Summary Financial Information (Sustainability)

Direct economic value produced and shared by Türkiye Finans in 20131 (in TL thousand)

Value Produced / Sum of Operating Incomes |

Value Shared |

|

|---|---|---|

1,182,266 |

Operating costs Personnel expenses Provisions for severance pay Fiscal charges Dividends2 Donations: - Nonprofit organizations - To natural and legal persons |

567,004 287,003 1,534 83,235 -

61 53 |

1) Non-consolidated data as of December 31st, 2013

2) No dividend was distributed to shareholders during the reporting period.

Summary financial information for the period ended 31.12.2013 (thousand TL)

|

2012 |

2013 |

Change % |

|---|---|---|---|

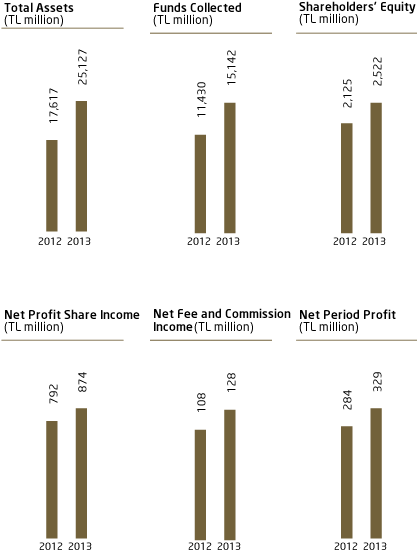

Total assets |

17,616,504 |

25,126,629 |

42.63 |

Loans |

12,763,400 |

17,447,961 |

36.70 |

Funds collected |

11,429,536 |

15,141,718 |

32.48 |

Shareholders’ equity |

2,125,162 |

2,522,381 |

18.69 |

Net profit share income |

792,111 |

874,083 |

10.35 |

Net fee and commission income |

108,231 |

128,272 |

18.52 |

Net period profit |

283,573 |

329,277 |

16.12 |

Capital adequacy ratio |

14.76% |

12.81% |

|

TL 329 million

2013 Net Period Profit

In 2013, Türkiye Finans achieved: |

|

2012 |

2013 |

Change % |

|---|---|---|---|---|

Total Number of Its Branches |

220 |

250 |

13.64 |

|

Total Number of Employees |

3,595 |

3,990 |

10.99 |

For the Summary Financial Information about the Operating Results of Türkiye Finans in 2013, please refer to pages 10 and 11 of the Bank’s Annual Report 2013, which is available on the following website: http://www.turkiyefinans.com.tr/en-us/investor-relations/financial-data-and-reports/Pages/annual-reports.aspx

42.63%

The increase in total assets as of year-end

Türkiye Finans is the highest taxpayer among participation banks.

Having paid TL 78,7 million in corporation tax in 2012, Türkiye Finans is the highest taxpayer among participation banks.

Türkiye Finans ranked 32nd among the Revenue Administration’s top 100 taxpayers list in the Corporation Tax category in 2012. With this result, Türkiye Finans has become the highest corporate taxpayer among participation banks.

Türkiye Finans’ contributions to the national economy increase in parallel with its steady growth performance. The Bank has been among the top 100 taxpayers for a sustained time, climbing higher in the ranking with each passing year with the pride of fulfilling this holy duty.