TL 12.9 billion

The Commercial/Corporate business family extended TL 12.9 billion in cash funds.

Ever increasing support for the real sector with the funds supplied

Supporting the real sector is Türkiye Finans’ main priority.

The Bank supplied funds, except legal provisions, to customers in 2014 as part of support for the real sector policy. Türkiye Finans directed almost 73% of its assets to the real sector. Funds supplied (including financial leasing) reached TL 24.3 billion, having grown by 32.8% when compared to the end of 2013. Meanwhile, the Bank’s non-cash loan portfolio expanded by 20% YoY to TL 10.6 billion in 2014.

Türkiye Finans’ basic strategy in supplying funds is to spread the risk to the base and to prevent risk concentration.

At Türkiye Finans’ risk is spread to the base and the risk per customer is lower than the sector’s average.

When the composition of risks is considered, the share of the 10 riskiest customers in funds supplied is 5%, while that of the 20 riskiest customers stands at 7%, the share of the 100 riskiest customers is 14% and the share of 200 riskiest customers is 20%. These ratios, which are at the same level as in 2013, were significantly lower than banking sector averages.

At Türkiye Finans, risk concentration is low on a sectoral basis. The Bank closely follows regional and sectoral developments and focuses on companies in sectors which offer growth potential. The Bank protects its qualified and healthy portfolio structure which comprises of companies that can sustain their growth cycle and that have high credibility and high capacity of solvency.

Despite expanding its loan portfolio at a rate in excess of the sector average, Türkiye Finans enjoyed a considerably lower NPL ratio than the sector average. There was no increase in Türkiye Finans’ NPL ratio, which remained at 2.4% - the same level as in 2013. This ratio is indicative of the Bank’s portfolio and asset quality. It also demonstrates that Türkiye Finans sustains its growth on a strong basis, and enhances the Bank’s competitive power.

Offering a wide array of services to commercial/corporate banking customers

Within the framework of its commercial/corporate banking activities, Türkiye Finans serves those companies with TL 15-50 million in annual net sales through the Commercial Banking department and those companies with a turnover more than TL 150 million through the Corporate Banking department.

With a versatile and solution oriented approach, Türkiye Finans aims to rapidly and effectively meet companies’ continuously changing demands under the scope of Commercial Banking. The Bank achieved an increase in its product penetration by expanding its customer base in 2014. Türkiye Finans increased the volume of funds supplied in the commercial/corporate segment.

The volume of Türkiye Finans’ supplied funds reached TL 8.4 billion in the Commercial segment and TL 4.5 billion in the Corporate segment in 2014 by offering integrated solutions with effective product management, service excellence, operational speed and a quality approach.

When it comes to deposits, Türkiye Finans repeated its success in cash funds. Türkiye Finans reached a volume of TL 2.9 billion with 39% growth in the Commercial segment, while the Corporate segment posted 8% growth to expand to TL 2.3 billion. The Bank reached a deposit volume of TL 4.9 billion in total with 24% growth as a Commercial/Corporate business family.

The Bank’s non-cash loans in this segment grew by 16% YoY to TL 8.4 billion in 2014.

Türkiye Finans continued to finance its customers in the commercial segment through the financial leasing model to cater for their needs for all kind of machinery, equipment and such items. The volume of financial leasing transactions increased by 40% to TL 850 million. Commercial Banking and Corporate Banking recorded 54% and 2% growth, respectively, in financial leasing.

Türkiye Finans sustained the growth in its foreign trade transactions, which increased by 50% to TL 3.4 billion in 2014. The corporate segment recorded 118% growth, while the Commercial segment posted 29% growth in 2014.

The Bank maintained its cooperation with the Türk Eximbank to support exporters and manufacturers that carry out production for exports. “Preshipment Export Loans” were issued within the framework of participation banking principles in line with the needs of customers. As of the end of 2014, a total of USD 12 million of loans was reached.

Türkiye Finans continued to support Turkey’s exports by intermediating in USD 550 million of non-cash loans in Türk Eximbank loans with short, medium and long term maturities in 2014.

Continuing to offer customers effective foreign trade solutions in 2014

Türkiye Finans, which is continuously enhancing its identity as a foreign trade bank, effectively utilizes loan alternatives such as the Saudi Export Program (SEP), International Islamic Trade Finance Corporation (ITFC), Islamic Development Bank (IDB), GSM and Eximbank. By doing so, the Bank brings together its customers with privileges thanks to its expertise in foreign trade advisory services. Within this framework, the Bank started to intermediate in Preshipment Export Loans in cooperation with Türk Eximbank. Moreover, the bank offered new services such as offering advice to customers with a “Specialist Foreign Exchange Line” by expert foreign exchange teams.

A growing volume of Direct Collection System (DTS) in cash management

Türkiye Finans increased the number of contracted firms from 29 to 50 and the number of sub-distributors from 150 to 256 in 2014. The Bank also increased its DTS limit from TL 95 million to TL 120 million while transaction volume rose to TL 264 million.

Alternative solutions in payment systems

The Bank continues to develop business partnerships with customers in payment systems by generating alternative solutions in this field. Within this scope, the number of commercial/corporate POS increased from 4,365 to 5,929. With the increase in number of POS, the Bank’s POS revenue also rose from TL 594 million to TL 1 billion

A more effective service for corporate portfolios

Within the context of the Corporate Banking Field Structuring, which was put into action in 2014, the Bank opened two new corporate branches in Istanbul (Boğaziçi and Trakya) in addition to Başkent and Kozyatağı Corporate Branches. With the realization of the project, the sales team, which was composed of 7 staff, expanded to 46 staff, with around 95% of the Bank’s 7,600 corporate customers gathered into four corporate branches and corporate portfolios that were set up in branches in 10 cities. By doing so, the Company took an important step towards providing specialized, direct and more qualified services to its customers.

Long term resources for our customers through lease certificates

Türkiye Finans realized a “first” in the sector and provided long term resources to its customers by intermediation in sukuk issues through its asset lease company. The Bank finalized 2 transactions amounting to TL 102.5 million and started 2 other issues amounting to TL 243 million.

One-to-one solutions to SMEs and micro enterprises through Enterprise Banking

Türkiye Finans offered financial support, information and advisory service with 564 SME MIY-MHY and 153 Enterprise MIY in 280 branches under the roof of Enterprise Banking with the mission of creating value for SMEs and micro enterprises that were the driving forces of the Turkish economy in 2014. Türkiye Finans takes actions towards customer orientation, proactivity and mobility principles to increase access to a wide SME and enterprise network in Enterprise Banking activities.

Enterprise Banking, serving more than 120,000 corporate customers with revenues of up to TL 15 million, and 50,000 company partners, saw 51% growth in cash loans to TL 6.7 billion while non-cash loans increased by 40% to TL 2.1 billion. According to the official SME definition, the Bank’s risk volume reached TL 12 billion with 57% growth in cash loans and to TL 5.4 billion with 31% growth in non-cash loans.

Türkiye Finans’ share in SME cash loans stands at 41% among participation banks and 3.6% in the banking sector. The Bank’s share in SME non-cash loans, on the other hand, stands at 33% among participation banks and 5.6% in the banking sector. According to the official SME definition, while SMEs had 27% and 25% shares in cash and non-cash loans in the sector, these ratios were both 51% for Türkiye Finans.

Providing support for SMEs and enterprises in their needs for machinery, equipment and similar investments, Türkiye Finans increased its leasing volume in Enterprise Banking by 33% to TL 312 million in 2014.

TL 312 million

Türkiye Finans’ leasing volume in Enterprise Banking increased by 33% YoY to TL 312 million.

Improvements in loan supply processes

As a result of developments in the Micro Scoring project, which was carried out to ensure faster and more effective evaluations of corporate customers’ demand for funding amounts of less than TL 50,000, customer demands were resolved in a shorter space of time in 2014.

Within the scope of “Business Scoring” application which was developed in 2014, customers with annual revenues of less than TL 2 million and who were requesting financing of more than TL 50,000 were evaluated within the same day through the application. Thanks to this project, the loan supply duration decreased while customer services and the allocation quality increased.

Moreover, the e-declaration project, which was launched in 2013, was improved in 2014. The automatic transfer of interim periods to the system was enabled and fund supply processes were shortened.

Directing SMEs accurately and offering them appropriate solutions by establishing cooperation with related institutions with our advisory services.

Türkiye Finans, which supports SMEs’ growth and development, is not only a financial institution for SMEs but also an advisor and business partner.

Türkiye Finans stepped up its cooperation with chambers of trade and industry for the development of SMEs that it serves and for developing the integration of SMEs with domestic and international markets. In line with this, the Bank signed a protocol with the Chambers of Trade and Industry in Cizre, Van, Ünye, Fatsa, Ordu and Karaman. Meetings, under the name of “Türkiye Finans Days”, related to information, advisory and sharing were held for SMEs.

Türkiye Finans continued to participate in fairs and conferences in line with the aim of meeting SMEs and expanding the cooperation with them in 2014.

Türkiye Finans participated in 6 fairs in 6 cities in the sectors of energy, agriculture and machinery in 2014. Moreover, the Bank participated in the Purchasing and Procurement Chain Conference organized by Istanbul Universtiy and the Pharmacy Management Summit organized in Cyprus as a sponsor. Türkiye Finans shared its sector specific solutions with sector representatives in these events.

The Bank also continued sponsorship activities to raise awareness of branding among SME’s and to contribute to the raising of new brands from Anatolia. Türkiye Finans again sponsored the Anatolian Brands Publicity Meeting in 2014, which was started in 2012. In these meetings, important figures from the Turkish economy shared their inspiring brand stories with participants in each city. Concurrently with the meetings, applications were received for the Anatolian Brands Contest 2014. Winners of the contest were handed their awards in a special ceremony organized in December.

Türkiye Finans carried out cooperation with an expert consulting firm, primarily regarding grants provided by the Development Agencies but also incentives that support innovation in production and given by TÜBİTAK, R&D incentives, TTGV support, KOSGEB Project Incentives, IPARS support, rural development and stockbreeding incentives. With this cooperation, a professional service was offered to SMEs concerning these grants.

Infrastructure activities by the ‘kolaygelsin.com’ (may your work come easily) portal were completed. This portal will be comprised of news on the macroeconomy, expert views, banking, finance, news of grants and incentives, investment recommendations and special announcements. It will be offered to customers in the first quarter of 2015.

Improving the activities we carry out for micro enterprises.

Türkiye Finans’ aim is to offer rapid, innovative and competitive solutions to meet the financial needs and demands of craftsmen and small sized enterprises and to spread the SME portfolio to the base. The Bank maintained the activities conducted in the Enterprise Banking segment, with efforts to improve the customer experience in 2014. Türkiye Finans increased its customer group and transaction volume.

Türkiye Finans supported 190,000 craftsmen and small sized customers in the Enterprise segment and have annual revenue of less than TL 2 million. The Bank provided TL 800 million in cash support, of which TL 160 million was composed of card products while non-cash support stood at TL 325 million.

POS among our priority products

POS product remained a priority product within the context of Türkiye Finans’ urban banking approach in 2014. The POS working team was established to improve service quality and offer a more competitive customer experience.

The Bank acquired around 10,000 new member workplaces throughout the year. Customer satisfaction, promotion and activation calls were made concerning the use of POS, reaching 6,000 SMEs each month.

Türkiye Finans is among the leading banks offering cash register devices for customers in an agreement with VERA POS. The Bank currently continues the sale of Vera, Profilo and Hugin branded cash register devices.

Türkiye Finans continued to offer supportive solutions to SMEs with the Siftah Card in 2014. With 3,300 cards, the Bank intermediated in the purchase of TL 122 million in goods and services for SME’s.

Helping make the lives of SMEs easier with the Siftah Card.

The “Siftah Card” was introduced for SMEs in 2013. With this card, Türkiye Finans offers SMEs the opportunity for POS machines to be installed within the scope of participation banking principles, according to installation models previously preferred and defined in the system. This avoids the need to go to branches for their purchases of goods and services. Türkiye Finans continued to offer supportive solutions to SMEs with the Siftah Card in 2014. The Bank, with 3,300 cards, intermediated in SMEs purchases of good and services amounting to TL 122 million.

TL 150 million

As of the end of 2014, the number of customers in the Faal Card program increased to 13,000 while the number of cards increased to 17,000.

Innovative solutions that overlap different sectors’ needs thanks to the Faal Card

The Faal Card provides quick, easy and simultaneous installation of goods and services purchases related to private companies’ commercial activities. With system improvements effected in 2014, Türkiye Finans offered the “Faal Card” to all corporate customers.

The Bank developed flexible payment options such as a grace period, annual payment and periodic payments to meet the demands of different sectors and occupational groups. Within this context, Türkiye Finans prepared and presented Faal Card packages which are comprised of special payment options for other sectors and occupational groups, primarily Faal Farmer for the agricultural sector, Faal Tourism Professional for the tourism sector and Faal Pharmacist for pharmacists.

The Faal Card Application space was opened in the corporate website to receive applications from non-branch channels.

Türkiye Finans provided TL 150 million of financing to its customers in 2014 for their purchases of goods and services. As of the end of 2014, the number of customers in the Faal Card program increased to 13,000 while the number of cards increased to 17,000. The volume of limit allocations increased to TL 265 million, while the risk balance stood at TL 100 million.

The Faal Card received wide media coverage on TV, newspapers, the internet and social media with the advertising campaign involving Alex de Souza. This provided a level of public awareness which was reflected to the number of applications received from branches and non-branch channels. Within the 3-month campaign period, almost 6,000 applications were received through the website and SMS.

More guarantees for SMEs

Türkiye Finans maintained its efforts to improve the customer experience in the Bank’s products and services throughout 2014. Within its consultancy strategy, the Bank offered a wide array of products to its customers designed to protect SMEs and Enterprises and to raise awareness of risk.

Türkiye Finans reached more than 30,000 policies in İşyerim Güvende (My Safe Office), Limit Güvence (Limit Assurance), Çek Güvence (Check Assurance) and Faal/Siftah Kart Güvence (Faal/Siftah Card Assurance), İnşaat All Risk (Construction All Risk), İş Yeri Yangın (Office Fire), Leasing All Risk insurances. With these insurance policies, our customers were brought under full protection against all risks that they may face.

Our support to SMEs that have Investment Incentive Certificate continues.

Within the scope of the “Profit Share Protocol” signed between Türkiye Finans and the Ministry of Economy, the Bank continued to support companies that have investment incentive certificate.

Within the scope of this product, customers that make their investments with the support of Türkiye Finans can utilize profit share opportunity of 3-7 points in TL funds and 1-2 points in foreign currency funds.

From the date the protocol was signed up until the end of December 2014, a total of TL 114.3 million in financial support was provided to SMEs in their purchases of goods regarding their investments. The Bank also intermediated in TL 9 million of grants received from the Ministry of Economy.

Within this context, customers who purchased goods amounting to TL 39.7 million in 2014 were awarded TL 3.07 million in grants.

Wider and more effective service through cooperation

The Confederation of Turkish Tradesmen and Craftsmen (TESK) was established in the form of a public institution which has one of the widest organization networks in Turkey bringing together tradesmen and craftsmen who form one of the most important building blocks of the Turkish economy. In line with the protocol signed between Türkiye Finans and TESK, the Bank prepared and offered financing packages to member enterprises of TESK. As a result, the cooperation with TESK was deepened.

With the development of the project, Türkiye Finans carried out cooperation with chambers of tradesmen, unions and cooperatives in cities such as İzmir, Karaman, Nevşehir, Kayseri and Manisa. The Bank provided special advantages and discounts to enterprises in their purchases of goods and services.

On the other hand, Türkiye Finans started to support SMEs with preferential terms in their purchases of machinery, goods and services through the Supplier Financing product. In addition, the Bank carried out cooperation with producers and distributors.

Special packages for SMEs

The Türkiye Finans Pharmacist Package was developed with the heading of “Pharmacists’ Medicine from Türkiye Finans” as a result of the approach of generating one-to-one solutions by establishing close communication with occupational groups.

The Pharmacist Package was prepared for pharmacies that play an active role in business life and that intensively use banking products, primarily cash management products. With this package, the Bank aims to satisfy all banking needs of pharmacists.

Following the announcement of the Pharmacist Package, Türkiye Finans became a sponsor of the 1st Pharmacy Management summit, which was organized in Cyprus. The Bank announced the advantages of this package and provided guidance to pharmacists in financial solutions during the investment management conference.

As of 2014 year-end, the Bank’s KGF collateral loan volume reached to TL 813 million which is 95% more collateralized support than the second ranking bank.

In the lead position in KGF (Credit Guarantee Fund) supported loans in 2014 (*)

Demonstrating a solution-oriented approach to facilitate SMEs’ access to financial resources, Türkiye Finans maintained its leading position in the banking industry in 2014 on the basis of Treasury Supported Credit Guarantee Fund collaterals, as it had in 2013.

As of the end of December 2014, the Bank’s KGF collateral loan volume reached TL 813 million, representing 95% more collateralized support than the second ranking bank.

Türkiye Finans carried out TL 294 million of Treasury Supported Credit Guarantee Fund collateral transactions in 2014. The Bank’s support supplied in this category increased by 43% when compared to the previous year. Türkiye Finans’ market share rose from 28% to 31%.

Türkiye Finans added a new program to the KGF Collateral programs, in which it is the leader, and the Bank formed a new program to support small and medium sized enterprises. The demands from customers settled in 43 cities were finalized in 1 day with the fast collateral system brought by the Portfolio Guarantee System (PGS), which was signed with the cooperation between KGF- Europe Investment Fund and Türkiye Finans. Accordingly, Türkiye Finans provided KGF Collateral support to micro and medium sized enterprises amounting to TL 10 million.

With awareness of its social responsibility, Türkiye Finans continued to intermediate in KOSGEB’s projects offered to SMEs. The Bank signed two different protocols with KOSGEB in 2014 to provide financial support to enterprises that suffered from accidents in Hatay, Van, Soma and 17 towns and cities in Turkey. Moreover, with the Co-Financing Protocol, Türkiye Finans intermediated in purchases related to business plans of all SMEs that were qualified as part of KOSGEB’s support packages.

Türkiye Finans will continue to offer collateralized solutions to SMEs and intermediate in KOSGEB’s support programs in 2015.

Growth in housing loans and personal financing.

Türkiye Finans provided real estate financing amounting to TL 2.2 billion in 2014, marking 6% growth over 2013. Housing Financing, in which all services are offered under the Çilingir (Locksmith) brand, had an 83% share of total real estate financing.

As a result of loans supplied, the risk balance of Housing Financing grew by 32% to TL 3.47 billion by the end of 2014. The risk balance of Installment Based Commercial Real Estate (Land/Office), on the other hand, increased to TL 690 million, marking 7.6% growth.

Türkiye Finans focused on cross sales to enhance customer loyalty and achieve growth in Housing Financing in 2014. The Bank introduced 2+1=4 Mortgages as a product, which provides a 0.04 point discount in the case of purchasing 3 products, to its branches. Türkiye Finans increased the cross sale ratio of its active real estate financing customers by 25%.

The Bank reached a mortgage financing volume of TL 580 million as part of the 2+1=4 Mortgage product.

In addition to the financing of completed real estate, Türkiye Finans played an active role in incomplete mass housing projects in 2014 with its financing strategies and effective and active marketing activities.

Türkiye Finans reached agreements on approximately 600 mass housing projects that are being constructed by the country’s leading companies. The Bank offered its customers the opportunity to be a homeowner in these projects.

*Based on data which is monthly sent to KGF working grub by The Banks Association of Turkey

Around 16,000 housing financing transactions, amounting to TL 1.8 billion, were carried out in 2014. TL 695 million of this volume was composed of financing provided within the scope of mass housing projects. Mass housing projects accounted for 38% of total housing financing.

Rapid Growth in Consumer and Vehicle Financing.

The growth rate in Consumer Financing stood at 34.5% when compared to the previous year.

Türkiye Finans realized growth in consumer financing far exceeding the rate in the sector through applications such as “Finansör” and “Hızlı Finansman (Fast Financing)” that are firsts in the participation banking sector.

The Bank continued to offer the Ready Limit which is pre-approved consumer and vehicle financing. The Bank’s customers were offered consumer financing opportunities after having been notified of the campaigns.

While vehicle loans contracted in the sector, Türkiye Finans’ risk balance for Vehicle Financing grew by 11%, indicating a high rate of growth compared to the sector.

As of 2014 year-end, the Bank reached a balance of TL 371 million in Vehicle Financing and TL 283 million in Consumer Financing, including commercial loans with personal installments.

The distribution network of Finansör was expanded in 2014. It was integrated into the HızliFinansman online platform. This enabled the Bank to receive Finansör applications from contracted distributors while simplifying the use of the application.

Fast and easy access to loan: Finansör and Hızlı Finansman (Fast Financing)

Türkiye Finans’ Hızlı Finansman (Fast Financing) distributors, the first of their kind in participation banking and which operate as an online financing channel, reached around 2,000 points.

In order to provide support for customers’ demands for consumer and vehicle financing, on-site supply was carried out with simultaneous responses from contracted distributors.

Türkiye Finans provides financing support through the Hızlı Finansman application with contracted distributors such as vehicle, furniture, white goods and electronics distributors. Funds supplied in 2014 within the context of Hızlı Finansman reached 30% of the Bank’s total Vehicle Financing and 60% of its Consumer Financing.

Within the context of consumer financing, the Finansör application demonstrated strong growth in 2014. In this period, the number of transactions increased to 192,000 while funds supplied reached TL 320 million. The Bank offered the opportunity to use Finansör, not only from the branches which customers are working with but also from every Türkiye Finans branch, in order to increase the service quality and customer experience.

The Finansör distribution network was expanded in 2014 and integrated into the Hızlı Finansman online platform. By doing so, Finansör applications could be received from contracted distributors, easing the use of the application.

Within the scope of Hızlı Finansman, a special premium structure was formed for distributors. An infrastructure identifying and managing sector, campaign, distributor and parent company based premium campaigns was developed.

Innovations in credit card applications

Turkey’s leading participation bank, Türkiye Finans, expanded its Happy Card portfolio in 2014. The Happy Kahramanmaraş Spor was added as a new credit card to the portfolio, joining the Happy Anne (Mother) and Happy Zero products.

The Happy Kahramanmaraş Spor Card is the first fan card in the history of participation banking. Happy Kahramanmaraş Spor Card holders enjoy advantages such as discounts, installments and extra points while they support their favorite sports club through the points that they will earn from shopping.

In addition to credit card applications such as social security premium payments, BKM express payments, bill payments, TL loading, HGS (Fast Pass System) and By Installment, Türkiye Finans started to offer the Virtual Card product for secure online shopping.

In 2014, Türkiye Finans included new value added services such as Kimliğim Güvende (“my ID is Safe”) and airport Lounge passes into its credit card services. By doing so, the Bank enhanced its value proposition.

Credit card holders (Türkiye Finans customers) may benefit from all privileges and opportunities offered by Türkiye Finans member workplaces and Bonus member workplaces. By means of regularly held campaigns, card holders are also offered advantages such as earning additional Bonus points, discounts on their shopping, promotions, additional installments and the chance to postpone installment payments. Current campaigns and all advantages offered within the scope of card program are shared on the www.happycard.com.tr website.

As of the end of 2014, the number of credit cards increased by 11.92% to 425,000 while the number of debit cards in circulation grew by 23.67% to reach 1,257,297.

Revenue from retail credit cards and debit cards increased by 26.43% and 37.13%, respectively.

POS revenue also continues to increase in line with the efficiency of member workplaces.

The number of member workplaces increased to 29,650 as of the end of 2014 in line with the efforts to increase shopping revenue through the Bank’s POS network, the activity ratio of member workplaces and cross sales.

Revenue per POS reached TL 120,000 while revenues from member workplaces increased to TL 2.5 billion.

In order to support the improvement of services offered to member workplaces, in 2014, Türkiye Finans:

- brought applications into use that provide the opportunity for installment payments, the earning of points and special campaigns for Bonus credit cards of all banks that are member of the Bonus platform (Bonus Acquiring),

- increased member workplace-POS field support. By acquiring new POS terminals working with the latest technology, the Bank raised the quality of services and devices offered to member workplaces,

- entered cooperation with different brands and carried out technical developments related to Cash Register Devices (ÖKC) to provide services to its existing and new member workplaces in this area. Türkiye Finans provided more than 1,000 cash register devices to contracted workplaces,

- installed a virtual POS in 468 tax offices of the Revenue Administration (GİB). This enables payments regarding motor vehicle tax, traffic fines and payments within the scope of the omnibus law 6552,

- enables member workplaces to receive POS account statement automatically through e-mail.

Also effectively using non-bank channels.

Türkiye Finans is one of few service providers to employ non-bank channels in the sector. Türkiye Finans reached a volume of TL 1.2 billion with 18 million collection transactions through Faturavizyon (Invoice Vision), a contracted firm, and Ödekolay (Easy pay), the Bank’s collection platform brand, in 2014 in invoice collection intermediary services through non-bank channels. Commission income from non-bank channels grew by 22% in 2014.

Hızlı Nokta (Fast Point), which was developed in 2014, is a technological and innovative platform providing service through new generation touch screen devices. This channel aims to ease access for consumers to carry out the transactions that they need, as an alternative to the current bank channels. It carries out the sale and marketing of a wide array of products and services such as invoice collections, tax payments, GSM TL loading and promotion of insurance products.

Volume increases in cash management.

As a result of segmentation conducted in 2014, DBHG (Other Banking Service Revenue) of TL 43 million was generated despite 130,000 real customers who were transferred to other business lines. With this figure, the Company recorded 70% target realization.

A wide array of new applications for retail customers were brought into force with the Law 6502 for the Protection of Consumers, including the following: collecting fees from expertise and mortgage establishment at an amount equivalent to their costs, removing the fee from removal of vehicle pledges and from mortgage releases, limiting the account maintenance fee with one fee for each drawee.

Western Union commission income increased with the personnel campaign conducted during the summer months, maintaining its growth trend until the end of year and recording 57% growth. The transition from an offline working system to an online working system will be completed at the beginning of 2015. Collections are expected to increase further in 2015.

Türkiye Finans started collections of 14 new utilities’ invoices in 2014. While efforts for the transition from an offline system to an online system were continuing, the Bank recorded a 20% increase in collections of corporations’ invoices in 2014. Moreover, Türkiye Finans also started salary payments for health institutions and pensioners.

Through the Bank’s channels, customers completed collection payments with the payments of utilities bills (water, electricity, natural gas etc.) and TL 23 million of automatic payment orders in 2014.

The HGS (Fast Pass System) product that customers use for toll roads, bridges and highways reached 47,000 units by the end of 2014.

SSI payments amounting to TL 14 million were completed in 2014 through Türkiye Finans credit cards held by customers.

The income from the CPP Card Protection Plan and ID-Safe products which secure credit card holders in adverse situations (such as loss or theft) increased by 74%.

TL 90 million

The Bank carried out a retail vehicle campaign within 2014 and offered customers financing support for 2015 model vehicles. A total of TL 90 million in loans were extended in 2014 through the campaign.

Campaigns pave the way for an important contribution to personal financing and card volumes.

The Bank set up the data of 1.2 million customers in field work conducted between May and the end of 2014. A total of 672,000 calls were made (call average within the period of 58%) of which 31% were replied to with a positive result. In the retail segment, a deposit balance of TL 312 million, loan balance of TL 12 million and NFG (Net Operational Income) of TL 12 million was booked. The new customer activation rate, which was around 55% in the ongoing campaigns, was increased to 73%.

The Bank carried out a retail vehicle campaign during 2014 and offered advantages to customers to finance 2015 model vehicles. The campaign was started by offering a 5-month no-payment term in the summer period. In line with the massive demand, the campaign was extended in the last quarter of 2014 with the opportunity for a 3-month no-payment term without an assignment fee.

The Campaign continues under the cooperation entered into with Sonax in a structure of 3-month non-payment period with special discounted rates for the new year without an assignment fee. Around 6,000 applications were received for the vehicle financing campaign, with TL 90 million of supply generated from this campaign alone in 2014.

In addition to campaigns made by the Bank or the Bonus Credit Card Brands Sharing Platform, which the Bank is a member of, special card campaigns based of customers’ card usage habits and segmentation were offered regularly each month during 2014.

The Bank undertook special campaigns for sectoral spending with the “By Installment” application which provides installments before the statement is prepared on the demand of customers in cash payments through credit cards. Within this context, 71,000 cash shopping transactions through credit cards amounting to TL 31 million were split into installments in the by Installment application in 2014.

Increased sales of insurance products in 2014

New products were introduced within the scope of offering insurance products.

Insurance policies such as Limit Güvence (Limit Assurance) Insurance, Invoice-Credit-Credit Card Unemployment Insurance policies, POS and Online Workplace Fire Insurance policies were introduced in 2014 and reached a certain level of volume.

Within the scope of insurance intermediary activities, the Bank generated TL 77 million of premiums and TL 18.4 million in commissions. When compared to the previous year, insurance intermediary figures grew by 45% in premium generation and approximately 50% in terms of commissions generated.

Türkiye Finans initiated intermediary activities in the Private Pension System (BES) in 2010. The Bank generated TL 2.7 million of commissions, corresponding to 12,313 sale units in 2014. At the end of 2014, the volume of Türkiye Finans’ funds reached TL 69.1 million and the Bank generated a total of TL 6.1 million in commissions.

BAL Account (Cumulative Account) and Physical Gold Trading introduced in 2014.

The BAL Account enables small scale savings through orders from customers’ accounts and credit cards. This participation account promotes savings with a minimum maturity of 5 years.

BAL Account is a deposit product that provides customers to save easily. This account may be opened in USD or EUR terms. The Bank maintains its efforts to make this account available with precious metals.

The Bank started physical gold trading in April 2014. Customers seeking to invest in gold can trade it on a gram basis with the Gold Account. Türkiye Finans, through its branches, allows all customers - whether or not they have accounts in the bank - to trade gold in amounts from 1 gram to 100 grams, that is produced by the Istanbul Gold Refinery and which has a logo, safety and package.

Türkiye Finans generated a total of TL 1.17 million in commission volumes from investment products (Equity Market transactions and investment fund trading) whose marketing activities are conducted under BMD (Bizim Securities) during 2014.

The mobile branch application, available for Android and iPhone, was enriched with a wide array of new functions such as investment transactions, equity shares, fund trading, motor vehicle tax payments and English language support.

Our multi-channel strategy contributes significantly to the customer experience.

ATM Banking

With the aim of expanding the ATM network, Türkiye Finans increase the number of non-branch ATMs from 69 to 154 with the investment undertaken in 2014. The total number of ATMs, on the other hand, jumped from 415 to 530, with 28% growth.

The number of financial transactions undertaken through ATMs increased by 27% when compared to the previous year.

The Bank changed the current ATMs with fully functioning ATMs in addition to taking the necessary actions for ATMs where the usage performances are not at the sufficient levels. By doing so, Türkiye Finans increased its customer experience and efficiency.

On the other hand, the Bank maintained its infrastructure investments to offer more qualified and uninterrupted services. Additional security applications were put into practice to increase ATM security and protect customers from fraud.

Internet Banking

Türkiye Finans carried out campaigns to provide several rewards and discount opportunities to attract customers and increase transaction volume in the Internet Branch in 2014.

The number of Türkiye Finans’ internet banking customers increased to more than 400,000 as of the end of 2014. The number of financial transactions, on the other hand, grew by 32%.

The number of products sold through Internet Branch stood at 98,000 units in 2014.

Mobile Banking

The mobile branch was the fastest growing non-branch banking channel in terms of the number of customers and transaction volume in 2014. The investments in the mobile branch continued in 2014.

The mobile branch application offers services for Android and iPhone operating systems. This application was enriched with an array of new functions such as investment transactions, equity share, fund trading, motor vehicle tax payment and English language support.

A mobile banking application developed specially for mobile devices with the Windows operating system, was also offered in the Windows Phone Application Store.

The number of financial transactions conducted through mobile banking in 2014 grew by 287% compared to the previous year. The number of downloads of applications that were developed for mobile devices with iPhone, Android or Windows Phone operating systems exceeded 100,000.

Customer Contact Center

The Türkiye Finans Customer Contact Center provides services with the principle of continuous innovation and transforming technology into a positive customer experience. This center continued to offer its value added services, increasing customer satisfaction and loyalty in 2014.

The Customer Contact Center contacted customers through a total of 6 million calls in 2014. It recorded sales of 240,000 units, with its speed, quality and customer satisfaction oriented approach, by introducing customers with products in line with their needs.

2014 was a renewal and change year for Türkiye Finans Customer Contact Center which continues realizing leading projects in banking sector.

Within the scope of Customer Contact Center Optimization Project, all processes and flows were restructured to enhance the efficiency, speed and excellence of the customer experience.

- The voice response system was renewed with new generation technologies as well as easy and user friendly features. The Bank covered in the scope of service, several easinesses and new features such as customers’ need are analyzed and they are directed to right process step thanks to calling customers with their names by recognizing them, directing them to specialist customer representatives with two different voice response systems - the commercial and retail and customer recognition systems.

- Türkiye Finans brought its Biometric Voice Signature (SeSİM) application into practice. With this application, the average duration of each call was reduced by 9% and customers were provided with a faster and more secure service. This application also contributed to the customer experience by enabling transactions without requiring personal information to be shared.

- The “E-reminder” gathers e-mail and SMS notifications to Non-Branch Banking customers regarding products and services. The “E-reminder” was offered to all Türkiye Finans

- customers following development efforts. The Bank was thus able to provide operational efficiency, primarily with respect to reducing the number of calls by Branches and the Customer Contact Center and to gain capacity.

- Within the scope of Centralizing Branch Calls Project, the Bank continued its improvement efforts in 2014. Customer satisfaction increased significantly. A number of activities were put into practice enabling customers to access branches in an easier manner. The rate of branch call response increased by 51%.

The Türkiye Finans Customer Contact Center holds the EN 15838:2009 certificate (Customer Contact Centers Service Standard). EN 15838 is a management system standard which sets out special conditions for call centers, has international validity, and defines management system requirements and technical conditions for providing call center service.

Türkiye Finans restructured its sales and service model. The Bank revamped the organizational structure of its branches as well as the structure and number of regions with their performances monitored during the year. The Bank identifies area of improvement and effects process improvements regarding its products.

Our goal is to improve customer experience.

Türkiye Finans operates in line with the ISO 10002:2004 Customer Satisfaction Management Standard.

ISO 10002:2004 is a management system which enables enterprises to meet customers’ expectations and which is composed of required conditions regarding creating a system for customer satisfaction by evaluating customer complaints under a defined approach.

Türkiye Finans successfully passed the documentation inspection in 2014. The Bank works to further improve the Customer Satisfaction System with the aim of increasing service quality and efficiency as well as raising the customer experience to the highest possible level.

Türkiye Finans maintains its efforts to determine areas of improvement through its Customer Experience and Multi-Channel Strategy Project. These efforts are summarized below.

- The Bank has been launching required applications to offer and maintain customer experience by taking into account the results of the analysis into the customer experience components for service channels. These applications are shaped on the basis of the Türkiye Finans Customer Constitution which was formed and shared with all employees and customers last year.

- Türkiye Finans’ sales and service model was restructured. The Bank changed the organizational structure of the branches as well as the structure and number of regions. In doing so, their performances were monitored within the year. The Bank practices improvement areas and process improvements regarding products. A 2015 Work schedule for improvement areas was prepared.

- Türkiye Finans redesigned the complaint management process. The Customer Experience Management Report started to be published through which the improvement trend of service quality can be monitored within the corporation. The 2015 work schedule for areas of continuous improvement regarding customer improvement was prepared.

- Response speed was increased with the improvements made in customer complaint management. Türkiye Finans enables customers to access the Bank through several channels. Notifications are replied to objectively. In the last 4 months of 2014, Türkiye Finans was ranked in first place among participation banks in the complaint index prepared by the ŞikayetvarCom website on the grounds of criteria such as the speed which complaints were resolved, satisfaction and the size of the firm.

- Türkiye Finans enables rapid access to branches, which is one of the factors affecting customer satisfaction. The Bank changed the exchange infrastructure and formed a monitorable and reportable structure.

- Questionnaire studies were conducted with the aim of continuously monitoring the satisfaction and experiences of internal and external customers, as well as determining areas for improvement. Areas for action were also determined.

- Within the scope of the customer satisfaction survey, Türkiye Finans effected improvements in areas that determined with the data from previous periods. A new questionnaire study was conducted to monitor service quality within the year. The 2014 Secret Customer Survey was completed by visiting each branch six times to observe customer experience in branches and to detect examples based on objective observations.

- Türkiye Finans carried out an Internal Customer Satisfaction Survey with the aim of monitoring internal customers/ employees, who are among the most important sources of customer satisfaction, and to determine actions for areas requiring improvement.

- The Bank defined inter-unit service levels to offer more qualified services by determining standards for services that it offers to internal and external customers.

- Within the scope of increasing quality of service given to customer and operational efficiency, effective lobby management and process improvement projects were put into practice. The Bank conducted supportive activities for the use of numerator in branch transactions.

- Türkiye Finans started work on the “simple branch project” with the aim of simplifying services provided in branches, especially regarding operational processes. The Bank also completed needs analysis. Output from the analysis will be realized within 2015 to provide faster and more qualified service to customers and to enable employees work flawlessly with high performance.

- The Digital Signage (Corporate TV) application started to inform customers and/or to change their ideas by channeling them to a certain area. Within the scope of this application, visual content (pictures, digital posters, news, videos, impressive slogans, customer sequence numbers, foreign exchange rates etc.) will be presented to customers and training will be provided to employees.

- Türkiye Finans practiced effective sales projects in branches. The Bank aimed to increase service quality, cross sale activities and profitability and decrease operational risk with CRM Performance scorecard application.

- The Bank provided systematic operability to “Recommendation System” which enables employees to play active roles in the Bank’s development processes. With the aim of promoting recommendations received to contribute the Bank’s development, the process was linked to awarding system.

Reflection of new centralized operation application on services

- Türkiye Finans completed the installation of Expert Foreign Exchange Service by Telephone. This system provides customers with support from the Bank’s expert personnel in foreign trade areas, which customers cannot access in the branches.

- POS statements started to be sent to member workplaces by e-mail.

- The Bank started to provide uninterrupted service for corporate and retail fund supply.

- Türkiye Finans developed new products in line with the New Financial Leasing Law. The most accurate solutions were generated by perceiving customer needs accurately. The Bank started to offer a personal service.

- The Bank regulated approval processes for fund supply. This brought a 133% improvement in the loan supplying time.

- Türkiye Finans carried out improvement works for infrastructure in companies’ salary payment operations. The Bank reached an important level of operational efficiency and minimized the risks. Türkiye Finans also completed its efforts for the safe transportation of negotiable paper.

- The Bank developed new working models for working with suppliers in a more effective manner. The positive results of the project were reflected in expertise processes, leasing operations and card-POS operations.

- The EFT system was encoded on BYS new banking architecture. Improvements were realized in systemic infrastructure. The automatic transfer to account rate increased to 85%.

- The closing time of TL cheque clearing operations was changed from 4.30pm to 5.15pm while the closing time for FC (Foreign Currency) cheque clearing operations was changed from 3.00pm to 4.30pm. In doing so, additional time was provided to customers and branches.

Organizational Changes within the Bank in 2014

Organizational changes carried out in 2014 are summarized below:

- A Methodology change was undertaken with the aim of increasing effectiveness, efficiency and speed as well as ensuring customer-oriented working in projects conducted with BS resource. Accordingly, the Bank switched to agile working method and scrum methodology. The BS business family was restructured within this scope.

- The “Investor Relations Department” which will carry out direct reporting to the Finance Executive Vice President, was formed to fulfill requirements of the Communique of Public Disclosures that was put into practice in 23 February 2014 by the CMB. This service was established within the Investor Relations’ scope to coordinate the Bank’s relations between the main shareholders, current and potential foreign corporate investors, shareholders and credit rating agencies and to provide a proactive, objective, correct, up to date, informative and regular transfer of information concerning the Bank, the banking sector and economic developments to investors and shareholders.

- The “Interest-free Banking Application and Development Service” was established with the purpose of Conducting product development activities in line with Interest-free Banking principles, managing relations with the current “Interest-free Banking Advisory Committee”, following whether applications comply with the principles of Interest-free Banking, providing employees with training concerning Interest-free Banking and its products, visiting branches and customers to inform them of Interest-free Banking and its products, and representing the Bank to discuss Interest-free Banking with non-bank institutions.

- Card Security, Member Workplace Security, ADC Security and Application Security were gathered under one roof in an effort to effectively tackle forgery and fraud in the Bank and to reduce risks. These operations were structured in the Payment Systems Operations Department under the name of the “Product and Customer security (Fraud) Service “.

- A “Market and Economy Analyst” position, which would have reported directly to the Head of the Treasury Department was repositioned. Accordingly this position will now report directly to the “Treasury EVP”.

- The name of the “Organization, Capacity Planning and Process Improvement Department” was changed to the “Organizational Development Department”. The Business Excellence Service was formed to conduct process optimization projects in line with six sigma methodology, which is more professional and simple in addition to quality and internal legislation, as well as capacity planning functions. In doing so, the unit was restructured in line with the Bank’s strategic goals.

Improved profitability and customer satisfaction in Treasury transactions with customer oriented pricing.

Türkiye Finans applied a volume based pricing policy which differs from customer to customer to increase its market share in treasury products in 2014 in line with the Bank’s growth strategy.

As a result of this strategy, profitability in foreign exchange transactions was increased while customer satisfaction was raised to higher levels.

The transaction volume of foreign exchange transactions conducted with customers in Türkiye Finans stood at USD 38 billion while transaction volume in the interbank market reached USD 63 billion.

More effective Asset-Liability Management

Türkiye Finans completed the integration of the Asset-Liability Management Static Analysis software to optimize the Bank’s profit and track maturity mismatch on a maturity basis in 2014. In addition, the Bank also ensured the formation of analysis and reports that will support the Asset-Liability Committee’s decision making process.

According to results of reports and analyses, Türkiye Finans actively uses on-book and off-book Islamic treasury risk management products to protect against risks that may occur as a result of maturity mismatch and that are held on the Bank’s balance sheet.

The Asset-Liability Management Dynamic Analysis software was completed at the beginning of 2015. Volume and profitability scenario analysis will start for the decision making processes.

TFXTARGET achieved more than 100% growth in the 2-year period and the level of customer satisfaction indicates that the product has been embraced with a strong position in the market.

TFXTARGET leading the sector in foreign exchange transactions

Türkiye Finans’ FX platform, which was put into practice in 2012, maintained its rapid growth in 2014 with its customer oriented structure.

TFXTARGET provides effortless and straightforward foreign exchange transactions 24 hours a day, 5 days a week. TFXTARGET continued to be a leading application in the banking sector.

TFXTARGET has achieved more than 100% growth in the 2-year period as well as high levels of customer satisfaction, indicating that the product is embraced and commands a strong position in the market.

Türkiye Finans launched www.tfxtarget.com.tr in 2014 to support the TFXTARGET platform and to reach a wider mass. This website is primarily a channel to share market oriented information and has a great deal of value added for the transaction platform. The website, which was launched in the last quarter of 2014, attracted more than 50,000 visitors and achieved an important success in its own area.

In 2015, chart support will be added to the product to develop the Bank’s transaction platform. In addition, improvements have been put in place, enabling forward foreign exchange transactions. With this addition, customers may carry out all foreign exchange transactions 24 hours a day, 5 days a week, without the need for bank personnel.

Fitch affirms Türkiye Finans’ credit rating which was “BBB”.

Fitch, an international credit rating agency, affirmed Türkiye Finans’ long term foreign currency credit ratings as “BBB” with a ‘stable’ outlook as a result of the evaluation made in 2014. The National credit rating was determined as AAA (tur) with a ‘stable’ outlook.

Fitch’s evaluation report mentioned that the strong support of National Commercial Bank (NCB), Türkiye Finans’ biggest shareholder, was important and that NCB placed strategic importance on Turkey.

Important results from strong relations with financial institutions

Türkiye Finans further strengthened its relations with financial institutions in 2014. The Bank showed it can sustain its performance in fund procurement and foreign trade intermediary in every conjuncture.

The Murabaha Syndication and two sukuk operations carried out in 2014 serve to confirm the international financial markets’ trust in the Turkish economy and Türkiye Finans.

59% increase in funds supplied from international sources

Türkiye Finans’ borrowing from international sources increased by 59% to USD 3.7 billion by the end of 2014 from the USD 2.4 billion at the end of 2013.

The average borrowing maturity increased by 16% to 1,130 days by the end of 2014 from the 970 days at the end of 2013.

The investor base was extended in 2014, with the Bank obtaining resources from more than 40 financial institutions in 20 countries. The share of non-deposit borrowing in total borrowing increased to 26% by the end of 2014, from the 20% at the end of 2013.

Türkiye Finans obtained a USD 350 million (USD 253.5 million and EUR 72 million) International Murabaha Syndication in 2014.

21 banks from 12 countries participated in the 1 year maturity loan. The co-leaders of this syndicated loan were ABC Islamic Bank (E.C.), Abu Dhabi Commercial Bank PJSC, Emirates NBD Bank PJSC, Noor Islamic Bank PJSC and Standard Chartered Bank.

Türkiye Finans carried out two important sukuk issuances to international institutions through TF Asset Leasing, its 100% subsidiary, in 2014.

Türkiye Finans conducted a USD 500 million sukuk issuance in 2014, in what was the second biggest sukuk issuance conducted in Turkey to international institutions following the Turkish Treasury’s issuance. International investors displayed a high level of interest in the sukuk issuances, with 127 investors placing bids. The issuance was 2.8 times oversubscribed with demand amounting to USD 1,405 million received.

Türkiye Finans was the first Turkish institution to issue a sukuk amounting to MYR 800 million with a 5 year maturity. In addition, Türkiye Finans conducted the largest MYR sukuk issuance to be undertaken by a foreign institution.

This operation was conducted within the scope of the sukuk issuance program formed in the Malaysian market with a 20 year maturity and amounting to MYR 3 billion. This represented an evolution for the Turkish Banking sector as it was the first step in Malaysia, which is the world’s largest and most active sukuk market.

Türkiye Finans carried out several murabaha operations with a number of banks through bilateral limits in 2014, in addition to the murabaha syndications and sukuk issuances.

The Bank continues to work for foreign currency sukuk issuance and TL domestic lease certificate operations in 2015. Türkiye Finans aims to reach USD 3.8 billion in non-deposit resources in addition to resource agreements which will be renewed in 2015.

As part of its foreign trade intermediary operations, Türkiye Finans has offered an increasing level of service to exporters/importers and customers providing infrastructure services in the Gulf countries, where the Bank’s main shareholder, NCB, is active.

We are increasing our weight in financing foreign trade.

Economic contraction in European Union which is Turkey’s biggest foreign trade partner continued in 2014. Turkish companies are successful in diversifying markets and they increased their export/import activities to Gulf and African countries.

As part of foreign trade intermediary operations, Türkiye Finans increasingly offered service to exporters/importers and customers providing infrastructure services in Gulf countries that the Bank’s main shareholder, NCB, is active in.

Türkiye Finans stepped up its efforts to establish a correspondent relations infrastructure and limit allocations regarding customers’ demands for confirmed export operation in Africa. Türkiye Finans’ recognition and credibility in the presence of correspondent banks enhances with each passing year. The Bank carried out foreign trade transactions with local and global correspondent networks within the framework of international rules and standards in 2014. Türkiye Finans provided, within the limits of agreements signed for foreign trade financing, long term resources as part of the GSM-102, SEP, ECA and the ITFC to customers who were importers.

The SEP operations limit was raised from USD 35 million to USD 60 million. The market share in these operations grew in line with the increase in the limit.

GSM-102 and ITFC limits amounting to USD 100 million and USD 25 million, respectively, were priced in the most efficient manner and provided to customers.

Türkiye Finans’ foreign trade volume reached USD 27 billion in 2014, up from USD 22.5 billion in 2013

In line with the increase in transaction volume, the Bank unwaveringly maintains its efforts to improve current transaction limits and to add new correspondent relations to the current network

Türkiye Finans’ market share in foreign trade transactions stood at 2.60% at the end of 2014.

In Agile Transformation, a first in Turkey’s IT sector, training was provided for 3 months, a record period, to 300 people including the entire IS organization, the General Manager, Executive Vice Presidents, outsourcing companies and business units who ere then awarded PSM1 certificates.

Strong structuring in Information Systems (IS)

Information Systems contributed Türkiye Finans’ growth in 2014 with its efficient demand management, project portfolio with job control, new resources regarding master plan projects and the Scrum framework.

In 2014:

- Türkiye Finans maintained its efforts for cloud computing and virtualization. Türkiye Finans reached a virtualization rate of 86.7%, marking an increase of 3.2%. The Bank is among the sector’s leaders in the virtualization area.

- The Bank exceeded the SLA targets in solving incidents and demands while shortening the solution periods significantly.

- SLA coherence rate in resolving end-users’ IS related problems increased to 99.70%. End-user and customer satisfaction improved, decreasing the solution time of meeting demands by 69%.

IS Agile Transformation

Türkiye Finans initiated Agile Transformation activities at the end of 2013. Following preliminary preparations, training activities started in May 2014 within the scope of the selected Scrum infrastructure.

In Agile Transformation, which is a first in Turkey’s information technologies sector, training was provided for 3 months, a record period, to 300 employees including the entire IS organization, the General Manager, Executive Vice Presidents, outsourcing companies and business units, who then received PSM1 certificates.

Team structures were organized in line with Agile Transformation. The biggest Agile Team in Turkey and Eastern Europe was formed with 48 project and Scrum teams.

With the transformation, the target of completing projects on time increased by 15% in the first 3 months.

Turkey’s first and only data center to hold TIER III Design and TIER III Facility certificates

The Türkiye Finans Data Center is a fully backed up data center which features state-of-the-art technology.

The backup center ensures the continuity of the data center, which was designed for uninterrupted service. The Data Center, which was structured in line with Green IT criteria, is one of the best data centers in Turkey and Europe.

Data Center received certification for compliance with Tier III Design standards in April 2013. It is our country’s second and the sector’s first data center to hold this certificate.

As a result of on-site inspection which was completed in November 2013 by the Uptime Institute (the USA) that examines data centers according to international standards, Türkiye Finans obtained our country’s first and only Tier III Facility Certificate.

Türkiye Finans’ environmentally friendly Data Center:

- offers a high level of security and instant watch and control function of conditions such as electricity load, heat and moisture.

- provides high effectiveness in energy usage. The Energy measurement ratio/PUE (Power Usage Effectiveness) stands at 1.6, well below the average for Turkey and Europe.

- is one of our country’s most environmentally sound data centers with energy savings of up to 50% compared to a standard data center, and with half the carbon emissions.

- has an infrastructure which has the capability to expand and which can support the Bank’s sustainable growth.

Türkiye Finans Data Center paves the way for USD 200,000 in annual energy savings with these features.

The center offers fully backed-up energy and cooling infrastructure, simultaneous maintenance, uninterrupted operations for 72 hours independent of the network.

The banking sector’s first and only business continuity certificate

Türkiye Finans complies with Business Continuity Management System international standards and holds the ISO 22391 Business Continuity Certificate. Follow-up inspections conducted by the British Standards Institute (BSI) confirmed that the Türkiye Finans Business Continuity Management System complied with international standards.

Türkiye Finans is still the only bank in the Turkish banking sector to hold this certificate. The success rate in business continuity tests at Türkiye Finans in 2014 showed an increase when compared to the previous year, to stand at 100%.

Follow-up inspections conducted by the British Standards Institute (BSI) confirmed the compliance of Türkiye Finans’ Business Continuity Management System with international standards.

CIO reward goes to Türkiye Finans for the second time.

Türkiye Finans received the CIO reward for the second time in the CIO Rewards 2014, organized by the CIO Magazine for the fifth time in 2014.

The reward program gathers more than 200 technology managers. Türkiye Finans received the CIO Reward for its Agile Transformation project.

Moving together to shape the infrastructure of the future…

Within the scope of program, Türkiye Finans continues work on the modernization and development of IS infrastructure with the support of business strategies and the IS Transformation Program that started in 2013.

The goals of the 3-year IS Transformation Program are summarized below:

- Providing an integrated and uninterrupted customer experience through multiple channels,

- Increasing service and operational efficiency,

- Decreasing product development costs and moving towards rapid production,

- Improving channel abilities,

- Improving CRM abilities and customer orientation,

- Improving sales effectiveness and campaign management,

- Adding new competencies in banking applications and IT infrastructure

Corporate communication campaigns create an impression.

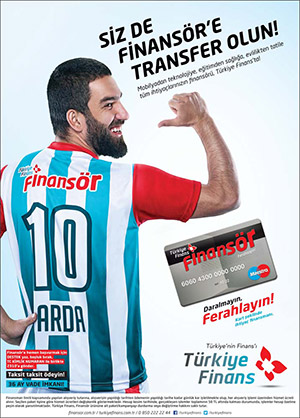

Türkiye Finans maintained its intensive communication activities in 2014 within the framework of the 360 degree continuous communication strategy. Türkiye Finans employed celebrities to be the face of the Bank in advertisements for the first time in the history of the Bank as part of its 2014 corporate communication activities. Advertising campaigns for Finansör, which included Arda Turan - a star player of the national team and Atletico Madrid - and Faal Kart starring Alex De Souza - Brazilian football player loved by all football fans in Turkey, attracted a great deal of interest from customers and potential customers. These campaigns significantly contributed to the improvement in the Bank’s popularity.

In 2014 Türkiye Finans diversified the media channels in which communication activities appear. Advertising campaigns appeared in national and local TV channels, radio stations, the internet, newspapers, magazines, outdoor billboards, stadia and other channels throughout the year. Advertisements were placed on the football pitches of teams in the Super League with the agreements entered into for the 2014-2015 football season. In addition, Türkiye Finans made an impression in football events which were closely followed throughout the year. The Bank reached large masses through pre-match, half-time and after-match advertisements in live broadcasts for the 2014 World Cup and 2014 Ziraat Cup. As a result of these communication activities, the total access value of Türkiye Finans advertisements increased by 120% when compared to 2013.

The twice-annual impact survey and corporate perception survey at the end of the year were carried out. The results of the surveys found that the Bank’s popularity and appreciation level increased in line with the rate of advertising when compared to previous years. It was observed that using celebrities in advertising campaigns increased interest in the Bank’s products and services, and positively supported the Bank’s popularity.

Türkiye Finans’ reputation in the presence of media institutions remarkably increased as a result of effective leader communication, PR and communication activities carried out in 2014. Accordingly, news about the Bank appeared in more quantitative broadcasts with bigger circulation, on more visible points with larger sizes. As a result of this, the equivalent of news about Türkiye Finans on printed media increased ten-fold when compared to 2013. Türkiye Finans maintained its position as a bank asked for opinions by the media in 2014.

The Bank participated in several fairs and seminars and carried out a number of field events throughout the year. In these events, the Bank demonstrated efforts to raise the popularity, recognition and reputation of the Bank and its products to its customers.

The Bank’s 2014 Annual Report was rewarded in 6 categories in the most prestigious competition of this field, which is organized by League of American Communications Professional.

Active communication in digital and social media

2014 was a year in which Türkiye Finans formed the brand’s strategy in digital and social media, sought to create popularity and realized the first digital activities. In parallel with its advertising campaigns, planning of a digital campaign and sponsorships specific to digital media were also carried out. In doing so, the Bank sought to reach a target audience in digital media, and increase the brand’s popularity.

Türkiye Finans created accounts on Facebook, Twitter, Youtube, Linkedin, Google+, Daily Motion and İzlesene in 2014. The Bank worked to increase its number of followers on these accounts and started to carry out customer management through these platforms. Türkiye Finans listened to recommendations, demands and complaints of customers and potential customers through these platforms and offered solutions accordingly. At the end of 2014, the Bank reached its targeted number of followers on the Facebook and Twitter accounts, with the number of followers increasing by 379% on Facebook and 482% on Twitter when compared to the first months of the year, when the Bank started active communication on these platforms. Türkiye Finans climbed to 34th and 18th places on Facebook and Twitter rankings, respectively, in the Social Bakers’ finance sector report.

Türkiye Finans started work on a New Corporate Website Project in 2014. In this project, the Bank aimed to renew the infrastructure of the current corporate website and create an infrastructure in which products and services could be presented more clearly and which could be transformed into an application channel. The new corporate website, which has been improved such that it will meet the needs of those visiting the website more effectively, is planned to be activated within 2015.

Türkiye Finans’ sustainability strategy, which will help it to reach its corporate goals, is defined on two main axes - good banking and good corporate citizenship.

Our sustainability approach and its applications

Türkiye Finans defines its sustainability strategy which will help it to meet its corporate goals on two main axes: good banking and good corporate citizenship.

Türkiye Finans’ sustainability strategy is focused on achieving good results in its core business and in the presence of society. The Bank’s goal is to enhance its contribution to society by being a good citizen while practicing the best banking applications.

Türkiye Finans, as a responsible corporate citizen, primarily follows its stakeholders closely but also keeps abreast of initiatives conducted on sustainability issues in Turkey and the world, shares its opinions and puts the regulations required in its service cycle into practice. All decisions and actions taken by the Bank are aimed at serving the needs of a sustainable future.

Türkiye Finans’ sustainability approach considers not only economic but also environmental and social performances. Türkiye Finans adopts this general approach as a part of its corporate culture. Thanks to this approach, the Bank will maintain its efforts to increasingly adopt sustainability and to create value accordingly.

Turkey’s first Sustainability Report among deposit and participation banks to be granted a grade A+ by the Global Reporting Initiative (GRI)

Türkiye Finans’ 2013 Sustainability Report was the first and only report to have been graded A+ by the GRI among Turkish banks which have right to collect deposits.

Türkiye Finans provided extensive coverage to the Kırkpınar Oil Wrestling Tournament, one of the Bank’s Corporate Social Responsibility (CSR) projects, in the Bank’s and Participation Sector’s first A+ graded Sustainability Report.

Türkiye Finans adopts a Corporate Social Responsibility strategy which is in line with the expectations of society and which contributes to economic growth as well as social development. In addition to offering products and services with a high level of quality and diversity, Türkiye Finans also aims to contribute to Turkey’s sustainable development through non-profitable social investments.

Through the support it extends to the Kırkpınar Oil Wrestling Tournament, the Bank believes that it plays an important role in transferring our cultural values to future generations.

In line with the aim of supporting the real sector, Türkiye Finans was a sponsor of the Anatolian Brands Contest for the third time in 2014, contributing to Turkish companies’ branding.

Other activities

In line with the aim of supporting real sector, Türkiye Finans was a sponsor of the Anatolian Brands Contest for the third time in 2014 to contribute to the promotion of the brands of Turkish companies.

Türkiye Finans extended its sponsorship for a year in the Dialogue in the Dark exhibition which it started in 2013 to raise consciousness of social citizenship. In 2014, the Bank maintained its support for the Mobile Downs Cafe, in which teenagers who suffer from Down’s syndrome work. Türkiye Finans supported the “Rescuing a Life Chain Collective Hear Massage” events staged by the Hayatta Kal (Stay Alive) Association in 2014 to indicate the importance of public awareness, primarily in first aid but also in health.

Türkiye Finans is aware of its responsibility to promote environmentally friendly renewable energy resources. Accordingly, the Bank participated in the “Anatolian Sun Generates Energy” fair - in which national and international representatives of energy sector participate - as a sponsor. The Bank maintained its efforts to raise awareness in this area with its products for financing renewable energy investments.

Türkiye Finans also unabatedly carries out its social responsibility activities in the field of education. Within this context;

- Türkiye Finans supported the Children and Youth Center of the Governorship of İstanbul. Projects were initiated with the aim of raising children who have faced social problems as individuals who are beneficial to the society. In the first step, activities for socialization of teenagers and increasing their motivation were practiced by improving the physical conditions of the Center.

- The Bank supported the “Darüşşafaka Kitapcan Velisi” project which was conducted for the first time in 2014 in cooperation between “Herkese Her Yerde Kitap” (A book for everyone, everywhere) Foundation and the Darüşşafaka Society.

- Türkiye Finans was the main sponsor of the Midtown Orchestra’s concert in Bodrum held in aid of education.

Türkiye Finans will continue to take steps that contribute to the values and culture of the society in which it springs to life.

Detailed information about Türkiye Finans’ sustainability applications can be found in the 2013 Sustainability Report 2013 on http://www.turkiyefinans.com.tr/surdurulebilirlik/tr/index.html

The value that Türkiye Finans generates for society posted an important level of progress with the bank’s systematic investment in human resources and corporate social responsibility projects.

Our road map for sustainability

In addition to recording steady financial results, Türkiye Finans continues to take active roles in issues that are of critical value for the future of our country. The Bank increased the support which it extends to the real sector within the scope of support for economic development. Türkiye Finans also offers innovative products and campaigns within the scope of following activities:

- protecting the environment,

- financing renewable energy investments,

- increasing public awareness of energy efficiency

On the other hand, there was important progress in the value that Türkiye Finans generates for society with its systematic investment in human resources and corporate social responsibility projects.