An Assessment of Türkiye Finans' Activities in 2013 and their Results

Türkiye Finans determines its strategies based on the following principles: to increase product penetration by expanding its client base, to establish permanent relations with customers by gaining their loyalty, and to become the most preferred bank for customers by deepening its relations with them.

A 32% increase in the total volume of collected funds

Thanks to its customer-oriented approach, expanding branch network and growing client base, as well as the strong relations it has established with its customers, Türkiye Finans raised the total amount of collected funds by 32% to TL 15 billion in 2013.

Our priority is to provide continuous support to the real sector by supplying funds.

In 2013 Türkiye Finans continued to supply the amount remaining after legal charges were deducted from collected funds, to its customers as funds, in line with its mission of supporting the real sector. The total amount of cash loans (including financial leasing) supplied by the Bank increased by about 40% YOY to TL 18.3 billion by the end of 2013.

In the participation banking sector, which is oriented to the real sector, the supplied funds/ total assets ratio is an important indicator. The Bank’s ratio of supplied funds/total assets was 73% at the end of 2013, indicating the intensive loan supply activities. In addition, the Bank’s non-cash loan portfolio grew by 25% YoY to reach a volume of TL 9 billion in 2013.

Türkiye Finans’ basic strategy in supplying funds is to spread the risk to the base

At Türkiye Finans, the risk per customer is low. When the composition of risks is considered, the share of the 10 riskiest customers in funds supplied is just 5%, while that of the 20 riskiest customers stands at 8%. The fact that these ratios are below 10% is an important indicator that there is no risk concentration.

On the other hand, as of 31 December 2013, the share of the sum of the risks of the 100 largest loan customers to the Bank’s total cash loan portfolio was 13.88%, while that of the 200 largest customers stood at 20.34% (31 December 2012: 14.04% and 20.69%).

At Türkiye Finans, risk concentration is low on a sectoral basis. The Bank is determined to protect its sound portfolio structure that comprises of sectors and companies deemed to offer high growth potential and which have no risk in terms of solvency. Despite the Bank’s strong growth rate - which was higher than the sector average - the ratio of its non-performing loans declined from 2.8% in 2012 to 2.4% in 2013. This ratio is lower than the sector average and the average ratio of participation banks. The low ratio of non-performing loans shows the quality of Türkiye Finans’ assets and the fact that it has grounded its growth plans on robust foundations, further strengthening the Bank’s competitive edge.

TL 9 billion

In 2013, the total amount of cash loans supplied by the Bank reached TL 9 billion with 37% growth in the commercial banking segment, 26% growth in the corporate banking segment and 33% cumulative growth in the commercial/corporate segment.

We maintain a balanced growth trend in the commercial/corporate banking segment

Within the framework of its commercial/corporate banking activities, Türkiye Finans serves those companies with TL 15-150 million in annual net sales through the Commercial Banking department and those companies with a turnover of more than TL 150 million through the Corporate Banking department.

Türkiye Finans determines its strategies based on the following principles: to increase product penetration by expanding its client base, to establish permanent relations with customers by gaining their loyalty, and to become the most preferred bank for customers by deepening its relations with them.

The Bank reaches its customers, which number more than 25,000 operating in different sectors, through its qualified staff, who are specialized in the art of relationship banking. Working to the target of being the first choice for customers, the Bank produces boutique solutions through its two corporate banking branches in Istanbul and Ankara, as well as 150 commercial customer relations managers and 65 customer services representatives who are employed in 120 branches throughout Turkey.

Reflecting its internal and external customer experiences to its own processes, Türkiye Finans also succeeded in raising the total volume of funds extended to the commercial/corporate segment in 2013, by keeping customer satisfaction at a maximum level and through its rich array products, rapid solutions and service quality.

In 2013, the total sum of cash loans supplied by the Bank reached TL 9 billion with 37% growth in the commercial banking segment, 26% growth in the corporate banking segment and a 33% cumulative increase in the commercial/corporate segment.

In the same period, the Bank achieved 198% growth in the commercial banking segment and 169% growth in the corporate banking segment in financial leasing, while the total risk of the commercial/corporate segment increased by 190% to TL 538 million.

Non-cash loans extended by the Bank in this segment grew by 23% YoY to TL 6.8 billion in 2013. As part of its efforts to support Turkey’s export activities, Türkiye Finans also mediated in USD 488 million worth of non-cash loans in the short-, mid- and long- term categories supplied by Türk Eximbank to exporters, manufacturers carrying out export-oriented production and contractors and entrepreneurs operating in foreign countries.

Aiming to raise the profile of our foreign trade bank identity

Türkiye Finans took strong steps in 2013 in line with its strategic priorities, such as enabling its commercial/corporate customers to receive an increasing share in foreign trade transactions and expanding their transaction volume. Generating solutions that aim to meet the expectations of its foreign trade customers, the Bank has improved the processes related to its existing products/services and shared the developments in this area with its marketing teams by organizing various training programs.

Taking steps to diversify such services that would raise the profile of its identity as a foreign trade bank, Türkiye Finans offers specialized foreign trade consultancy services to its customers by making effective use of major loan alternatives as provided by institutions that support foreign trade, such as the Saudi Export Program (SEP), the International Islamic Trade Finance Corporation (ITFC), the Islamic Development Bank (IDB), GSM and Eximbank.

We continue to expand our product portfolio.

Within the framework of data collected from our customer experiences, the Bank launched new products in the commercial/corporate segment in 2013:

- The International Finance Package for those customers who are engaged in intensive foreign trade activities

- Non-licensed Renewable Energy Package for those customers operating in the energy sector and/or who have high energy costs

- Customer Loyalty Package aimed at increasing the activation of existing customers

- Welcome Package aimed at the activation of new customers gained by the Bank

In the field of Cash Management, the Bank provides Commercial Cards and Direct Collection System (DTS) services under the roof of Commercial Business Family.

In 2013 Türkiye Finans made its revenues in this area sustainable by expanding its client base and increasing its market shares through its existing products and services.

The number of parent companies that the Bank has entered into a Commercial Card agreement with increased from 11 in 2012 to 14 in 2013 and the number of sub-dealers from 38 to 43 in the same period.

Similarly, within the scope of DTS, the number of parent companies that the Bank entered into agreements with increased from 15 in 2012 to 29 in 2013; the number of sub-dealers increased from 101 to 183 and the allocated DTS limit from TL 46 million to TL 95 million, while the transaction volume rose TL 109 million to TL 240 million in the same period.

In addition, the total amount of taxes and social security payments of customers mediated by the Bank increased by 109% YoY to TL 1 billion. The Bank, by producing alternative solutions for payment systems, continues to develop its existing partnerships with customers in this area. As part of the Bank’s efforts to this end, the number of its commercial/corporate customers using its POS devices climbed by 5% to 676 and the Bank’s POS turnover increased by 6% to reach TL 594.3 million. As a result, the Bank’s revenues in this area rose by 151%, amounting to TL 472,000.

We set up our field organization in the corporate banking segment.

Positioned as part of the Bank’s Multichannel Strategy and Customer Experience Improvement, the Corporate Baking Field Organization project was completed in 2013 and will be launched in 2014. Within the scope of the project, the Bank has planned to open, two new corporate branches in Istanbul and corporate representative offices in 10 cities where there is high corporate customer potential, which will compliment the Başkent and Kozyatağı Corporate Branches which are already in operation,. With the completion of the project, the Bank aims to provide direct, specialized and high-quality service to nearly 95% of its 7,600 corporate customers through a field sales staff of 46 people.

A 30% increase

The number of customers in the SME and Enterprise segment increased by 30% YoY, approaching 243,000 in 2013.

Always standing by SMEs and micro enterprises through Enterprise Banking

Having concentrated on the enterprise banking segment based on such pillars as customer orientation, proactivity and mobility within the framework of its mission to produce added value for SMEs and micro enterprises, that are the driving forces of the Turkish economy, Türkiye Finans provides financial support, information and consultancy to its customers.

Within the scope of the Entrepreneur Job Family program, the Bank extended TL 4.9 billion in cash loans (an increase of 65% YoY) and TL 2.6 billion (up by 35% YoY) in non-cash loans.

According to the official SME definition, the Bank’s loan risk magnitude in the enterprise banking segment reached TL 7.7 billion. Meanwhile, the Bank has a 27% share in SME loans among participation banks, and a 2.8% share in the entire banking industry.

Providing support to meet the needs of SMEs and enterprises for all types of investment tools, such as machinery, equipment etc., Türkiye Finans increased its financial leasing transaction volume by 129% YoY to TL 234.9 million in the enterprise banking segment.

In line with its target of expanding its customer mass and acquiring new customers by widening the base in the SME and enterprise segments, the Bank worked with a strong team of 526 people from 250 branches in 2013. With such efforts, the number of customers in these segments rose by 30% YoY to reach nearly 243,000 in 2013.

Expanding the base in the SME portfolio through enterprise banking

The Enterprise Banking Department was founded in January 2013 in order to expand the base in the SME portfolio and to offer rapid, innovative and competitive solutions for the financial needs and requests of tradesmen and small scale enterprises, which differ from commercial and corporate customers because of their management structures and needs as well as their scale.

In 2013, the Bank provided TL 191 million in cash loans and TL 61 million in no-cash loans to nearly 136,000 tradesmen and small scale enterprises in the Enterprise Banking segment.

Effective processes in loan supply

Launched in the first half of 2013, the “Micro Scoring” project aims to implement faster and more effective credit assessment processes to deal with the loan requests of up to TL 50,000 of tradesmen and enterprises whose annual turnover is less than TL 500,000.

In 2013, a total of 3,700 applications for loans of less than TL 50,000 were immediately concluded. By this means, the Bank gained the opportunity to serve its customers more rapidly. The Bank now aims to provide instant service to more customers, shorten the application procedures and raise the quality of its services and loan allocation processes by including loan requests of up to TL 250,000 in the scope of the “Micro Scoring – 2” practice in 2014.

Moreover, by means of the e-declaration project launched in 2013, the Bank has shortened fund allocation process by enabling automatic transfer of customers’ financial information to the system.

Speeding up trade, with the Faal Card

Maintaining its easy accessibility and ability to provide rapid services through its card products, the Bank issued the Faal Card in 2013 to meet the financing needs of enterprises on a 24/7 basis.

The Faal Card is a debit card developed with the motto, “The Card That Speeds up Trade”, which allows tradesmen and micro enterprises to instantly split the payments of purchased products and services related to their trade activities into the agreed number of installments and over the agreed profit share. The Bank instantly concludes Faal Card applications submitted through branches and the branches deliver customers their Faal Cards with their limits loaded. Customers can begin using their cards immediately at all POS devices in Turkey with the approved limits.

Given to nearly 7,000 customers, the Faal Card generated TL 95 million in turnover and reached TL 56.7 million in risk remainder. The Faal Card was a product that has supported the Bank’s strategy to expand the base with an average limit of TL 15,000 and a risk remainder of TL 9,000 per customer.

The Siftah (First Sale of the Day) Card, the first debit card in participation banking, was offered to the service of our customers in June 2013.

Another first in participation banking: The Siftah Card

Launched in June 2013 for the service of its customers, Siftah Card was the first card in participation banking to allow SMEs to reorganize and secure their cash flows by offering them the opportunity to pay for the prices of purchased products and services in instalments and without using check or promissory note. As the first debit card that also offers corporate financial support, Siftah Card provides high flexibility to customers due to its ability to automatically split the payments of all purchased products and services into the agreed number of instalments, the opportunity that it offers to customers to change the number of instalments at any time based on their cash flows and the fact that the limits of extra cards can be determined separately. Siftah Card has reached more than TL 35.7 million in turnover in a 6-month period.

Other card solutions specific to SMEs

By carrying out improvements on the Business Card to better serve customers, the Bank enabled credit cards to also be used as debit cards. Again, by developing the “private point” feature in 2013, the Bank allowed customers to use the points they receive in private transactions, such when buying fuel or flight tickets.

Thanks to the Paratik Ticari (Money-Practical Commercial) Card offered to the use of SMEs and enterprises in 2013, customers can easily perform their banking transactions through ATMs on a 24/7 basis at all times. At the end of the year, the number of Paratik Ticari cards in circulation had reached 45,000.

Through the SME Card Protection Plan, Türkiye Finans has guaranteed SMEs and their employees against any undesired expenditures and negative situations that might arise in the event that their personal or commercial cards are lost or stolen.

More assurance

In 2013, the Bank launched new products and services aimed at meeting the needs of craftsmen and small scaled enterprises and performed some work to improve customer experience in existing products and services.

Within the framework of its strategy to provide consultancy to SMEs, the Bank launched, in the third quarter, işyerim Güvende (My Safe Office), Limit Güvence (Limit Assurance), Çek Güvence (Check Assurance) and Faal/Siftah Card Assurance insurances that are prepared specifically to ensure the sustainable growth of SMEs. Through 14,000 policies, the Bank has brought customers under protection against any risks that they may encounter in their commercial activities.

Gülen Çiftçi (Smiling Farmer) Agriculture Package

The Gülen Çiftçi Agriculture Package, which takes account of regional characteristics and also covers financial leasing projects was revised and offered to the use of farmers. To this end, and as part of its efforts to raise its market share in agricultural loans, the Bank provided farmers with financing facilities with favorable maturities and profit shares by entering into cooperation with corporations selling combine harvesters, tractors and agricultural equipment in various cities, especially Kırşehir and Kırıkkale. Through the restored Gülen Çiftçi Agriculture Package, a total of TL 73 million in loan support was provided to customers in 2013.

Cooperation with TESK

The Confederation of Turkish Tradesmen and Craftsmen (TESK) is a professional organization established in the form of a public institution, which has one of the most widespread organization networks in Turkey bringing together tradesmen and craftsmen, who form one of the most important building blocks of the Turkish economy. The Bank signed a special protocol with TESK that covers financing packages prepared for member enterprises.

In accordance with the signed protocol, the Bank has prepared four different financing packages with special maturity and profit sharing for TESK members. These packages were offered to the use of more than 2 million craftsmen and tradesmen operating in 491 business sectors and registered to a total of 3,170 chambers under 13 professional federations and 82 unions. As an extension of this project, the Bank has entered into local protocols with the Chambers and Associations of Craftsmen and Tradesmen of Antalya, Kayseri and Denizli, and gathered craftsmen and tradesmen under a single roof, while offering them the opportunity to benefit from special advantages and discounts in product and services purchases. TESK members were regularly informed and special campaigns such as Faal Card and POS were organized for them.

In order to get closer to the small enterprises and tradesmen who constitute the Bank’s primary target mass, and to cover their needs, resolve their problems and strengthen the Bank’s relations with them, the Bank participated in the 26th Ahi Community Week organized by TESK in Kırşehir - the center of the Ahi Community.

We are coming together with SMEs

Attaching great importance to the development of SMEs and their integration with domestic and foreign markets, the Bank added momentum to its efforts with the chambers of trade and industry. To this end, the Bank signed protocols with the Chambers of Trade and Industry of Denizli, Uşak, Mardin, Çanakkale, Rize, Nevşehir, Yozgat and Kastamonu; and held meetings entitled “Türkiye Finans Days” in a variety of cities in Turkey with the aim of providing SMEs with information and consultancy services and the chance to share their own experiences.

In addition to these efforts, the Bank has entered into sponsorship agreements to raise SMEs’ awareness for branding and to contribute to the rise of new brands from Anatolia; and started “Anatolian Brands Publicity Meetings” in June. During this period, special meetings were held with the cooperation of the Chambers of Trade and Industry of Denizli, Şanlıurfa, Gaziantep and Çanakkale, while an important figure from the Turkish economy would share his/her inspiring brand story with participants in each city. Concurrently with the meetings, applications were received for the Anatolian Brands Contest. A number of institutions and agencies from all across Turkey participated in the Anatolian Brands Contest 2013. Winners of the contest were granted their awards in a special ceremony organized in December.

Supporting SMEs with the Investment Incentive Certificate

Within the scope of the “Profit Share Protocol” signed by and between Türkiye Finans and the Ministry of the Economy, the Bank continued to support SMEs through the Investment Incentive Certificate in 2013. In this area, the Bank provided a total of TL 55 million of financial support to product purchases related to customers’ investments in 2013.

Special packages for SMEs

Having participated in the 4th National Energy Efficiency Fair held in Istanbul on January 10th-11th with the 100% Energy Package offering favorable profit and maturity conditions, Türkiye Finans provided solutions for the emergent financing needs of enterprises operating in the energy sector and have projects aimed at energy saving. One of the solutions was the Faal and Siftah Card which was offered to participants of the fair. The Bank extended TL 82 million of loans through the 100% Energy Package, which is aimed at meeting investment and other financing needs of customers, including foreign trade transactions, and offers advantages and price discounts in banking transactions, as well as product classes that are subject to financial leasing.

Supporting environmentally friendly renewable energy production under the motto, “Generate Your Own Electricity”, the Bank offered its customers the Renewable Energy Package that finances all turnkey expenses at favorable maturities and rates, including equipment purchases related to “no license” renewable energy production, as well as the installation and construction of generators and their connection to the national grid.

Having participated in the Furniture and Decorations Fair held in inegöl, Bursa, where the Bank opened a booth, Türkiye Finans continues to support enterprises in the furniture sector with the Decorative Furniture Package. The Bank extended nearly TL 17 million in resources to its customers in 2013 through the Decorative Furniture Package, which allows furniture companies to access the required banking services with various advantages.

As in 2012, Türkiye Finans maintained its leading position in the banking industry in 2013 on the basis Treasury Supported Credit Guarantee Fund collaterals.

Strengthening Cooperation with KGF (Credit Guarantee Fund)-KOSGEB (Small and Medium Enterprises Development Organization)

In 2013 Türkiye Finans continued to provide such unique services that contribute to the growth and development of SMEs. Supporting the development of SMEs by offering them easy access to financial resources was one of the first and foremost items on Türkiye Finans’ agenda in the area of SME banking in 2013.

Demonstrating a solution-oriented approach to facilitate SMEs’ access to financial resources, Türkiye Finans maintained its leading position in the banking industry in 2013 on the basis of Treasury Supported Credit Guarantee Fund collaterals, as it had in 2012. Having allocated a total of TL 260 million worth of resources through Treasury Support KGF Collaterals in 2013, the Bank attained a total of TL 503 million in total transaction volume, providing 63% more collateralized support than the second ranking bank. By increasing the volume of resources supplied in this category by 107%, and raising its market share from 18% to 28%, Türkiye Finans succeeded in providing SMEs with more collaterals than any other bank.

Having completed the necessary infrastructure work to allow tradesmen and small enterprises to benefit from the KGF Collateral Program (in which the Bank is a leading partner), the Bank allowed small enterprises to receive KGF support as well.

Acting on its awareness of social responsibility, the Bank entered cooperation with KOSGEB to support enterprises which had suffered financial hardship in the grievous tragedy which took place in the district of Reyhanlı in the Hatay province in 2013, and extended help for them to restart their operations.

Having adopted the mission of engaging in any type of project that would contribute to the development of our economy, Türkiye Finans offered the Cansuyu Kredisi (Lifeline Loan) for the product and service purchases of SMEs, whose projects are deemed worthy of support within the scope of Support Packages launched by KOSGEB.

Growth in personal financing of housing loans

2013 was an extremely strong year in terms of Personal Financing products. The positive impact of Türkiye Finans’ vision of meeting its customers’ financing needs instantly and applicably was reflected in the Bank’s loan supply and existing remainder figures.

Launched in the last quarter of 2012, Cepte Finansman (Financing in the Pocket) and Hızlı Finansman (Fast Financing) were two important practices within this framework. The Bank received nearly 20,000 applications through the Cepte Finansman channel in 2013, while reaching a total of 344,000 dealers in the Hızlı Finansman channel. Moreover, within the framework of the Personal Loan Processes Optimization Project, the Bank realized a 33% improvement in the duration of the peer-to-peer personal lending process in 2013. For the same purpose, the Bank raised the NBSM automatic decision ratio from 18% to 47%.

Türkiye Finans realized its targets in real estate financing for 2013 at a rate of 102%, and increased its risk remainder in housing financing by 37% to TL 2.6 billion by the end of 2013.

By means of active marketing policies and the effective and efficient use of its delivery channels and for completed projects or projects sold through model houses, the Bank has financed more than 500 mass housing projects nationwide, capturing a significant share from the market.

The Bank provides all services in real estate financing under the Çilingir (Locksmith) Mortgage brand.

In 2013, the Bank extended a total of TL 1.7 billion in housing loans through nearly 16,000 transactions, with loans extended within the scope of mass housing project financing accounting for TL 660 million of this amount. The Bank launched a new product, 2B Financing, in line with the arrangements set out in the Reciprocity and 2B Laws. In 2013, the Bank supplied TL 1.3 million in loans through 2B Financing, and TL 1 million through the mortgage opportunity offered to foreigners.

In 2013, the Bank raised its Consumer Vehicle Financing volume by 22% to a remainder of TL 224 million and its Consumer Loan volume by 207% to a remainder of TL 32 million. These growth rates are significantly higher than the sector average rates.

1,675%

The number of Finansör cards surged at an extremely high rate of 1,675% YoY to reach 83,000 with a total size of TL 88 million in 2013.

Finansör - consumer financing in the form of a card - gains prominence in the sector

There was significant demand for the Finansör product in 2013 as well, and debit card expenditures soared by 133%. With the Finansör product, Türkiye Finans maintained its leadership in terms of debit card shopping volume during 2013.

The number of Finansör cards grew at an extremely high rate of 1,675% YoY to reach 83,000, with a total size of TL 88 million in 2013.

The consumer loan limit applied through Finansör allows for direct payments to the seller’s account through POS machines in product purchases. Moreover, Finansör provides customers with various advantages in terms of service fees and profit share prices, by offering 14 different packages on the basis of identified sectors and customer groups.

All of the latest campaigns and all advantages offered by the Bank are shared with customers on the website at www.finansor.com

The Bank's turnover in personal credit cards rose by 35% YoY. During the same period, the number of deposit cards climbed by 26% YoY to reach 986,000.

Expansion of Happy Card range and practices

In 2013, the Bank expanded its Happy Card portfolio by offering its customers two new products; Happy Mother and Happy Zero. Social security premium payments, BKM Express payments, invoice payments, TL loading and HGS (Fast Transit System) payment functions were added to credit card applications. The number of credit card application channels was increased. Moreover, the ‘BY INSTALLMENT’ practice was launched, offering customers the opportunity to pay by installments in cash transactions.

Credit card holders (Türkiye Finans customers) may benefit from all privileges and opportunities offered by Türkiye Finans member workplaces and Bonus member workplaces. By means of regularly held campaigns, card holders are also offered advantages such as earning additional Bonus points, discounts on their shopping, promotions, additional installments and the chance to postpone installment payments.

Thanks to the features added to credit cards:

- The total number of HGS cards launched in February 2013 reached 28,567;

- In a period of 7 months, TL 25 million in customer transactions were later split into installments through TAKSiTLE (BY INSTALLMENT), a project launched in May 2013 to split advance payments into installments;

- In a period of about 5 months, a total of 70,000 invoices were paid through the following features launched in May 2013; the opportunity to place automatic payment orders and orders for invoice payment with credit cards; and

- With the social security premium payment feature added to credit cards in 2013, the Bank mediated in a total of TL 1.1 billion of social security premium payments in November and December.

All of the latest campaigns and all advantages offered by the Bank within the scope of the credit card programs are shared with customers on the www.happycard.com.tr website. The total number of credit cards issued by Türkiye Finans rose by 19% to 361,000 by the end of 2013.

The Bank’s turnover in personal credit cards rose by 35% YoY. During the same period, the number of deposit cards went up by 26% YoY to reach 986,000.

Turkey’s first credit card unique to mothers - ‘Happy Mother’

Designed specifically for mothers and mothers-to-be, the ‘Happy Mother’ offers customers a general concept that combines discount opportunities, assistance services, free subscriptions and surprise gifts. Holders of the ‘Happy Mother’ card may invest in the future of their children, access privileges that help make life easier while also donating while shopping, to offer a touch of glamor to the lives of people in need.

The most effective zero from Türkiye Finans: Happy Zero Card

Happy Zero cardholders can carry out shopping through installments without paying any card fee, earn points, perform cash advances free-of-charge and without commission, complete their bill payments and BKM Express payments and perform HGS loading. Advance transactions may later be split into installments and customers may donate their points. Moreover, Happy Zero cardholders may also benefit from the assistance services offered to other Happy Card holders.

A first in Turkey: A credit card that shows the direction of Mecca (Kiblah) - Haremeyn ŞUA

Possessing the broadest credit card product range in the participation banking segment, in 2013 Türkiye Finans offered its customers Haremeyn ŞUA, the first and only credit card in Turkey to show the direction of Mecca (Kiblah). For transactions to be made with contracted Hajj and Umrah travel agencies and for shopping to be made in stores that sell materials for Hajj and Umrah travels, the card offers a whole range of advantages, such as splitting some advance payments into installments, emergency healthcare service in return for an additional fee, emergency cover in the event that the card is lost or stolen and translation services for those unable to speak the language of their country of travel, along with many more comprehensive assistance services. Haremeyn ŞUA cardholders may donate the bonus points that they earn during credit card spending to contracted associations and/or foundations.

Rising POS turnover and profit in parallel with an increase in member workplace efficiency

Having carried out a series of measures in 2013 aimed at raising its POS turnover and profit and member workplace activation rate, Türkiye Finans had reached a total of 19,000 member workplaces by the end of the year, while its turnover per POS was realized TL 96,000 with a total member workplace turnover reaching TL 2.3 billion. As a result, the Bank achieved 7% growth in the number of workplaces, 9% in turnover per POS and 10% growth in total turnover.

In order to support the improvement of services offered to member workplaces, in 2013, Türkiye Finans:

- increased member workplace-POS field support. By acquiring new POS devices working with the latest technology, the Bank raised the quality of services offered to member workplaces.

- entered cooperation with different brands within the scope of Cash Register practice to provide services to its existing and new member workplaces in this area. The Bank entered agreements with workplaces to install its POS application at a total 1,100 Cash Registers.

- through the BKM SGK payment gate practice, developed by the Bank in cooperation with BKM (Interbank Card Center) and the SGK (Social Security Institution), customers of the Bank who are holding personal or corporate credit cards are offered the opportunity to pay their social security premiums with their credit cards.

- launched the BKM Express practice in cooperation with BKM Express - a joint platform of banks - and leading brands in the industry; the Bank’s customers are thus given the opportunity to shop over the internet more easily and securely without entering their credit card information.

Invoice collection services through non-bank channels

In the area of invoice collection through non-bank channels, a practice used by only a few banks in the sector, Türkiye Finans reached a significant volume of TL 1 billion through 16.5 million collection transactions in 2013 conducted over the Bank’s Faturavizyon (Invoice Vision) and Ödekolay (Easy Pay) devices, a platform developed for and marketed to enterprises. The commission revenues generated by the Bank through non-bank channels climbed by 28% YoY in 2013 to reach TL 2.6 billion.

The Bank carried out a significant volume of sales through personal financing products and card campaigns.

In 2013, Türkiye Finans and the Bonus Platform, which the Bank is a member of, held customer-oriented campaigns in addition to general campaigns. As a result of these campaigns, the number of active cardholders increased by 57% YoY.

In addition to its existing packages in consumer loans (including Finansör) and vehicle loans, the Bank satisfied customers’ needs with a number of campaigns throughout the year by organizing an average of 4 different periodic campaigns per month. Half of vehicle loans and 30% of consumer loans were provided through periodic campaigns. Moreover, the opportunities offered by standard packages were maintained at all times under a competitive approach which is in line with current market conditions.

In 2013, the Bank also carried out a number of housing financing campaigns and provided loans to customers looking to buy a home. The Bank extended a total volume of TL 110 million in the following campaigns which included the 2+1 mortgage, evlenene mortgage (mortgages for married couples), dosya masrafsız mortgage (mortgages without file costs), bayramı yeni evinizde geçirin (spend your holidays in your new home).

Moreover, Türkiye Finans launched a new product entitled “Hazırevim” (My ready home) in 2013, offering an opportunity to customers who had received mortgages from the Bank to have their utility subscriptions for their new homes started up free-of-charge.

TL 1.3 billion

There was strong development in invoice collections throughout 2013 with the number of collections reaching 22 million with a total of TL 1.3 billion collected.

Aiming to be the primary bank for firms and companies in invoice collection and payment processes.

The Bank offers a number of high value, cash management products and services, such as check books, salary payments, tax and social security premium payments, invoice payments, automatic payment/collection systems.

There was strong development in invoice collections during 2013. The number of collections reached 22 million with a total of TL 1.3 billion collected. Meanwhile, the number of institutions for which Türkiye Finans carries out invoice collection climbed to 118.

In 2013, the Bank continued to offer services such as customs tax collection, social security premium collection while taking Hajj and Umrah payments through the internet branch. The Bank increased the total amount of tax and social security premium collections and payments related to the Directorate of Religious Affairs by 67% YoY and the number of related transactions by 25% YoY in 2013.

Continued growth in the private pension area on the back of BES (Private Pension System)

Launched in early 2013 with the aim of increasing savings in Turkey, BES grew by 33% in terms of the number of participants, supported by the 25% government contribution, while Türkiye Finans grew by 42% in this area. The Bank reached a total fund size of TL 33 million with a growth rate (106%) far in excess of the sector average (23%). By adding two new alternative funds - “Gold Pension Mutual Fund” and “Alternative Standard Pension Mutual Funds” - to the Private Pension Plan portfolio which had, until then, only included the “Flexible Alternative Fund” product, the Bank aims to address BES customers, who are sensitive on the issue of interest-free saving.

Collaboration strengthened with insurance companies in 2013 by carrying out joint projects, including sales campaigns

New products such as Güvenli Ev (Safe Home), AGP, Faal/Siftah Card Assurance, Check Assurance, Limit Assurance and işyerim Güvende (My Safe Office) were supported with sales targets, a move that has allowed the Bank to achieve significant success in insurance sales. The total number of policies produced increased by 23% YoY to 159,000 and the total volume of premiums collected surged by 63% YoY to TL 38 million. The Bank’s insurance commission income target was realized at a rate of 134%, collecting TL 10.3 million in insurance commissions.

Complementing our service cycle with investment products

Through new products and services launched in 2013, Türkiye Finans has succeeded in utilizing its customers’ savings, not only in traditional banking products, but also in alternative investment products.

In order to expand its customer base, the Bank effected improvements in the “Smart Account” product, which offers a variety of advantages to small investors. The Smart Account offers +10 sharing points for up to TL 100,000 and +5 sharing points for up to USD or EUR 50,000. A total of 5 EFTs and 5 money transfers may be performed through Smart Accounts at the internet branch, while no account maintenance fee is charged.

In line with the increasing demand for investment instruments based on precious metals, and the increase in transaction volume, the Bank offered its customers various investment alternatives, such as the Gold Participation and Silver Participation Accounts.

Having broken new ground in the industry, the Bank launched a new product entitled “Türkiye Finans Type B Sukuk Mutual Fund” for investors seeking to invest in mutual funds but who have a low risk profile. This product is the first sukuk mutual fund in Turkey and the first type B mutual fund in participation banking. The entire composition of the fund is comprised solely of sukuk bonds, which provide investors with the opportunity to invest at a low risk level and in accordance with the principles of participation banking.

The Bank collected TL 1.2 million in commission revenues (a 5% YoY increase) from investment transactions in general.

By carrying out various campaigns through its digital channels in 2013, Türkiye Finans provided all of its services to its customers through all channels based on the same principle of offering the best customer experience.

A multichannel strategy - the same customer experience

By carrying out various campaigns in its digital channels in 2013, Türkiye Finans provided all of its services to customers through all channels based on the same principle of offering the best customer experience.

In 2013, the rate of utilization of Alternative Delivery Channels (ADC) stood at 73%, while the number of products sold through ADC reached 300,000.

ATM Banking

In 2013 Türkiye Finans raised the number of its ATMs from 271 to 415 and restored its service network will full-function devices. Second ATMs were installed in 96 branches to promote customer satisfaction, business continuity and management of transaction intensity.

Within the framework of the ATM Service Continuity Project, the Bank increased the ATM availability rate and launched the Cash Projection System aimed at effective ATM Cash Management.

Furthermore, the Bank pressed ahead with its infrastructure investments aimed at providing uninterrupted and high-quality services, and completed all necessary arrangements such that the debit cards of foreign banks can also be used at Türkiye Finans’s ATMs.

The Bank also accelerated its efforts to expand its ATM network and install non-branch ATMs, in a bid to be closer to its customers.

Internet Banking

In order to increase the number of customers actively using the internet branch, the Bank added an array of new features to this channel in 2013. Functions such as invoicing, the ability to pay motor vehicle tax and traffic fines by credit card, transactions related to the Siftah and Faal Cards, Taksitle (By Installment) transactions, money transfer from the file and updating customer information were offered for the service of our customers.

The number of customers using the internet branch reached 300,000 by the end of 2013, while the number of transactions performed through the internet branch increased by 5% YoY with a total of 72,000 products sold through the internet branch, thanks to the channel changeover program and various campaigns that encourage customers to use the internet branch channel.

The Most Admired

Türkiye Finans' Mobile Branch application became Turkey's "Most Admired Mobile Banking Application" by receiving 4.5 points out of 5 in the iPhone category.

Mobile Banking

The Türkiye Finans Mobile Branch, which has provided services from the mobil.turkiyefinans.com.tr website since 2005, began to serve its users on an application basis from mobile phones using the iPhone or Android operating systems in April 2013.

The number of transactions performed over mobile phones increased by 181% YoY in 2013, while mobile banking applications specifically designed for iPhone and Android devices were downloaded a total of 40,000 times in 2013.

Working to bring ease to their daily lives, the Bank offers its customers a wide range of features in addition to the most frequently used banking transactions; such as the opportunity to pay bills by their barcode no, to define favorite transactions, to send IBAN information via SMS or e-mail, adding a profile photo, the locations of the closest branch and ATM and acquiring addresses and market information. Cep Şifre (Pocket Password) is another feature of the new application which generates a single use only password for users accessing the Mobile Branch or the Internet Branch. The mobile connection and all transactions with respect to the use of the Mobile Branch are offered free-of-charge.

According to a list prepared based on mobile users’ comments on banking application provided at the App Store and the points that users give to these applications, Türkiye Finans’ Mobile Branch application became Turkey’s “Most Admired Mobile Banking Application” by receiving 4.5 points out of 5 in the iPhone category as of September 2013 (* Pozitron Insights 2013 - Mobile Banking Applications in Turkey Report).

Customer Contact Center

As an exemplary and pioneering organization with an array of achievements in the sector, Türkiye Finans’s Award-Winning Customer Contact Center operates as a communication center that seeks to provide the highest benefit to customers through its unwavering efforts in the area of customer satisfaction, continuity of product use and ease of accessibility, as well as its sales- and collection-oriented efforts.

As a result of its customer-oriented service approach, the Türkiye Finans Customer Contact Center was granted the certificates for EN15838:2009 Customer Contact Centers - Requirements for Service Provision and ISO 10002:2004 Customer Satisfaction - Quality Management System, thus certifying that it provides high-quality services to international standards. The Bank is the fourth bank in the sector to be granted the EN15838:2009 Customer Contact Centers - Requirements for Service Provision certificate.

Türkiye Finans Customer Contact Center was also handed the “Turkey’s Best Call Center” (with less than 500 seats) and “Most Praiseworthy Team Leader” awards in the Turkey Call Center Awards 2013 hosted by IMI. These achievements were primarily in recognition of the Call Center’s customer-oriented approach, successful human resources and high technology, as well as its innovative practices which lead the banking industry.

One of the most important projects carried out by the Bank within the framework of its efforts to excel in customer experience was to forward inbound calls to the Customer Contact Center. All inbound calls were forwarded by branches to the Customer Contact Center in 2013 to provide better service to customers.

The Bank aimed to raise customer satisfaction by undertaking investments in technology on complaint management. Through a platform which is integrated into the Bank’s system, the Bank addresses all customer expectations and requests forwarded through the Customer Contact Center, branches, corporate webpage, e-mail, fax and mail, as well as through social platforms like Facebook and Twitter, and websites where people share their complaints about companies. The Bank completed 2013 as the sector leader according to the “Complaint Management Success List”, which is determined by Sikayetvar.com on a sector basis.

Having grown by 60% YoY, the Customer Contact Center communicated with customers through 5.5 million inbound/outbound calls. Moreover, the Center performed sales by identifying the products and services addressing customer needs. In 2013, the Customer Contact Center became one of the Bank’s major sales channels by selling 215,000 products.

Striving to promote a better customer experience and high customer satisfaction…

In 2013, Türkiye Finans continued to plan and launch important projects that raise the quality of service and efficiency on the basis of customer orientation.

- As a bank that is constantly growing and developing, Türkiye Finans has concentrated on improving the customer experience and undertook significant work in this area during 2013. To this end, the Bank revamped its sales and service model, product/services, channels and processes based on the elements of customer experience and will complete its efforts to widen the customer experience concept.

- The Bank prepared the Customer Constitution in order to inform its customers of the priority that it attaches to customer satisfaction. In this constitution, Türkiye Finans promises its loyalty to customers and sensitivity on the subject of customer satisfaction. The Bank aims to provide one single universal message regarding customer satisfaction by sharing the Customer Constitution with customers through its branches and other channels.

- The Bank aims to regularly keep a close view of customer satisfaction and the standards of the quality of service and to take the necessary action as swiftly as possible. To this end, it determines areas requiring improvement and takes action as soon as is practicable by performing “customer satisfaction”, “confidential customer” and “internal customer” research studies.

- The branch organization was revised, placing prominence on customer and employee satisfaction. The Bank has reorganized its branch operations in order to ensure that lobby management is performed more effectively and on the basis of customer efficiency, while the operational staff at branches are able to allocate more time to sales activities, and operational personnel are able to support and back each other up. The Bank aims to make more efficient use of resources through the q-matic system, by effectively integrating the whole banking system. The Bank strives to enable tellers to serve customers in accordance with pre-determined Service Level Agreements. The Bank will quantify the quality of service and take the necessary action.

- The Bank prepared Service Level Agreements for critical processes subject to customer experience, in order to determine the standards for the services that it provides to its internal and external customers. Critical processes are quantified and evaluated on a monthly basis and the necessary action is taken.

- The Bank actively included its employees in the innovation process and launched the “Suggestion System and Management”. The Bank also brought the “kat kazan” (contribute and win) award system into practice in order to encourage employees to contribute to the development of the Bank by sharing their suggestions/opinions.

- The Bank offered “lean six sigma” training to its employees and begun to execute its projects and activities according to this methodology, in order to carry out projects more effectively and in compliance with certain standards. The Bank has taken all necessary step to adopt use of the lean six sigma methodology throughout the Bank and ensured that all of its managers and directors participated in this training. The Bank later plans to carry out simplification projects in every area based on customer experience by making use of the lean six sigma methodology.

Türkiye Finans' treasury transactions, which played a key role in raising the Bank's profitability and efficiency in 2013, also maximized internal and external customer satisfaction.

Competitive FX practice reflected to exchange profit in 2013

Türkiye Finans’ treasury transactions, that played a key role in the improvement in the Bank’s profitability and efficiency in 2013, also maximized internal and external customer satisfaction.

In order to attain a higher market share in line with its growth strategy, the Bank applied a competitive FX policy in customers’ exchange costs, providing a significant increase in customers’ transaction volumes compared to the previous year.

In 2013, the FX transactions performed with customers amounted USD 37.8 billion in total and the Bank’s transaction volume in the interbank market reached USD 71.4 billion.

The competitive exchange rates provided by high FX transaction volumes were reflected to the rates offered to customers. The Bank’s exchange profit target for 2013 was 100% realized.

Türkiye Finans operated with high liquidity in 2013, succeeding in bringing resource costs down.

In 2013, TL and FX sukuk bonds issued by the Undersecretariat of Treasury were added to the Bank’s balance sheet, providing a significant contribution to liquidity management.

Türkiye Finans considerably expanded its non-deposit fund resources to support its growth and began to receive resources with longer maturity to enable resource diversification and to protect the maturity balance of assets/liabilities.

To this end, the Bank successfully issued USD 500 million worth of sukuk bonds with a 5-year maturity; and provided cost-efficient (low interest rate) TL funding with a 5-year maturity through the restructured funding instrument.

New practices to increase our strength in the market

Türkiye Finans had launched the FX platform in 2012 in order to lower its FX costs and gain a stronger position in the interbank market. The platform was offered to customers in 2013. Rapidly addressing a growing number of customers, the platform’s transaction volume is also rising rapidly. While customer feedback indicates that the platform is effectively used, it is close to reaching a position where it could raise efficiency by contributing to the Bank’s profitability, as well.

Improvements were carried out in the Bank’s fund transfer pricing process in line with the principles, needs and best practices of participation banking. For this purpose, the yield curve which will be used in pricing was determined based on the marginal funding costs in the market. Within the scope of deposit categorization efforts, various analyses were performed to evaluate stickiness, sensitivity to market return rates and average lifecycles of each product and segment before they were added to the pricing model.

The Bank initiated the integration of the Assets/Liabilities Management Analysis Reporting software in order to optimize profitability and increase the effectiveness of Assets/Liabilities Management. When the integration work is completed, an effective liquidity risk management will be enabled by allowing the preparation of analysis and reports that will support the Assets/Liabilities Committee during the decision-making process.

Rising popularity and credibility among correspondent banks, in line with the Bank’s strong shareholding structure and foreign trade transaction volume

Having maintained its international credibility and strong relations with financial institutions in the challenging global conjuncture of 2013, Türkiye Finans upheld its reputation in the international arena with its extensive loan supply volume and the total size of the foreign trade transactions which it mediated in.

The Bank’s foreign borrowing jumped by 72% YoY from approximately USD 1.4 billion at the end of 2012 to USD 2.4 billion by the end of 2013.

The average maturity of the loans provided by the Bank climbed by 37% from 710 days in 2012 to 970 days as of end-2013.

The Bank provided resources from more than 50 banks in more than 20 countries until the end of 2012 but from more than 100 financial institutions in nearly 30 countries in 2013 alone, thanks to the expanding investor base.

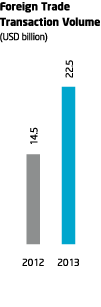

55%

The Bank's foreign trade transaction volume rose by 55% YoY to USD 22.5 billion during 2013.

Increased foreign trade transaction volume

In 2013, when the economy of EU - Turkey’s largest foreign trade partner - was still sluggish, Turkish companies succeeded in diversifying their markets by increasing their export/import activities, particularly with countries in Africa and the Gulf region. Within the scope of its efforts to mediate in foreign trade transactions, Türkiye Finans offered an increasing number of services to its exporting/importing customers in relation to countries in the Gulf region dominated by NCB, the parent company of Türkiye Finans.

The Bank added momentum to its efforts to establish and improve its correspondent bank relations infrastructure in Africa in cooperation with global and local banks. In compliance with international rules and standards, the Bank carried out various foreign trade transactions with every country in the world, from Angola to Zambia, through its network of more than 1,100 correspondent banks as of the end of 2013.

In accordance with the agreements signed with correspondent banks and international institutions for financing foreign trade operations, the Bank provided long-term resources to importers within the framework of the following programs: GSM-102, SEP, ECA and ITFC. The Bank raised the existing limit applied to GSM-102 transactions from USD 70 million to USD 100 million, a move that led to an increase in the Bank’s market share to 10%. The Bank offered customers a limit of USD 35 million received for SEP transactions and a limit of USD 25 million received for ITFC transactions after pricing these loans in the most cost-efficient manner.

The Bank’s foreign trade transaction volume rose by 55% YoY from USD 14.5 billion at the end of 2012 to USD 22.5 billion by the end of 2013, in line with its strategy and targets. In line with the increasing transaction volume, infrastructure work is under way at full pace to raise existing limits and to add new correspondent banks to the Bank’s current network.

At the end of 2013, the Bank’s market share in foreign trade transactions had been realized at 3.5% in exports, 2.5% in imports and 2.80% in total foreign trade transaction volume.

By receiving USD 500 million of international murabaha syndicated loans with the participation of 28 banks in 2013, Türkiye Finans thus launched the largest murabaha syndicated loans ever in the Turkish participation banking industry.

Gaining valuable experience in sukuk bond issues

Türkiye Finans was the only Turkish bank to be assigned as a co-arranger in the sukuk bond issue worth USD 1.25 billion with a 5-year maturity carried out by the Undersecretariat of the Treasury. HSBC, QInvest and Standard Chartered were authorized as primary arrangers in this sukuk bond issue, which was realized with a rent rate of 4.557% and 5-year maturity, with Türkiye Finans, CIMB Bank Limited, the Dubai Islamic Bank PJSC, QNB Capital LLC and NCB Capital as the co-arrangers.

In 2013, Türkiye Finans, together with Türkiye Finans Varlık Kiralama A.Ş. (TF Asset Leasing Inc.), carried out a USD 500 million sukuk bond issue. With this transaction, Türkiye Finans performed the highest international sukuk bond issuance after those carried out by the Undersecretariat of Treasury. The Bank’s sukuk bond issue attracted a great deal of interest from international investors: a total of 105 investors submitted offers and the Bank accepted a total order volume of USD 1.850 billion, which was 3.7 times the planned amount.

Share of non-deposit borrowing in total financing rises from 17% to 24% during 2013.

Türkiye Finans launched the highest volume of murabaha syndicated loans ever in the Turkish participation banking industry, receiving USD 500 million (USD 426 million and EUR 57 million) as international murabaha syndicated loans with the participation of 28 banks in 2013. The co-leaders of this syndicated loan were the ABC Islamic Bank (E.C.), Al Hilal Bank PJSC, Emirates NBD Capital Limited, Noor Islamic Bank PJSC, Standard Chartered Bank and The Saudi British Bank. A USD 360 million portion of the syndicated loan has a maturity of 2 years - the first transaction with such a long maturity ever realized for a long period of time. It is also an indicator that international financial markets place their trust in the Turkish economy and Türkiye Finans.

As well as murabaha syndicated loans and sukuk bond issues, the Bank received murabaha loans from a number of banks in 2013 within the framework of mutual borrowing relationships, thus providing more than USD 1.2 billion in resources with various maturities.

Our credit rating stands as testament for our reputation and reliability.

As a result of an evaluation performed by the international credit rating agency, Fitch, at the end of 2013, Türkiye Finans’ long-term credit rating in FX terms was determined as BBB with a stable outlook and a financial capacity rating of BB-.

This rating stands as a reflection of Türkiye Finans’ profitability, steady growth and sound shareholding structure in an environment where the credit rating of the Turkish economy has also increased. It also shows the strong support provided to Türkiye Finans by NCB (A+), its parent company which holds the largest capital of any bank in the Middle East.

Customer-oriented IT

2013 was a year in which the Bank focused on customers in its IT efforts. The Bank has improved its customer experience and increased the efficiency, quality and speed of services provided through information technology. The primary work carried out by the Bank in this context can be summed up as follows:

- The Bank added momentum to its efforts in the areas of cloud computing and virtualization. As the sector leader in virtualization, Türkiye Finans reached a virtualization rate of more than 84% in 2013 - a 4-point increase.

- The Bank expanded the structures - which allow the Bank to instantly monitor the performance and availability of IT systems in banking services - so as to cover all critical services. Service quality was improved along with the identification of problems in a proactive manner, even before the problems arise and are reflected to customers and end users.

- The Bank shortened the time needed to resolve end users’ IT-related questions by 87% and the time needed to fulfill their requests by 52%, thus raising the level of satisfaction of end users and the customers they serve.

- The Bank pressed ahead with its modernization efforts for the infrastructure which banking systems operate on, shortening the time needed for these systems to respond to customers by 30%. The performance of Türkiye Finans’ banking systems ranked among the top of the sector.

- The Bank cut its paper and printing use by 41% by centralizing the management of output received within the Bank. As such, as well as reducing costs, the Bank contributed to the efficient use of our country’s natural resources.

- By means of detailed analyses aimed at protecting critical bank data, the Bank continued real-time monitoring and blocking activities. Proactive changes were implemented by considering the risks that can be introduced by developing technologies.

- According to ITIL which is one of the methodologies aimed at ensuring operational excellence in IT systems, the Bank demonstrated progress towards the level of best practices with the highest level of maturity.

The first and only data center in Turkey to certify its high standards

Established at the end of 2011, the Türkiye Finans Datacenter is a fully backed high-tech center. Designed to provide uninterrupted service, the continuity of the datacenter is ensured through a backup datacenter. The Türkiye Finans Datacenter is one of a number of datacenters in Turkey and Europe. Designed by taking green IT criteria into account, the Datacenter’s certification of compliance with Tier III design standards was completed in April 2013. Accordingly, it became the second datacenter in Turkey and the first in the banking industry to hold this certificate. Analyzing datacenters based on international standards, the Uptime Institute (USA) completed all necessary on-site auditing in November and was the first and bank in Turkey to receive the Tier III operation certificate with its Türkiye Finans Datacenter.

The Türkiye Finans Datacenter:

- is highly secure and has the ability to instantly monitor and control such conditions as electricity charge, heat, moisture, etc.;

- provides high efficiency in energy consumption; its PUE (Power Usage Effectiveness) of 1.6 is significantly lower than the average value in Turkey and Europe;

- is one of Turkey’s most environment-friendly datacenters, with up to 50% less energy usage and carbon emissions when compared to a typical datacenter;

- has an expandable infrastructure that can support the Bank’s sustainable growth.

98%

In 2013, the Bank achieved a success rate of 98% in business continuity activity tests.

The first and only business continuity certificate in the banking industry

In September 2013, Türkiye Finans received the ISO 22301 Business Continuity Certificate, demonstrating that the Business Continuity Management System set up by the Bank complies with international standards. Türkiye Finans was the first and only bank in the Turkish banking industry to be granted this certificate. In 2013, the Bank achieved a success rate of 98% in business continuity activity tests.

A risk management model meeting international standards and supporting growth

Possessing strong and proactive risk management infrastructure that supports healthy growth, Türkiye Finans is prominent among participation banks, thanks to the internal dynamics that it has put in place and the growth trend that it has exhibited.

In terms of risk management, in order to strengthen its infrastructure for both personal and commercial banking with advanced rating and scoring models, Türkiye Finans launched a variety of projects in 2010 which are executed with job families; these were then implemented in 2011. With the recalibration work performed in 2013, the Bank restructured the rating models that are monitored on a regular basis for sustainable success and established a new sectoral model to ensure that these models demonstrate maximum performance.

Commercial fund supply - rating models: These models were developed by using statistical methods specific to Türkiye Finans’ portfolio. It is a system that also calculates the probability of default (PD). At the end of the process, a separate credit rating and PD value is calculated for each company. Before granting loans to any company, work such as determining credit limits, granting collaterals and pricing are performed based on this assessment.

Fund supply to individuals - NBSM decision engine and scoring models: Designed as a decision support engine, the NBSM decision engine and scoring models allow individual loan requests to be automatically finalized, allowing loan supply processes to be completed in a very short time depending on loan supply policies and criteria that are systematically applied by the Bank. Thanks to its infrastructure, Türkiye Finans was able to reduce the completion process for individual financing and credit card requests to a matter of minutes.

Türkiye Finans commands a strong and competitive position in the sector in terms of troubled loan stock. The Bank currently carries out various projects, such as improvement of early warning systems and collection processes, management of transactions and debts of customers, etc., in order to maintain and further improve its sound asset structure.

In addition to rating modeling, Türkiye Finans attaches great importance to the monitoring function in loan and risk processes. In this context, the Bank conducts early warning exercises at specific intervals and carries out the necessary efforts to identify troubled loans before they are overdue, to strengthen collateral and to settle associated risks.

An active year in corporate communication

Within the framework of its 360-degree continuous communication strategy, Türkiye Finans pressed ahead with its intensive communication efforts in 2013.

The Bank performed a total of 90 communication activities on various platforms in 2013. As a result of these campaigns, advertisements related to Türkiye Finans extensively appeared on TV, the radio, the internet, newspapers, magazines and open air platforms such as stadiums throughout the year.

As a result of effective PR and communication efforts performed in 2013, the number of news items concerning Türkiye Finans which appeared in the written media increased by 92% compared to 2011 and by 54% compared to 2012, placing Türkiye Finans as one of the banks to attract frequent press attention.

The Bank carried out a number of field events throughout the year. In these events, the Bank demonstrated efforts to raise the popularity, recognition and reputation of the Bank and its products to its customers.

According to the Corporate Brand Perception and Promotion Effect Research performed twice a year, the Bank’s popularity and recognition among its customers, particularly potential customers, as well as the level of admiration commanded by the Bank and the possibility of seeing the Bank in advertisements have all significantly increased.

The Bank’s 2012 Annual Report was granted the Bronze Award in the Banks’ Annual Reports category at the international LACP (League of American Communications Professional) 2012 Vision Awards (July 2013).

Within the scope of efforts in the digital communication-social media area, the Bank’s digital check-up was performed and its digital communication roadmap was issued, accordingly. The necessary analysis and planning was conducted in order to restructure and reposition the Bank’s social media accounts. Under the Corporate Communication Department, the Digital Marketing and Social Platforms Service was established, which entered operation in early 2014.

Türkiye Finans strives to become a leading corporation that guides all of its stakeholders and rivals through activities which generate added value for sustainable economic growth and social development.

Our sustainability approach and practices

Türkiye Finans strives to become a leading corporation that guides all of its stakeholders and rivals through a range of activities which generate added value in promoting sustainable economic growth and social development.

Türkiye Finans plans to allocate an increasing volume of resources to the education, healthcare and energy sectors through its awareness of social responsibility and approach to sustainability.

In 2013, within the framework of a sustainable economic approach, Türkiye Finans:

- took the first step in banking activities aimed at helping the disabled through “Vehicle Financing for the Disabled”; and

- increased the number of financing solutions provided to energy projects through products such as “No License Renewable Energy Package”, “Financing Energy Efficiency” and “100% Energy Package for SMEs”.

In 2013, Türkiye Finans announced its corporate social responsibility policy and took action to reflect this to its practices as rapidly as possible.

- The Bank started to prepare its 2013 Annual Report and Sustainability Report. The latter, which will be ready at the beginning of April, will be the first Sustainability Report ever published by a participation bank in Turkey.

- Within the framework of sponsorship activities, the Bank sought to raise the satisfaction of its customers by inviting them to all games, concerts and events held throughout the year at the Ülker Sports Arena owned by the Fenerbahçe Ülker basketball team.

- In line with the Bank’s primary goal of supporting the real sector, Türkiye Finans became a sponsor of the Anadolu Markaları (Anatolian Brands) Contest for the second time in order to support Turkish companies in taking significant steps towards branding. Within the scope of this project, meetings were held for SMEs and enterprises in four cities (Denizli, Çanakkale, Gaziantep and Şanlıurfa) in 2013. The contest’s award ceremony was held in Istanbul in December, attracting wide participation by the press and business community.

- The 652nd historical Kırkpınar Oil Wrestling Festival was held with the sponsorship of Türkiye Finans. This event is a cultural heritage event, and has one of the longest histories of any sports event after the Olympics, and has been added to UNESCO’s list of Intangible World Cultural Heritage events. During this sponsorship, which extends up until the end of 2015, the Bank aims to raise the popularity of this important cultural image, as well as striving to ensure that people lay claim to it and transfer it to the next generations.

- Türkiye Finans has been one of the sponsors of the exhibition, Dialogue in the Dark, which has attracted more than 7 million visitors in 130 different cities across the world since 1988. This exhibition, which allows visitors to experience their daily lives in a fully dark environment without straining their eyes, will be open to visitors at the “Dialogue in the Dark” Exhibition Area in Istanbul from 20 December 2013 to June 2014.

- Within the framework of the Bank’s sponsorship of the 17th International Mediterranean Games, Türkiye Finans provided service to all participants for their banking and financial transactions through two stationery branches in Mersin and Adana, and two mobile branches.

- The Mobil Down Café, employing young people suffering from Down’s syndrome, was opened on August 15th with the support of Türkiye Finans. Within the framework of the social responsibility project, the Bank also provided supplies to the Şişli Down Café throughout the year.