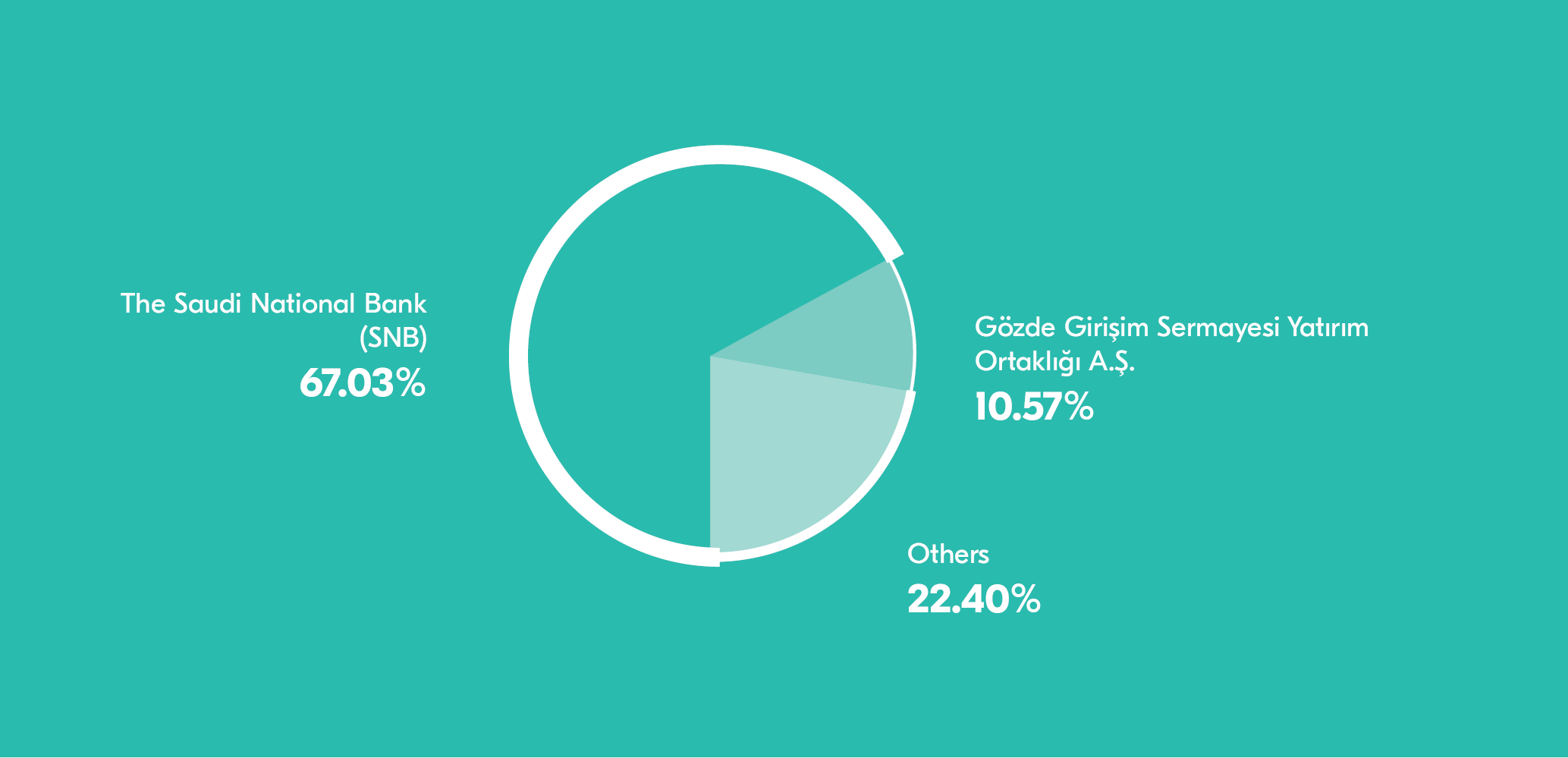

The Saudi National Bank is the controlling shareholder which holds the management control of Türkiye Finans through its 67.03% share in the paid-in capital.

Shareholder |

Share Amount (TL) |

Share Ratio (%) |

The Saudi National Bank (SNB) |

1,742,676,447 |

67.03 |

Gözde Girişim Sermayesi Yatırım Ortaklığı A.Ş. |

274,838,187 |

10.57 |

Others |

582,485,366 |

22.40 |

Total |

2,600,000,000 |

100.00 |

Information about shares

The Bank’s capital is represented by shares, each of which has a nominal value of TL 1.00 (one Turkish lira). All shares have been issued against cash and all are registered in the shareholder’s name. No shareholder nor any group of shareholders enjoys any preferential rights arising from their shareholding interests. None of the Bank’s shares are preferred shares.

Voting rights

At meetings of the Bank’s general assembly, shareholders may cast one vote for each share which they own or control and which is worth one Turkish lira. Shareholders may exercise their voting rights personally or through a proxy. Voting may be conducted by a show of hands, or by standing up, or by individually saying “aye” or “nay”; however it may also be conducted employing electronic devices, each one of which is individually assigned to each shareholder upon entry into the meeting place on the day the general assembly convenes or also by other means which allow cast votes to be counted. Recourse shall be had to secret ballots upon the demand of one twentieth of the shares represented at a general meeting.

The Saudi National Bank (SNB)

The National Commercial Bank (NCB) is the largest financial institution in Saudi Arabia. Since its inception in 1953, NCB has widely been seen by people as a reliable business partner and a symbol of innovation and leadership, both in their business lives and their private lives. The name NCB is derived from the Arabic name, “Bank Alahli”, which means national.

NCB’s 63-year history of growth and development is a reflection of Saudi Arabia’s progress towards contemporary civilization and continuous development. Today, NCB commands an important reputation in the eyes of its customers with its widespread and effective service capability and successful business partnerships. NCB responds to the needs of its customers with its existing product and service range, the innovative solutions which it offers to its customers and the technologies which improve the customer experience.

NCB carried out its first international acquisition in 2008 and became the controlling partner of Türkiye Finans, one of the leading participation banks in Turkey. NCB holds a 67.03% stake in Türkiye Finans.

In 2014, the Initial Public Offering of NCB’s 25% stake marked the beginning of a new era for the Bank and the Bank has now started to share the returns from its growth and many projects in the sector with its investors.

In 2021, NCB completed the merger with the Samba Financial Group and changed its trading name to The Saudi National Bank (“SNB”) with effect from 1 April 2021.

In 2023, SNB served 9 million customers from 470 branches in Saudi Arabia and is engaged in Islamic Banking with 3,654 ATMs and 8,460 employees throughout Saudi Arabia.

Among the first Saudi companies to implement Corporate Governance principles, SNB the first bank to receive the “International Business Continuity Management Certificate” in Saudi Arabia. The Bank also maintains its leadership in Corporate Social Responsibility. In this context, the Bank conducts a business opportunity program in which it provides consulting and funding support to entrepreneurs.

SNB is one of the largest banks in the Arab financial world with a paid-in capital of SAR 60 billion (USD 16 billion). As of the end of 2023, its total assets amounted to SAR 1,037 billion (USD 277 billion), while writing a net profit of SAR 20 billion (USD 5.3 billion) for the same period. Its shareholders’ equity increased to SAR 176 billion (USD 47 billion), while generating a Return on Equity of 11.7%.