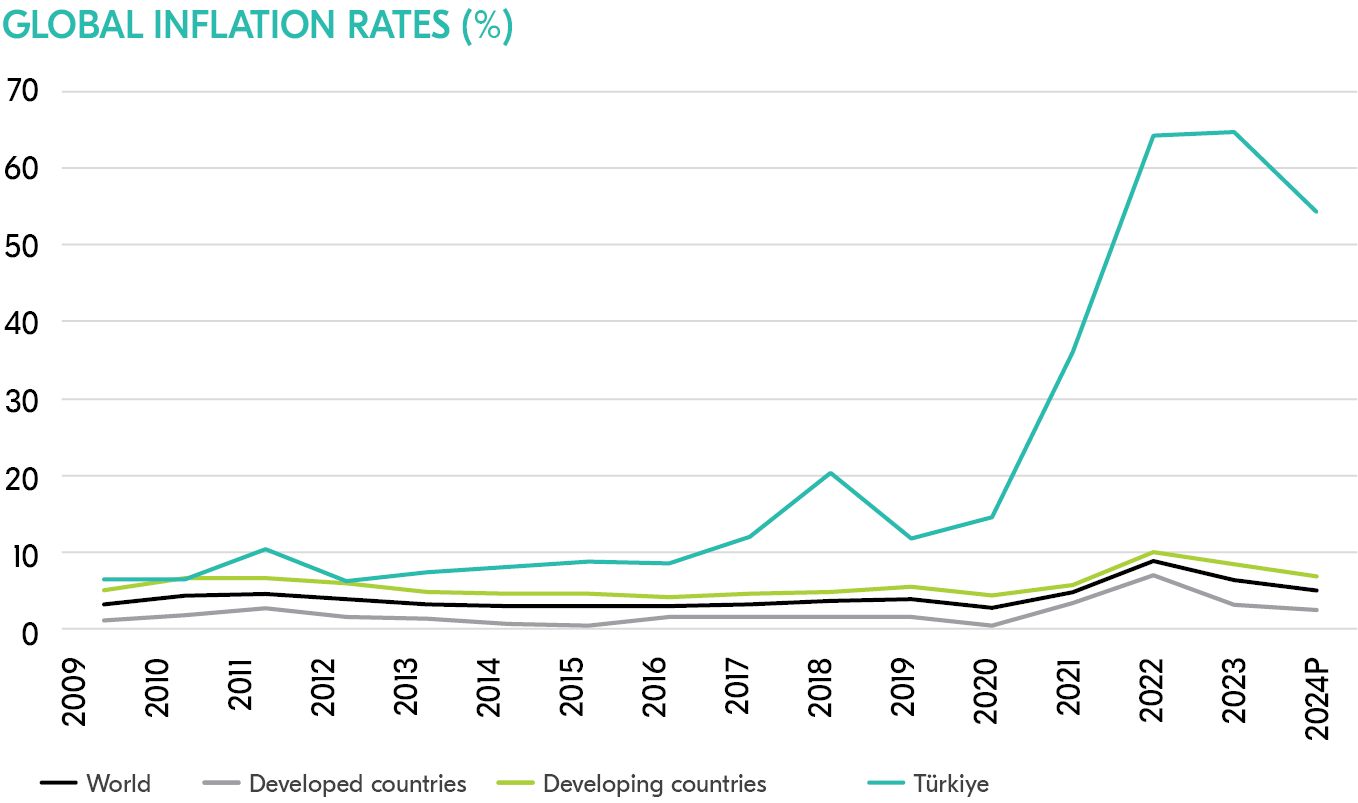

The global inflation, which ended the year 2022 at 9.4%, declined to 5.5% by the end of 2023.

Global Economic Outlook

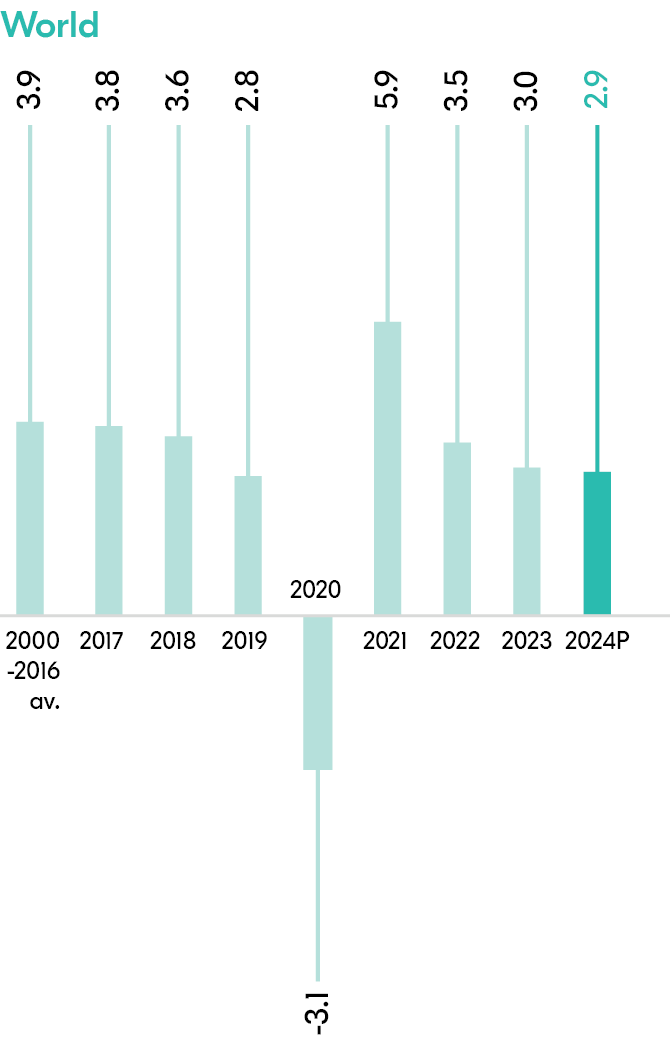

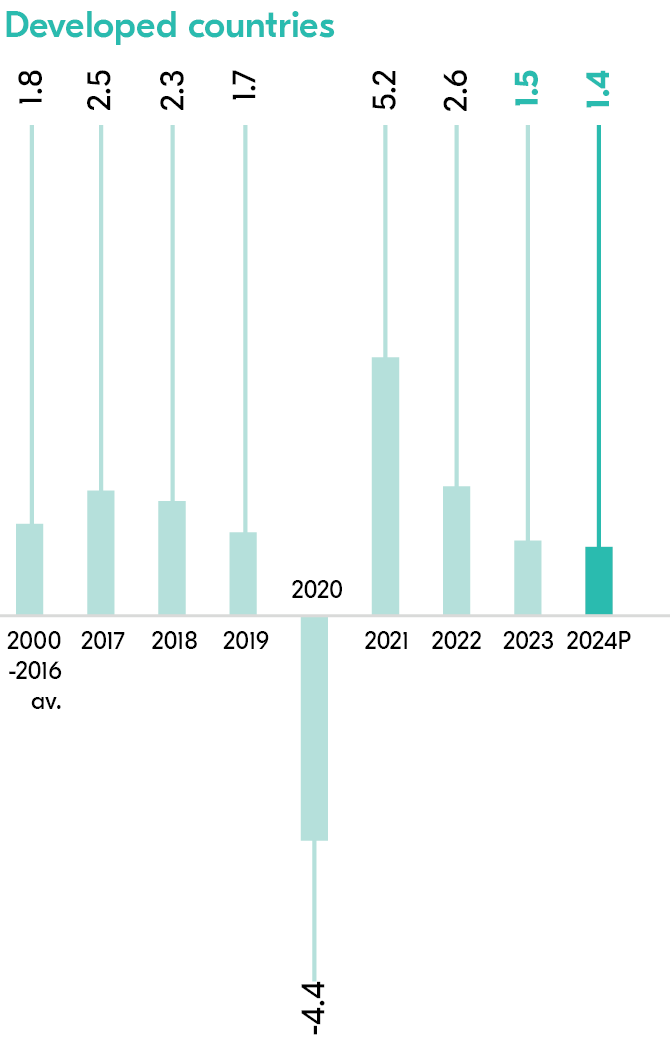

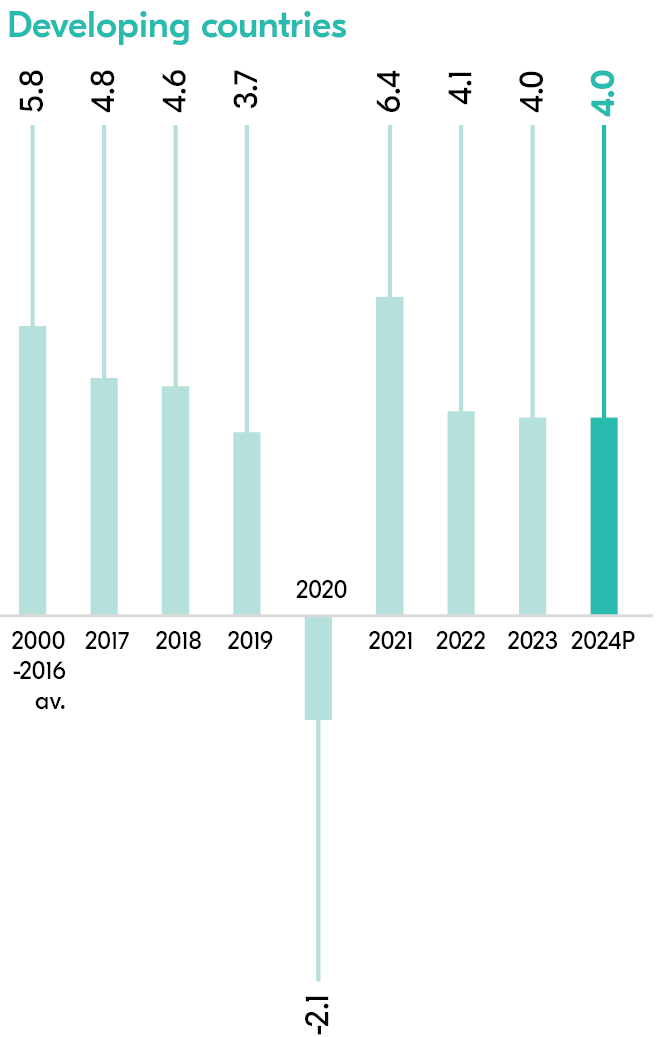

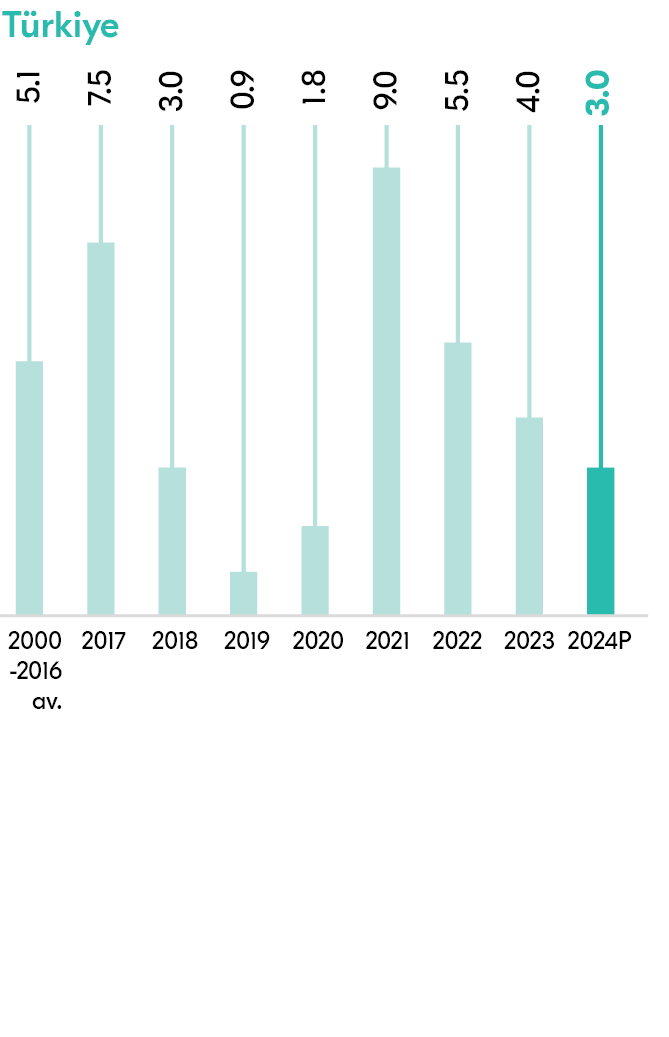

poised to be a year of weak growth, leading to discussions about interest rate cuts. In 2022, global central banks responded to the high inflation triggered by supply shocks due to COVID-19 and spikes in commodity prices caused by the Russia-Ukraine war with the tightest monetary policy in the last 25 years. However, the effects of the tightening monetary policy started to be felt in the global economy. Indeed, global inflation, which ended the year 2022 at 9.4%, declined to 5.5% by the end of 2023. The cost of the decline in inflation was mainly borne by growth. The global economy, which grew by 6.1% in 2021, expanded by only 3.5% in 2022 and it is estimated that the growth rate decreased to 3.1% in 2023.

Looking ahead to 2024, global growth is expected to remain significantly below the average of 3.8% for the years 2000-2019, at 3.1%. It is anticipated that emerging economies will contribute to global growth. Growth expectations for the United States, the Eurozone, and Japan in 2024 are around 1%.

In developing countries, Brazil is expected to accelerate growth as interest rate cuts begin, while countries like Russia and Turkey will see the negative impact of interest rate hikes reflected in growth.

As a result of the global monetary tightening implemented, inflation, which declined in 2023, is expected to continue to decrease in 2024, and the delayed impact of tight monetary policy will become even more pronounced. In this context, it is expected that inflation will approach pre-COVID-19 levels in almost all countries, but it is expected to exceed these levels.

In 2023, policy interest rates in most countries have reached their highest levels in the last 25 years, while it can be observed that the sizes of balance sheets have declined, albeit limitedly.

Regarding monetary policy, a period of tightening by central banks since 2022 is coming to an end. Developing countries started tightening early, while developed countries, which felt inflation pressure later, began raising interest rates and reducing balance sheets towards the second half of 2022. At this point, policy interest rates in most countries have reached their highest levels in the last 25 years, while it can be observed that the sizes of balance sheets have declined, albeit limitedly. However, these sizes still remain significantly above pre-COVID-19 levels. The total balance sheet size of the Federal Reserve, ECB, Bank of England, and Bank of Japan, which was USD 15 trillion before COVID-19, stood at USD 21 trillion at the end of 2023. This number had risen to USD 25 trillion in 2020.

GSYH BÜYÜME ORANI (%)

Source: IMF, TÜİK, TCMB

3.1%The global economy, expanded by only 3.5% in 2022 and it is estimated that the growth rate decreased to 3.1% in 2023.

The Turkish economy, which achieved growth based on domestic consumption in 2023, grew by 4.5% on an annual basis.

Outlook of the Turkish Economy

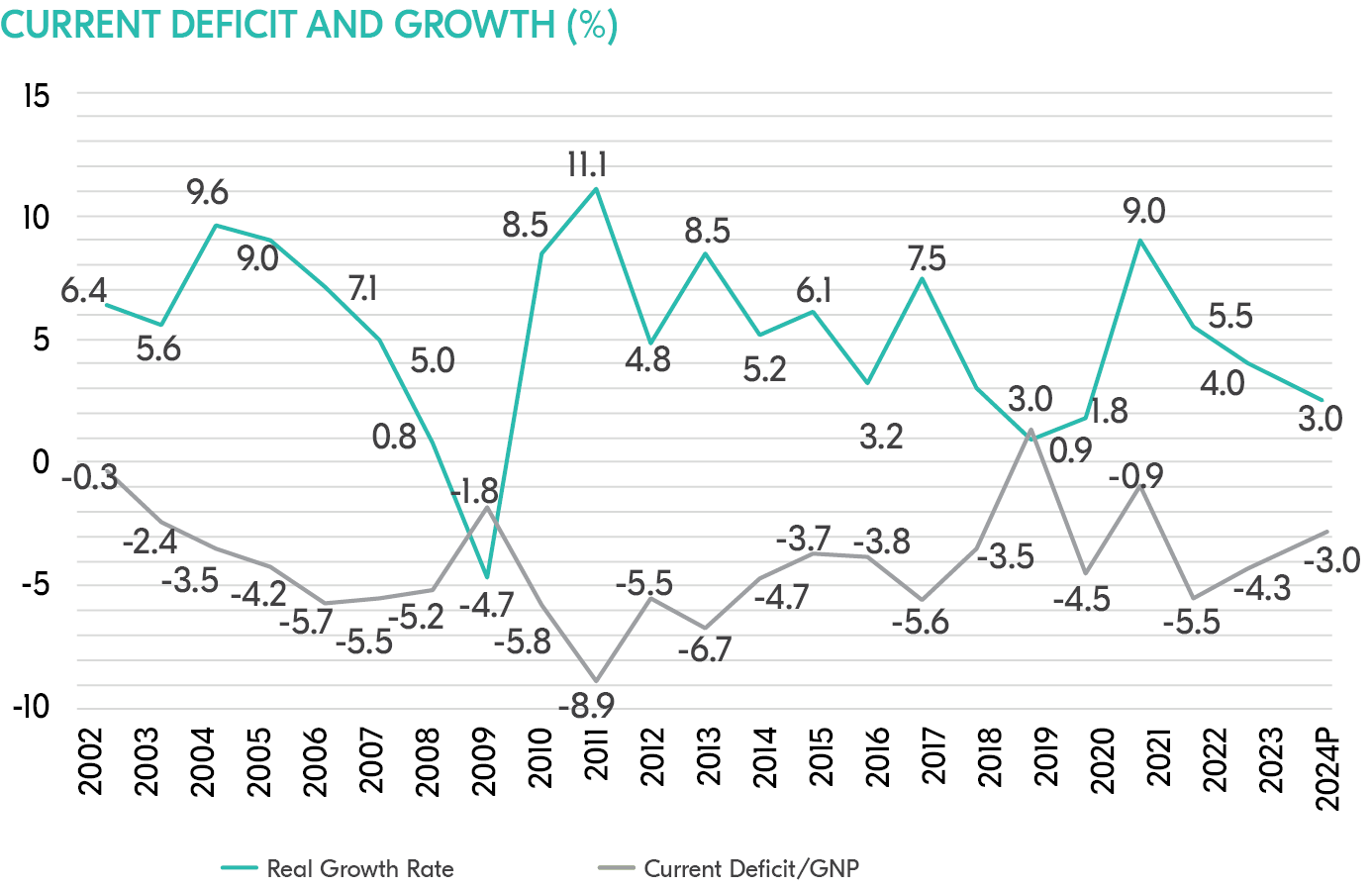

The Turkish economy achieved high growth rates in the years 2021-2022, when global demand was strong, thanks to the contribution of external demand as well. However, starting from the third quarter of 2022, with the already high inflation environment, the rapid increase in consumer credit growth due to excessively loose monetary policy, along with the early retirement law (EYT) and the increase in the minimum wage stimulating consumption, the composition of growth began to shift towards being entirely based on domestic consumption. Despite high credit growth and low interest rates, the contribution from investments was negative in 2022, but it turned positive in 2023 due to a low base and improvement in long-term expectations with changes in economic management. GDP growth, which was 4.0% in the first half of the year, increased to 6.1% in the third quarter, while quarter-on-quarter growth was 0.3%. The largest contribution to growth in 3Q23 came from private consumption, which grew by 11.2% annually, contributing 6.4 percentage points, surpassing investment growth for the first time since 1Q21. Growth slowed down to 4.0% quarter-on-quarter in 4Q, while the contribution of private consumption continued at 6.7 percentage points. Annual growth rate was realized as 4.5%. Due to monetary tightening, consumer spending may almost come to a halt and significant slowdown might occur in 2024 due to the impact of “holidays and bridging days” suppressing growth. On the other hand, the construction sector will remain strong thanks to the reconstruction of the earthquake zone.

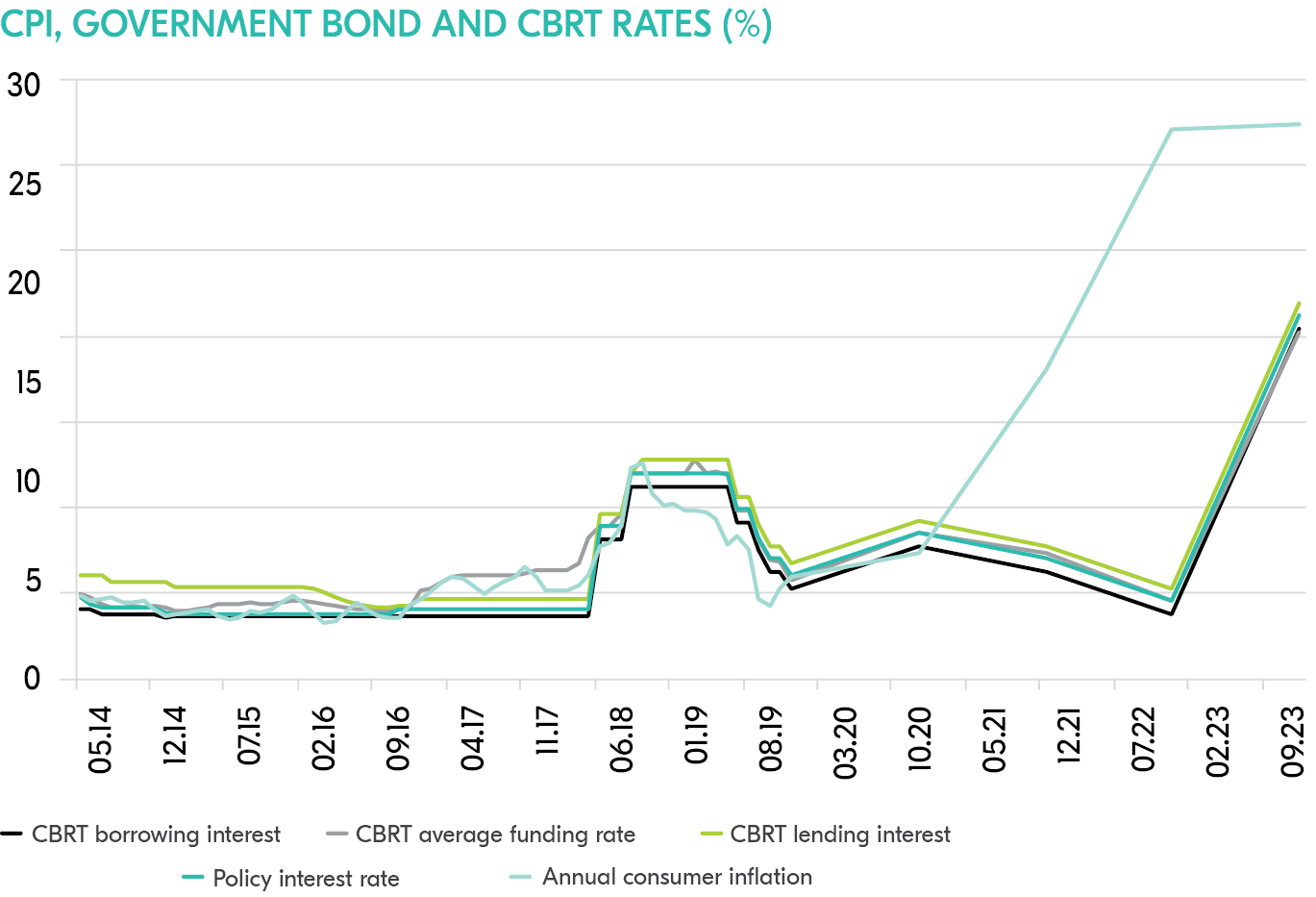

Consumer inflation, which ended 2022 at 64.3%, continued to be high throughout 2023, reaching 64.8% by the end of the year.

Looking at the employment side, in Turkey, the minimum wage reached 520 Euros for the year 2024 with a significant increase of about 24.5% annually. This increase, which corresponds to a 99.8% increase in Turkish Lira terms, may have a more pronounced effect, especially on low-tech and low value-added producers, and may lead to some job losses, particularly in the early months of the year. Rising wages may keep consumer appetite strong in the first quarter, but higher deposit interest rates compared to previous years will encourage individuals to increase their savings rates. Therefore, if there is no further increase in wages, a decrease in household demand is likely in the second half of the year.

The Turkish economy witnessed a decline in the unemployment rate to single-digit figures due to erosion in real wages and strong economic growth. Experienced workers leaving the labor market after the early retirement law allowed unemployed individuals to rejoin the workforce. However, with the tightening measures implemented by the Central Bank of Turkey (TCMB), the unemployment rate may rise to low double-digit levels in 2024. This situation may pose difficulties for low value-added producers and SMEs and may lead to some reduction in the workforce.

In mid-August, the TCMB implemented a decision to set targets for exiting the currency protection deposit program (KKM).

Consumer inflation, which ended 2022 at 64.3%, continued to be high throughout 2023, reaching 64.8% by the end of the year. Although there was a slight decrease in inflation in the first 5 months due to the resilient trend in the Turkish Lira, tax revisions, the increase in the exchange rate against the TL, and strong demand pushed inflation upwards. Despite a relaxation in energy prices, headline inflation remained below core inflation during this period, with core inflation and PPI completing the year at 70.6% and 44.2%, respectively. In December, service inflation increased significantly by an annual rate of 90.66%, setting a new record in the series recorded since 2003. Among service categories, especially rent inflation closed the year at 108.6%, while annual transportation service inflation was 92.4%, hotel inflation was 93.2%, and restaurant inflation was 93.2%. However, due to the 49% increase in the minimum wage and revisions in administered prices (such as excise tax increases on fuel and alcohol prices), monthly inflation surged in January. It is expected that inflation will peak in May, just before the base effect comes into play. A significant slowdown in inflation in 2024, especially with improvements on an annual basis due to base effects in the second half of the year, should be considered as the main scenario.The gross reserves of the Central Bank of Turkey (TCMB) exceeded USD 140 billion in 2023 with an increase of USD 12.3 billion. Following the change in management at the TCMB, the Bank accumulated reserves exceeding USD 40 billion, while the Bank’s net open foreign exchange position, including swaps with banks, decreased from -USD 76 billion in June to -USD 45 billion in December. Reserve accumulation is expected to continue in 2024. In mid-August, the TCMB implemented a decision to set targets for exiting the currency protection deposit program (KKM). Although there has been a slowdown in the past few weeks, the initial downward trend continues, with exits from the KKM reaching approximately USD 50 billion. The TCMB’s latest Monetary Policy report for 2024 suggests that the liraization strategy will continue, with a proposal for TL deposits to account for 50% of total deposits in 2024. Currently, except for the KKM, TL deposits are at 41.5% as of the first week of the new year.

The central government budget, which had a deficit of TL 142.7 billion TL in 2022, amounted to TL 1,375.0 billion in 2023, equivalent to 5.4% of GDP, compared to 0.9% in 2022. The Medium-Term Program (OVP) announced in September indicated a deficit of 6.4% for 2023, especially due to earthquake-related expenditures. The program envisages a total expenditure of TL 3 trillion over four years for the reconstruction of areas affected by the earthquake (TL 762 billion in 2023, TL 1,062 billion in 2024, TL 566 billion in 2025, and TL 380 billion in 2026), which amounts to USD 75 billion when discounted from the future. It is estimated that a total of TL 800 billion occurred in 2023, with construction spending gaining momentum in 2024 due to the upcoming local elections. Therefore, while it is estimated that the budget deficit for 2024 may exceed 5% of GDP, this rate still indicates a lower level than the OVP’s projection of 6.4%.

The volume of deposits in the banking sector as a whole increased to TL 15,754 billion, chalking up a 69% rate of growth; participation banks, meanwhile recorded a 71% increase in collected funds to TL 1,550 billion.

The Banking Sector in Turkey and Participation Banking

According to the BRSA’s weekly bulletin, participation banks increased their allocated funds to TL 1,060 billion, recording a 65% rate of growth. This was in excess of the rate of growth in the banking sector, where total loans grew by 56% to reach TL 12,180 billion. On the other hand, the volume of deposits in the banking sector as a whole increased to TL 15,754 billion, chalking up a 69% rate of growth; participation banks, meanwhile recorded a 71% increase in collected funds to TL 1,550 billion. The average loans to deposit ratio among all banks was 76%, with the ratio among participation banks being around 67%.

There was an improvement in asset quality both in the banking sector and in the participation banking sector in 2023 when compared to the previous year. The NPL ratio in the sector decreased from 2.0% at the end of 2022 to 1.6% at the end of 2023, while this ratio decreased from 1.4% to 0.9% for participation banks. There was a decrease in the special prevision ratios for NPLs in the banking sector and an increase among participation banks. At the end of 2023, the special provision ratios for non-performing loans declined from 84% to 82% in the banking sector and rose from 99% to 99.8% among participation banks.

In 2023 the volume non-cash loans in the sector increased by 72% YoY, with an increase of 78% among participation banks.

The NPL ratio in the sector decreased from 2.0% at the end of 2022 to 1.6% at the end of 2023, while this ratio decreased from 1.4% to 0.9% for participation banks.

+57% The volume of assets held by Türkiye Finans at the end of 2023 stood at TL 240 billion, an increase of 57% YoY.

Evaluation of the Bank’s Position in the Sector in 2023

Türkiye Finans constantly strives to be not just a financial institution but rather a genuine business partner for all of its stakeholders. The Bank conducted its operations with 3,824 employees and a network of 305 branches in 2023.

The volume of assets held by Türkiye Finans at the end of 2023 stood at TL 240 billion, an increase of 57% YoY, while funds allocated, including the financial leasing receivables, which constitute the largest share among its assets, increased by 49% YoY to reach TL 122 billion, while funds raised, which account for the largest share in liabilities, amounted to TL 177 billion, an increase of 72% compared to the previous year.

At the end of 2023, the bank accounted for 1.0% of the sector’s allocated funds and 1.1% of the sector’s funds collected.

Maintaining its strong capital structure, Türkiye Finans increased its shareholders’ equity by 79% to TL 19.8 billion in 2023. With a capital adequacy standard ratio of 25.85%, Türkiye Finans closed the year 2023 with a profit of TL 5.8 billion, an increase of 101% YoY.