The global macroeconomic outlook

The global economy started the year 2016 facing a number of serious difficulties. The rebalancing of the Chinese economy led to risk aversion on a global scale; declining commodity prices increased risk premiums in emerging economies, especially commodity exporters; and the uncertainties surrounding the Fed’s policy stance ignited volatility. In the USA, the Fed raised its interest rate in the last month of the year in response to the moderate and general recovery observed in the economy, after the US economy could not achieve the desired rate of growth in the first half of the year amid global headwinds and a loss of productivity. However, heightened external risks, the short-term outlook of the labor market and the failure of inflation to reach the expected levels weakened the Fed’s hand in carrying out the expected interest rate hikes before the end of 2016. This allowed risk premiums in developing countries to remain relatively low. Long-term low growth, low yields and low inflation, which are described as chronic recession, continued until the presidential election in the USA.

After the outcome of the US presidential election, there were mounting expectations that the expansionist monetary policies would be interrupted on a global scale and that economic risks would be limited by expansionist fiscal policies. The rise in external borrowing costs and a climbing inflation rate on the back of higher oil prices suggest that there could be a limited tightening in monetary policy and financial conditions. In addition, the idle capacity and ongoing imbalances in the global economy and the high debt ratios in Europe and China in particular, indicate that China and many countries in Europe and in other countries with high external financing needs, will continue to be dogged by economic difficulties. Meanwhile, as in 2016, unfavorable developments regarding political stability and geopolitical problems have been shrouding predictability and have compromised risk appetite as we go into 2017.

Britain’s decision to leave the EU (Brexit) in 2016 and the election of Donald Trump as the president in the USA were historical events, leading to a revision in global macroeconomic forecasts. The US economy is expected to record an increase in its growth rate from 1.9% in 2016 to 2.1% in 2017. If the newly elected President Trump implements the economic policies he promises, we could see an even more rapid rate of growth in the USA, which could persuade the Fed to follow a more hawkish policy.

The Eurozone, which has been facing increasing geopolitical risks since the middle of 2015 and internal uncertainties caused by these risks, is expected to post just 1.5% growth in 2017, a slacker rate than recorded in 2016. The European Central Bank’s decision to maintain its expansionary monetary policy, which the ECB has been already implementing, but to start reducing its quantitative easing from 2017 has increased the risk of asset quality concerns in the heavily indebted public and banking sectors. Although uncertainties remain regarding the Brexit process, the slowdown in the UK economy is expected to be more apparent in 2017. The markets will also be keeping a careful eye on the results of elections to be held throughout the continent during the year.

China, meanwhile, sought to revive its exports by devaluing its currency by 7% during the year. However, even this monetary policy preference failed to prevent economic growth in China from declining from 6.9% in 2015 to 6.7% in 2016, due to the global headwinds. Moreover, growth in China is expected to remain near the lowest rates seen in the last thirty years, with a growth rate of less than 6.0% expected in 2017. China is therefore expected to maintain expansionary policies, despite the recent upturn in inflation.

When it comes to developing countries, the combination of rising inflationary risks and a reversal in the trend in interest rates to an upward one for the first time since the global crisis struck has precipitated economic difficulties to increase. On the other hand, Russia, Brazil and Mexico that were one of the economies that shrunk in 2015 and 2016 are expected to grow in 2017 with increases in commodity prices led by oil prices. For this reason, volatility is expected to remain high in developing countries, but with a moderate revival in demand.

The Turkish economy could only muster up 2.2% in the first three quarters of the year due to global challenges, geopolitical risks and in particular, the treacherous coup attempt on July 15th and terrorist acts.

Outlook for the Turkish economy

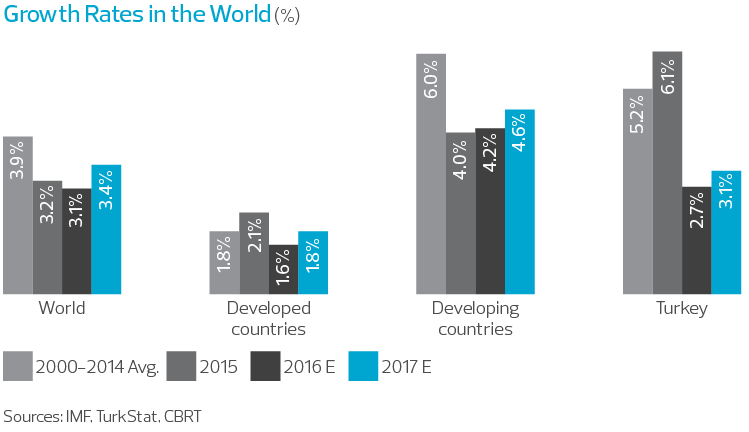

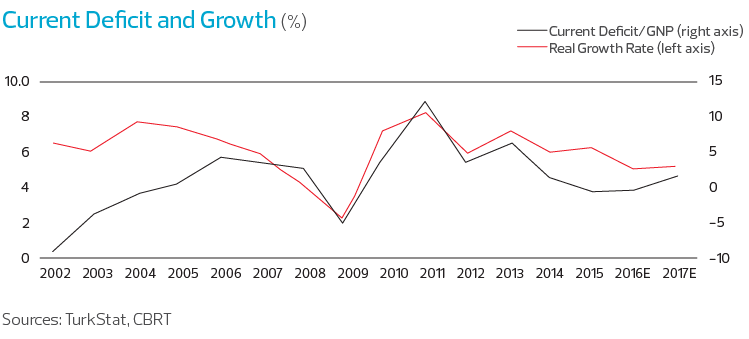

The Turkish economy, which grew by 6.1% in 2015, could only muster up 2.2% in the first three quarters of the year due to global challenges, geopolitical risks and in particular, the treacherous coup attempt on July 15th and terrorist acts. It is estimated that the economy posted a modest recovery and wrap up the year with 2.8% by the end of 2016, following the third quarter of the year, the first time in the past seven years that a shrinkage in the economy has been registered by one-off effects. In 2017, with the recent expansionary fiscal policies and macro-prudential measures taken, it is envisaged that economy notch up a slightly faster pace of growth with 3.1% growth. Provided the rate of economic growth in the European Union, Turkey’s main trading partner, confounds expectations and does not slow down in 2017, that predictability is increased by improving the investor perception in Turkey and if the geopolitical risks can be managed, our country could post a much higher than predicted growth rate.

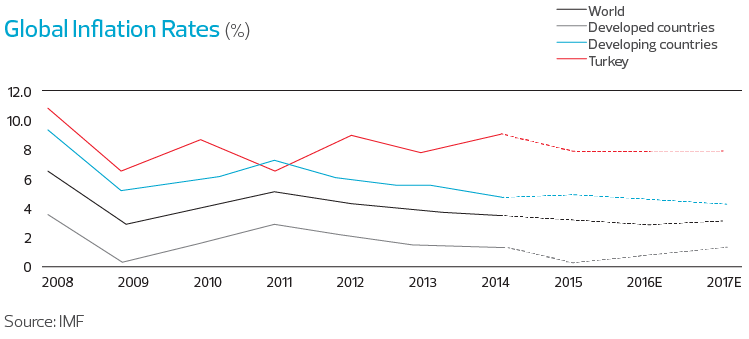

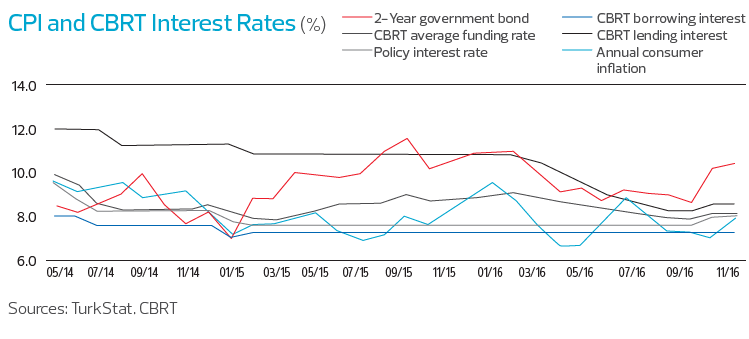

The annual rate of consumer inflation declined from 8.8% at the end of 2015 to 8.5% as of December 2016. The recent steep depreciation of the TL, tax hikes and the normalization in oil prices indicate that inflation will gradually increase in the coming period. Issues such as global inflation developments, the course of food prices and whether there will be additional tax hikes will determine the course of inflation in the upcoming period. These uncertainties could nudge Turkey into double-digit inflation, especially in the first half of 2017.

Given that the inflation outlook has deteriorated as a result of the double-digit depreciation of the TL, the Central Bank surprisingly increased interest rates after three years, in response to the recent increase in global uncertainty and high volatility. The Central Bank raised its policy rate from 7.50% to 8.00%, and overnight lending rate from 8.25% to 8.50%. As a result, the average funding interest rate was increased from 7.9% to around 8.25% as a result of the liquidity policy.

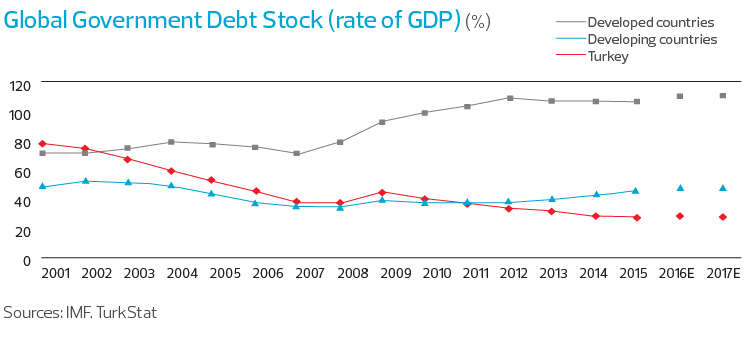

In 2016, the central government budget recorded a deficit of TL 29.3 billion (TL 23.5 billion in 2015), while the primary surplus declined to TL 21 billion (TL 29.5 billion in 2015). In spite of the expansionary public finance incentives, the banking sector as well as public finance have remained relatively strong in Turkey with the effects of the stabilization measures. In fact, public debt stock as a ratio of GDP stands at just 27.5% in Turkey, well below the Maastricht criteria of 60% and the 47% average for developing countries, confirming Turkey’s positive decoupling.

The current account deficit is expected to gradually widen in the coming period with the rapid increase experienced following decisions for the supply side cuts in oil prices, but the weak domestic demand will go some way towards limiting this trend. The main risk factors in the economy are how long the depreciation of the TL continues and its effect on the real sector balance sheets and accordingly, the weakness in Turkey’s growth outlook.

The Turkish Banking Sector and Participation Banking

As in the previous years, the banking sector continued to contribute significantly to Turkey’s growth in 2016 thanks to its strong financial structure.

Based on December 2016 figures, the banking sector’s asset volume increased by 16% to TL 2,731 billion, deposits* increased by 17% to TL 1,548 billion, the volume of loans** expanded by 17% to TL 1,787 billion and shareholders’ equity amounted to TL 300 billion, posting 14% YoY growth. In the same period, the total assets of the participation banks amounted to TL 133 billion, with 11% growth, while the collected funds amounted to TL 85 billion, representing an increase of 12% YoY; the volume of funds supplied by participation banks expanded by 6% YoY to TL 86 billion while equity stood at TL 11.5 billion, an increase of 8%. The loan /deposit ratio in the banking sector maintained 2015 level and it was around 115% in 2016.

In the sector, a total of TL 116.3 billion in securities were issued in the domestic and foreign markets in 2016, an increase of 19% YoY.

At the end of 2016, while participation banking commanded a 4.9% market share in terms of assets, the share of funds supplied and collected funds 5.5% and 4.8% respectively. The share of participation banking equity was 3.8%.

The banking sector recorded a total profit of TL 37.5 billion at the end of 2016, with an increase of 44%. In the same period, participation banks wrote a net profit of TL 1,106 million, marking an increase of 171%. The BRSA (Banking Regulation and Supervision Agency)’s reduction of the risk weightings applied to different credit types supported the capital adequacy ratios of banks, but the rapid fall in the value of the Turkish Lira against other currencies and the work carried out towards Basel III harmonization had the effect of lowering capital adequacy. Accordingly, the sector’s capital adequacy ratio which was 15.6% at the end of 2015, maintained its same level at the end of 2016. Among Participation Banks, precipitating an increase in the capital adequacy ratio from 15% to 16.2%. Thus, participation banking maintained a level of growth which exceeded that of the banking sector as a whole.

While entry of public banks into the participation banking sector raised the expectation of rapid growth to come, the issuance of sukuk (lease certificates) by both the Treasury and the participation banks promoted the financial deepening in the sector. The Interest-Free Finance Coordination Board, which undertook a critical role in raising the high potential of participation banking, convened for the first time at the beginning of 2016, chaired by the Deputy Prime Minister under the Treasury Undersecretariat. The Interest-Free Finance Coordination Board identified a number of areas for development during the meetings held, which attracted a high level of participation. With the Board’s valuable visionary contributions, participation banks will support more to the economy and it is aimed to be able to assume a critical role towards İstanbul’s goal of becoming a Financial Center in the upcoming period.

The Turkish banking sector, which rounded off 2016 with strong profitability with the contribution of one-off revenues, expects a more moderate course in terms of both profitability and growth in 2017. In this respect, it is predicted that despite the slowdown in terms of profitability, the sector will sustain a reasonable level of credit growth with its strong capital structure.