Global macroeconomic outlook

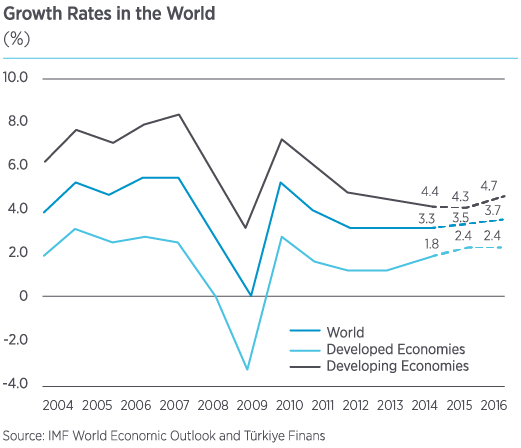

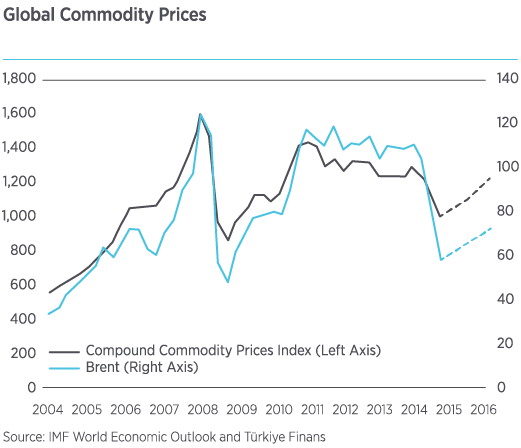

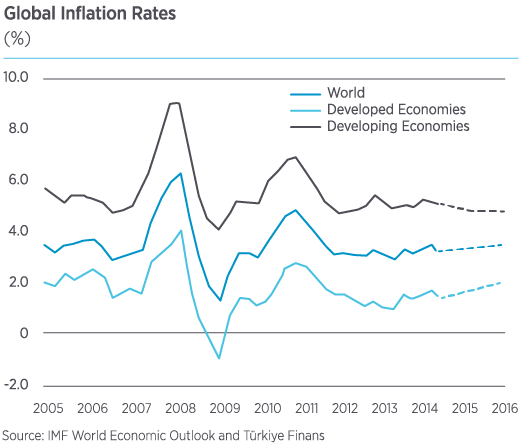

Fears of permanent recession and concerns over deflation remained at the forefront in 2014. Although the positive growth outlook in developed countries at the end of the previous year raised hopes of stronger global growth, realizations the first half of 2014 led to disappointment. Developing countries, on the other hand, remarkably lost pace due to structural reasons and the impact of low growth in developed economies. The fragile outlook in the world economy precipitated general selling in commodities, leading to a decline in prices - mainly energy prices. As a result, inflation rates around the world declined to below their historical averages, while monetary policies maintained their supporting position.

The USA economy grew at a moderate 2.4% in 2014 and unemployment declined to below 6% as of the end of the third quarter. While the recovery in the labor market continued in line with economic growth, the FED terminated its asset purchases as of October. Due to decrease in global commodity prices and high level of idle capacity in the economy, the rate of CPI inflation was realized at 0.8% during the year - lower than the FED’s target of 2%, as it was for most of the year.

Eurozone economies sustained the recovery trends which started in 2013 and which continued in early 2014. However, due to increased geopolitical risks in the second quarter of 2014, recovery trends started to lose pace. While the annual rate of growth around the region was 0.8% in the third quarter, the annual rate of CPI inflation decreased to -0.2% at the end of 2014 - the lowest since 2009. Against a backdrop of such low inflation, the European Central Bank (ECB) cut its policy rates to record low levels. The lending rate was reduced to 0.05% while the deposit rate was taken down to -0.20%. Liquidity provided to the banking sector was increased with a targeted longer term refinancing operation (TLTRO). In the first month of 2015, the ECB took the decision to embark on quantitative easing, which includes asset purchases of countries. These steps aim for an extraordinary expansion in the ECB’s balance sheet.

China, the world’s second biggest economy, decided to balance its growth by reducing the risks in its banking sector in 2014. However, China’s growth rate decreased by more than the targeted level because of the measures taken and the loss of growth momentum in developed economies. The Chinese economy grew by 7.4% in 2014. While commodity prices were starting to decline in response to the slowdown in global growth rates, the country’s CPI inflation decreased to 1.5% by the end of 2014 - the lowest level of the year.

Growth in certain developing countries that tightened monetary policies at the end of 2013 to prevent capital outflows and limit rises in inflation rates exhibited a remarkable slowdown in the first half of 2014. Increased geopolitical risks exacerbated the deceleration of growth in some of these countries. These countries experienced difficulties in easing their monetary policies to the levels in early 2013 due to volatility in financial markets and uncertainty surrounding the Fed’s policies. While inflation started to decline in these countries with low commodity prices, the growth outlook remains still weak.

A stronger growth performance is expected in 2015 when compared to 2014 thanks to the monetary policy measures taken by developed economies. While uncertainty over the timing and pace of Fed’s interest rate increases continues, global liquidity conditions are expected to be balanced by expansionary steps taken by other economies. Therefore it is anticipated that emerging economies are in a position to gradually recover on the assumption that there is no significant curtailment in capital inflows to these economies. While the importance of structural reforms in boosting growth and alleviating fragilities has been emphasized, it is considered that the effectiveness of monetary policy measures can be increased. With these expectations, the global economy is expected to grow relatively slowly when compared to the pace seen in previous years, but still exceeding the rate of growth seen last year. A gradual increase in commodity prices and inflation is also expected going forward.

Outlook for the Turkish economy

At the beginning of 2014, expectations regarding the economic outlook were generally pessimistic due to capital outflows from our country and a hectic political agenda. However, despite all of these points, the Turkish economy leaves 2014 behind in a stronger state. While inflation has started to come down, albeit gradually, there has been a limited weakening in the currency and increase in interest rates. The composition of growth was realized in a balanced manner. The current account deficit narrowed with the support of lower energy prices.

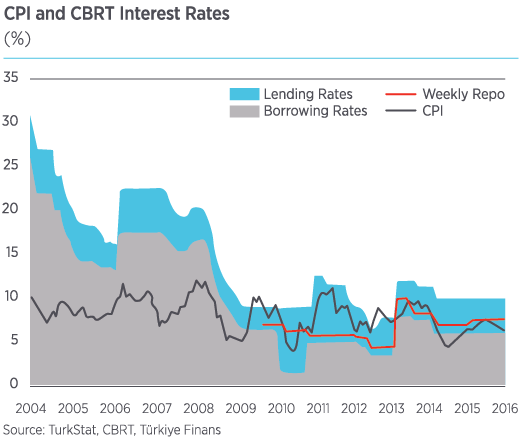

The CBRT conducted an aggressive tightening process by raising the one week repo rate from 4.5% at the beginning of 2014 to limit the negative impact of the devaluation in TL which was a result of a deterioration in the risk perception. Since the end of second quarter, while uncertainties in the country eased while global liquidity conditions also improved, the CBRT maintained its cautious stance in its liquidity policy and reduced interest rates accordingly. However, while inflation was high throughout the year, the CBRT limited its cuts in interest rates. The one week repo rate, which is a policy rate, ended the year at 8.25% after the cuts in interest rates implemented after the second quarter.

The devaluation in the TL at the beginning of the year and in food prices - which stand higher than global levels due to the drought - were the reasons for consumer inflation approaching double digit levels in 2014. The negative impact of foreign exchange rates on inflation started to be relieved in the second half of the year. The rise in inflation did lose some pace thanks to the decline in global commodity prices. However, the fact that expected correction in food prices was limited delayed the recovery in inflation. The CBRT had to stand cautiously amid the uncertainties in global markets. As a result, consumer price inflation, which was 7.75% at the end of 2013, ended 2014 at 8.17% after having peaked at 9.66% in May.

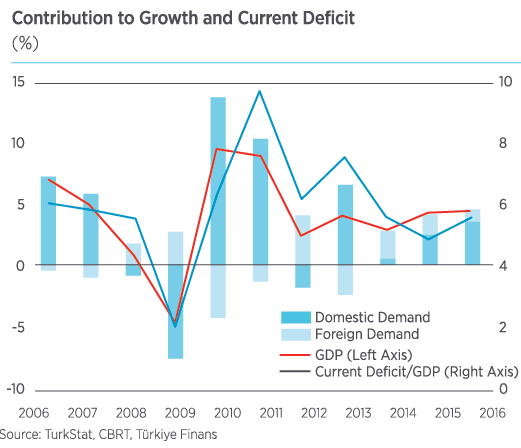

Domestic demand exhibited a sharp deceleration in the second quarter due to lagged impacts of the tightening in monetary policy and the macro prudential measures taken by regulatory authorities. Thanks to the devaluation of the TL, there was no significant loss in Turkey’s competitive power despite the low growth performance in the economies of some of Turkey’s trading partners. As a result, foreign demand effectively supported growth in 2014, in contrast with the weak performance in domestic demand. Following the strong 4.8% growth rate in the first quarter, the annual rate of GDP growth declined to 2.2% and 1.7% in the second and third quarters, respectively. According to leading indicators, although growth in the fourth quarter was better than in the third quarter, the growth rate for the year is expected to have been around 3.3%.

The positive impact of the fall in commodity prices started to be seen towards the year-end. Thanks to weak domestic demand, imports contracted by 3.7%. Exports, on the other hand, increased by 3.9% thanks to fall in the TL to a more competitive position, despite the slowdown in Europe and increased geopolitical risks. Therefore, the trade deficit contracted by 15.4% YoY to USD 84.5 billion in 2014, from USD 99.9 billion at the end of 2013. Likewise, the current account deficit narrowed from USD 64.7 billion in 2013 to USD 45.8 billion in 2014.

The TL depreciated by 15% against the USD and Euro, when compared to its 2013 average. In real terms, the currency lost 6.3% and 3.7% of its value against the currencies of developed and developing countries, respectively. If it is considered as a basket, the fall in the currency was 5.6%. The compounded yield on the benchmark bond increased from 10% in 2013 to a high 11.6% in 2014 before falling to 8% by the end of 2014 thanks to recovery in the inflation outlook and the CBRT’s rate cuts.

The Turkish economy is expected to post around 4% growth in 2015 with growth expected to pick up on the back of structural reforms and the recovery in global growth. A balanced growth composition seems possible with the decrease in foreign demand and moderate level of domestic demand. With the help of lower energy and commodity prices, the current account deficit is expected to decline to 5.2% of GDP with inflation expected to decrease to 5% within the year. However, inflation is expected to increase towards the end of year (on a YoY basis) due to the base effect. With the recovery in the inflation outlook, the CBRT may cut its monetary policy interest rates further. The volatility in financial markets is expected to be high depending on global developments.

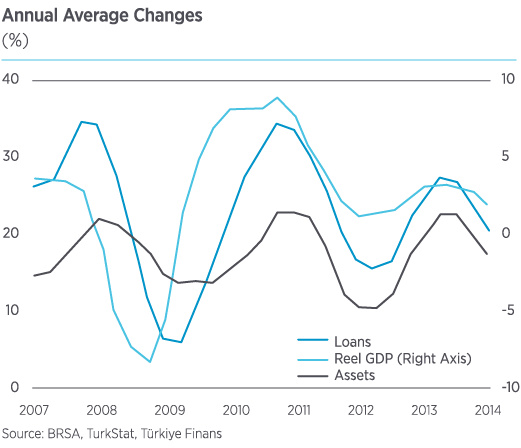

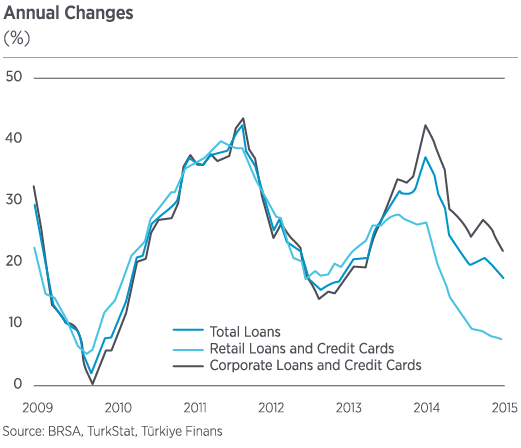

The Turkish banking sector and participation banking

As a result of the BRSA’s macro prudential measures as well as the CBRT’s monetary policy tightening at the beginning of 2014, the Turkish banking sector realized a remarkable slowdown in its growth. A wave of regulations were introduced in the banking sector from the second half of 2013, including an increase in general provisions, an increase in risk weightings, limitations placed on credit card borrowing and limitations on the maturities of consumer loans. These regulations were clearly restrictive of the sector’s loan composition, growth and profitability performance in 2014.

The increase in funding costs in the first quarter negatively impacted the sector’s profitability for a time, but this effect eased in the periods that followed. Loan composition, on the other hand, changed in line with the balancing in the economy thanks to the macro prudential measures taken. While the slowdown in consumer loan growth was more apparent, the rapid growth in corporate loans limited the deceleration in total loans. Thanks to the experience gained in previous years and a sound financial structure, the sector left behind a difficult year with success, as the economy did.

120%

The banking sector’s average loans/deposit ratio plunged for a short time in the middle of the year before rebounding to 120% by the end of 2014, compared to the 113% at the end of 2013.

The sector’s assets size grew by 15% YoY to TL 1,994 billion in 2014, while deposits increased by 11% to TL 1,057 billion. Loans grew by 18% to TL 1,241 billion while equity jumped to TL 232 billion with 20% YoY growth. The banking sector’s average loans/deposit ratio plunged sharply for a short time in the middle of the year before rebounding to 120% by the end of 2014, compared to the 113% at the end of 2013.

The volume of securities issued by the sector to domestic and foreign markets rose by 47.4% YoY to TL 89.3 billion. While commissions income declining on the back of an increase in costs at the beginning of the year and the BRSA’s measures, profitability in the banking sector remained almost the same as in 2013, at TL 24.67 billion. With these results, the sector’s capital adequacy rose to 16.3% by the end of 2014, compared to 15.3% at the end of 2013.

In addition to the Treasury’s sukuk (lease certificate) issuances in domestic and foreign currency denominations, participation banks - including our Bank - also carried out sukuk issuances. Despite the volatility in financial markets, the Treasury’s and participation banks’ sukuk issuances attracted strong demand.

The banking sector is expected to post moderate growth in the first half of 2015, broadly in line with what was seen in the second half of 2014, but with a more rapid rate of growth expected in the second half of the year in line with the recovery in the economy. An increase in profitability is expected despite the volatility in financial markets.