Assessment of Financial Position, Profitability and Solvency; Asset Quality and Profitability

Asset Quality and Profitability

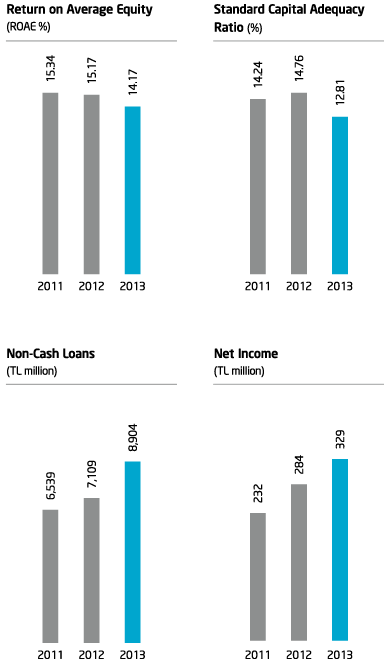

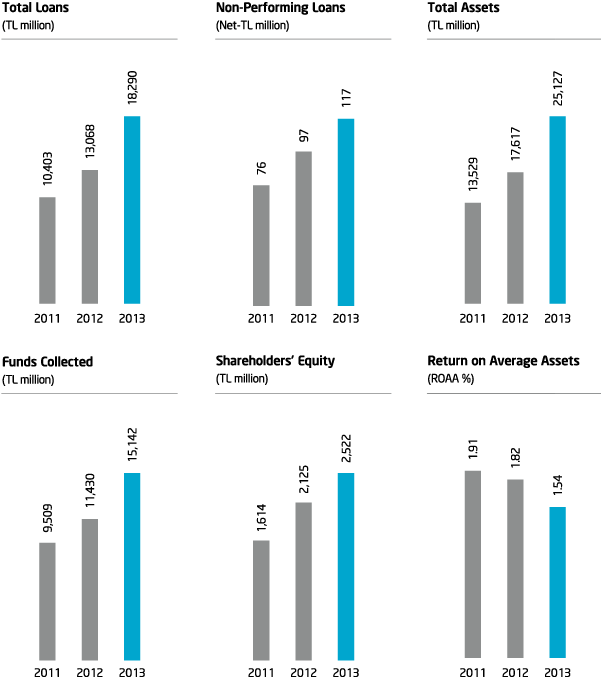

Türkiye Finans’ total assets increased by 43% YoY to reach TL 25.1 billion in value as of December 2013. The Bank posted gross income of TL 412.5 million and net income of TL 329.3 million. The latter figure corresponds to a YoY rise of 16%.

Funds Collected and Shareholders’ Equity

Funds collected, which represent the Bank’s most important financial resource, increased by 32% YoY to reach TL 15.1 billion as of December 2013. Funds collected accounted for a share of about 60% in the Bank’s overall balance sheet. Of this total, 64% is held in Turkish Lira and the remaining 34% in foreign currency accounts. With the inclusion of retained previous year profits, total shareholders’ equity amounted to TL 2.5 billion last year.

The Bank’s standard capital adequacy ratio stood at 14.76% in 2012. As of December 2013, it had decreased slightly to 12.81%.