Commercial Banking Group continued to adapt to economic and technological developments with an agile structure in 2023, sustaining its support for the economy.

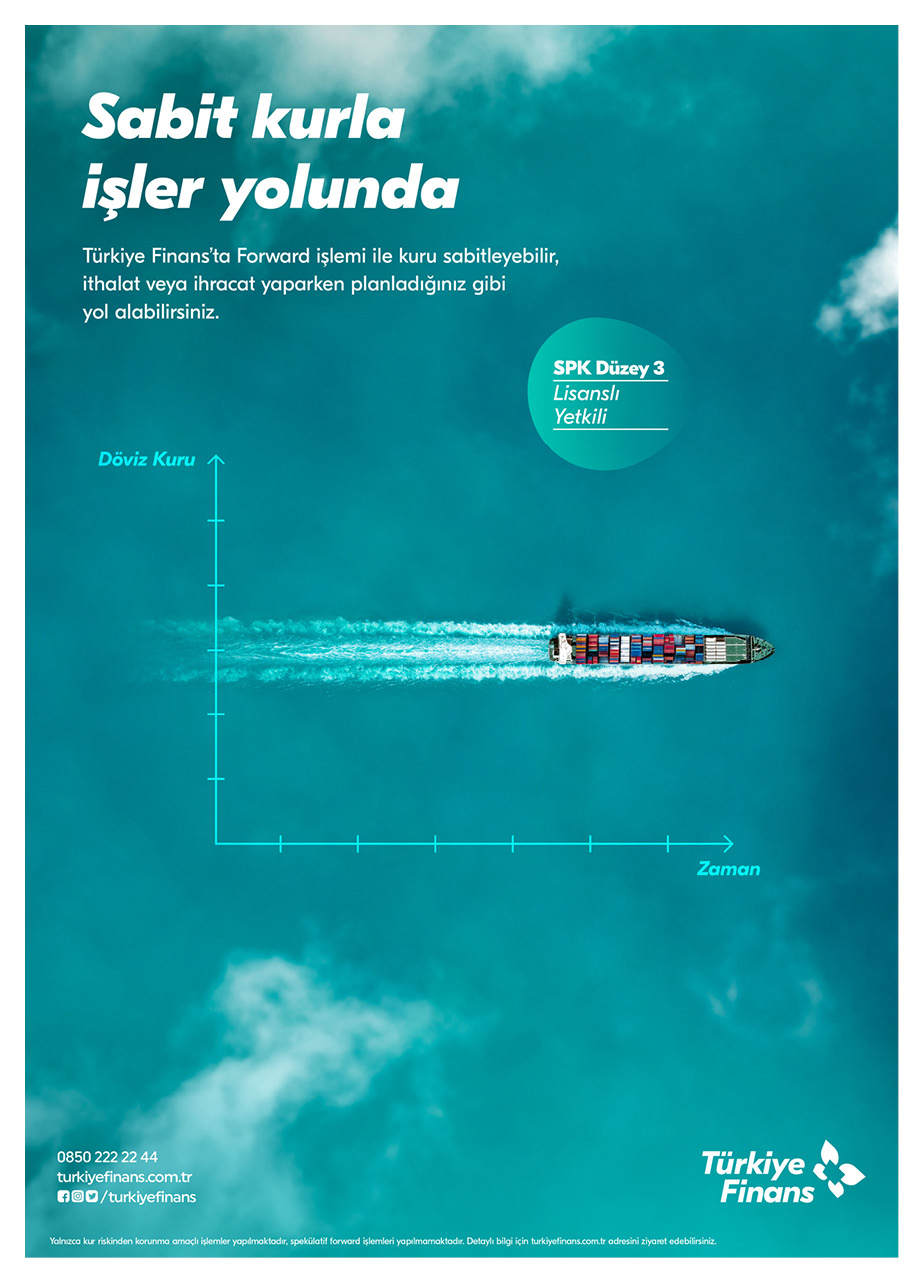

Term Export Financing (“TEF”)Aiming to increase its contribution to export financing, Türkiye Finans started to provide financing to its exporter customers with its product called Term Export Financing (“TE”), which was launched in 2023.

Commercial and Corporate Banking

Commercial Banking Group continued to adapt to economic and technological developments with an agile structure in 2023, sustaining its support for the economy. Its vision of creating end-to-end value has been decisive not only in meeting the current needs of Commercial and Corporate segment customers but also in shaping the future.

The Commercial Banking Group serves Corporate and Commercial segment legal entities and partners with a customer and user experience-focused expert team at a total of 46 branches, including 5 corporate branches, 40 commercial branches, and 1 free zone branch.

By achieving a growth of 128% in net operating income and 280% in non-interest income compared to the end of 2022, the Commercial Banking Group concluded the year 2023.

Foreign Trade

Türkiye Finans has increased the number of customers using high-value-added foreign trade products (letters of credit, acceptance/aval credits, documentary collections), significantly boosting transaction volume in these items.

In 2023, the Bank began providing financing to its exporter customers with a product called Term Export Financing (“TEF”), which it made ready for use with the aim of increasing its contribution to export financing. Particularly, more disbursement is anticipated in this product in 2024. Additionally, with a financing agreement signed with Saudi Exim in the last days of the year, financing will continue to be provided to customers importing raw materials from Saudi Arabia with a maturity of over 2 years, supporting the country’s economy and trade.

With its investments in human resources and technology, especially in 2023, the Bank has solidified its sustainable growth goals and targets to support investment in the real sector.

Project Finance

Our Bank, which has adopted the mission of providing project financing services which will add value to society and our country within the framework of environmental, social and corporate governance principles, has provided financing to a wide range of projects ranging from energy to tourism, infrastructure investments and investments in production facilities.

By the end of 2023, the total volume of the portfolio of funds which we had extended within the scope of project finance had reached TL 8.5 billion.

Investments in renewable energy constitute a significant proportion of our project finance portfolio. Our Bank continues to contribute to our country’s sustainable growth targets within the framework of the principles of respect for the environment and society with TL 5.5 billion of financing provided in the sector.

Financial leasing, which is used to finance investments that directly support production, employment and exports, will remain a key area of focus of Türkiye Finans in the future.

The Commercial Banking Group achieved 128% growth in net operating income and 280% growth in non-dividend income in 2023 compared to 2022.

TL 5.5 billion

A significant portion of the project finance portfolio, worth TL 5.5 billion, consists of investments in renewable energy resources.

Financial Leasing

Financial leasing is one of the most important products used in the financing of machinery and investments in technology undertaken by the real sector for their production activities. Financial leasing, which is used to finance investments that directly support production, employment and exports, will remain a key area of focus of Türkiye Finans in the future. With its investments in human resources and technology, especially in 2023, the Bank has solidified its sustainable growth goals and targets to support investment in the real sector. The Bank increased its financial leasing disbursement to TL 9.5 billion in 2023, growing it fourfold through technology infrastructure investments. Sustaining this growth with ongoing investments will continue to be a priority for Türkiye Finans, aiming to expand its customer base in this area and support investments in the real sector.

Cash Management and Transaction Banking

Türkiye Finans continues to strive to become one of the best cash management banks in Turkey, enriched with product and service diversity.

Customers in the Commercial and Retail Banking Group are provided with cash management products and services for their payment, collection and electronic banking needs within the scope of daily banking transactions. Solutions were developed and presented with a customer-centric approach during 2023 within the scope of cash management and transaction banking, addressing the needs not only of its own customers but also those of stakeholders with whom its customers had business dealings.

Within the scope of supply chain solutions, we were the first participation bank to be included in the supplier financing system created through the platforms of technology companies. Under the platform supplier financing system, supplier requests were made from end-to-end digital media on a paperless basis without instruction in supplier financing transactions conducted over platforms.

At the beginning of 2024, the Corporate Customer Digitalization Project was initiated to offer strategically prioritized services in the product range to corporate customers through digital channels.

Checkbook from mobile

In order to provide a better customer experience for the checkbook product, applications have started to be received through digital channels.

Checkbook from mobile

In order to provide a better customer experience for the checkbook product, applications have started to be received through digital channels.

Projections for 2024

- At the beginning of 2024, the Corporate Customer Digitalization Project was initiated to offer strategically prioritized services in the product range to corporate customers through digital channels. This project aims to simplify the lives of corporate customers while minimizing branch operational costs.

- Among the business plans for 2024 is the review of product and service processes with a focus on customer experience and updating them interactively to ensure process excellence.

- Investment in technology and human resources will continue, with a focus on multiple channels, lean business processes, and digital solutions.

- In the field of Cash Management, Türkiye Finans will continue to generate innovative solutions in 2023 by expanding its 24/7 digital services which are not limited either by place or time.

- The goal is to provide customers with a new experience by initiating the process of securing collateral by capturing images of customers’ collateral checks through the mobile banking application.

- Facilitating customers’ foreign trade transactions will be ensured by conducting cash / commodity-based import transactions through digital channels.

- Efforts are ongoing to digitalize product contracts and approve paperless transactions in the digital environment as part of digitalization goals.

- With the Payment Request project, customers will request to receive money for themselves. The aim is to provide customers with a new experience in money transfers through this method.

Retail Banking and Consumer Finance

In 2023, the Bank recorded 55% growth in Consumer Finance by extending TL 8 billion, 164% growth in Vehicle Finance by extending TL 10.4 billion, and 1171% growth in House Finance by extending TL 5.3 billion.

Türkiye Finans’ market share in consumer finance, vehicle finance and house finance rose to 0.83%, 10.02% and 1.54%, respectively.

The Bank recorded a 64% growth in its market share in total consumer finance in the sector.

In line with its goals for 2023, new functionalities have been introduced.

A comprehensive end-to-end lending infrastructure for vehicle financing applications has been implemented through the Mobile Banking Branch, eliminating the need to visit branches.

An online shopping finance model has been launched, allowing customers to use it for purchases on e-commerce websites.

An automation infrastructure has been established to generate and offer ready-to-use limits for customers, including 24/7 availability for eXtra Limit, personal, vehicle, and home financing.

Within the framework of the Fast Finance online platform, collaborations with businesses have continued and new digital partnerships have been established under the umbrella of consumer financing, particularly with the introduction of the online shopping finance model.

Various financing opportunities have been offered to meet customers’ needs through periodic campaigns held in 2023.

Predictions for 2024

The infrastructure, collaborations, and campaigns for financing support will be sustained in 2024, aiming to meet all customer needs by increasing channel and product diversity.

Operational processes will continue to be improved with innovative approaches, focusing particularly on enhancing customers’ experiences in digital channels.

A project enabling installment-based commercial vehicle financing through the Fast Finance Online Platform will be implemented. This service will allow corporate customers to access financing through the Fast Finance platform, diversifying the customer base and aiming to increase market share in commercial loans.

Total participation accounts reached TL 120 billion, showing a 101% increase, while deposits rose to TL 177 billion, marking a 72% increase compared to the previous year.

Fund Collection and Investment Products Marketing

Türkiye Finans has achieved significant successes in 2023 with its continuously evolving infrastructure and digitalization-focused strategies. Total participation accounts reached TL 120 billion, showing a 101% increase, while deposits rose to TL 177 billion, marking a 72% increase compared to the previous year.

Successful compliance with regulations such as Mandatory Reserves and Securities Regulation has been achieved, supporting foreign currency conversion and significant steps have been taken in line with the liraization strategy. Additionally, with the launch of the Daily Account in August 2023, customers were provided with the opportunity to invest their savings without any maturity requirement and to use them whenever they want. The Daily Account has enabled both the Bank and customers to adapt to dynamically changing market conditions in an agile manner.

The integration of the KAD-SIS system and the development of the FATSI product in February 2023 have contributed to the liraization strategy by bringing physical gold stored outside the banking system into the economy.

With the Foreign Banking Package, the focus on YUVAM accounts has been increased, and the YUVAM balance reached USD 239 million by the end of 2023.

Throughout 2023, the diversity and sector share of the Bank’s investment products, such as investment funds, stocks and lease certificates, have continuously grown. Securities commission income has increased by 70% with products compliant with Participation Finance principles, taking into account customers’ different preferences. With digital transformation and an expanding product range, the number of investment customers has increased by 30%.

Four new investment funds bearing the Bank’s name have been established exclusively for Türkiye Finans customers, achieving a 635% growth in fund size compared to the previous year. A new participation fund created exclusively for Âlâ Banking customers has created investment alternatives tailored to segments.

Collaborations with leading portfolio management companies in the market continue to expand the range of investment funds.

Customer-focused experience and ease of use have been provided through developments on the TFX Target platform. Campaigns for investment products based on analytical data tailored to market developments have been organized, offering various advantages to customers.

Projections for 2024

In fund collection and investment products, the Bank aims to expand the product range by adding alternative and new products, taking into account possible changes in regulation, economic expectations, and global developments, and expanding customer count and product volume to the base. The criteria for the affluent segment of Âlâ Banking will be structured to support new customer acquisition with updated value propositions.

Deepening Customer Relationship Efforts were carried out periodically to gain customers through target audience-based campaigns, and to deepen customer relations by increasing NOR and customers’ product variety and usage.

CRM, Campaign and Segment Management

Within the scope of the 2023 activities, customer product preferences and needs were determined through data science applications, and related targeted marketing activities were increased. Campaign structures derived from data models were used to ensure product retention in existing customers, and activities were carried out to increase NOR, product diversity, and active product usage.

Periodically, target audience-based campaigns such as “Retirement Pension Promotion Campaign”, “International Women’s Day Campaign”, “Special Benefits for Healthcare Workers”, and “Ramadan Holiday Campaign” were conducted to acquire new customers, increase NOR, product diversity, and usage and deepen customer engagement. Collaboration with GastroClub was established for Âlâ Segment customers of the Bank, offering various campaigns and exclusive value propositions in sectors such as restaurants, clothing and groceries.

A total of 2,300 campaigns were delivered through 8 different channels including SMS, Email, Push Notifications, Call Center, Branches, Mobile Banking, Internet Banking and ATMs.

This year, regular recommendation and satisfaction survey structures have been initiated through the call center.

Additionally, channel-specific satisfaction scores were measured and channel satisfaction structures were implemented in Mobile Banking to measure satisfaction after service delivery.

Projections for 2024

In 2024, customer behavior segmentation performed using clustering methods, along with churn and propensity models developed through data science applications, will be made operational in real-time. Customers will be modeled in real-time, allowing instant offers to be presented to them. By tracking customer behavior and instantly calculating the corresponding trend, the most suitable product will be offered directly at the most opportune time. Additionally, in the new year, the display areas for campaigns in digital channels will be enriched, and actions will be taken to show more campaigns to customers.

Banking Insurance

Türkiye Finans aims to establish a product range and distribution channel to meet all insurance needs of its customers through Banking Insurance, aiming to minimize risks for both the Bank and customers with insurance policies in finance-related transactions.

As of 2023, the Bank continues to serve as the exclusive bank agent of HDI Katılım Sigorta A.Ş. for non-life insurance and exclusive bank agent of Bereket Emeklilik A.Ş. for life insurance.

In addition to accelerating service provision to customers through both branches and digital platforms, projects to activate different channels are underway, with the aim of advancing while keeping existing products parallel to the services offered and competitive in the market.

In 2023, with a more intense focus on exclusive agency, total commission income increased by approximately 330% to TL 314,3 million, with TL 172,1 million from non-life, TL 135.2 million from life and TL 7 million from Private Pension System (BES) commission income.

Projections for 2024

Taking into account the principles of participation banking, the focus of the marketing efforts for the year 2024 aims at meeting the needs of both individual and corporate customers in the best possible way. The focus is on providing the right service through the right channel with the right communication at the right time to both existing and potential customers, while being by their side.

In line with this objective, front-end operations will be actively maintained in mobile and internet branches, where changing customer expectations and needs are identified, the best experience is aimed for, and alignment with evolving digital trends is achieved.

Efforts will continue to strengthen the insurance screens and infrastructure used by branches with the most up-to-date applications and systems.

95,379 digital customer acquisition In 2023, the goal of acquiring 70,000 digital customers was exceeded by 36.8% with 95,379 new customer acquisitions.

Digital Banking

Happy Customer Experience through Digital Transformation

In order to enhance the customer experience, survey studies have been initiated within the bank in 2023 to hear the voice of customers more effectively. In addition to these efforts, comparisons are made between Türkiye Finans and other banks of similar size and structure in terms of customer satisfaction, bank perceptions, and Net Promoter Scores (NPS) through an independent research company.

According to the Open Market research conducted by SOR Research Consultancy firm, the Bank’s NPS score increased from 46 in December 2022 to 72 in December 2023, showing a 58.7% increase.

The sector average for this score is 61.

Throughout 2023, efforts have been concentrated on processing and resolving notifications received from customers by the Customer Solution Center without being directed to any specific solution group, and ensuring necessary information is provided to customers to conclude the resolution.

The Customer Solution Center achieved a 56% improvement in 2023 compared to the previous year by expanding the Operational Transaction Set and Authorization Definition.

To ensure the uniqueness of announcements and make directions to customers more understandable in the Interactive Voice Response System, work has been done with the renowned actor and voice-over artist Dolunay Soysert, considering the importance of effective speech, tone, emphasis and intonation in transaction guidance.

Türkiye Finans is one of the first banks to initiate Remote Customer Acquisition through Video Calls.

As one of the first banks to initiate customer acquisition through digital channels with the motto “There is No Time or Place to be a Türkiye Finans customer”, instant product usage has been provided to customers through video calls without redirecting them to different channels.

In 2023, the goal of acquiring 70,000 digital customers was exceeded by 36.8% with 95,379 new customer acquisitions.

The number of new customers acquired through video calls increased by 443% compared to the previous year.

“With an ‘Innovative Approach,’ momentum has been gained in the journey towards digitalization.

Türkiye Finans, considering feedback and data-based information from all digital channels in line with the changing financial needs of customers, stands by its customers with designed experiences and smart solutions. Leading the developments in ‘Digital Banking,’ the Bank pioneers entirely digital products and services with an innovative approach. Actions taken with this perspective can be summarized under three main headings:

- Continuous improvement of the transaction set and user-friendly experience across all channels so customers may carry out their transactions quickly and easily.

- Performing analytical-based marketing communications in order to present the right product in the right channel at the right time by observing the behavior and actions of the customers, under the banner of being with them, wherever they are and wherever the need us.

- Continuing to work on developing innovative business models and evaluating collaborations with the fintech ecosystem, and closely following open banking regulations and developments.

Investments in Mobile and Internet Branch channels have been increased and functions that will incentivize customers have been developed.

Throughout 2023, efforts were made to enhance the transaction set by adding new products and services to channels with a design-focused approach, aiming to create an integrated experience across channels. A digital experience designed based on innovative technology, design trends, and customer feedback has been developed to improve customers’ digital banking journey.

As a continuation of the “Mobile Branch User Experience” development project completed in 2022, which was shaped by customer expectations and encompassed within digital trends, a search function has been added to the Mobile and Internet Branches to facilitate customers’ access to desired transactions within an expanded transaction set.

Several new functions and improvements have been made on card screens. The option for deferring credit card expenses has been added to Mobile and Internet Branches.

A comprehensive menu has been created in Mobile and Internet Branches through the insurance project. With options including Comprehensive, Traffic, Home, DASK, Annual Life insurances, as well as My Goods are Safe, Mobile Security, Cyber Protection, Cell Phone and Travel Health insurance payments, customers can now conduct insurance transactions through bank channels.

Numerous developments have been implemented for SMEs alongside individual customers. Functions have been developed for SME customers to apply for financing, checking accounts, and ratings through digital channels, as well as to purchase Findeks packages and view export payment acceptances.

A referral code feature has been developed for existing mobile branch users to invite their acquaintances to use the Mobile Branch.

As part of the affiliated ATM infrastructure, the display of the nearest Yapı Kredi and PTT ATMs has been enabled through the Mobile Branch, aiming to enhance customer satisfaction and experience.

The “Become a Customer from Mobile Package,” implemented in 2023, has created a comprehensive digital banking package bringing together the most extensive opportunities in the sector for users who become customers via mobile. The package offers advantageous products and services ranging from financing needs and investment evaluations to basic banking transactions for customers who become Türkiye Finans customers via mobile.

The “Friend-Referral Campaign” has been launched, allowing existing customers benefiting from the advantages of the Mobile Branch to share the app with their loved ones, enabling both the referrer and the referred person to earn bonuses. Through an end-to-end digital campaign initiated via the referrer’s generated invitation code and ending with the invitee becoming a customer, both parties earn bonuses, and the new customer benefits from the advantages of becoming a Mobile Customer Package user.

To avoid charging individual customers for their basic banking transactions, the “No Charge Trio” campaign, initiated in 2019 was relaunched as the “No Expense Campaign” with its improved setup and renewed name.

The campaign announced with the slogan “With Türkiye Finans, Cost-Free is Already in Your Pocket, Plus More Awaits You!” has made the branchless banking concept attractive to customers.

Throughout the year, personalized communications have been conducted to enable both new and existing customers to benefit from the products and services offered through digital channels at the right time and with advantageous opportunities, aiming for activation and deepening of engagement. These communications ensure that customers are aware of the opportunities and information provided through the channels.

42.5% During the “Become a Customer” campaign period, 42.5% of customers acquired across all segments and application channels were acquired through mobile.

In 2023, there was a fourfold increase in the number of customers acquired through mobile channels.

- During the “Become a Customer” campaign period, 42.5% of customers acquired across all segments and application channels were acquired through mobile.

- Compared to 2022, the number of products sold through Mobile and Internet Branch channels increased by 25%.

- The number of products sold exclusively through the Mobile Branch increased by 12%.

- The rate of digitalization has increased by 9% compared to the end of the previous year.

- 98% of customers using digital channels preferred the Mobile Branch.

Türkiye Finans has begun offering banking services through various e-commerce platforms as an integrated part of the embedded finance system.

Financial ecosystem players have been gained through Open Banking and Fintech collaborations.

In 2023, significant developments occurred in the banking and finance industry with regulations on open banking, digital banking, and service model banking, opening up opportunities for innovation and services to reach potential customers who have not yet been included in the financial ecosystem, and integrating them into the banking ecosystem.

One of the current trends in the banking world, Embedded Finance, has led to integration with one of the leading e-commerce platforms in our country in 2023, through the use of BaaS and APIs to provide financial services by non-financial service providers such as e-commerce platforms. This integration facilitates consumers’ financial processes and improves their experiences, while enabling non-financial sector firms to facilitate financial transactions without licenses.

The Rapid Financing and Payment Platform product, which is the first of its kind in the participation banking sector, allows many banking services, from financing applications to invoice and dues payments, from credit card applications to insurance offers, to be offered without being tied to physical branches and working hours. The platform’s network has been expanded through Compay and Maslak integrations.

While processes were being improved, technology has been made the most fundamental component of the whole.

In 2023, efforts continued to accelerate and streamline the services provided to customers through digital and non-branch channels, resulting in a total gain of 88.12 Full-Time Equivalent (FTE).

Robotic Process Automation (RPA): With the inclusion of 25 new processes in 2023, a total of 54 projects enabled 25,000 hours of work to be carried out by robots. As a result, cycle times were reduced, leading to improvements in customer experience.

OCR: The automation of data entry at the Bank was enabled through the integration of an artificial intelligence-based document analysis solution. The automation of data entry initiated with customer instructions aimed to shorten end-to-end processes and prevent operational errors.

In the focus on digitalization, opportunities in artificial intelligence and RPA will be evaluated to continue improving processes.

By enabling teams with AI training capabilities to work as a business unit in technology and digital transformation, the goal is to become capable of generating business without the need for IT through the low code method.

Our devices have been renewed to provide high-quality service.

500 new devices have been purchased to renew our currency counting machines. As a result, transactions are now performed 1.7 times faster with the ability to detect torn, worn and painted money, ensuring faster processing. Additionally, automatic recording of serial numbers and more reliable counterfeit detection have reduced risks.

100 new devices have been purchased to renew ATM machines, introducing features such as Recycle ATM functionality and support for the Win 10 operating system. With a Wide Screen Design (19” Multi-touch Screen) and increased cassette/banknote capacity, customer experience has been enhanced. Security controls have been reinforced with features such as banknote serial number reading and tamper-resistant card readers.

16 Instant Transaction Points have been deployed within our branches, enhancing convenience for customers.

As part of the Centralization of Operations activities, the centralization rate of transfer transactions has been increased to 78%.

- The implementation of the Signature Circulation Analysis project has enabled the rapid completion of transactions initiated by customers at the counter through PUSH approval, following analysis.

- To reduce operational risk, the system now alerts the counter officer when the authorized signature list or power of attorney of customers undergoing signature analysis is due, or when an authorized person is added or removed.

- The implementation of the Joint Approval structure allows tracking of all transactions sent for approval to the Branch Operations Directorate, enhancing transaction efficiency.

- By adding foreign exchange and precious metal buying/selling/arbitrage transactions to the Central Instruction System, the burden of these transactions on branches has been reduced, increasing centralization rates. Additionally, the central execution of transactions aims to increase efficiency and reduce operational risk.

- The implementation of the Central Task Assignment Project ensures that other tasks transmitted to the branch through instructions, such as IBKB, Contract Entry, and Collateral Entry, are also sent to the central office through the system. This reduces the workload at the branch, contributes to marketing activities, increases efficiency, and reduces operational risk by enabling transaction tracking through the system by both the branch and the Branch Operations Directorate.

In the Guarantees and Retail Credit Operations, an additional 23% automation has been implemented.

- With the full automation project for Service Lease Credits, the Headquarters operation station has been eliminated, and with auto-approval, 11,000 consumer credits are now reaching customers with zero waiting time per month.

- Through the Blocked Resolution Approval project for Convertible Guarantee Checks, 1,000 transactions are now approved by the system monthly.

- Systematic improvements in Quick Finance have provided convenience of use to dealerships and branches, reducing waiting times.

- Digitalization in Vehicle Pledge Contracts has eliminated the need for documentation.

A fast solution for letters of guarantee and international payments

- In 2023, the implementation of the Letter of Guarantee Transformation Project provided a fast, efficient, and customer-friendly experience, reducing customer waiting times and enhancing compliance with bank policies and procedures.

- Thanks to Türkiye Finans’ world-class, fast, and high-quality service in international payments, the Bank was awarded the Straight Through Processing (STP) Certificate by two of the world’s leading correspondent banks, J.P Morgan Chase Bank and Citibank, in 2023.

- The goal is to enable cash and goods-based import transactions to be carried out through the Mobile Branch and website.

- Efforts are underway to enable IBKB transactions to be conducted through the Mobile Branch and website.

In 2023, Türkiye Finans implemented projects that made a difference for credit cards and bank cards.

With the Troy Card project, the product range was expanded, allowing customers to receive Troy-based credit card services in addition to those based on Mastercard and Visa infrastructure.

Through the Digital Card project, the functionalities of credit and bank card products were enriched. With the aim of improving customer experience and being there for them when needed, the digital card project allows customers to use their cards directly with their digital features upon approval without waiting for the physical card to be delivered. Existing customers can instantly use their cards with their digital features in their daily lives without the need to carry their physical cards.

Deferred payment functionality for credit cards and digital statement features were added as well.

Several projects related to credit cards were undertaken in 2023. “On Numara Kart” project was deepened where POS blocks are counted as collateral, enabling member merchants to manage their cash flows easily.

Our POS Support Line, 0 850 221 1607, which member merchants can contact for POS transactions, was launched in December to serve the needs of member merchants.With its work on ATM Banking, the number of Türkiye Finans ATMs reached 513 by the end of 2022, with the number of ATMs outside branches reaching 104.

Work to position ATMs at the most optimal locations and increase efficiency continued.

Preparations are ongoing to renew ATM designs and transaction flows, as well as to increase the limits of lobby-type ATMs in branches, in order to improve the user experience and enable customers to perform transactions more quickly. Investments have been made in control mechanisms to ensure immediate intervention in all issues experienced by customers at ATMs, and the information processes have been revised with a focus on customer experience.

To enhance customer satisfaction, the daily withdrawal limit from our bank’s ATMs has been increased to 5,000 TL and made available 24/7.

The collaboration with approximately 8,200 contracted Yapı Kredi and PTT ATMs continued in 2023 with the aim of enabling customers to receive free services outside of Türkiye Finans ATMs. Within the scope of this agreement, the free withdrawal limit for Bank customers has been increased to 5,000 TL from 2,000 TL, and free deposit transactions have also been provided. The contracted ATM network has been added to the Türkiye Finans Mobile Branch to provide customers with information about the nearest contracted ATMs.

Transactions continue to be carried out using QR codes, eliminating the need to carry cards. Customers can easily withdraw and deposit money using QR codes even if they don’t have their cards with them. As a first in the industry, users who are not Türkiye Finans customers can download the Türkiye Finans mobile branch application and deposit money instantly into Türkiye Finans current accounts via ATM by entering the desired description with the QR code, eliminating the requirement to carry cards.

“Yarına Varız”

“Yarına Varız” ilkesiyle hareket eden Türkiye Finans, “Dijital Slip” uygulamasını devreye alan ilk katılım finans kuruluşu olmuştur.

With our Sustainable Banking Approach “We’re There for Tomorrow”

With its commitment to sustainable banking under the motto “We’re There for Tomorrow”, Türkiye Finans has been pioneering the finance sector with innovative products, customer-centric banking, and sustainability approaches.

As part of its sustainability efforts, the Bank has significantly reduced its annual paper consumption from 25,000 to 5,000 cartons, resulting in a savings of 9.7 million pages of paper.

Türkiye Finans became the first participation finance institution to introduce the “Digital Slip” application. This allows customers to receive and track digital versions of the paper slips they would otherwise receive physically when making transactions with Bank or credit cards at Bank POS terminals via the mobile application. This initiative not only reduces carbon footprint but also enhances efficiency and performance while contributing to both employee and customer satisfaction.

During the Environment Week event with the participation of climate activist Güven İslamoğlu, Türkiye Finans highlighted its projects aimed at reducing carbon footprint and minimizing environmental impact through innovative projects that make business processes more efficient and effective while focusing on eco-friendly practices by minimizing paper consumption.

As part of its social responsibility initiatives, Türkiye Finans collaborated with the “Çorbada Tuzun Olsun Derneği”(a non-profit charity organization) to distribute hot meals to those in need in Istanbul on World Food Day, October 16th. By adhering to the principle of “We’re There for Tomorrow” and contributing to environmental sustainability while providing benefits in food security and social assistance, the Bank will continue its efforts to benefit society and make an impact in various areas through social responsibility projects.

The Bank has also implemented the HR Paperless initiative, enabling recruitment processes to be conducted without paperwork. Through the PlaTForm application, new colleagues joining the Bank can upload their documents and communicate during the recruitment process.

Under the Innovation Leadership program, Türkiye Finans conducted an Ideathon to evaluate and implement employees’ new business ideas and innovative suggestions, demonstrating its commitment to listening to the voice of its internal customers.

The collaboration with approximately 8,200 contracted Yapı Kredi and PTT ATMs continued in 2023 with the aim of enabling customers to receive free services outside of Türkiye Finans.

Projections for 2024

The Bank will continue to innovate in digitalization, aiming to bring customer satisfaction to excellence in every service area, in addition to its innovative steps towards digitalization driven by the driving force of digitalization and by including artificial intelligence technologies in all its projects with its strong infrastructure, and optimizing human resources to take customer experience to the highest level in 2024.

To facilitate customers’ lives and improve their experiences across channels, the goal is to provide smart assistant support through technical methods such as natural language processing and artificial intelligence, including chatbot services.

With the ChatBot project, customers will not only be able to quickly access the information they need by asking questions via Mobile Branch and Internet Branch but also be able to solve their transactions quickly themselves with the guidance they receive (such as EFT Limit Update - Transfer Limit Update - Shopping Settings Update). This will ensure uninterrupted and instant service to customers while reducing the workload of customer representatives, thereby improving call quality.

With the Dynamic Call Center project, the voices of customers connected to the call center will be recorded and matched with a voice recognition system in their next calls, allowing customers to automatically pass the security step and complete their transactions.

Through the Call Back application, customers who call the call center but cannot connect to a representative due to the busy line within the specified time frame will be contacted by an appropriate call center representative as soon as possible after closing the call, based on the options provided by IVR, to receive support for their transaction.

Payment system development efforts will be made to improve the customer experience, such as digitalizing channels without digital approval structure for credit card applications and updating instant card distribution situations through courier web integration. The Installment Cash Advance project will offer customers a new function not available on cards, aiming for new customer acquisition and increased customer activity.

In 2024, campaign management will focus on differentiation for the recovery of inactive customers by launching campaigns tailored to specific customer segments. Special campaign management will be carried out for inactive customers during the year. The Campaign Advantage Management project will design new campaigns to increase cross-selling ratios for customers.

For corporate customers, the digitalization of Business card application processes will be ensured, allowing corporate customers to complete card applications through branchless banking. The completion of this project is aimed at enabling corporate customers to quickly access card services, thereby increasing business card usage.

Meeting the evolving expectations and needs of both individual and corporate customers, adapting to changing digital trends, and providing the best experience are set as goals.

A minimum 100% increase in POS numbers is targeted for 2024. In this context, efforts have been initiated to implement the Joint POS, BKM TechPOS, and Mobile POS projects.

In 2024, efforts will continue to expand the customer base with innovative and value-added products, services, and solutions; increase infrastructure investments; strengthen the integrated channel strategy; and expand the transaction set.

In this context, the screen designs of Türkiye Finans customers will be renewed to enable faster and more user-friendly transactions on ATMs, in line with general usage habits. Departing from the conventional ATM transaction directions, an innovative navigation experience will be provided for customers to complete their transactions with fewer buttons.

Data-driven customer interaction will be on the agenda throughout the year, analyzing customers’ needs accurately, delivering personalized offers and information through data and algorithms, and improving and optimizing these processes.

Efforts will continue with a “competition” approach with both business partners and competitors in fintech to develop innovative products and services.

Efforts will be made to expand the portfolio of SMEs, which play a significant role in the Turkish economy, by expanding digital solutions, products, and services to meet the changing needs of customers.

Treasury

In 2023, Türkiye Finans demonstrated its success in ensuring an optimal level of liquidity and maturity risk by taking into account legal and internal ratios and the Bank’s strategies. In addition, our Bank continued to progress in line with its targets of sustainable non-dividend profitability with effective management of its foreign exchange position.

In line with developments in the markets, we set out projections based on the information we gathered on the types, prices and volumes of financial resources and we took necessary actions to determine the most appropriate strategy through these projections.

With the steps taken in the liraization policy, at the beginning of 2023 when domestic foreign currency liquidity decreased and foreign interest in Turkey was weak, some murabaha transactions were made with foreign banks, and in the second half of the year, borrowing in EUR and USD from various banks was increased due to the confidence provided by the Monetary Policy stance and the decrease in CDS premiums.

In 2023, proactive and agile actions continued to be taken towards determining the most suitable balance sheet management strategy through projections compiled based on developments in the markets regarding the types, prices and volumes of financial resources. Throughout the year, progress was aimed at with the most optimal Asset-Liability mix regarding Bank growth, profitability, and risk position, and action plans and strategies were frequently discussed and closely monitored at the senior management level. Liquidity management, an integral part of balance sheet management, continued to be important in the volatile market of 2023. The Bank has meticulously managed liquidity by managing both money market transactions, foreign borrowings, and customer-sourced funding in the most appropriate manner for the balance sheet structure, prioritizing liquidity under all circumstances.

The Treasury follows the basic policy of ensuring effective management by planning the composition, constitution and changes of active and passive items, as well as off-balance sheet items, controlling financial risks, and fulfilling basic obligations.

The scope of Asset-Liability Management strategy includes control and management of risks such as liquidity, market, and foreign exchange positions, funding and capital planning, profit planning and growth projections, as well as the determination and analysis of scenarios, and the preparation of emergency and unexpected situation plans related to liquidity management.

Türkiye Finans continued to progress in line with its targets of sustainable non-dividend profitability with effective management of its foreign exchange position.

Projections for 2024

The importance of effective strategic balance sheet management will continue to grow in 2023. In this context, work will continue on the development and implementation of products which can guide companies in the management of balance sheet and exchange rate risk.

In 2024, Türkiye Finans will continue to be there for customers with appropriate solutions to manage their financial risks by analyzing their needs. Türkiye Finans aims to expand its market share in Treasury operations, both directly and through alternative channels and to continue expanding its Treasury customer base with a strong bank image and a competent team.

USD 434 million Together with the borrowing transactions with foreign banks with a term of 1 year and above conducted by Türkiye Finans in 2023, the total amount of the Bank’s long-term external cash funding reached approximately USD 434 million.

International Banking

Within the scope of international banking activities, relationships with correspondent banks are managed most effectively considering the principle of reciprocity in order to facilitate the execution of customers’ foreign trade transactions and payments. Efforts are made to increase the market share in foreign trade and to obtain foreign sources. In parallel with the growth strategy, in 2023, despite geopolitical and economic fluctuations both domestically and globally, Türkiye Finans continued to facilitate its customers’ foreign trade transactions and financing needs under favorable conditions with its privileged services and products in international banking. The Bank continued to provide fast solutions to its customers.

The Bank concluded a year in which it continued its traditional and deep-rooted collaborations with global financial institutions, in order to offer the right financial solutions to its customers. By the third quarter of the year, Türkiye Finans continued to contribute to the national economy with nearly 115 billion TL in cash and non-cash funds, remaining active in production and trade. In addition to the agreement signed the previous year, Türkiye Finans signed an additional financing agreement with the Saudi Exim Bank. With this agreement, the aim is to cover the purchase costs of products/raw materials for Turkish companies importing goods other than crude oil from Saudi Arabia. Despite the challenging market conditions, the directing of these new resources to the Turkish economy once again confirmed the trust placed in Türkiye Finans and the Turkish banking sector.

Türkiye Finans has attached great importance to developing its multifaceted and long-term relationships with customers and banks within the framework of its international banking strategy. Türkiye Finans responded to the needs of its customers to increase their competitiveness in national and international markets and to consider growth opportunities. The Bank was able to maintain its position in a wide region extending throughout the Middle East, Africa and Asia, and especially in the European region where the country’s foreign trading volume is highest, and it was able to respond at the highest level to customers increasing their competitiveness in national and international markets and seizing growth opportunities. In line with the country’s economic and political strategies, the Bank, focusing especially on export transactions, was able to add banks which have a position in new countries on a local scale to its existing correspondent bank network.

In 2023, the Bank continued to maintain its correspondent banking network with a quality-oriented, innovative, and proactive approach, involving 800 banks domiciled in 107 different countries. The number of banks in the Bank’s limit relationship was increased to 212, thus providing the opportunity to transact in many parts of the world due to the diversity of correspondent banks.

With the rapid integration of digitalization into the banking sector in 2023, correspondent banking discussions were conducted more intensively on virtual platforms. In order to further strengthen the visibility, vision and strategy of Türkiye Finans on international platforms, the Bank was represented at a high level in international organizations and meetings. In this context, participation was ensured in events such as the 2023 SIBOS, Turkey-Saudi Arabia Business and Investment Forum, etc., and discussions were held with representatives of correspondent banks to aim for the continuity and effectiveness of correspondent banking relationships.

Foreign Borrowing Transactions

The borrowing transactions carried out in 2023 have been tangible evidence of Türkiye Finans’ credibility in international capital markets, especially in Gulf countries. Despite challenging market conditions, Türkiye Finans has successfully completed a year in securing external funding. Thanks to its high credibility, strong capital structure, and the trust support provided by its main shareholder, Saudi National Bank, Türkiye Finans has continued to pursue a strategy focusing on alternative funding sources in international markets that provide cost and term advantages.

A strategy aimed at diversifying funding sources and supporting companies in need of financing has been pursued, aiming to boost momentum and vitality in the Turkish economy. As a result of all these efforts, the positive and strong contribution of foreign loans, which constitute a significant portion of Türkiye Finans’ liabilities, to the Bank’s total funding source in terms of term and price, is clearly evident. Together with the borrowing transactions with foreign banks with a term of 1 year and above conducted by Türkiye Finans in 2023, the total amount of the Bank’s long-term external cash funding reached approximately USD 434 million.

Projections for 2024

In 2024, the aim is to increase the Bank’s foreign trade volume and revenues, in line with the Bank’s strategy, through active marketing activities in the market in collaboration with foreign trade teams closely monitoring all types of customer needs.

Thanks to the additional financing agreement signed with the Saudi Exim Bank, it is aimed to provide working capital to Turkish companies importing products/commodities from Saudi Arabia under favorable conditions in 2024, excluding crude oil, and to contribute increasingly to the real sector.

Türkiye Finans plans to continue benefiting from the opportunities to create foreign sources through its correspondent banking network, which is based on long years and mutual trust, with appropriate terms and costs to the maximum extent possible, and to provide funding to its balance sheet. In this context, the Bank will continue to diversify its funding base, use international funding sources and deepen its strong correspondent banking and investor portfolio.

Despite challenging conditions, the communication strategy centered on investing in people and supporting production continued in 2023.

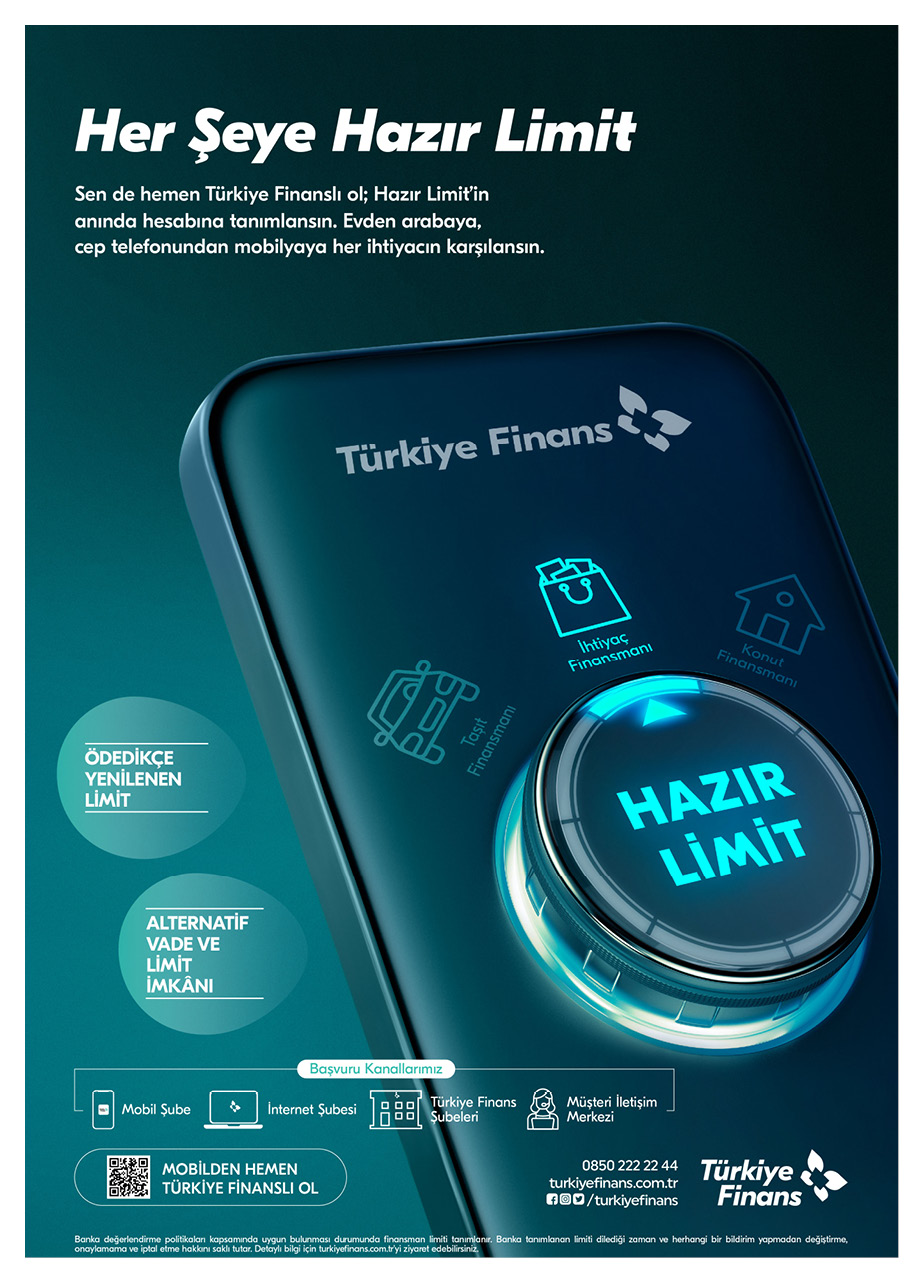

Ready Limit In line with the pioneering vision of digital banking, the “Ready Limit” product was introduced, automatically assigning limits to customers for all kinds of financing needs such as eXtra Limit, housing, vehicle and personal loans.

Marketing Communication and Brand Experience

In line with the vision of digital banking, Türkiye Finans’ 2023 strategies focused on Investing in People and Supporting Production.

Following the earthquake disaster at the beginning of 2023, a communication strategy was shaped with a production and people-oriented approach aiming to benefit the community. In this context, the goal was to progress by offering innovative products and services tailored to the expectations of existing and potential customers, aiming to support different segments of society. While aiming to meet financial needs without time and space constraints, a strong role in the industry was assumed with pioneering services aimed at attracting new customers to the participation banking sector. Despite challenging conditions, the communication strategy centered on investing in people and supporting production continued in 2023. In this year highlighted by digital banking, the focus was on future goals with a pioneering vision and communication strategy parallel to digital transformation. Special campaigns and impactful communication efforts were developed with the aim of benefiting society by prioritizing the satisfaction of employees and customers.

Efforts to increase the Bank’s digitalization index continued in 2023.

With the understanding of digital banking that is independent of location and time, Türkiye Finans continued to be with its customers for all their needs in 2023.

In 2023, services were continuously digitalized with a fast, uninterrupted, and excellent customer experience through an integrated channel strategy. Through a joint effort with AcerPro, HDI Participation Insurance, and Bereket Retirement, the Bancassurance Platform was renewed, and insurance sales through digital channels were initiated. The Bancassurance Platform, which is a successful output of the vision of banking without time and place, provides customers with a much more practical insurance experience.

In line with the pioneering vision of digital banking, the “Ready Limit” product was introduced, automatically assigning limits to customers for all kinds of financing needs such as eXtra Limit, housing, vehicle and personal loans. With this product, customers could see their personalized Ready Limits on the entry pages of internet and mobile branches at any time and use them whenever they wished.

In 2023, Türkiye Finans introduced the chequebook application service for commercial customers entirely through digital channels. With this service, commercial enterprises with limits at the Bank can apply for chequebooks through Türkiye Finans Mobile Branch and Internet Branch without the need to go to the branch or additional procedures.

Special campaigns and impactful communication efforts were developed with the aim of benefiting society by prioritizing the satisfaction of employees and customers.

With the understanding of digital banking that is independent of location and time, Türkiye Finans continued to be with its customers for all their needs in 2023.As a pioneer in the finance sector with its innovative products, people-focused banking approach, and sustainability focus, Türkiye Finans became the first participation finance institution to introduce the “Digital Slip” application. This allows customers to receive and track digital versions of the paper slips they receive physically for all transactions made with Bank or credit cards through Bank POS terminals via the mobile application. This not only contributes to reducing carbon footprint but also enhances efficiency and performance, while also contributing to employee and customer satisfaction.

In 2023, Türkiye Finans updated its Mobile Branch with a more modern design for its customers. Additionally, new features were added and some improvements were made to make it a more user-friendly application for an easier banking experience.

With the strength derived from new technologies, Türkiye Finans continues to develop its digital products to be there for its customers. By utilizing Embedded Finance, a new banking trend, financial services are integrated into non-financial service providers like e-commerce platforms using BaaS and APIs, enabling financial transactions to be integrated into customers’ daily interactions. This simplifies financial processes for consumers and allows non-financial sector firms to facilitate financial transactions without the need for a banking license, thereby increasing customer loyalty and revenues.

In this context, a consumer financing agreement was signed with Trendyol in 2023.

Expanding the network with Compay and Maslak integrations, the Quick Finance and Payment Platform product, which allows various banking services from financing applications to bill and dues payments, credit card applications to insurance quotes to be provided without being bound by physical branch and working hours, has been expanded, being the first of its kind in the participation banking sector.

In 2023, many projects carried out by Türkiye Finans were honored by leading award organizations in the industry, including prestigious institutions such as J.P. Morgan, Stevie and Citibank.

This year, we received awards, felt proud and shared this happiness with everyone.

In 2023, many projects carried out by Türkiye Finans once again proved its pioneering and innovative role in the sector. The implemented projects were honored by leading award organizations in the industry, including prestigious institutions such as J.P. Morgan, Stevie and Citibank. The awards were shared with pride and satisfaction through all communication channels to emphasize the Bank’s service quality and effective communication strategy.

Listed in the “Companies with the Highest Proportion of Women in the Board of Directors” and “Companies with the Highest Proportion of Women in Middle Management” categories of the Women’s Power in Business Research conducted by Inbusiness magazine, Türkiye Finans was recognized as one of the “Top 100 Companies Leading Equality for Women’s Advancement”.

Züleyha Büyükyıldırım, Deputy General Manager of Human Resources, was included in the “Top 50 Most Innovative HR Leaders” list by Fast Company.

Fahri Öbek, Deputy General Manager of Information Systems and Operations, was included in the Next 2022: Technology Leaders C-Suite Series 50 CTO list prepared by Fortune Turkey magazine, prioritizing growth, digital transformation, artificial intelligence and technology topics. He was also listed in the “Most Innovative Leaders” category at the CIO Awards, an organization that honors successful digital transformation projects led by technology executives.

Türkiye Finans has been recognized as one of Turkey’s most innovative 50 companies in Fast Company magazine’s “Top 50 Most Innovative Companies” list, which is considered one of the most prestigious publications in the business and finance world.

Additionally, Türkiye Finans has been honored with the “Most Innovative Participation Bank” award by ‘Global Business Outlook’, one of the leading financial publications in the United Kingdom.

In the “Women-Friendly Companies” research, which focuses on the employment of women employees, women managers, and women board members in Turkey’s largest companies, Türkiye Finans ranked 69th on the “Women Employee-Friendly 100 Companies” list with 1,506 female employees and 82nd on the “Women Manager-Friendly 100 Companies” list with 50 female managers. The Bank is the only participation bank listed in both categories of the research.

In the “Turkey’s Most Preferred Companies” research conducted by Realta Consulting, which attracted the participation of nearly 63,000 university students and nearly 29,000 young professionals, Türkiye Finans was ranked as the 34th most preferred company in Turkey.

These awards not only confirm the Bank’s achievements but also serve as a source of inspiration and motivation to further develop and reinforce its customer-centric approach to satisfaction and experience.

Our communication efforts on social media during special occasions have been effective.

In line with our social media communication strategy, instead of focusing solely on product and service promotion, as a bank that embraces the values of our country and reflects these values, special videos have been prepared and shared with our followers on days that hold significance for our society and our country. On April 23rd, National Sovereignty and Children’s Day, and during Ramadan, communication was conducted under the slogan “The Light of Hope”.

On 19 May, the importance of our youth, who are the face of our Republic, was emphasized. On 30 August, Victory Day, running and hiking clubs gathered in Afyon to participate in a victory march together. On 29 October, when we celebrated the 100th anniversary of our Republic, a film with the hashtag #Futureatour100Years was shared with employees and followers.

In short, throughout the year, the Bank’s social media presence has been strengthened with special content created to uphold all the values that unite our society.

In line with our social media communication strategy, instead of focusing solely on product and service promotion, as a bank that embraces the values of our country and reflects these values, special videos have been prepared and shared with our followers on days that hold significance for our society and our country.

In 2023, more than 20 strategic level master plan projects were completed quickly and on time with fully agile methods.With our leadership communication approach, we effectively showcased our Bank’s strong vision in communication.

Türkiye Finans strategically positioned its leaders at the forefront of its media communication strategy, presenting its vision, strategic approach, and the value it brings to society to a wide audience.

The presence of Bank executives has been strengthened across various media platforms, ranging from business magazines to interviews, television channels, summits, and newspapers. As a result, corporate messages have been effectively delivered to target audiences through different channels.

Information Systems

Our banking vision, which we define as “becoming a leading bank which provides principle financing and investment to all individual customers and company owners in Turkey” forms the framework of our business strategies. This framework, which stands on four main pillars; supporting production, being just, contributing to our strong values and being participatory, has helped our Bank become a pioneer and market leader in many areas of the sector it operates in while enabling the Bank to shape the future on a solid foundation.

The main initiatives determined by our Bank for 2022 are to raise the rate of digitalization by expanding its range of products and services, increasing the number of channels, enhancing its capabilities and usage, bringing innovative R&D products to participation banking and supporting operational efficiency and quality by continuous process and technology improvement.

In 2023, the Bank implemented projects to simplify banking and service processes and increase their effectiveness by using new technologies, centralizing operations and enhancing the optimization in processes, and being one step ahead of the competition by improving the quality of service it provides its customers.

In 2023, more than 20 strategic level master plan projects were completed quickly and on time with fully agile methods. High efficiency and user satisfaction were achieved with products and services developed to provide a competitive advantage to Türkiye Finans.

Türkiye Finans, which was the first bank to use agile methods in the sector, has maintained its development in this field and become as a point of reference in the sector, commissioning many applications including innovative products and services which enhance the customer experience. Some of the projects are listed below:

With the Leasing Transformation project, the application interface has been renewed; user experience has been improved, and new functions have been added. Lease processing times have been minimized.

The Digital Pre-Approved Limit Application project enables OBI and Entrepreneur segment customers to apply for pre-approved limits digitally.

With the Ready Limit Financing and Digital Channel Processes Modernization project, infrastructure improvements have been made, and Ready Limit Financing limits are offered to customers through digital channels.

The Mobile Onboarding for Individual Enterprises project has designed and launched processes for individual enterprises to become customers remotely, similar to individuals.

The List of Authorized Signatures Analysis project enables corporate customers who want to conduct transactions in branches to have their signature authorization lists checked by the application.

With the Insurance Infrastructure Update and Insurance Sales from Channels project, new functions have been added thanks to the renewed infrastructure, providing a user-friendly interface and online insurance policy sales through channels.

The Digital Channel Vehicle Financing Application project enables vehicle financing applications and usage to be completed digitally without visiting a branch.

The Transfer of Instructions via OCR project ensures that instructions are read with OCR and transactions are automatically performed with AI-supported applications.

The Fast Financing Corporate Customer Disbursement project ensures the disbursement of the preferred product, which continues to be used by individual customers, for corporate customers as well.

With the Inflation-Linked Reserve Account Product project, higher limit usage is made possible by associating the reserve account product with the inflation rate.

At Türkiye Finans Data Center, which has Turkey’s first Tier III Operation Certificate, processes and infrastructure are continued to be operated in compliance with both legal regulations and up-to-date and reliable technologies required by the age, ensuring high accessibility. Data center operation and management are conducted above Tier III accessibility standards (while annual 1.6 hours of downtime is accepted within the Tier III standards, the Bank has not experienced any downtime due to the Data Center in its services for 12 years).

Our Data Center holds the following certificates

- UPTIME Institute Tier III Design

- UPTIME Institute Tier III Facility

- PUE Power Usage Effectiveness Green Data Center

- ISO 27001 Information Security Management Systems

Details of the project, which will ensure the continuation of 100% accessibility on the DC side are as follows:

- As part of the Data Center infrastructure modernization, the existing generators have been replaced with next-generation DCC (Data Center Continuous) generators, providing faster and safer activation during power outages, achieving 30% fuel efficiency, and significantly lower annual maintenance costs, as recommended by the Uptime Institute for Data Centers, which certifies Data Centers. This structure, capable of providing continuous power for 365 days a year, ensures the highest possible availability.

- Additionally, the lighting infrastructure of the Data Center has been renewed, transitioning to full LED lighting. This not only enhances lighting quality and physical security but also achieves energy savings. Thanks to these and similar energy-sensitive applications, the Data Center’s energy efficiency has exceeded the Turkish average.

- To enhance business continuity and operational efficiency, new mobile branches have been prepared nationwide to serve at any required point, in addition to the existing infrastructure. Their information system hardware, network infrastructures, and other physical technological infrastructures have been installed to provide uninterrupted service.

- As part of the monitoring system improvement and updates, systems monitoring the main banking system and applications have transitioned to redundant architecture, ensuring continuous operation for monitoring infrastructures and systems.

- Technological renewals have been made in Central Identity Management and cross-platform integration applications, providing environments that work with modern architectures and current structures, thereby preparing the ground for new integrations and collaborations in the future.

- To provide faster and better access to Information System services, a video training series has been created to increase the knowledge and awareness levels of bank users in information system support processes.

Various projects have been implemented in end-user systems to improve service quality and provide a better experience to customers. Some of these include:

- Software and hardware changes and improvements have been made in the scanner, printer, and cash counting machine equipment used in banking operations by branches. This ensures faster and healthier transactions.

- A system that allows remote reinstallation in case of PC failures requiring reinstallation has been implemented as part of the remote management of end-user systems, along with improvements to distribute operating system updates with less bandwidth.

- The printer server used in the infrastructure of printer services used throughout the bank has been replaced, transitioning to a more secure and efficient infrastructure.

- Video conferencing systems have been installed in selected meeting/executive rooms besides the main video conferencing rooms to increase remote working and interactive meeting capabilities.

- All infrastructure on which banking systems operate is served from the Bank’s data center, and the annual average availability rate of these systems has been classified as best in class with a rate of 99.99% in benchmark studies.

- The integrated platform (Oracle Exadata) serving a total of 6 critical applications used in the Bank, including TFX Target, has been renewed with the latest hardware and system level (X9). Additionally, the version of the databases running on the server has been upgraded (from 11g to 19c), bringing them to the most up-to-date state both in hardware and software. With this change, the backup of all databases on this system has been ensured with minimum interruption time (RTO/RPO) on the Disaster Recovery Center, thanks to the additional capacity provided.

- In the scope of ensuring the highest availability and performance standards for the Bank’s information system services, server virtualization efforts have continued, maintaining a reference rate of 99.27% virtualization in the industry.

- As a result of upgrade operations, 110 Server Operating Systems, the Sharepoint application running on the Enterprise Site, and Datawarehouse and Archive databases have been upgraded to their current versions.

- Continued Network and Security Infrastructure modernization with HSM circuit, router, switch, and FW renewals.

- A virtual desktop system server modernization project was conducted to enhance the user experience for branch teams and headquarters end-users, resulting in a 190% performance gain. Additionally, optimization efforts were carried out to effectively utilize system resources, resulting in a 30% capacity gain.

- An investment and optimization effort in our backup infrastructure led to a 50% capacity increase in archive backup environments.

- Structural changes were made in 2,700 tables where audit logs of the main banking database are kept, eliminating potential performance risks and contributing to service continuity.

50% capacity An investment and optimization effort in our backup infrastructure led to a 50% capacity increase in archive backup environments.

Projections for 2024

In 2024, the Bank will continue to focus on the following objectives in line with its strategic goals:

- Enhancing customer experience and satisfaction across all channels through continuous improvement efforts.

- Widening the adoption of initiatives aimed at digitalization and increasing the digitalization rate.

- Increasing the variety of individual and corporate products aligned with participation principles and addressing customer needs.

- Offering user-friendly products and processes with high satisfaction levels for corporate customers, focusing on ease of use.

- Continuing to improve the customer experience in mobile banking.

- Increasing the utilization of OCR, AI, and Robotic technologies to enhance operational excellence and efficiency, reduce service delivery times, and mitigate risks.

- Expanding the integration of artificial intelligence components in credit processes.

- Generating faster outcomes and increasing satisfaction both among employees and work units as a result

Secure Banking

As a Bank which demonstrates the highest sensitivity to ensuring, protecting and developing information security, customer security and business continuity while working in accordance with relevant legislation, we place the highest importance on the security and privacy of the data and transactions belonging to our partners, employees, customers and suppliers and we regard information, digital security and business continuity as our critical needs. We closely keep track of the most up-to-date technology and applications and adapt them to our processes, and undertake continuous investments in the competencies of resources and technology. The Secure Banking Department manages the critical functions of Information Security, Product and Customer Security and Business Continuity with a high level of expertise.

Three new domestic and two global applications providing high-level cybersecurity in advanced technology have been deployed.

Our Cybersecurity and Information Security Management System teams have continuously enhanced their competencies through current attack and governance standards training, as well as attack simulations in virtual laboratory environments, ensuring the relevance of defense techniques against zero-day attacks.

Information Security

During the year, all global and local Information Security threats, risks and development needs were followed and managed closely by our specialized employees with advanced technologies and Cyber Intelligence Services. Strategic plans were drawn up at the Senior Management level and all of these plans were realized. Case studies were deployed continuously as crucial inputs for the enrichment of new plans and new monitoring processes, and the structure is constantly improved upon.

In the field of information security, continuous evaluation has been given to the selection processes of both global and local technologies, with a high priority placed on assessing domestic and national technologies. Three new domestic and two global applications providing high-level cybersecurity in advanced technology have been deployed.

New technologies that detect abnormal behavior in network traffic and increase network visibility have been implemented, enhancing proactive cybersecurity management.

The managed security infrastructure for monitoring security alarms and taking necessary measures has been modernized with the implementation of new artificial intelligence-based technologies, providing speed and automation in security actions.

The hybrid working method, consisting of remote and office work, has continued to be implemented in the Bank. In order to continuously monitor and improve the cybersecurity of this method, cybersecurity teams with deep expertise in infrastructure and application security have conducted continuous tests and strengthened security levels with additional security actions.

Cybersecurity teams with different sub-expertise profiles that continuously monitor and adapt to the best and most up-to-date global and local security structures have been implemented, ensuring rapid adaptation of new applications to the working system.

In addition to ensuring successful critical security updates for applications and devices, the Bank has developed central cybersecurity management applications and 24/7 monitoring scenarios based on current attack techniques.

All cybersecurity scenarios and incident response plans have been tested by independent cybersecurity consultancy firms through cybersecurity simulation exercises, and all tests have been reported with a “Successful” outcome by the independent organization.

Regular awareness campaigns have been conducted for all bank employees and strategic suppliers in critical priority areas of cybersecurity, such as mobile device security, remote working security, data security, and application security, against current cyberattacks and social engineering methods.

Furthermore, the “Cybersecurity Week” events held annually aim to keep employee awareness alive, continuously improve it, and mature it.

In addition to the independent audits carried out by the BRSA and the security tests carried out by our expert teams, compulsory SWIFT Customer Security Framework compliance audits and Information and Communication Security Guide Compliance Audit studies published by the Presidency Digital Transformation Office were successfully completed.

Having successfully completed all the comprehensive audits carried out by the Independent Auditor in 2023, the Bank again qualified to maintain the ISO 27001 Information Security Management System Certification and demonstrated once again that it had maintained “Information Security Management in International Standards”. A new application has been deployed to operate the Information Security Management System fully automated, ensuring digitalization for all users.

Our Cybersecurity and Information Security Management System teams have continuously enhanced their competencies through current attack and governance standards training, as well as attack simulations in virtual laboratory environments, ensuring the relevance of defense techniques against zero-day attacks.

Comprehensive review exercises have been conducted on all information security incidents to identify potential information security risks. As a result, corrective and preventive actions have been planned and implemented through top-level decisions.

With the ISO 22301:2019 Business Continuity Management System Certificate, Türkiye Finans has been registered as performing “Business Continuity Management at International Standards”.

Business Continuity