Asset Quality and Profitability

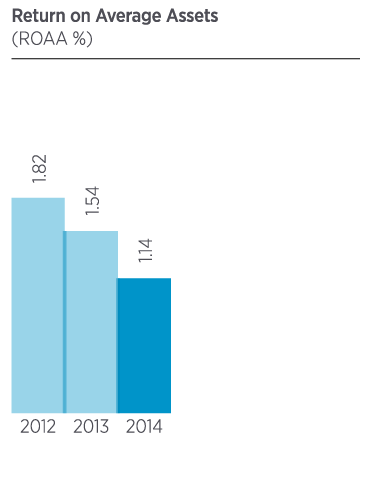

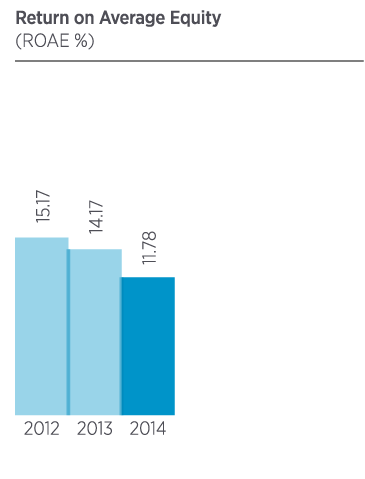

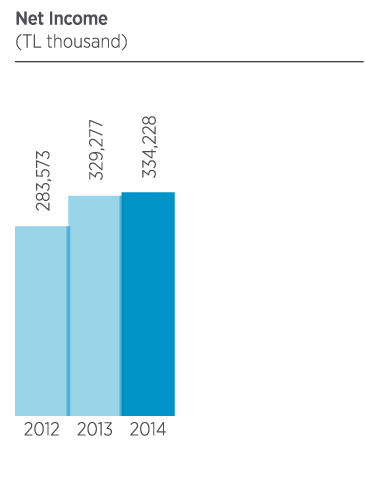

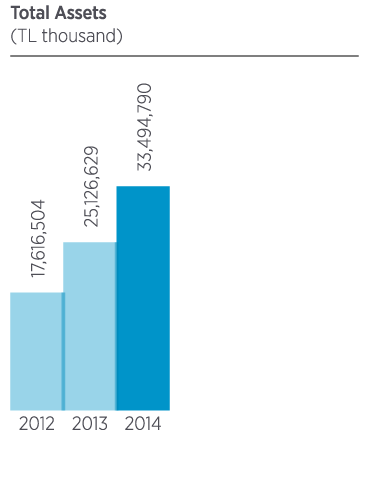

The total assets of Türkiye Finans increased by 33.3% YoY to reach TL 33.5 billion in value by the end of December 2014. The Bank posted a profit of TL 425 million before tax and net income of TL 334 million. The latter figure corresponds to a YoY increase of 1.5%.

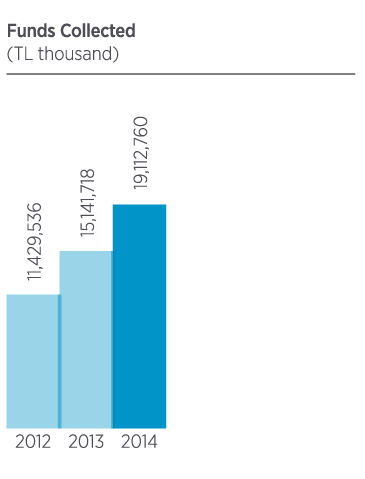

Funds Collected and Shareholders’ Equity

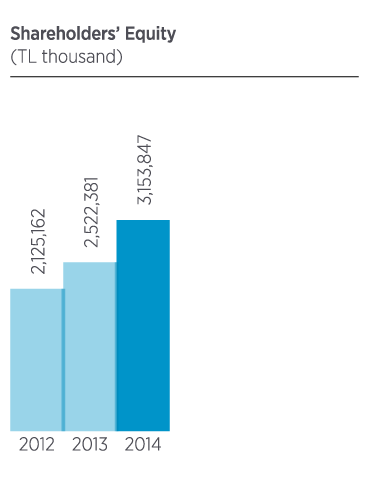

Funds collected, which represent the Bank’s most important financial resource, increased by 26.1% YoY to reach TL 19.1 billion as of December 2014. Funds collected accounted for a 57% share in the Bank’s overall balance sheet. Of this total, 65% is held in Turkish Lira and the remaining 35% in foreign currency accounts. With the inclusion of retained previous year profits, total shareholders’ equity amounted to TL 3.2 billion in 2014.

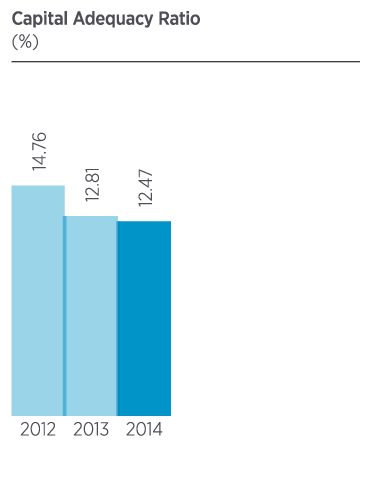

The Bank’s standard capital adequacy ratio stood at 12.47% as of the end of December 2014, compared to 12.81% a year ago.