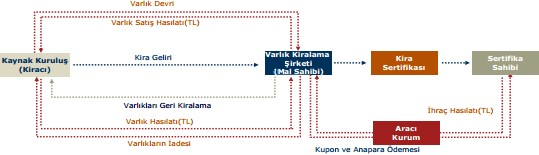

Lease Certificates are the type of security which is issued by asset leasing companies and enables its holders to get a proportionate share from the revenues derived out of such assets and rights.

It boasts a higher resilience as it is issued backed by an asset that can be sold for funding purposes. Therefore, it is a reliable investment alternative in particular for Participation Banking customers.

Government Lease Certificates

Government Lease Certificates are issued by T.C. Hazine Müsteşarlığı Varlık Kiralama Anonim Şirketi (HMVKŞ) to finance assets that are acquired through purchase or leasing.

Government Lease Certificates, issued by HMVKŞ to its name and to the account and benefit of certificate holders, are the kind of securities offering the holders lease yield in proportion to their shareholding rate.

Features of Government Lease Certificates

- Government Lease Certificates are under the guarantee of Turkish Republic Undersecretariat of Treasury.

- Hazine Müsteşarlığı Varlık Kiralama Anonim Şirketi distributes to lease certificate holders the lease yield in proportion to their share as well as lease certificate prices.

- Lease Certificates can be converted into cash prematurely, as they are traded on Borsa Istanbul.

- Lease Certificate trading prices are daily announced on Borsa Istanbul Outright Purchases and Sales Market.

- Please visit www.hazine.gov.tr to learn more about Government Lease Certificates.

Türkiye Finans Varlık Kiralama Şirketi A.Ş. Lease Certificates

These lease certificates are issued by Türkiye Finans Varlık Kiralama Şirketi A.Ş to finance assets that are acquired through purchase or leasing.

The Lease Certificates, issued by Türkiye Finans Varlık Kiralama Şirketi A.Ş to its name and to the account and benefit of certificate holders, are the kind of securities offering the holders lease yield in proportion to their shareholding rate.

Features of Türkiye Finans Varlık Kiralama Şirketi A.Ş. Lease Certificates

- Türkiye Finans Varlık Kiralama A.Ş. Lease Certificates are issued as fixed-return and coupon certificates.

- Issuance period could be shorter or longer than one year

- After issuance, it is tradable on the secondary market mediated by Türkiye Finans branches.

- Details of public offering of Türkiye Finans Varlık Kiralama A.Ş. Lease Certificates are announced to our customers through our sales channels prior to issuance.

- Please visit http://www.tfvarlikkiralama.com.tr to learn more about public offering.

Taxation of Lease Certificates

- A 15% income tax withholding is applicable to income derived from lease certificate trading and lease payment by natural persons with limited and unlimited liability or legal entities such as foundations and associations.

- For natural person investors, 15% withholding tax is the final tax and may not be included into annual income tax return.

- The joint-stock or limited liability companies or simple partnerships, the investment funds and joint ventures subject to CMB, the similar foreign funds, ventures or any other entity deemed as similar to these by the Ministry of Finance are subject to a 0% income tax withholding over the income derived from lease security trading and lease payment.

- Any other person not covered by the above definitions is subject to a 15% withholding tax. The withholding tax paid will be deducted from the corporate tax amount calculated.

- Institutions liable to pay BITT must pay a 1% BITT over their income derived from lease certificate trading and %5 BITT over lease payments.

Overview of Lease Certificates