CEO's Message (Annual)

We are a profitable bank that grows strongly under all circumstances.

2013 was the beginning of a challenging period for the banking industry, not only because of the global macroeconomic conjuncture, but also due to the rising funding costs and interest rates in the domestic market, as well as the pressure brought by tight money policies on loan volumes and the devaluation of the Turkish Lira.

For Türkiye Finans, on the other hand, 2013 was a year full of achievements in which the Bank reached its targets in primary financial indicators, raised its market share and grew stronger than the sector.

By the end of 2013, Türkiye Finans’s total assets had increased by 43% YoY to exceed TL 25 billion in value. The total size of funds collected by the Bank grew by 32% and reached TL 15.1 billion, while the total volume of funds, including financial leasing transactions, which were supplied to customers, increased by 40% YoY to reach TL 18.3 billion. The Total Supplied Funds/Total Assets ratio was realized at 73%. Thanks to the right loan supply and risk management policies, the Bank ensured the continuity of its growing loan volume without compromising on loan quality. The ratio of non-performing loans to the total amount of funds supplied by the Bank fell to 2.4%. The Bank’s shareholders’ equity amounted to TL 2.5 billion, with an average return on equity of 14.2% and a capital adequacy ratio of 12.81%.

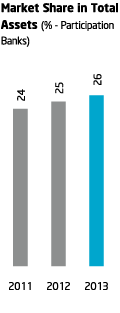

Maintaining its title as the most profitable participation bank for the last 3 years in a row, the Bank raised its net profit by 16% to TL 329 million in 2013, while also demonstrating a better performance in terms of net profit margin than the average of participation banks. As of the end of 2013, Türkiye Finans had increased its market shares among participation banks in every category with a 26% market share in total assets, a 27% market share in funds supplied and a 25% market share in collected funds.

As our target for 2013, we opened 30 more branches, thus operating a total of 250 branches by the end of the year. Our branches reflect our service approach and our restored image, not only visually, but also with their organization structures and operations.

Supporting its organic growth with qualified human resources, the Bank had a large team of nearly 4,000 employees at the end of 2013. We were proud to have achieved a 3 percentage point increase in the ratio of female employees in our workforce, to 29% by the end of 2013.

Türkiye Finans aims to “BECOME ONE” with its fair, transparent and people-oriented approach that is in harmony with the Bank’s principles, and to gain a pioneering and strong position in the sector with its most valuable asset, its human resources. We believe it is the “people” who make us different. We act based on the vision of working with professional and well-trained human resources which contribute to the sector. We provided 67 hours of training per employee in 2013, reflecting the great importance we attach to personnel training.

We have restructured our sales team, restoring a more dynamic structure in 2013 in line with our Bank’s growing business volume and the needs arising as a result of its organizational structure. We are determined to improve our human resources in accordance with the needs of our organization undertake every effort to become one of the most preferred employers in our industry.

A flawless customer experience

The Customer Experience and Multichannel Strategy Project was launched in 2013, which aims to create a flawless customer experience and envisages deeply rooted changes in Türkiye Finans's style of conducting business.

Working to a target of continuous improvement in customer experience

The Customer Experience and Multichannel Strategy Project was launched in 2013, which is aimed at achieving a perfect customer experience, envisaging deeply rooted changes in Türkiye Finans’s style of conducting business. Within the framework of this project, we set up the elements of customer experience and our related strategy based on our customers’ needs and the principle of efficiency. Also drawing our Customer Constitution which lies at the heart of this strategy, we once again stressed that our raison d’être is to generate added value for our customers, our shareholders and our employees. Our Customer Constitution clarifies our roadmap by laying down the foundation of all necessary arrangements and improvements with respect to our sales and service model, products/services, delivery channels and processes.

A bank guided by technology

Our innovative product and service approach supported by information technologies allows our Bank to differentiate itself in the industry while continuing to grow. Our high capability and determination in reflecting the latest technology to our processes and product/service cycle in the most effective manner provide us with the opportunity to offer a whole range of “firsts” to the market. Possessing Turkey’s most modern data center, in 2013 our Bank realized its target of being the first corporation and first financial institution in Turkey to receive the Tier III Operations (Constructed Facility) certificate.

In order to provide easier and more extensive access in line with our customer-oriented strategies aimed at improving customer experience, we continue to step up our investments in alternative delivery channels that effectively incorporate the latest technologies.

With our superior information systems, we have broken new ground in the field of mobile banking in 2013, providing our banking services to smart phones through our mobile internet branch. Compatible with all devices with an iOS or Android operating system, our mobile internet branch offers a wide range of features in addition to the most frequently used banking applications for the service of our users. As a result, our mobile internet branch ranked first in the list of “Most Admired Mobile Banking Practices in 2013”.

By the end of 2013, Türkiye Finans had increased its market share among participation banks in all categories with a 26% market share in total assets, 27% in funds supplied and 25% in collected funds.

We will further strengthen the value proposition which we offer our individual customers and SMEs, particularly through the use of our human resources and by applying the latest technology.

We are the leading participation bank in terms of product development.

Türkiye Finans works unstintingly to introduce banking industry products and services of high added value that are in compliance with the principles of participation banking, maintaining its leadership in product development. A new product, Finansör, which we developed for our individual customers, has continued to attract a great deal of attention. In 2013, we have offered our customers the opportunity to pay through installments when shopping with their credit cards through the service entitled “Do Installments”. As part of our card finance solutions, we offered Siftah (First Sale of the Day) Card to our SME customers and the Faal (Active) Card to our customers in enterprise banking.

Showing our difference in participation banking with an array of awards

As well as the new products and services which it has introduced to the participation banking sector, Türkiye Finans maintains its leadership in the sector, as proven by the awards it has received, both from within Turkey and abroad.

Thanks to its approach based on customer and employee satisfaction, our Bank received a total of 15 awards in 2013, including “Turkey’s Best Call Center”, “Turkey’s Best Participation Bank”, “Respect for People” Award, “Turkey’s Best MASAK-Compliant Bank” and “Best Complaint Managing Participation Bank of the Year”. The details of all of these awards are provided on page 7 in this report. I would like to thank all of our stakeholders who contributed to this successful picture.

USD 500 million

Türkiye Finans performed the largest sukuk bond issuance after those carried out by the the Undersecretariat of Treasury.

In 2013, Türkiye Finans significantly improved its ability to access international resources.

Having launched the largest murabaha syndicated loans in the participation banking industry over the last two years, Türkiye Finans received a USD 500 million murabaha syndicated loan - the highest amount ever in a lump sum ever in the participation banking sector. Provided with the participation of 28 banks from 14 countries, this loan was twice as large as the initial amount of USD 250 million.

The Bank formed an inclusive funding structure with longer maturity by providing new resources through the issue of sukuk bond and other restructured funding instruments in 2013, in order to extend the maturity of funds provided from money and capital markets and to expand the investor base. Within this framework, Türkiye Finans performed the highest sukuk bond issuance after those carried out by the Undersecretariat of the Treasury. The Bank launched this USD 500 million loan, which was more than 3.7 times oversubscribed with demand from 105 different investors from Asia, Europe and the Middle East.

Towards higher targets, altogether…

The primary factors that accurately guide us in our growth-oriented roadmap are our human resources and our competence in deploying the latest technology, as well as our new products and practices aimed at our individual customers and, in particular, SMEs; and our efforts to implement our processes and to add strength to our service platform.

The strength arising from our partnership and financial structure, as well as our management approach, vision and strategies will cement our competitive edge in the period to come. I would like to take this opportunity to extend my sincerest gratitude to our employees, business partners, customers and investors for their trust and support, and for believing in us as we together strive to realize our constantly rising targets.

Yours sincerely,

Derya GÜRERK

CEO