Corporate Governance Organization at Türkiye Finans

Türkiye Finans accepts corporate governance and full compliance with the law as an essential factor in achieving its "best banking" target within the scope of its sustainability strategy.

For Türkiye Finans, corporate governance and full compliance with the law form:

- the basis of sustainable economic performance,

- the framework of ethical and honest competition, and

- the primary element of balancing and observing stakeholder benefits.

Türkiye Finans accepts corporate governance and full compliance with the law as an essential factor in achieving its “best banking” target within the scope of its sustainability strategy. Türkiye Finans’ corporate target is to improve its reputation and brand strength in the market through best banking practices. This can only be achieved through full compliance with the law and legislation, as well as ethical values. Best corporate citizenship practices that include contributions to the community, the environment and the social life are other key factors for success.

Türkiye Finans has policies, procedures and risk management principles which are clearly defined for the Bank’s business lines, services and products. Thanks to its robust IT infrastructure, the Bank:

- rapidly and effectively adopts policies, procedures and systems into its service cycle;

- fulfills all management reporting functions in the most efficient manner; and

- completely fulfills all internal and external audit functions.

Corporate Governance Structure

Türkiye Finans is a privately-owned corporation whose shares are not publicly held.

Türkiye Finans is not subject to the provisions of the CMB’s communiqué in issues regarding corporate governance. However, the Board of Directors of Türkiye Finans ensures compliance with the BRSA’s regulations and has adopted and applies, whenever possible, those practices that are defined by CMB for publicly-held companies.

Shareholders may obtain information about Türkiye Finans directly from the Bank or its Board of Directors or through Annual General Meetings. Furthermore, the Bank’s audited annual financial statements are published on its corporate website. The Bank’s corporate governance organization comprises of the following bodies:

Board of Directors

Türkiye Finans’ Board of Directors consists of 6 non-executive members and the CEO. This number enables the board to effectively organize all of its activities.

The Chairman of the Board and the CEO are two different persons. The Chairman is a non-executive member of the Board. There are no independent members on the Board.

For information about the Board members of Türkiye Finans, please refer to page 46 of the Bank’s 2013 Annual Report, which is available from the following website: http://www.turkiyefinans.com.tr/en-us/investor-relations/financial-data-and-reports/Pages/annual-reports.aspx

Board Level Committees

Türkiye Finans Board has established an,

- Audit Committee,

- Credit Committee,

- Corporate Governance Committee,

- Compensation and Nomination Committee

which are required by the related banking regulation.

The Board has also established an Executive Committee to closely monitor strategy execution and performance management.

Türkiye Finans has policies, procedures and risk management principles which are clearly defined for the Bank's business lines, services and products.

The authorities and responsibilities of each committee are prepared under the supervision of the Corporate Governance Committee and submitted to the Board for discussion and approval. The approved form constitutes the charter of the related committee.

Basic information regarding the committees at Türkiye Finans and their activities during the reporting period is available on page 52 of the Bank’s 2013 Annual Report, which is available from the following website:

http://www.turkiyefinans.com.tr/en-us/investor-relations/financial-data-and-reports/Pages/annual-reports.aspx

Senior Management

As defined in the BRSA regulation, the Senior Management refers to members of the Board and members of the high level management team. Appointments to Senior Management positions fully comply with the qualifications required by the regulation and by considering their suitability for the role and the Bank.

The Senior Management includes the CEO, Deputy CEOs, employees who directly report to the CEO and the managers of internal system functions.

For information concerning Türkiye Finans’ senior management, please refer to pages 48-50 of the Bank’s 2013 Annual Report, which is available from the following website:

http://www.turkiyefinans.com.tr/en-us/investor-relations/financial-data-and-reports/Pages/annual-reports.aspx

Türkiye Finans’ Code of Conducts Policy (Ethical Rules)

The Türkiye Finans Board approved the Code of Conduct Policy in 2010. This policy covers all ethical rules and processes to ensure compliance with the Code of Conduct. Necessary training is organized and conducted by the Compliance Department and the Product and Services Compliance Control Service. An ethics notification hotline is set up and the process is designed to analyze and report the outcome any infringements.

Information concerning the Board members and their shares in the Bank is available on page 13 of the Bank’s 2013 Annual Report, which is available from the following website:

http://www.turkiyefinans.com.tr/en-us/investor-relations/financial-data-and-reports/Pages/annual-reports.aspx

Capital and Shareholder Structure(*)

Shareholder |

Share Amount (TL thousand) |

Share Ratio (%) |

|---|---|---|

NATIONAL COMMERCIAL BANK |

1,176,369 |

66.27 |

GÖZDE GİRİŞİM SERMAYESİ YATIRIM ORTAKLIĞI A.Ş. (ÜLKER GROUP) |

205,405 |

11.57 |

(HACI) MUSTAFA BOYDAK (1934) |

41,173 |

2.32 |

BOYDAK HOLDİNG A.Ş. |

39,213 |

2.21 |

BEKİR BOYDAK |

33,269 |

1.87 |

MEMDUH BOYDAK |

33,269 |

1.87 |

MUSTAFA BOYDAK (1963 SON OF SAMİ) |

33,250 |

1.87 |

YUSUF BOYDAK |

31,309 |

1.76 |

ŞÜKRÜ BOYDAK |

27,730 |

1.56 |

HACI BOYDAK |

26,678 |

1.50 |

Total |

1,775,000 |

100.00 |

(*) Shareholders holding 1% or more Interest in Türkiye Finans are shown in the table above. 130 shareholders, which have interest below 1% In the Bank represent a total of 7.2% share.

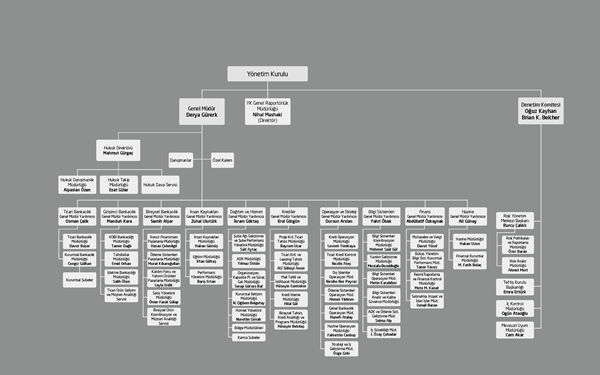

Organization Chart

Click the image below to view Türkiye Finans organization chart.

The internal audit, internal control and risk management activities at Türkiye Finans are spelled out in published regulations.

Policies adopted by Türkiye Finans and legal compliance

Türkiye Finans has designed and developed policies in a number of areas from customer satisfaction to legal compliance. Implemented throughout the Bank, these policies are:

- Customer Constitution

- Credit Policies

- Ethics

- Risk Management Strategy

- Internal Control Policies

- Customer Satisfaction Policies

- Audit Board Policies

- Quality Policy

- Compliance Policy

Internal audit, internal control and risk management activities

The internal audit, internal control and risk management activities at Türkiye Finans are carried out by the Board of Auditors, the Internal Control Department and the Risk Management Center, all of whose duties and responsibilities are spelled out in published regulations and which are organizationally independent of each other. The activities of these units are coordinated by the Audit Committee acting on behalf of the Board of Directors.

Türkiye Finans acknowledges the high level of importance of risk management activities in terms of sustainability performance. In this context, the Bank systematically monitors and measures - within the framework of its written risk policies - the risks that it is subject to by using methods that comply with internationally recognized standards. The Bank also reports such ricks to regulatory and supervisory authorities in accordance with legal requirements.

Regulatory compliance activities at Türkiye Finans

The Regulatory Compliance Department also reports to the Board of Directors through the Audit Committee. There are two units under the Regulatory Compliance Departments:

- The Product and Service Regulatory Compliance Unit considers all of the Bank’s existing and proposed activities (including new processes and products) from the standpoint of their compatibility with applicable laws and regulations, with the Bank’s own policies and rules, and with ordinary banking practices.

- The MASAK (Financial Crimes Investigation Board) Compliance Unit carries out activities to ensure that the Bank is not in violation of any laws, regulations or administrative provisions or of any international regulations or standards as may be applicable to the prevention of money-laundering and of financing terrorism. In the conduct of such activities, the Unit takes a risk-based approach to ensure the complete satisfaction of the Bank’s regulatory compliance policy. The head of the unit is responsible for analyzing and reporting any transaction or situation which is deemed to be suspicious in light of MASAK rules and regulations.

During 2013, 51% of Türkiye Finans’ personnel received training specific to MASAK-related issues and 90% received Code of Ethics Policy training.

For information about risk management, internal audit and control and regulatory compliance activities at Türkiye Finans, please refer to pages 64-65 and 245-246 of the Bank’s 2013 Annual Report 2013, which is available at the following address: http://www.turkiyefinans.com.tr/en-us/investor-relations/financial-data-and-reports/Pages/annual-reports.aspx

Türkiye Finans receives the “Internal Audit Awareness” Award

Thanks to its internal audit practices which meet international standards, Türkiye Finans received the “Internal Audit Awareness” Award provided by the Institute of Internal Auditing - Turkey.

Internal Audit Awareness Awards are given by the Institute of Internal Auditing - Turkey (TIDE) to ensure that all internal audit practices in Turkey are carried out at international standards, to ensure the auditing is performed flawlessly and to raise awareness of internal auditing. Internal Audit Awareness Awards are given in five categories: Social Awareness, Corporate Awareness, Individual Awareness, Academic Awareness and Volunteering Organizations. In 2013, Türkiye Finans was awarded in the Corporate Awareness category.

In a statement issued regarding the award, the CEO of Türkiye Finans, Derya Gürerk, said “Internal audit is of great importance to risk management. Thanks to internal audit, we can also ensure the efficiency and effectiveness of our activities, protect the confidentiality of financial information and carry out regulatory compliance efforts in a controlled manner. I believe those companies seeking to contribute to the national economy with their organizational structures will take significant steps through internal audit practices.”