The cheque with funds is an innovative service, offered by Türkiye Finans to its customers.

Commercial and Corporate Banking

Full support to the Turkish economy through fund allocation

Türkiye Finans offers its services to more than 3,000 corporate customers and their partners who have turnover of TL 150 million or more in the Corporate Banking segment.

In Commercial Banking, Türkiye Finans increased its cash loans by 27% YoY to TL 6.6 billion while non-cash loans grew by 8% YoY and reached TL 4.7 billion to TL 5 billion as of the end of 2016.

Türkiye Finans serves more than 16,000 corporate customers and their partners with annual net sales revenue of TL 15-150 million in the Commercial Banking segment.

In 2016, Türkiye Finans increased its commercial banking cash loans to TL 10.5 billion and non-cash loans to TL 5.4 billion.

Total financial leasing transaction volume reached TL 1.4 billion in 2016.

Türkiye Finans offers financial leasing services for all types of machinery, equipment and similar equipment, which are suitable for financial leasing and are procured both in Turkey and abroad by the customers who are in Corporate, Commercial and SME segments. Türkiye Finans’ total financial leasing transaction volume amounted to TL 1.4 billion as of the end of 2016.

A pioneer in the QR code Cheque based application (Karekodlu Çek)

In February 2016, Türkiye Finans implemented “Karekodlu Çek” (the Cheque with QR code), which will become an obligation in the sector in 2017.

With its finger on the pulse of technological developments and implementing innovations rapidly, Türkiye Finans offered Karekodlu Çek (the Cheque with QR code) product to its individual and corporate customers who use cheque books. The Bank gained the acclaim of its customers in a manner that is worthy of its title of being the pioneer bank with the project.

Karekodlu Çek (the cheque with QR code) application allows the holder to swipe the QR code on the cheque, thus enabling payments by cheque to be collected more securely by allowing the payer’s past cheque payment status to be seen without the need to go through an approval process. It also provides the opportunity to see if the cheque has been forged or not.

Cheque with funds service to help ensure ease in payments for companies’ cash flows

The cheque with funds is an innovative service, offered by Türkiye Finans to its customers in 2015, marked a first in the participation banking sector. The cheque with funds is a payment method that provides financing to the customers within the framework of the principles of participation banking.

The cheque with funds is based on the principle that the cheque given by the customers for the purchase of goods will be funded at pre-determined maturities and rates on the swap day. In addition, through the financing opportunity that it offers, the service provides companies with ease of payment in their cash flow cycle.

With Türkiye Finans’ Direct Collection System (DTS), collections are guaranteed

The “Direct Collection System” (DTS) at Türkiye Finans provides customers with rapid and guaranteed collection for their payments.

With the DTS, the Bank offers a practical solution to the advance or term collections of the companies that work with a large number of customers or have dealership systems.

The DTS product also provides exclusive services in the following,

- purchases of goods by dealers,

- automatic payment of bills that are uploaded to the system by the parent company,

- Installment over the agreed rate and maturity,

- facilitating the flow of goods of the main company,

- easy collection by the main companies.

Distinction in foreign trade transactions

Türkiye Finans offers high added value solutions that are tailored to the needs of the customers with a professional team which is highly knowledgeable in the field of foreign trade and a global correspondent network that is ever expanding every year.

In 2016, the Bank employed foreign trade sales managers in the İstanbul and Marmara regional directorates to facilitate foreign trade transactions of existing customers and to reach more companies. Foreign trade sales managers respond quickly to all requests of the customers by providing one-to-one technical support to the customers through the branch and customer visits channels.

At the same time, Türkiye Finans also mediates in internationally sourced, medium and long term financing with affordable loans through institutions such as Eximbank, GSM and SEP and diversifies the opportunities of the placement that it offers its customers.

In 2016, the Bank mediated the supplied of Eximbank’s Pre-Shipment Export Loan, amounting to USD 35 million.

Expectations for 2017

In line with the Commercial and Corporate Banking segment strategy, Türkiye Finans plans to enhance its product range, expand its customer base, meet the financial needs of companies and extend an increasing degree of support to customers in 2017.

The Bank aims to expand the functionality of its cheque with funds product by upgrading its features, including early collection of installments, the option of partial collection, being evaluated within the scope of general loan and the guarantee option.

The work on the ready limit for the DTS product is planned to more rapidly draw up a pre-approved ready limit for more of the Bank’s customers in 2017.

With a solution-oriented and risk-focused perspective, Türkiye Finans will continue to work to meet the financial needs of companies quickly and effectively during 2017, with a focus on expanding its customer base.

supporting to SMEs

In the light of data of the year 2016, according to the official definition of an SME, Türkiye Finans alone provided 43.9% of the cash funds granted to SMEs in the participation banking sector.

SME Banking

Strong market share in SME banking

While cash loan allocation increased TL 12.4 billion and non-cash loan allocation grew TL 5.6 billion, a total fund size reached TL 18 billion in SME Banking.

In the light of data of the year 2016, according to the official definition of an SME, Türkiye Finans alone provided 43.9% of the cash funds granted to SMEs in the participation banking sector, while the sector’s share in the Bank’s non-cash loans allocation stood at 42.5%.

Specialist staff at Türkiye Finans on hand to offer the support that SMEs need.

Türkiye Finans continued to offer the following solutions to its customers during 2016 through its specialist, professional SME Banking staff;

- Treasury Supported Credit Guarantee Fund Surety,

- KOSGEB (Small and Medium Scale Enterprise Development Administration) supports,

- Grants and incentive opportunities.

Going beyond being a financial service provider for SMEs and being a consultant and business partner

Türkiye Finans works in strategic cooperation with a consultant firm that is specialized and competent in many fields, especially in the field of grants given by development agencies and TÜBİTAK (The Scientific and Technological Research Council of Turkey) and which supports innovation in production, R&D incentives, support from the TTGV (Turkish Technology Development Foundation), KOSGEB project incentives and support from the IPARD. Türkiye Finans provides professional services to SMEs concerning grants. Türkiye Finans also provided intermediary services in purchases undertaken by those SMEs entitled to support from the KOSGEB support packages under the Co-Finance Protocol.

Contributing to the growth and development of SMEs in every area, Türkiye Finans also continues to support SMEs with Investment Incentive Certificates. Within the framework of the “Profit Share Protocol” signed between Republic of Turkey Ministry of the Economy and Türkiye Finans, companies which received the investment incentive certificate continued to receive support in 2016. Since the date the protocol was signed, a total of more than TL 188 million in financial support was extended for the purchase of goods of SMEs aimed at their investments. In addition, Türkiye Finans mediated for obtaining the right for grant of more than TL 16 million from the Republic of Turkey Ministry of Economy.

Providing qualified solutions to facilitate access to finance for those SMEs that have difficulty producing security when taking out loans, Türkiye Finans maintained its pioneering role in the banking sector on bailed loans with the Treasury Supported Credit Guarantee Fund. Türkiye Finans provided one of the highest level of guarantees in the entire banking sector within the scope of Treasury support.

Offering high added value solutions in the field of foreign trade.

Türkiye Finans offers high value-added and tailor-made solutions to its customers with its experienced staff in foreign trade and its extensive correspondent network all over the world.

In 2016, within the scope of efforts to develop correspondent relations and in line with the policies of encouraging foreign trade and foreign currency earning activities between Russia and Turkey, the Ruble Account was opened at correspondent banks. Türkiye Finans accordingly began to carry out foreign currency transfers in Ruble terms directly without the need for an intermediary bank.

Diversified the product, service and solution range

Türkiye Finans continued to develop its cooperation with the KKB (Credit Registration Bureau) with the aim of increasing the financial awareness of its customers and raising knowledge of risk management. In this context, the Bank provided the customers with the opportunity to obtain Findeks reports from branches of the Bank in 2016.

In 2016, Türkiye Finans also continued to provide funding support for the machinery, equipment and similar equipment requirements of SMEs, which was supplied from domestic and international markets, through the financial leasing model. The financial leasing business volume carried out with SMEs increased by 2% during 2016.

Türkiye Finans continued to support agricultural production through its “Smiling Farmer Agriculture Package” (Gülen Çiftçi Tarım Paketi).

In 2016, another area of focus for the Bank was energy, tourism and various production facility projects, particularly renewable energy.

Expectations for 2017

Work continued on the preparation of sector specific packages in the Siftah Card product, which offers SMEs financing opportunities without the need to visit the branch. The Bank plans to offer these special service packages to its customers during 2017.

As in past years, Türkiye Finans aims to continue offering increasing value to SMEs in 2017, to facilitate the work of SMEs in every field and to provide the highest quality service standards within the framework of a widespread based growth model.

In brief, Türkiye Finans aims to gain an ever greater presence in the everyday lives of SMEs in 2017 and beyond.

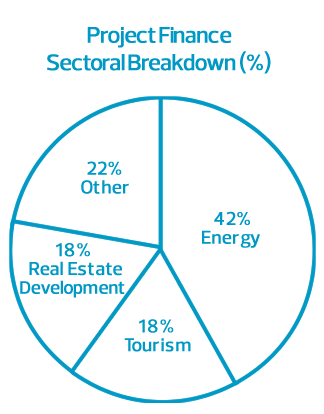

A 42% proportion of the loans supplied by the Bank for Project Financing were allocated to the energy sector, 18% to the tourism sector, 18% to the real estate development sector, and 22% to other sectors.

Project Financing

A 30% increase in project financing in 2016.

Türkiye Finans maintained its steady growth in the Project Financing and specialized investment financing, where repayment of loans was based on the project’s own cash flow.

A total of TL 2.6 billion of cash and non-cash funds were funds allocated by Türkiye Finans within the scope of Project Financing in 2016, an increase of 30% YoY.

A 42% proportion of the loans supplied by the Bank for Project Financing were allocated to the energy sector, 18% to the tourism sector, 18% to the real estate development sector, and 22% to other sectors.

A focus on Renewable Energy Projects

In line with our country’s strategy and priorities in the field of energy, Türkiye Finans places priority on supporting renewable energy sources, which have a much reduced impact on the environment when compared to conventional energy sources.

As of the end of 2016, the Bank had extended approximately TL 1.1 billion of financing support to energy projects with a combined installed capacity reaching 300 MW, with the majority of this capacity consisting of renewable energy.

Effective financing solutions for solar energy projects

The rise in investment in solar energy and investor interest in this field has elevated this market to a different position when compared to previous years. In this respect, Türkiye Finans also increased its share in the financing of solar energy investments during 2016 and strengthened its position in the market.

As of the end of 2016, a total of approximately TL 553 million in financing support had been provided to 88 solar energy projects.

The total installed capacity of the solar energy facilities financed by Türkiye Finans amounts to 145 MW. In the context of the total amount of electricity generated by solar power in Turkey, Türkiye Finans stands as an important player in funding solar energy projects.

In 2016, Türkiye Finans agreed on obtaining consultancy services, which will support the business quality of project financing and the risk analysis level, from third party subject specialists. This will ensure the effective management of the risks arising from the projects for which financing support has been provided.

As of the end of 2016, a total of approximately TL 553 million in financing support had been provided to 88 solar energy projects.

In 2016, an emphasis was placed on training activities in order to monitor and implement developments worldwide and in Turkey’s legislation, especially in the energy sector.

Expectations for 2017

During 2017, Türkiye Finans aims to maintain its strong and stable position in financing projects which will support the rapid development of our country.

Retail Banking

Growth in business volumes supported by a sincere dialogue established with customers.

In 2016, Türkiye Finans carried out activities focused on boosting efficiency in its processes, expanding the use of resources and stepping up communication with its customers in order to ensure customer satisfaction in the Retail Banking business branch.

Working with the aim of being the main bank of its customers, the Bank carried out “welcome” calls to those customers who had recently joined its portfolio as part of an effort to make customers feel that they were part of the Türkiye Finans family and to share contact information with customers, enabling customers to reach the Bank on a 24/7 basis. Besides, in line with the goal of meeting all of the banking needs of its customers within the first three months, the Bank offered customers an array of products and services through appropriate and rapid communication methods.

Unwavering growth in the field of consumer financing in 2016.

Türkiye Finans reached a risk size of TL 3.8 billion in 2016 by extending TL 850 million in real estate financing. The real estate credit risk stood at 15% of the Bank’s total credit risk as of the end of the year.

In 2016, the Bank offered preferential profit rates to its customers, based on cross-selling, by prioritizing the sustainability in customer acquisition realized through housing loans. On the other hand, the Bank increased customer loyalty and efficiency through increasing product use.

We specialize in funding mass housing projects

Türkiye Finans is involved in ongoing mass housing projects as well as the completed real estate financing. The Bank, which has been working on branded and niche projects built by leading Turkish construction companies, has contracts with about 2,000 mass housing projects throughout Turkey.

In 2016, within the context of mass housing projects, 2,705 customers were offered the opportunity to own a residence with preferential profit rates. Allocation of funds under the mass housing projects accounted for 42% (TL 289 million) of the total business volume of the real estate financing of Türkiye Finans.

An intensive year for consumer loans

In 2016, Türkiye Finans continued to offer financing opportunities under competitive conditions to its customers through a number of campaigns in the vehicle financing business. The Bank extended TL 133 million of loans in this segment during 2016.

In accordance with new legal measures imposing a maximum limit on the number of credit card installments permitted on purchases and the terms of consumer loans, Türkiye Finans increased the number of installments for the Finansör product, which offers advantages to customers by allowing them to meet their needs for consumer loans through the Bank card, to 48 months. Finansör cards were in circulation at the end of 2016 with total allocation of funds of TL 51 million.

Hızlı Finansman (Fast Financing) dealer network allowed rapid response to customer applications for consumer and vehicle financing, with on-site loan extensions and flexible payment plans offered in accordance with the incomes of the applicants.

During 2016, Türkiye Finans entered agreements with 64 private schools that serve as pioneers in the sector and stand out with their educational quality, within the scope of the Automatic Collection System (OTS). The system reached around 2,000 customers who pay school fees to these institutions in installments. The Bank mediated in collection transactions worth a total of TL 3.8 million.

Expectations for 2017

In 2017, Türkiye Finans aims to increase the volume of consumer loans and reach new customers in order to achieve its goal of sustainable profitability against a backdrop of increasing competition and narrowing profit margins in the Retail Banking business line of the banking sector. To this end, Türkiye Finans plans to expand the variety of personal products as well as taking measures aimed at enhancing the customer experience and improving satisfaction in existing products.

According to the principles of participation banking in Turkey, the premium system will be added to the Hızlı Finansman (Fast Financing) module in 2017. Türkiye Finans presented this to the market for the first time and it serves as an online financing channel and this upgrade is expected to pave the way for a significant increase in volumes in 2017.

In addition to the branch channel, Türkiye Finans plans to carry out system development activities during 2017 that will allow applications to be received through branchless banking channels such as ATMs and internet banking for the convenience of customers who use products such as credit cards or Finansör.

Findeks

The Findeks product, which is a financial services platform designed for individuals and the real sector and implemented by the Credit Registration Bureau (KKB) was offered to customers through the Bank’s branches.

Micro Banking

Full support to micro businesses with the definition of segmentation specific to Türkiye Finans

The services are provided to all micro and small businesses with annual turnover of between TL 0-2 million, especially artisans in the Micro Banking segment of Türkiye Finans. In this scope, the financial support and consultancy services needed by the customers is provided, with the cash management products assisting the periodical and daily financial lives of the Bank’s customers. The sectoral solutions that are customer oriented and proactive approach based are produced within the Micro Banking. The financial needs of the businesses for trade, production and employment are being met and their sustainable growth is contributed to.

Quickly accessible and solution focused financing support for needs

The main strategy of the Türkiye Finans Business loans is to provide quickly accessible and solution focused financing support for needs and the differentiated maturities and payment schedules.

The regulations implemented in the loan allocation processes paved the way for more rapid and effective risk management and loan evaluation. Artisans and small enterprises were able to access credit through loan applications received through alternative distribution channels.

The total volume of cash loans stood at TL 893 million at the end of 2016. The total financing support provided to the businesses and the Bank’s customers that are business partners of these businesses by Türkiye Finans stood at TL 1,583 million.

Türkiye Finans, which is geared towards growth on widespread development in funds collected, achieved a deposit volume of TL 2.4 billion by placing priority on growth in current deposits.

Standing shoulder to shoulder by small businesses with letters of guarantee and cheque cards

Türkiye Finans remained firmly behind small businesses in letters of guarantee.

The Bank provided support for the supply of cheque books, which play an important role in the cash cycle of small businesses, during 2016. Türkiye Finans achieved a volume of TL 47 million by the end of 2016, providing financial leasing support throughout the year to artisans and small enterprises to meet their investment needs, including in items such as machinery and equipment.

The Findeks product, which is a financial services platform designed for individuals and the real sector and implemented by the Credit Registration Bureau (KKB) was offered to customers through the Bank’s branches.

Türkiye Finans tripled its number of Cash Register Device (ÖKC) during the year by increasing the number of contracted brands in the ÖKC POS with which it has an agreement.

Work on the Faal Card product, which provides companies with a quick and easy financing solution for purchasing goods and services in their commercial activities, continued and privileged packages offering different payment conditions for tradesmen were prepared. Within this scope, a total of 3,700 artisans and small enterprises were provided with a total of TL 46 million in financing support with the Faal Card during 2016.

Turkey’s leading participation bank, Türkiye Finans, asserted its presence in Agricultural Banking by continuing to support agricultural producers with a wide range of products and services. Its customers’ needs for agricultural vehicles, machinery, raw materials and equipment are financed through affordable payment terms with the Smiling Farmer Agriculture Package, Beekeeping (Apiculture) Faal Card Package and the Faal Card Farmer Package. Support is provided in accordance with the farmers’ cash cycles in the harvest period with payment plans which offer terms of 12 months and up to 5 years maturity.

supporting agriculture

Its customers’ needs for agricultural vehicles, machinery, raw materials and equipment are financed through affordable payment terms with the Smiling Farmer Agriculture Package, Beekeeping (Apiculture) Faal Card Package and the Faal Card Farmer Package.

Esnafımız Gülsün, Bereketini Görsün (Let Our Artisans Smile and Prosper)

Türkiye Finans Micro Banking, maintained its principle of growth spread to the base, with the number of active customers reached 102,000 at the end of 2016. During the year, the Bank adopted the principle of being “the Bank of Artisans” with an exhaustive range of products and services, which form an integral part of the texture of the city where the Bank operates and offer differentiated solutions.

Working under the slogan of “Esnafımız Gülsün, Bereketini Görsün” (Let Our Artisans Smile and Prosper), all products and services provided by Türkiye Finans aimed at tradesmen were gathered under the Esnaffinans, which was promoted in all communication channels. Advertising campaigns for financing packages specific to the needs of artisans were offered with attractive conditions, while periodical campaigns were held to ensure artisans were able to conduct purchases of goods and services without difficulty. At the same time, an advertising campaign was organized, aimed at establishing the perception of Türkiye Finans being a bank on the side of artisans.

Expectations for 2017

Micro Banking unit will continue to meet all kinds of needs of small enterprises, especially those of artisans, during 2017 with a range of products and services offered under the Esnaffinans. The unit will also facilitate their day-to-day operations through support provided to cash management.

Work on the development of the Faal Card product and package will continue, with the aim of shortening the time needed to access financing and increasing the quality of service with the projects of applications received from alternative distribution channels and ready limit projects.

Fund Collecting and Investment Products Marketing

Funds collected, which represent the most important source of funds for Türkiye Finans, stood at TL 21 billion at the end of 2016. The Bank’s current deposits increased by 6.3% YoY to approximately TL 6 million during 2016. In terms of the distribution of funds collected during 2016, 56% was made up of TL accounts and 44% was made up of foreign exchange accounts.

The Bank’s current deposits increased by 6.3% YoY to approximately TL 6 million during 2016.

Çeyiz Hesap (Dowry Account), to alleviate marital expenses

In 2016, Türkiye Finans commissioned the Çeyiz Hesap (Dowry Account) product. Çeyiz Hesap (Dowry Account), that provides a state contribution with regular payments, is a participation account which enables customers to benefit from high profit share revenue in the long term and provides advantageous banking services.

State subsidized “Konut Hesap” (Housing Account)

Konut Hesap (Housing Account) is a participatory account that provides profit share revenue to those customers who aspire to own their own home for the first time, as well as providing state support. Türkiye Finans began to offer its customers an opportunity to make use of their savings advantageously and safely with its Konut Hesap (Housing Account) product.

4% increase in investment products in 2016

In January 2016, Türkiye Finans obtained permits for Intermediation for Order Transmission, Portfolio Intermediation, Transaction Intermediation and Limited Custody activities. A monthly average of TL 155 million in transaction volumes was realized in the transactions of investment products (equity market transactions and investment fund buy/sell transactions) during 2016, marking an increase of 4% YoY.

Complete and tailor-made solutions to meet all of the insurance needs of Türkiye Finans customers

Türkiye Finans works in cooperation with leading insurance companies both in Turkey and the world in securing everything which customers attach value to. Türkiye Finans’ affordable and high-collateral insurance solutions minimize the risks associated with the customers’ homes, cars, health and retirement.

Türkiye Finans also supports the lives of its customers by standing by them in their times of need. In this context, the Bank continued to produce special and privileged solutions during 2016 by offering consultancy services in line with customer preferences as well as offering damage, assistance and guidance services.

Türkiye Finans and the Interest-Free Individual Pension

Türkiye Finans Private Pension System (BES) is composed of individual pension funds consisting entirely of interest-free investment instruments. BES is established as a complementary system to the existing public social security systems and provides supplementary pension income in addition to the pension that customers will receive from social security institutions.

Expectations for 2017

Türkiye Finans aims to expand its customer base in the collected funds and significantly increase its market share. In order to reach the targets set out, the Bank plans to expand the product range in investment and insurance product services.

Payment Systems and Credit Cards

Türkiye Finans increases its number of POS machines to 45,000.

In 2016, Türkiye Finans increased its number of POS machines by 8.5% and the revenues obtained from POS machines by 41%, placing Türkiye Finans at the top among participation banks in terms of the number of POS machines and POS revenues.

Within the scope of Bonus POS application, which is the first of its kind in the participation banking sector, contracted member businesses were able to set up installment payments on approximately 16 million credit cards of 10 other member banks of the Bonus platform, enabling their customers to earn Bonus points and thereby increasing turnover volume.

As a first in participation banking, Ready-Made POS Packages (Hazır POS Paketleri) tailored to the individual needs of artisans were brought into service. Within the scope of the packages, member businesses were given the opportunity to conduct transactions without a commission charge and without blockage for a monthly fixed package fee, with the options of prepaid and installable packages which do not require a POS turnover commitment.

Cards with the Troy logo started to be accepted by Türkiye Finans POS machines.

Growing volume in payments

In 2016, Türkiye Finans defined the collection of SGK and Tax debts, which were structured under Law No. 6736, on the channels of the Bank and began to accept the transactions.

The online Apsiyon platform, which enables the administration of collective structures such as housing complexes, apartment blocks, residences and plazas to monitor the collections and payments electronically, was put into practice. Residents of apartment blocks and housing complexes were given the opportunity to pay their monthly fees through Türkiye Finans channels (cash desk, internet branch, mobile, automatic payment etc.) easily by credit card or direct debit.

In 2016, the Bank completed the necessary work for the additional 402 tax departments. The Bank collects payments for Vehicle Tax and Traffic Fines which are affiliated to these tax departments of the Revenue Administration. The Bank also began to collect the payments from Property Income, Stamp Duty and Duties Payable by Those Bringing Electronic Devices into the country.

The transition to the HGS (Fast Transition System) at the İstanbullines, İDO (İstanbul Sea Bus), Osmangazi Bridge and the Eurasia Tunnel was completed.

Such payments started to be collected through the Bank channels having entered agreements for the collection of bill payments with 6 new institutions.

A total of 16 million transactions, worth TL 1.3 billion in turnover, were realized through non-bank channels such as Hızlı Nokta (Fast Point) and Faturavizyon.

Building credit card products and services based on positive customer experience

In 2016, Türkiye Finans maintained its product development activities in the credit card segment to serve its customer base. The contactless feature was added to the cards in the Bank portfolio, thereby allowing customers to conduct purchases quickly and easily.

The Bank continued to provide the interest-free Happy Advance application, introduced to meet the urgent needs of credit card holders. With the application of the Installment option, sector based campaigns were organized and customers were offered the advantages of added ease in payment for their transactions, with cash from credit card and instalments on credit card.

In 2016, Türkiye Finans began to receive credit card applications through the Internet Banking channel.

The Bank completed the year 2016 with 384,000 individual credit cards and a turnover of TL 2.1 billion and with 1.5 million individual bank cards in circulation.

The School Payments System (SPS) and the School Reserve Account

The SPS is a cash platform provided by Türkiye Finans for the payment of school fees. The Bank ensured that the services provided through the SPS were more comprehensive with the new School Reserve Account product. Within the scope of the SPS, parents can issue instructions from their accounts and benefit from the Türkiye Finans credit card or the School Reserve Account limit.

The School Reserve Account is a current account with Benevolent-Loan and is a consumer financing application. If a customer does not have a sufficient balance on the day of the school fees instalment being due, the shortfall is met from the customer’s School Reserve Account limit. Within the scope of the SPS, 69 institutions were worked with in 2016. Agreements with new institutions have been continuing in 2017 with the School Reserve Account development.

Expectations for 2017

Türkiye Finans will focus on increasing the number of dealers and business volumes in Hızlı Finansman (Fast Financing) portal in 2017. At the same time, the Bank will continue to focus on the POS product and continue to grow.

Türkiye Finans will increase its cooperation with Fintechs and complete projects which facilitate the payment of bills to licensed institutions through non-bank platforms.

Türkiye Finans, which plans to add new payment institutions to its applications, will in 2017 continue to rapidly implement projects that will provide added value to its customers.

The Troy (Turkey’s Payment Method) national card project is being created by the Interbank Card Center (BKM) is supported by Türkiye Finans. The issue of cards with the Troy logo will get underway in 2017.

78%

Türkiye Finans customers carried out 78% of their financial transactions through digital channels in 2016.

Customer Experience and Service Management

We aim to achieve long lasting customer satisfaction.

Aiming to achieve long lasting satisfaction in its relations with customers, Türkiye Finans attaches importance to standing with its customers at all times, everywhere and in all situations, to listen to them, to create solutions for their financial needs and to facilitate their transactions.

The Bank has been implementing systematic projects to generate permanent solutions for customer complaints through a service approach which is transparent and oriented towards providing information throughout the process.

Carefully implementing improvements in response to the feedback processes by handling feedback from customers meticulously and with the greatest sensitivity, Türkiye Finans protects the interests of its customers at all times and responds to all received requests thoroughly.

Türkiye Finans effectively records all complaints, appeals, suggestions, gratuities and requests received from customers. The Bank continuously carries out improvements in its infrastructure to ensure a healthy flow through the existing system.

Meanwhile, a number of process improvement projects were implemented within the context of improving the service quality offered to the customers and increasing operational efficiency. The installation of institutional TV in the branches continued in 2016, along with adjustment in the branch layouts.

Expectations for 2017

In 2017, Türkiye Finans will continue its work in the field of customer satisfaction and service management, which is accepted as a fundamental element of customer loyalty.

In line with the findings of the survey, customer feedback, the recommendations and the findings shared by the Türkiye Finans teams, projects will be developed and implemented to enhance the service experience and total service quality of its customers, who make up the Bank’s most important stakeholder group.

Digital Banking

Continuing to digitize its services as part of providing a rapid, uninterrupted customer experience with excellence under the integrated channel strategy, Türkiye Finans maintained its investments in technology during 2016. The Bank offered a wide range of diversity in transactions and services to its customers in its distribution channels.

Branchless Banking

Türkiye Finans customers carried out 78% of their financial transactions through digital channels in 2016.

The Bank realized around 280,000 product sales and activations through these channels.

With the work carried out in 2016, a number of innovative practices were implemented, which will increase the preference of digital channels and ensure their effective use and a sales-oriented approach was followed.

Mobile Banking

Following a new function development studies by taking into account customer needs, the Bank continued its investments in the mobile branch, which is the fastest growing non-branch banking channel in terms of the number of customers and transaction volumes.

A number of functions and features are offered to users, such as easy and quick access to mobile banking applications, payment of traffic fines, additional card debt payment and shopping settings and multilingual support in English for the iPad mobile banking application.

The number of active customers in the mobile branch grew by 74% YoY in 2016 while the number of financial transactions grew by 82% YoY. The number of downloads of mobile banking applications developed by Türkiye Finans for iPhone, Android, iPad and Windows Phone platforms exceeded 180,000 in 2016.

Internet Banking

Within the scope of providing Internet Branch customer channel migration and increasing transaction volume, campaigns were launched to offer awards and a wide array of discount advantages to customers in 2016.

The number of the Bank’s internet banking customers had exceeded 600,000 by the end of 2016, while 130,000 products were sold through the Internet Branch.

Customer Contact Center

The Türkiye Finans Customer Contact Center holds the Customer Contact Centers Service Standard (EN 15838: 2009). This standard defines the technical requirements necessary for call centers to provide their call center services and their management system needs and includes specific requirements at international standards for call centers. The Türkiye Finans Customer Contact Center successfully passed the audit in 2016 and renewed its certification.

The Customer Contact Center, which is one of the Bank’s important sales channels, contacted customers through 4.8 million calls in 2016. The Center, which stands out with an approach focused on speed, quality and customer satisfaction, realized sales of 238,000 products and their activation by offering products that meet the needs of its customers. The Center also continued to implement value added services to increase customer satisfaction and loyalty throughout the year.

ATM Banking

As a result of new investments undertaken in 2016 within the scope of the ATM expansion strategy, Türkiye Finans increased the total number of ATMs to 572 and the number of non-branch ATMs to 188.

Developmental work continued during 2016 with the aim of providing a faster and uninterrupted service to customers through the ATMs. In this context, better equipped ATMs were put into service by defining innovative applications and new functions. In addition, the user experience was improved with re-designed screens and process flows.

The Recycle ATM Project, which allows the money deposited in ATMs by customers to instantly be used for the transactions of other customers, was completed and put into service for Türkiye Finans customers.

Campaigns carried out and their results

In 2016, under the new Internet Branch launch, various campaigns were offered to customers including special benefits, rewards and discounts. In addition, promotional activities were organized as well as the comprehensive campaign, in which gifts were distributed and accordingly transaction and customer channel migration was achieved. As a result of these activities, the level of product sales executed from digital channels stood at over 180,000 units in 2016.

With the activities carried out throughout the year, innovative applications aimed at increasing the preference of other digital channels and their effective use were implemented.

The New Internet Branch

In 2016, Türkiye Finans commissioned the new Internet Branch that is fast, user friendly and through which new sets of transactions and services are offered, consistently exceeding customer expectations. The new Internet Branch is structured in two main segments including Personal and Corporate Internet Branch. The features of the platforms, where personalization stands out and which are aimed at a better customer experience, were enhanced. The aim here is to ensure that banking transactions are carried out in a more practical and healthier manner with their new design and multilingual support.

Expectations for 2017

Türkiye Finans’ digital banking transformation will gain pace in 2017. Accordingly, the Bank expects to step up its investments in digital platforms.

The Bank plans to commission a raft of new projects in 2017 that will add value to Türkiye Finans and its customers, including the implementation of new transactions, new features and services such as becoming a customer of the Bank and transferring money from one mobile phone to another, the facility to withdraw cash from ATMs without a card with QR code and iBeacon technologies, facilitating and optimizing the password/password processes of digital channels through the web site and mobile applications.

In addition, in the coming period, the Bank will continue to invest in expanding its non-branch ATM network to meet its customers’ cash needs.

Türkiye Finans diversified its lease certificate investment portfolio with the lease certificates indexed to the Consumer Price Index (CPI) in 2016.

Treasury

An optimal liquidity level with effective asset liability management

In 2016, Türkiye Finans aimed to achieve sustainable profitability by effectively managing its profit share and legal ratio risks through its strong foreign exchange position management. In this context, it succeeded in achieving an optimal level of liquidity by taking into account the legal and intra-bank liquidity ratios and strategies.

Also, in 2016, Türkiye Finans diversified its lease certificate investment portfolio with the lease certificates indexed to the Consumer Price Index (CPI).

Qualified solutions for exchange rate volatility with the Forward product

Türkiye Finans continues to offer services to its customers through its branches, electronic platforms and direct communication channels. The Forward product was effectively promoted and its application was explained in the customer, regional and branch visits carried out by the Bank in 2016. The Forward product is intended to reduce the impact customers may face from exchange rate movements experienced throughout the year.

On the other hand, as in previous years, in 2016, customers were briefed on the use of both TFX TARGET and integral foreign exchange trading platforms.

A pioneer in foreign exchange transactions with the ever-evolving TFX TARGET platform

In 2016, new customer acquisitions were accelerated with TFX TARGET and helped the Bank’s profitability target to be minimally affected even in volatile market conditions, thanks to its massive customer base. The Bank added a new function to TFX TARGET by enabling forward transactions to be conducted through the platform, thus maintaining its position of being a pioneer in the banking sector.

Expectations for 2017

In 2017, effective strategic balance sheet management will continue to become more prominent. In this context, work aimed at implementing the strategies determined by changing market conditions and balance sheet developments will be also carried out in the forthcoming periods.

In 2017, a risk map was set out to protect customers using the Türkiye Finans Foreign Exchange Loan from possible exchange rate movements. In this framework, informative visits will be conducted to customers deemed to be the most vulnerable to such risk, where they will be advised of hedging.

The mobile infrastructure work for the TFX TARGET platform will be completed in 2017. This work will allow pricing from a mobile phone initially, before being expanded to include tablet devices.

International Banking

Expanding the correspondent bank network

In 2016, Türkiye Finans unwaveringly continued activities to develop its correspondent relations despite the political, economic and geopolitical developments in Turkey and the world. Within the framework of these activities, the Bank developed new strategies within the scope of its international banking activities by taking into account the countries where Turkey has intensive foreign trade relations, along with the transaction volumes and demands of its customers.

Attaching importance to the diversity of Turkey’s foreign trade partners and the continuity of customer transactions in the new markets concerned, Türkiye Finans has been serving customers with its extensive correspondent network, especially in Africa transactions. Within the scope of the determined strategies, the Bank succeeded in establishing correspondent banking relationships with banks that have both a global and local scale in the new countries.

In 2016, the number of correspondent banks with which Türkiye Finans has a mutual credit limit relationship reached 231 and the opportunity to easily trade with every country of the world was made possible through the branches of correspondent banks.

The level of awareness and credibility that the correspondent banks brought the Bank has been increasing year after year in line with the volume of foreign trade. Under the agreements signed with the correspondent banks and international institutions for the financing of foreign trade, long-term funds were extended to customers who import within the scope of the Saudi Export Program (SEP), Export Credit Agency (ECA) and World Bank loans.

On the other hand, with foreign trade volume approaching USD 40 billion, efforts to bring foreign resources to the Bank in line with the Bank’s strategies continued effectively. Likewise, syndications organized for corporate companies were followed up through the correspondent banks and the Bank participated in transactions of companies providing favorable conditions for Türkiye Finans.

In addition, long term funding was obtained from correspondents of Türkiye Finans for a number of corporate customers. Under the Türkiye Finans guarantee, customers were able to benefit directly from foreign financing resources with affordable conditions.

We offer reliable investment alternatives with our sukuk/lease certificate issuances.

Türkiye Finans has introduced many firsts in its sukuk/lease certificate issuances.

Since its establishment, as a participation bank that provides direction to the sector, Türkiye Finans has offered its customers investment and financing solutions through innovative products. In this context, the Bank became the first and only participation bank to implement the issuance of lease certificates in the financing of the real sector in Turkey. The work in this vein continued unabated in 2016.

Through domestic and international issuances, Türkiye Finans offered highly profitable and reliable investment alternatives to its customers. Furthermore, with the resources obtained from these issuances, the Bank provided companies with affordable funding with attractive terms.

In 2016, Türkiye Finans issued approximately TL 1 billion of lease certificates with a maturity of 6 months.

In 2017, Türkiye Finans expects to continue to issue lease certificates within the scope of the TL 2 billion ceiling, whose application was approved, in line with the market conditions and the Bank’s funding and liquidity needs.

International murabaha transactions

As of the end of 2016, the sum of the borrowings realized by Türkiye Finans, excluding the sukuk/lease certificate transactions, stood at USD 2,549 million.

Expectations for 2017

Also in 2017, within the framework of its corporate strategy, Türkiye Finans will continue to diversify its portfolio of correspondent banks and investors. In this context, it will continue to evaluate new borrowing transactions in light of market conditions and customer demands.

By increasing investments in digital channels and organizing various campaigns through these channels, Türkiye Finans developed the Facebook application, “Win with Shooting” (Şutla Kazan) for basketball fans.

Corporate Communication

Türkiye Finans continued to execute its multi-channel strategy successfully on the axis of corporate communication.

In 2016, Türkiye Finans focused on corporate communication campaigns on digital platforms, as well as in written and visual media.

Türkiye Finans continued to stand with its customers by providing uninterrupted support in all conditions and at all times without compromising the principles of participation banking. In this respect, Türkiye Finans used outdoor and interior space channels in a planned and systematic manner with its advertising campaigns prepared for this purpose.

At the same time, the Bank continued to work on raising brand awareness through various channels and fields such as television, radio, the internet, newspapers, magazines, outdoor advertising, shopping malls and stadiums.

Renewal of Türkiye Finans’ personal and corporate internet branch

Türkiye Finans transformed the Internet Branch into something “more like a conventional branch” in order to facilitate its customers’ access to internet banking services. The renovated Türkiye Finans Internet Branch was offered to users with a more practical, quicker and convenient design.

Türkiye Finans has also been bringing in digital platforms.

By increasing investments in digital channels and organizing various campaigns through these channels, Türkiye Finans developed the Facebook application, “Win with Shooting” (Şutla Kazan) for basketball fans.

With this application, the ten users to score the most points in 1 minute by shooting the highest number of baskets were given the chance to watch the Fenerbahçe basketball team’s Turkish Airlines Euroleague game at the Ülker Sports Arena.

Türkiye Finans Rowing Team continues to win awards

The Türkiye Finans Rowing Team achieved 3rd place in the category of Dragon Festival Boat Races organized in İstanbul between 28-29 May 2016, in cooperation with İBB (The İstanbul Metropolitan Municipality) Youth and Sports Directorate and the Turkish Canoe Federation.

The Dragon Fest is one of the most widely attended events with the participation of national and international companies and is organized among institutions. The Türkiye Finans Rowing Team has been taking part in the Dragon Fest for three years and has won the “the Best Team Spirit” award for the last two years in succession.

In 2016, the Rowing Team, which is one of the Bank’s most active clubs, participated in a number of sporting events such as the İstanbul Technical University Coastal Water Sports Festival and the Küçükçekmece Municipality Water Sports Festival and won a number of awards.

Our sustainability approach and practices

The sustainability strategy of Türkiye Finans, which is configured on the main axes of “good banking” and “good corporate citizenship”, is aimed at success on a social level and is focused on the result.

As a corporate citizen which takes responsibility, Türkiye Finans works to increase its contribution to society by undertaking good corporate citizenship projects as well as following good banking practices.

Closely following the work of national and international initiatives that are focused on international sustainability, the Bank implements the necessary regulations.

The sound, responsible, reliable and transparent banking approach that the Bank is committed to implementing for its stakeholders has been an indispensable element Türkiye Finans’ value since its establishment. The various awards won both in Turkey and in the world in 2016 stand as testament to the performance of Türkiye Finans, both in terms of its banking practices and its social contribution activities.

As a part of the society of which it is a member, Türkiye Finans will continue to add value, produce, develop projects and offer them to society throughout 2017, and fulfill its social responsibilities as well as remaining true to its primary mission.

65% e-receipt

The Bank encouraged the sending of credit card account statements by e-mail instead of in paper statements; the e-receipt ratio was increased to 65%.

Operational Services

Operation enhancing activities increase efficiency

In 2016:

Within the scope of Payment Systems Operational Activities;

- By expanding the transaction functions and authorities of the branches, process stations in customer services were reduced service delivery times were shortened.

- Version updating was initiated for about 35,000 POS devices on site.

- A 63% improvement was achieved thanks to the improvement program implemented to enhance the competency of employees.

- The Bank encouraged the sending of credit card account statements by e-mail instead of in paper statements; the e-receipt ratio was increased to 65%.

Within the scope of Banking Services Operational Activities;

- As part of the efficiency projects carried out, significant savings were achieved by improving the business processes. Requests from branches were resolved through support from the head office, or were directed to the relevant units for solution.

- The Operation Support Line, established in June 2015, continued to provide operational support to the branches as the Operation Support Desk Service from January 2016.

Within the scope of Loan Operational Activities;

- As part of the operation carried out, a 35% increase in productivity was achieved in transaction numbers. Significant increases were seen in the operational revenues of the Small Business, SME, Corporate and Commercial segments through systematic developments.

Within the scope of Commercial Loan Control Activities;

- The quality and speed of transactions was increased by providing interactive training to the branches concerning the products and processes, along with automation measures. A 60% improvement was achieved in the incoming offer return rates at the branches.

Within the scope of Organization and Process Development Activities;

- The following changes were implemented in the Bank’s organizational structure.

- Region Allocation Directories were established to report directly to the Executive Vice President of Direct Loans.

- The Treasury Department was restructured into two separate units; the Assets and Liabilities Management Department and the Treasury Marketing Department.

- The name of the Internal Control Department was changed to the Internal Control Directorate and the name of the Legislation Compliance Department was changed to the Compliance Directorate.

- The Cash Management Department was put into operation with the aim of ensuring that customers’ cash flows be carried out through the Bank with the products to be developed.

- The Information Systems (IS) Business Group and the Operation Business Group were united under the name of the Information Systems and Operation Business Family.

- The name of the Risk Monitoring, Collection and Legal Business Group was changed to the Loan Quality and Collections Business Group. Two new units that are named as Loan Quality and Collections Analytical Directorate and Specialty Collections Directorate were added to this business group.

- The position of Senior Executive Vice President responsible for Internal Systems, to which Internal Systems units would report to. The Senior Executive Vice President will report to the Audit Committee.

- The position of Chief Legal Counsel was set up. The Chief Legal Counsel will report directly to the CEO.

Restructuring and process improvement activities were carried out in Türkiye Finans during 2016 under the scope of 8 projects and programs and a total of 43 IS and non-IS improvement activities were carried out. This achieved substantial savings both in labor and operational costs.

Expectations for 2017

In 2017, Türkiye Finans plans to carry out activities on signature and authority analysis, branch transaction approvals, şubematik, fax management, joint transaction pool, OCR (Optical Character Recognition) & ICR (Intelligence Character Recognition) integration, centralization, e-signature/KEP (Registered E-Mail: REM) the imo and easy infrastructure within the scope of service quality and process efficiency activities.

Other operational projects that the Bank aims to implement in 2017 are summarized below.

- The Bank plans to continue process improvement and digitization activities in order to minimize branch operational risks, achieve efficiency in card payment systems’ operations, minimize risks and improve customer experience.

- The Bank aims to centralize EFT (Electronic Funds Transfer) remittance transactions and extend this from pilot branches to all branches. The collection of tax and Social Security Institution (SGK) payments are also planned to be centralized. In addition, the Bank plans to continue Social Security Institution (SGK) / E-Distraint project activities.

- It is aimed to implement improvement and new design activities in the application and flow of collateral accounts, collateral cheque blocks, limit risk calculations, commercial and consumer installment collections.

- In 2017, centralized control activities are planned to be carried out in order to minimize operational risks arising from differences.

92% virtualization

By virtualizing the Remote Desktop Server (RDS)servers, the Bank’s virtualization ratio was raised from 89% to 92%, thereby providing ease of installation and management.

Information Systems

A 100% success rate in Business Continuity tests

Türkiye Finans was the first bank in the Turkish banking sector to receive the Business Continuity Certificate.

Türkiye Finans once again attained a strong success rate in business continuity activity tests conducted in 2016, extending the run of success achieved in previous years. As a result of the audits carried out by the British Standards Institute (BSI), the compliance of the Business Continuity System, which encompasses all of Türkiye Finans’ units and branches, to the international ISO 22301 standard was once again confirmed.

Türkiye Finans’ Information Systems Transformation Program, which was completed in 2016 commanded the number one position in the Corporate Transformation Category and the number two position in the Technology Services Category within the scope of IDC Technology Awards. The Bank also received the CIO of the Year Award from the CIO Magazine.

Türkiye Finans’ Data Center ranked above average in Turkey in terms of energy efficiency

The Türkiye Finans’ Data Center holds Turkey’s first Tier III Operating Certificate, ensuring high security and instant monitoring and control functions of electrical/mechanical load, heat and humidity conditions and achieving high efficiency in energy usage, as well as a level of energy efficiency which is higher than Turkey’s average.

As of the end of 2016, the Türkiye Finans Data Center operated at an occupancy ratio of 39%. In 2016, the Data Center provided significant energy savings with its numerous features. The Data Center’s performance has also won acclaim from domestic and foreign companies and attracts frequent visits.

Türkiye Finans aims to replace the Data Center’s lighting with LED technology and cut its annual energy costs by 49.8%.

Improvement in the Information Systems and development activities

By virtualizing the Remote Desktop Server (RDS) servers, the Bank’s virtualization ratio was raised from 89% to 92%, thereby providing ease of installation and management. Türkiye Finans invested in some of the most advanced and best performing All Flash Storage systems. In first phase, high performance was achieved by moving all virtual servers to this structure.

Türkiye Finans ensures the security of the services that it offers to its customers and employees throughout the business cycle by investing in the latest technologies.

The Bank defines confidentiality, integrity and accessibility values of corporate information at the appropriate level of classification and prevents all kinds of internal and external threats by deploying effective security measures. Türkiye Finans conducts its activities effectively, accurately and safely in this direction.

In 2016, the old security technologies that reached the end of their technological lifecycle were upgraded to the latest and effective technologies and the security level was increased against APT (Advanced Persistence Threat) in e-mail, web and Endpoints.

Similarly, in 2016, an interface study was carried out aimed at increasing internal customer satisfaction by taking employees’ opinions and suggestions into account. In the study, users provided feedback concerning the problems experienced and their requests and rapidly obtained information about the opened requests. The application was integrated into the Business Solution Center service with the Interactive Voice Response (IVR) system and efforts to improve the end user service level and satisfaction were completed.

In 2016, a total of 143,000 records, including 62,000 requests and 81,000 event records, were managed by the Automation System. The SLA (service-level agreement) compliance measurements and reportings have been started to be made by monitoring the event records and returns of the contracted external companies, from which services are obtained.

Oracle databases were modernized to ensure a modern infrastructure and were consolidated on a single platform; the consolidation paved the way for savings from the server and disk space usage and licensing costs were reduced. Additionally, the management of databases was simplified in operational terms by ensuring the performance of applications ran twice as quickly.

Expectations for 2017

Efforts to establish the Türkiye Finans R&D Center process are planned to be sped up. The Bank’s objective is to meet its own needs with the activities to be carried out in the R&D Center and to develop export opportunities through international institutions. Within the scope of the activities carried out, an agreement on academic cooperation was reached with the Gebze Technical University (GTU) and a protocol was signed with the Bilkent University Department of Industrial Engineering. The Bank aims to cooperate with companies that concentrate on FinTech technology in its R&D studies.

Türkiye Finans will relocate the General Directorate to its new building in 2017 and necessary IT infrastructure work for the new Head Office building has been scheduled. The Bank aims to establish a high speed communication infrastructure with backup through dark fiber between two locations.

Türkiye Finans has carried out software development studies including master plan projects, transition requests to implementation and problem solutions with agile methods. A total of 42 scrum teams were appointed for these projects. With this structure, Türkiye Finans is the largest organization in Turkey to work with agile work management.

In addition, a total of 32 master plan projects, 4,088 requests for transition to implementation and 5,517 problem recording resolution activities were completed in this context during 2016. Eight master plan projects are planned to be completed in January 2017.

During 2017, Türkiye Finans will carry out activities concentrated on the fields of digital transformation and efficiency.