Capital and Shareholder Structure (*)

Shareholder |

Share Amount (TL thousand) |

Share Ratio (%) |

|---|---|---|

NATIONAL COMMERCIAL BANK |

1,176,369 |

66.27 |

GÖZDE GiRiŞiM SERMAYESi YATIRIM ORTAKLI⁄I A.Ş. |

205,405 |

11.57 |

(HACI) MUSTAFA BOYDAK (1934) |

41,173 |

2.32 |

BOYDAK HOLDiNG A.Ş. |

39,213 |

2.21 |

BEKiR BOYDAK |

33,269 |

1.87 |

MEMDUH BOYDAK |

33,269 |

1.87 |

MUSTAFA BOYDAK (1963 SON OF SAMi) |

33,250 |

1.87 |

YUSUF BOYDAK |

31,309 |

1.76 |

ŞÜKRÜ BOYDAK |

27,730 |

1.56 |

HACI BOYDAK |

26,678 |

1.50 |

Total |

1,775,000 |

100.00 |

(*) Shareholders holding 1% or more Interest in Türkiye Finans are shown in the table above. 130 shareholders, which have interest below 1% In the Bank represent a total of 7.2% share.

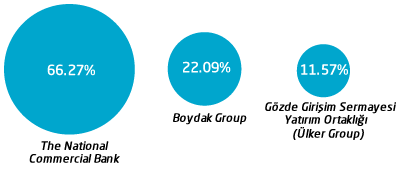

Carrying out their strategic partnership mission in the management of Türkiye Finans, NCB, the Boydak Group and the Ülker Group held 66.27%, 22.09% and 11.57% stakes in the bank, respectively, as of 31 December 2013.

About NCB

NCB (National Commercial Bank), Türkiye Finans’s majority shareholder is the most deeply-capitalized bank in the Gulf region and the largest bank in Saudi Arabia with equity amounting to USD 10.9 billion. At the end of 2013, the bank had total assets worth USD 100.6 billion. NCB serves a customer base of more than 3.5 million with 7,119 employees in 329 branches located in Saudi Arabia. The bank employs highly effective and efficient use of alternative delivery channels, which now account for 92% of its customers’ transactions. In 2013, NCB was deemed worthy of the “Best Islamic Bank in the Kingdom of Saudi Arabia” and “Islamic Bank of the Year in Saudi Arabia” Awards from a variety of publications, most notably The Banker magazine. Also, according to the bank principal capital (Tier 1) listing prepared by The Banker in 2013, NCB ranked 1st in the Middle East and 115th in the world.