(‘000 TL) |

31 December 2016 |

31 December 2015 |

Change (%) |

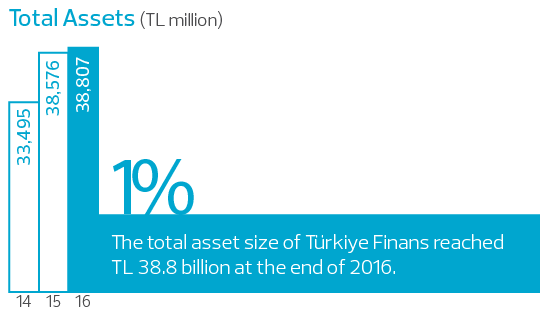

Assets |

38,807,717 |

38,576,299 |

1 |

|---|---|---|---|

Cash and Banks |

6,230,623 |

5,597,872 |

11 |

Securities |

4,063,820 |

3,173,456 |

28 |

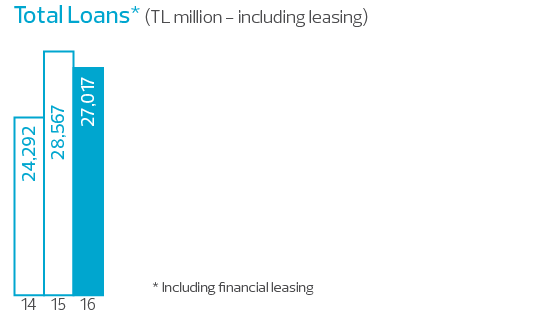

Loans |

25,599,230 |

27,014,513 |

(5) |

Receivables from Leases |

1,417,512 |

1,552,415 |

(9) |

Fixed Assets (Net) |

741,309 |

512,130 |

45 |

Other Assets |

755,223 |

725,913 |

4 |

|

|

|

|

Liabilities |

38,807,717 |

38,576,299 |

1 |

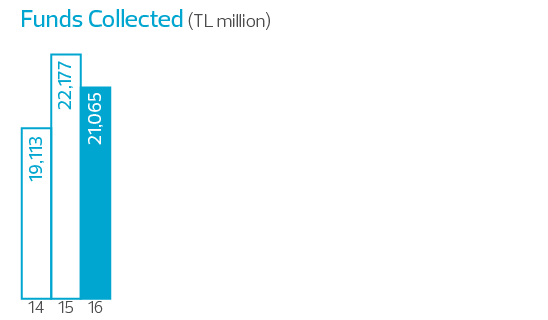

Funds Collected |

21,064,781 |

22,177,414 |

(5) |

- Special Current Accounts* |

5,773,877 |

5,432,281 |

6 |

- Participation Accounts* |

15,290,904 |

16,745,133 |

(9) |

Loans Received |

10,256,573 |

8,657,646 |

18 |

Subordinated Loans |

890,500 |

733,023 |

21 |

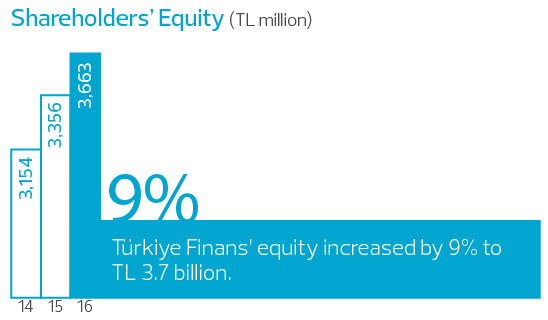

Shareholders’ Equity |

3,663,014 |

3,356,757 |

9 |

Paid-Up Capital |

2,600,000 |

2,600,000 |

0 |

Other Liabilities |

2,932,849 |

3,651,459 |

(20) |

|

|

|

|

Non-Cash Loans |

12,361,123 |

12,502,404 |

(1) |

|

|

|

|

Income and Expense Accounts |

01/01/2016-31/12/2016 |

01/01/2015-31/12/2015 |

|

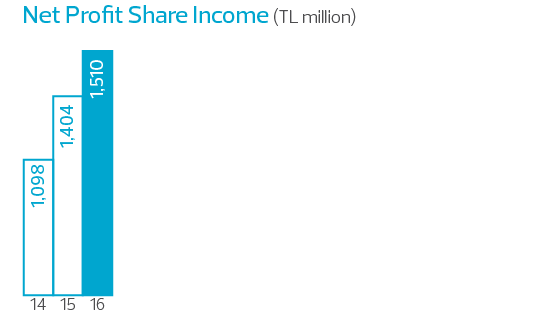

Profit Share Income |

2,981,301 |

2,780,246 |

7 |

Profit Share Expenses |

(1,471,762) |

(1,375,984) |

7 |

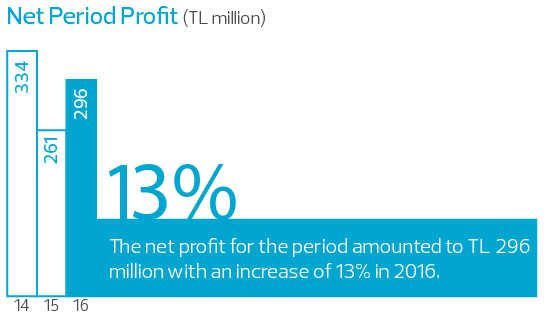

Net Profit Share Income |

1,509,539 |

1,404,262 |

7 |

Net Fee and Commission Income |

143,012 |

142,469 |

0 |

Other Non-Profit Income |

413,083 |

145,108 |

185 |

Non-Profit Share Expenses |

(1,696,559) |

(1,359,014) |

25 |

Profit Before Tax |

369,075 |

332,825 |

11 |

Provision For Taxes |

(72,832) |

(71,749) |

2 |

Net Period Profit |

296,243 |

261,076 |

13 |

|

|

|

|

Key Ratios |

31 December 2016 |

31 December 2015 |

|

Capital Adequacy Ratio |

15.58% |

13.51% |

|

Return on Equity (Annual) |

8.44% |

8.02% |

|

Loans / Total Assets** |

69.62% |

74.05% |

|

Current Accounts / Funds Collected |

27.41% |

24.49% |

|

Non-Performing Loans (Gross) / Loans |

5.00% |

4.27% |

|

|

|

|

|

Other |

31 December 2016 |

31 December 2015 |

|

Total Number of Branches |

286 |

286 |

|

Total Number of Personnel |

3,989 |

4,132 |

|

* Special current accounts and participation accounts include precious-metal accounts.

** Loans include financial leasing receivables.