intend to correctly and proactively perceive, respond to, and internalize these trends in a timely fashion. Only by doing so will it be possible for Türkiye Finans to distinguish itself from its competitors, to motivate and improve its human resources, and to ensure the durability of the value that it creates for its stakeholders.

In the context of this background, Türkiye Finans has formulated a double-pronged sustainability strategy capable of supporting the realization of its corporate goals.

Our sustainability strategy is focused on achieving successful results not just in our core business activity but-and to the same degree-on the social plane as well. Just as we abide by good banking practices so too do we serve as an example of a good corporate citizen, thereby redoubling our contributions to society in both domains.

Our sustainability strategy and priorities are summarized below:

good corporate citizenship

Just as we abide by good banking practices so too do we serve as an example of a good corporate citizen, thereby redoubling our contributions to society in both domains.

TÜRKİYE FİNANS’ CORPORATE SOCIAL RESPONSIBILITY (CSR) POLICY

Scope and objective

Türkiye Finans’ Corporate Social Responsibility Policy sets forth the Bank’s values and the basic principles of its corporate social responsibility approach, which is in line with its corporate strategy. Based on these principles, the Bank focuses on priority topics, and accordingly, designates its roadmap and takes all required emergency actions.

This policy covers the Bank’s Corporate Social Responsibility Strategy, which is a 3- or 5-year roadmap that sets forth the systematic actions to be taken and the long-term route of the corporate social responsibility projects and activities to be conducted by the Bank.

Determination of the CSR policy

In setting up its corporate social responsibility project, Türkiye Finans applied AA1000SES, the first and only international standard which was developed to help companies execute stakeholder participation processes in a proper manner. According to this standard, Türkiye Finans set up a CSR Workshop Team from among its managers and employees and determined its Stakeholder Roadmap and CSR-related priority areas that must be focused on, depending on their impact on the Bank.

Requirements of corporate social responsibility

The importance that Turkish banks stick to the principles of transparency and carry out their activities with an awareness of their corporate social responsibilities and for the sake of the community was clearly expressed in the Article 75, entitled “Ethics” of the Banking Law; in Article 7, entitled “Transparency in Corporate Governance” of the Communiqué on the Banks’ Corporate Governance Principles; Article 3, entitled “General Principles”; and Article 20, entitled “Ethics” of the decision “Banking Ethics” of the Participation Banks Association of Turkey.

Closely following the provisions set forth in the legislation in effect in its Corporate Governance Policy and Ethics Policy, Türkiye Finans has adopted and accepted these as a part of its corporate governance principles.

As a fair, transparent, accountable and reliable bank which essentially operates on the basis of basic banking ethics, Türkiye Finans' Corporate Social Responsibility Strategy is to contribute to Turkey's sustainable development.

Türkiye Finans’ approach to corporate social responsibility

Türkiye Finans’ approach to corporate social responsibility is one of the elements forming the basis of the Bank’s corporate strategy.

In this context, the Bank’s economic, social, environmental and ethical responsibilities to its stakeholders and its corporate strategy are in continuous interaction and are shaped according to the expectations of its stakeholders and the needs of the community it serves.

Türkiye Finans is aware that transparency and responsibility are the critical elements of steady economic development and sustainable growth and that it can only be successful through the development of the community which it serves.

Aiming to be successful in its main field of activity, Türkiye Finans’ mission, in line with the principles of participation banking, is to share the added value that it generates through its activities with its stakeholders in a fair and transparent manner, instead of promoting unlimited consumption.

Türkiye Finans enjoys a sustainable competitive edge by virtue of its activities which support value creation which are undertaken under an approach that sets the Bank apart from its current and future rivals.

economic priority

As Türkiye Finans, to increase our effectiveness together with our shareholders, existing and potential customers and business partners in line with the principles of participation banking.

The priority topics and the targets determined by Türkiye Finans within the framework of its corporate social responsibility policy and strategy are set out below:

TÜRKİYE FİNANS’ SUSTAINABILITY PRIORITIES

Within the scope of its efforts for the preparation of its sustainability report of 2013, Türkiye Finans evaluated stakeholder feedback submitted to the Bank through various channels and determined its priorities according to this feedback.

The Bank keeps a close watch on a number of economic, environmental and social issues that directly or indirectly affect the Bank’ activities. In addition to these, the Bank has attached priority and importance to issues which:

- directly concern the Bank’s core business lines;

- have been prioritized by the Bank’s basic stakeholder groups; or

- may be influenced by Türkiye Finans, or in which the Bank can make a difference.

The prioritization process was carried out by the Bank based on the GRI Technical Protocol.

The findings achieved during prioritization will provide key information to Türkiye Finans in the coming period for

- development of services and processes,

- design and development of new products, and

- identification of strategies and policies to be pursued in the future.

Issues prioritized by Türkiye Finans under main sections in the Bank’s Sustainability Report of 2013 are summarized as follows:

environmental priority

To raise the awareness of our employees, our business partners and our suppliers on ecological balances and environmental protection.