Macroeconomic Outlook and Sectoral Developments

Global economic activity expected to grow stronger in 2014.

Global macroeconomic outlook

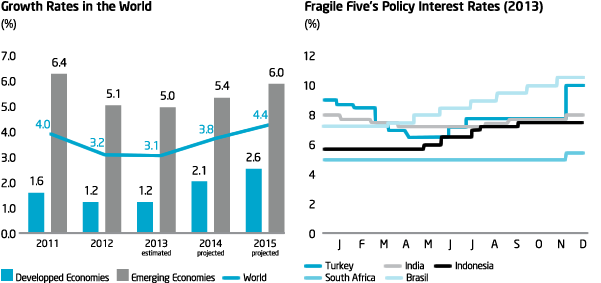

Despite the weak outlook in early 2013, there was a whole different perception in developed countries in the second quarter. Developed countries, particularly the US economy, enjoyed a period of sound recovery, while emerging markets began to suffer weaker economic activity. The volatility in capital inflows to emerging markets worsened after the FED (Federal Reserve Bank) hinted at a strategy to end its supportive money policies, as well as the mounting uncertainty over its financial policies. There was a balanced trend in prices globally thanks to the weak commodity prices resulting from capacity surpluses.

In addition to falling growth rates, emerging markets have also struggled with the challenges of the re-pricing period and the effects of FED’s strategy to exit supportive money policies since mid-2013. Among emerging economies, those named as the “Fragile Five” which have high current account deficits and/or budget deficits demonstrated a weak and fragile performance, while they were also forced to tighten their monetary policies.

Global economic activity is expected to grow stronger in 2014. On the other hand, a severe and uncontrolled slowdown in emerging markets could lead to deterioration in global perceptions. Moreover, political difficulties arising in some emerging markets, as well as fragilities in developed countries and reviving concerns with respect to the debt problem in the Eurozone are deemed as other risk factors for the global economy. The following need for foreign financing, credibility and predictability in monetary and financial policies and political stability will also stand as primary selection criteria in terms of capital flows.

Outlook for the Turkish economy

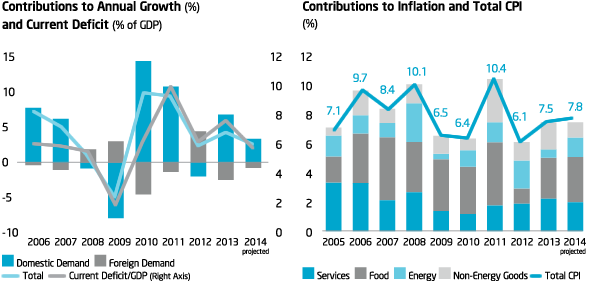

The improvement in Turkey’s credit rating and strong capital flows supported economic growth in the first half of the year. The Turkish economy grew by 3.8% YoY in this period while demonstrating a moderating inflation trend and an easing current account deficit. Encouraged by such a positive environment, the CBT aimed to keep the value of the TL under control by applying a flexible monetary policy and balanced liquidity policy.

After May, Turkey was one of the markets to lose significant value during the global selling wave initiated by the FED’s decision. Developments in Turkey during the summer months severely compromised foreign investor interest in Turkey and a new wave of selling began in December as the FED began to taper asset purchases, along with weak data from emerging markets. Again, the political developments in Turkey in December exacerbated sales in the financial markets by worsening the perception of political risk in the country.

3.5-4%

Data for the last quarter of 2013 indicates that Turkey was on course for 3.5-4% economic growth in 2014.

Although economic activity lost some momentum due to the volatility in financial markets and the CBT’s efforts to tighten the monetary policy to a limited extent, a strong trend was observed in the second half of 2013. Data related to the last quarter indicate that Turkey’s growth rate in 2013 was estimated to have reached 3.5-4%.

The TL demonstrated a weak performance with its risk premium considerably increased. The inflation rate started to edge higher due to fluctuating food prices and the fall in the TL, while the CBT began to apply a more cautious policy. Within the framework of this policy, the CBT raised the upper band of the interest rate corridor by 125 basis points in total and began to tighten liquidity conditions by launching additional monetary tightening (EPS) practices. The CBT also started to sell foreign exchange and intervene in the FX market in order to provide the required FX liquidity and avoid unhealthy price formations.

Although economic activity lost some momentum due to the fluctuations in financial markets and the CBT's efforts to tighten its monetary policy to a limited extent, a strong trend was observed in the second half of 2013.

In late January, the CBT held an interim meeting in order to limit the negative reflections of the worsening risk perception in domestic and foreign markets, and accordingly, limit the effect of the falling TL and surge in Turkey’s risk premium on inflation rate and macroeconomic stability. The CBT finally decided to dramatically tighten its monetary policy and simplify it within the operational framework. The bank raised the 1-week repurchase interest rate from 4.5% to 10% and began to provide funding essentially at this rate instead of the marginal rate. The bank also raised the marginal funding rate from 7.75% to 12%, the overnight borrowing rate from 3.5% to 8% and the interest rate applied on the borrowing of market-making banks through repurchase transactions within the framework of open market transactions from 6.75% to 11.5%. Uncertainty is expected remain rife in the periods to come, given the domestic and foreign factors at play. As a result, there is a risk that the Turkish economy may grow slower than the 4% rate projected in the Medium Term Program (OVP), and that inflation could be significantly higher than the CBT’s forecast of 5.3%. Under these circumstances, it is believed that the pressure on the exchange rate and downward pressure on market incomes could continue.

The Turkish banking industry and participation banking

In the first half of 2013, the banking industry demonstrated a successful performance supported by the low interest rate environment and recovering domestic demand. Improving economic activity and the rise in Turkey’s credit rating to investment grade were other factors supporting this process. At the same time, leading figures from the sector raised their foreign borrowing in this cost-efficient environment.

The second half of the year was marked by a challenging process in parallel with macroeconomic developments. The CBT’s interest rate hikes and the precautionary macroeconomic measures taken by the Banking Regulation and Supervision Agency (BRSA) caused economic growth to lose momentum with increasing costs and shrinking revenues.

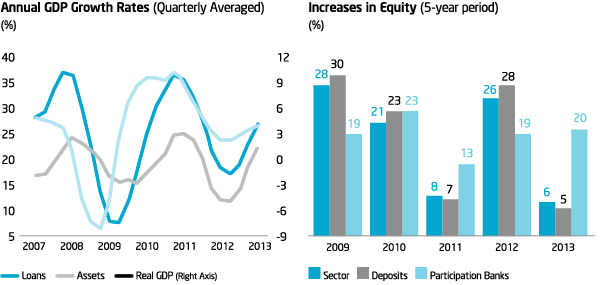

In 2013, the total assets of the banking industry grew by 26% YoY to TL 1.732 trillion, with collected funds increasing by 23% YoY to TL 946 billion, with a 32% YoY increase in supplied funds to TL 1.047 trillion and a 6.5% YoY increase in shareholders’ equity to TL 194 billion. During the same period, participation banks’ total assets held by grew by 37% YoY to TL 96 billion with collected funds increasing by 28% YoY to TL 61 billion, supplied funds by 29% YoY to TL 62 billion and shareholders’ equity by 20% YoY to TL 8.9 billion. Participation banks’ share in the banking industry increased from 5.1% to 5.5% in terms of total assets, from 6.2% to 6.5% in terms of collected funds and from 4.1% to 4.6% in terms of shareholders’ equity, but declined from 6% to 5.9% in terms of supplied funds.

Despite the downward pressure on financial markets, there was strong demand in the sukuk bond issues carried out by the Treasury and participation banks.

The average loans/deposits ratio continued to rise in the banking industry in the first half of the year, while its growth slowed down in the second half due to the measures taken by regulatory authorities in the face of the general economic developments. Despite this, the loans/deposits ratio reached 113% by the end of the year. Securities issued by the sector to domestic and foreign markets rose by 60% to TL 60.6 billion in 2013. Despite the strong growth in loan volume, the banking industry’s total profit rose by 5.1% to TL 24.7 billion while that of the participation banking sector increased by 17% to TL 1.1 billion because of the contraction in margins due to rising costs.

In addition to the Treasury’s sukuk bond issues, participation banks including Türkiye Finans also carried out sukuk bond issues. Despite the pressure that the financial markets were under, the Treasury’s and participation banks’ sukuk bond issues attracted strong demand.

In the second half of the year, a number of measures were taken in the banking industry: general provisions set aside by banks and risk weight weightings were raised, while credit card limits and the maturities of consumer loans were limited. The impact of some of these measures began to be observed in 2013.

On the other hand, the sector’s growth is expected to be limited in 2014 due to the measures taken for the banking industry, as well domestic and foreign developments. Despite rising funding costs, the banking sector’s profitability may also be limited by increasing provisions.